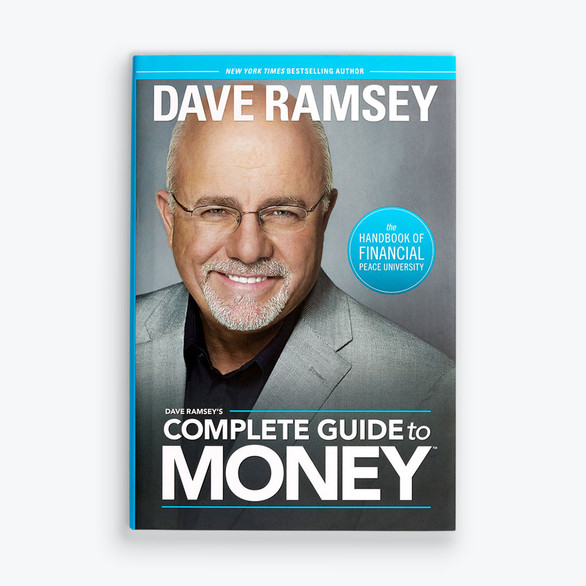

Dave Ramsey’s Complete Guide to Money offers the ultra-practical way to learn how money works. These are the principles Dave learned after losing everything. They’re the same principles that have helped millions of families go from the stress of debt to the peace of knowing the future is secure.

Now’s the time to stop worrying about money and take control. Dave Ramsey’s Complete Guide to Money will teach you:

- 7 simple steps to financial freedom

- How to budget, dump debt, and save

- The power of marketing gimmicks

- Planning strategies for college and retirement

- What types of insurance you need

- Keys to buying and selling a home

TABLE OF CONTENTS

- Dedication

- Acknowledgments

- Introduction

- Chapter 1 - Super Saving: Common Sense for Your Dollars and Cents

- Chapter 2 - Relating with Money: Nerds and Free Spirits Unite!

- Chapter 3 - Cash Flow Planning: The Nuts and Bolts of Budgeting

- Chapter 4 - Dumping Debt: Breaking the Chains of Debt

- Chapter 5 - Credit Sharks in Suits: Understanding Credit Bureaus and Collection Practices

- Chapter 6 - Buyer Beware: The Power of Marketing on Your Buying Decisions

- Chapter 7 - Clause and Effect: The Role of Insurance in Your Financial Plan

- Chapter 8 - That's Not Good Enough: How to Buy Only Big, Big Bargains

- Chapter 9 - The Pinnacle Point: Understanding Investments

- Chapter 10 - From Fruition to Tuition: Planning for Retirement and College

- Chapter 11 - Working in Your Strengths: Careers and Extra Jobs

- Chapter 12 - Real Estate and Mortgages: Keeping the American Dream from Becoming a Nightmare

- Chapter 13 - Give Like No One Else: Unleashing the Power of Generous Giving

- Afterword

- Notes

- Financial Management Forms

- Author:

- Dave Ramsey

- Pages:

- 331

- Publisher:

- Ramsey Press

- Format:

- Hardcover

- Release Date:

- 2011

- Chapters:

- 13

- Language:

- English

- ISBN-13:

- 978-1937077204

- Genre:

- Personal Finance

- Target Audience:

- People Who Want to Pay Off Debt, Build Their Savings, and Stop Living Paycheck to Paycheck