STUDY SUMMARY

- Students who take a personal finance class are 23% less likely to plan to use loans to pay for college.

- 87% feel confident about their ability to invest for the future.

- They are more than three times as likely to say they’d rather have $500 in the bank instead of a smartphone.

Downloads

- Full Study (PDF)

- Press Release (PDF)

- Infographics

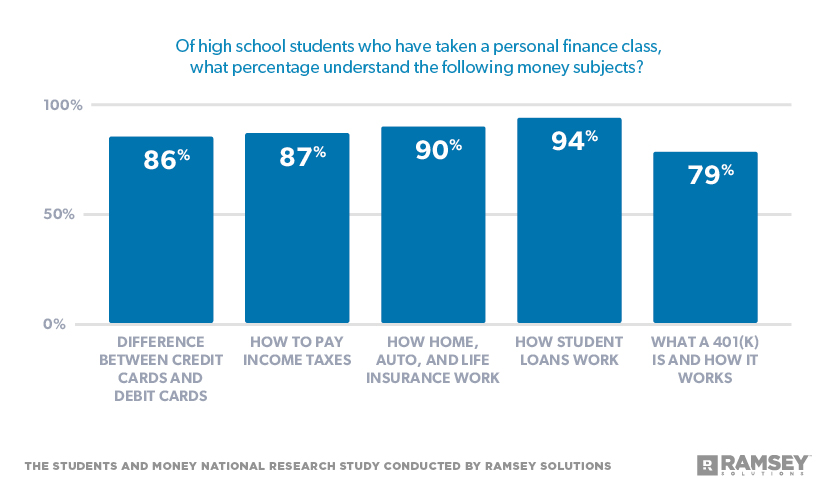

- Percentage of Students Who Understand Money Subjects

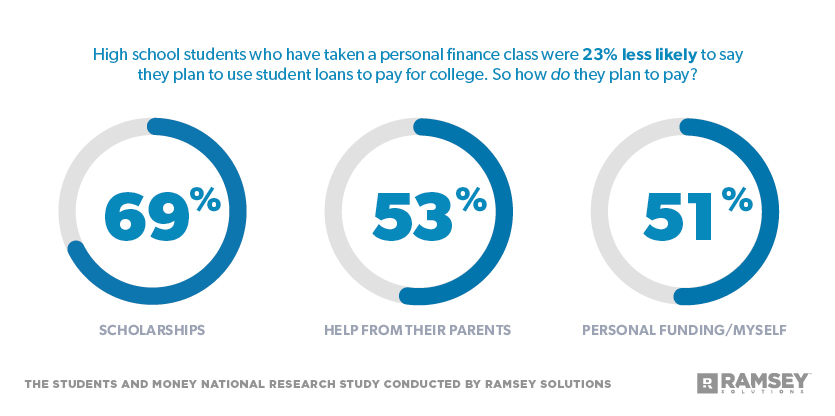

- How Students Plan to Pay for College

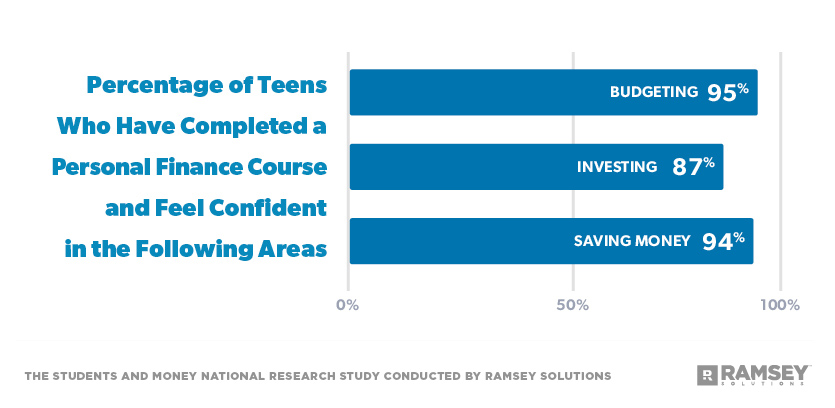

- Percentage of Teens Who Feel Confident in Budgeting, Investing, and Saving

- Students who Say They’re Earning Money

- Teens Who Say They Create a Monthly Budget

- $500 Instead of a Smartphone

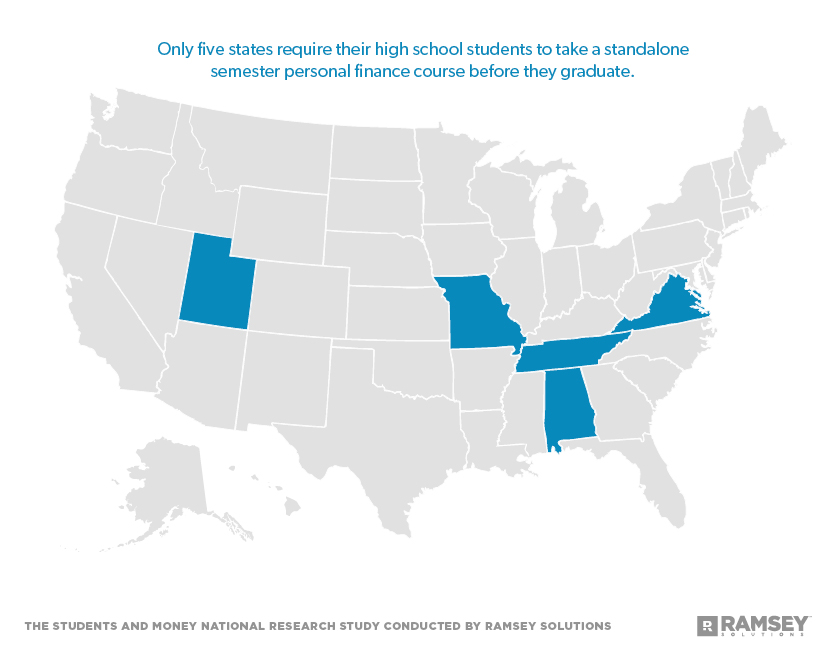

- States Requiring a Personal Finance Course Before Graduation

Have questions about this study? Email us or visit our newsroom for more information.

High School Students With Personal Finance Education Exhibit Strong Money Knowledge and Habits

Personal experience can be a thorough teacher, especially on the topic of money. Unfortunately, the lessons learned can be costly—just ask anyone who’s signed up for a car loan payment that equaled a quarter of their income, has neglected to get the proper insurance coverage, or is facing a retirement savings shortfall.

When those personal finance lessons are taught in high school classrooms, however, students build a solid knowledge base about how money works, establish good financial habits early on, and enter adulthood with confidence about how to manage their money.

High Marks in Overall Money Knowledge

Ramsey Solutions surveyed more than 76,000 high school students across the nation for its Students and Money National Research Study. This report, the first of a five-part series based on the survey results, focuses on the financial knowledge and money habits of students who take personal finance education courses as part of their high school education.

The survey measured students’ understanding of several financial topics ranging from the basic, such as the difference between a debit and credit card, to more complex concepts, like income taxes, insurance, student loans and 401(k)s.

Not only did students who had taken a personal finance course score higher in every topic than students who had not taken such a course, but they also scored extremely high in each category. For example:

- 86% of students reported a complete understanding of the difference between a debit card and credit card.

- 87% said they understand how to pay income taxes.

- 90% said they understand how home, auto and life insurance work.

Increased Understanding of Student Loans

High school-level personal finance courses also prepare students well on the topic of student loans, with 94% of those students saying they understand how student loans work. On the other hand, students who had not completed such a class were twice as likely as those who had to say they do not understand how student loans work.

“Many college students use loans to pay for college without truly understanding what they’re signing up for and the uphill battle they’ll face after graduation,” says Anthony ONeal, youth and money expert and speaker with Ramsey Solutions.

“We’re seeing recent college graduates enter the workforce with an average of $37,000 in student loan debt,” added ONeal. “Instead of having the freedom to choose where they’re going to live or the job of their dreams, this debt limits their choices and prevents them from taking the next step in their lives.”

Students who had completed a personal finance course appear to agree with ONeal that student loans are to be avoided. They were 23% less likely to say they plan to use student loans to pay for college than students who had not taken a personal finance course. Their top college funding sources include scholarships (69%), help from their parents (53%), and personal funding/myself (51%), instead.

“It is possible to get through college without student loan debt—even if you have to foot the entire bill yourself,” ONeal said. “It will be hard work, but it’s worth it to graduate and begin the next phase of your life without the burden of student loans.”

Students Face Retirement Planning With Confidence and Know-How

When it comes to saving for retirement, students who have taken a personal finance course will enter the workforce with an advantage. Nearly 80% said they understand what a 401(k) is and how it works, compared to just 63% of students who have not taken such a course.

In addition to imparting financial knowledge, personal finance classes equip students with the confidence they need to put that know-how into practice. Nearly all students who have completed a personal finance course report high confidence levels in several money skills: 95% of students are confident about budgeting, 87% about investing, and 94% about saving money.

“Many adults lack these three important skills, which keeps them from winning with money long term,” ONeal said. “It’s important that young people learn how to budget, save money, and invest for their retirement early in life so they can avoid the financial mistakes and regrets that many adults have,” ONeal said.

Education Impacts Behavior

Lessons learned in the classroom have already translated into real-life action. According to the survey, nearly 80% of personal finance students have their own bank accounts.

And those accounts aren’t gathering dust, waiting for the next infusion of birthday cash, either. Almost two-thirds of students who took a personal finance course say they are earning money, bringing in an average monthly income of $243, totaling $3,000 per year.

Not only that, nearly 8 in 10 students who’ve completed a personal finance course say they create a monthly budget for their money, and 20% say they have a car they paid for by themselves.

Financial Priorities Are Clear

Students with a personal finance education also show a solid ability to prioritize financial choices based on necessity and security rather than luxury.

For example, students who have completed a personal finance course were more than three times as likely to say they’d rather have $500 in the bank instead of a smartphone.

If you make the wrong choice in class, you get a bad quiz grade. If you make the wrong choice in real life, you could end up paying for it for years!

- Anthony ONeal

Students lacking a personal finance education were 25% more likely to rank television/cable as a necessity. Students who have taken a personal finance course were more likely to rank insurance (96%), utilities (94%), mortgage/rent (83%) and a college education (83%) as their must-haves.

“Being able to recognize wants versus needs is key for people of all ages. But there’s a real benefit to learning it in the classroom,” ONeal said. “If you make the wrong choice in class, you get a bad quiz grade. If you make the wrong choice in real life, you could end up paying for it for years!”

Few Students Receive the Benefits of Personal Finance Education

Despite the benefits of personal finance education in high schools, only five states require their students to take a standalone semester personal finance course before they graduate, according to the Council for Economic Education.

“Our educators have an important job preparing our high school students for the future,” ONeal said. “But whether those kids go on to college or enter the workforce right away, they will all need to learn how to manage their money.

“If we give them the chance to learn those skills early in a safe environment like the classroom, we also give them the opportunity to avoid the mistakes many of us have made and set out on a path to a brighter, more secure financial future.”

About the Study

The Students and Money National Research Study is based on a series of surveys conducted with more than 76,000 high school students from across America. The goal of the study is to gain a better understanding on attitudes, behaviors and perceptions around the topic of personal finance with the younger population. The sample group was polled between April 7 and April 25, 2016 in conjunction with Dave Ramsey’s Financial Literacy Challenge.