Start Comparing Term Life Insurance Quotes

We just need a few details about you to give you accurate rates.

The life insurance quotes are estimates based on the health class you have selected. Final rates are always subject to underwriting approval by the insurance company. There are many factors involved in the final approval price, such as (but not limited to) health history, lab results, family history and driving record.

The Lampo Group, LLC, through ramseysolutions.com, provides advertising for third parties, including Zander Insurance Group. This form is provided as a direct link to Zander Insurance Group’s site. Information submitted by you is collected, stored and/or used by Zander Insurance Group for the purpose of providing the insurance quotes you request. ramseysolutions.com, with your permission, collects only your name, phone number, email address and postal code. All other information, necessary for the generation of an insurance quote, submitted on this form is directly linked to Zander Insurance Group’s site and is in no way collected, reviewed or stored by ramseysolutions.com. Likewise, all quotes are solely provided by Zander Insurance Group, and are not generated or provided by ramseysolutions.com. The Lampo Group, LLC, is not an insurance company or insurance producer and does not warrant any sites, services or information provided by Zander Insurance Group.

We do not sell your personal information to anyone. You will not receive unsolicited, intrusive calls or emails from other agents and companies across the country. If you do provide your telephone number, a Zander representative or their partners may call or text message/SMS you at the phone number(s) above, including your wireless number if provided. Normal charges may apply. This call may be generated using an automated technology and if Zander is unable to reach you when they call, they may leave you a pre-recorded message, so you can call them back. Your consent to Zander calling is not required to get a quote or make a purchase and may be revoked at any time. You may simply call Zander at 800.356.4282. (Sorry for the long, boring disclaimer . . . our attorney made us do it.)

Zander Term Life Insurance

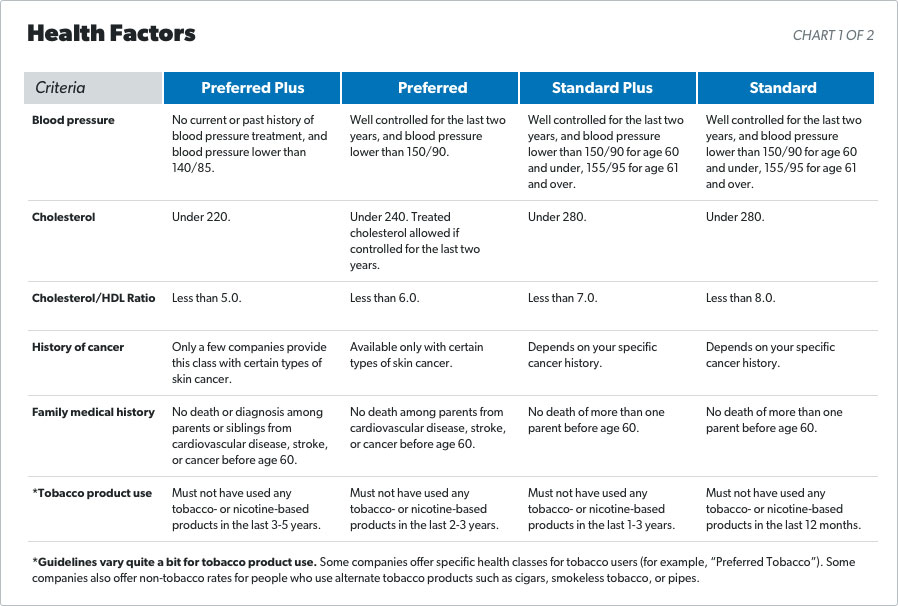

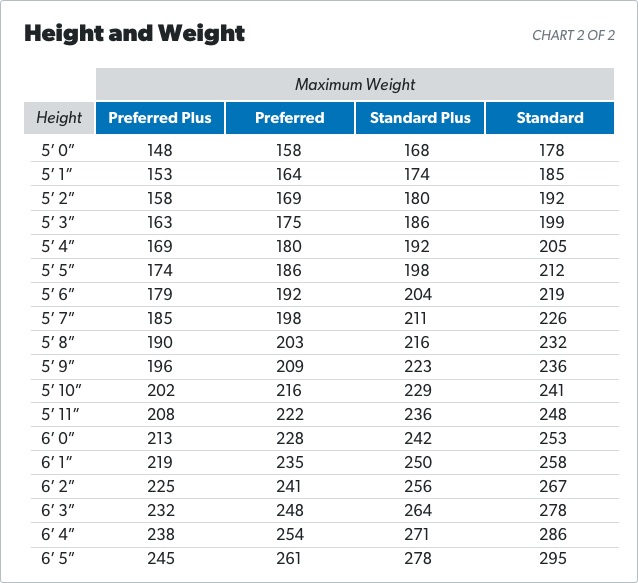

Determine Your Health Level

Using the “Health Factors” and “Height and Weight” charts below, choose one of the four health classes. Each company has different criteria, so these guidelines have been combined and simplified to give you the best chance of choosing your actual health class. Don’t worry, Zander will make sure your health class is accurate.