Your Membership Includes:

Financial Peace University

Learn the step-by-step plan to win 👏 with 👏 money. 👏

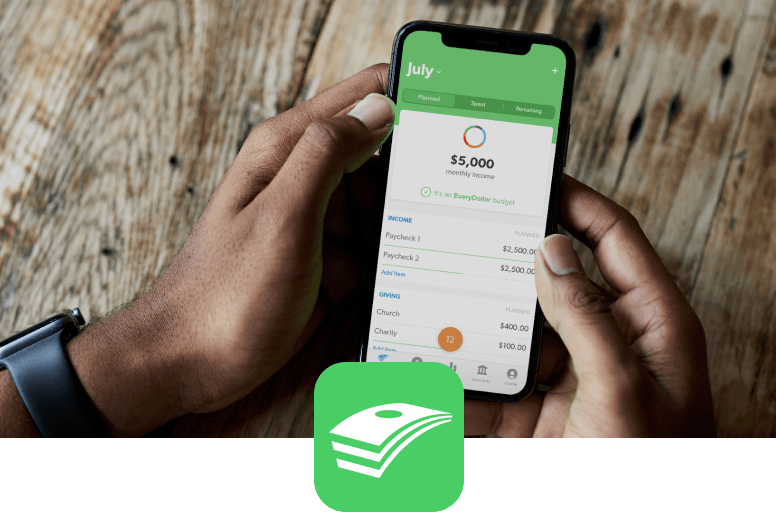

EveryDollar

Stay on track with our premium budgeting app, ad-free.

. . . Plus So Much More

More courses. Financial coaching. Ramsey SmartTax. We’re always adding more to your membership!

One all-access membership.

Three ways to pay, after your free trial.

Pay $0.00 today with your 14-day free trial.

Cancel anytime. No hassle.

3 Months

$59.99

That's $19.99/month.

Renews every 3 months

12 Months

$129.99

That's $10.83/month.

Renews yearly

6 Months

$99.99

That's $16.66/month.

Renews every 6 months

Common Questions (and Answers)

-

Does Ramsey+ help me even if I don't have debt?

-

Absolutely! Paying off debt is only the beginning. Handling money the right way is a lifelong process. That's why FPU teaches you all about money—from paying off debt to insurance and investing to buying real estate. And the best way to build up those financial muscles at any step is budgeting. EveryDollar makes it easy to set up your monthly budget, track your expenses, and head toward your goals even faster.

-

Can I buy Ramsey+ as a gift for someone else?

-

You bet! Visit our store to purchase. When you check out, select “Send as a gift” and fill in the recipient’s information at the bottom of the form. After you purchase, they will immediately receive an email with instructions on how to set up their account.

-

Can I share my membership with my spouse?

-

Yes! Just use the same username and password to log in to as many devices as you need.

-

Do I need a Ramsey+ membership if I've already taken Financial Peace University?

-

Learning to handle money the right way doesn't stop after the nine lessons in FPU—it's a lifelong journey. There are tons of tools, new courses, deep dives and other perks that come with a Ramsey+ membership—like free federal tax filing, audiobooks and livestreams.

-

I have an activation code. What do I do?

-

Redeem it here.