How to Get Out of Debt With the Debt Snowball Plan

5 Min Read | Apr 23, 2024

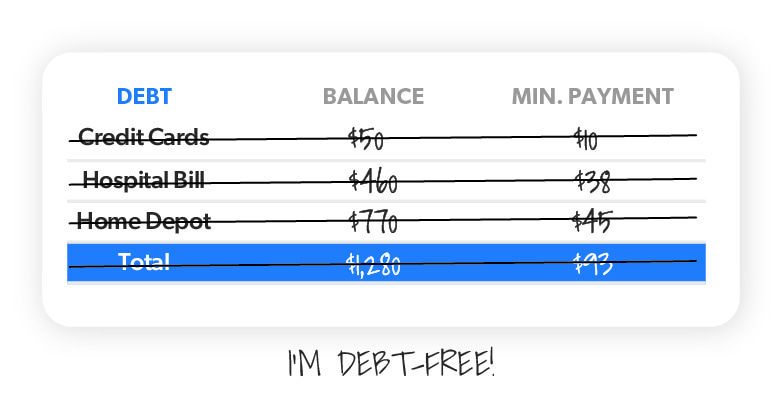

What could you do if you didn’t have a single debt payment in the world? That’s right—no student loans, car payments or credit card bills. You could free up an extra $300, $500 or maybe even $800 in your budget every month! Ah, that’s the debt-free life.

And the quickest way to make your debt-free dream a reality is to use the debt snowball method.

What Is the Debt Snowball Method?

The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates.

Not only does the debt snowball help you get rid of debt fast, it’s also designed to help you change your behavior with money—so you never go into debt again.

Here’s how the debt snowball method works:

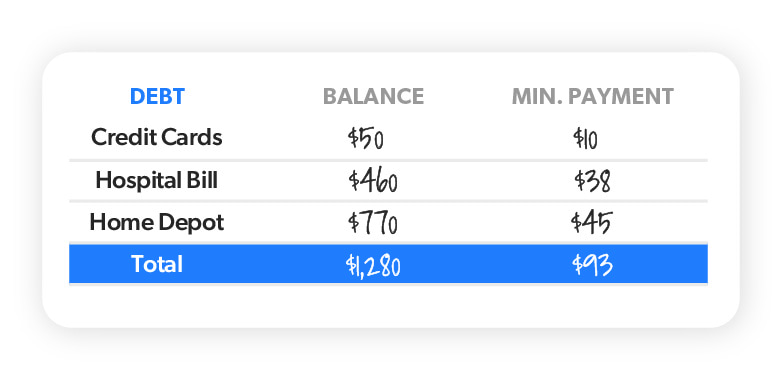

Step 1: List your debts from smallest to largest.

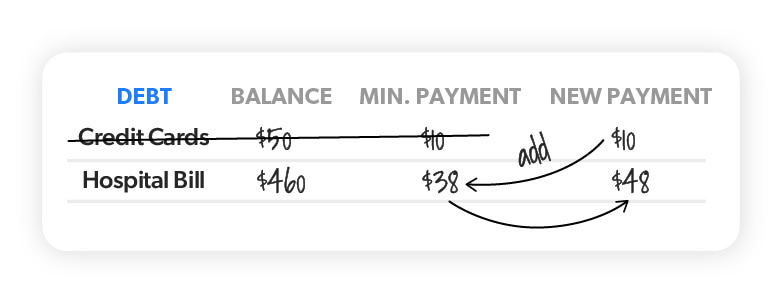

Step 2: Make minimum payments on all debts except the smallest—throwing as much money as you can at that one. Once that debt is gone, take its payment and apply it to the next smallest debt (while continuing to make minimum payments on your other debts).

Step 3: Repeat this method as you plow your way through the rest of your debt. The more you pay off, the more money you can throw at your next payment—like a snowball rolling downhill, getting bigger and faster as it goes!

Why Ignore the Interest Rates?

Sure, you might think paying off the debt with the highest interest rate first would save you more money in the end. That method (known as the debt avalanche) seems like it would make the most sense—at least mathematically.

But here’s the deal: Personal finance is 80% behavior and only 20% head knowledge. Just because it makes the most sense on paper, doesn’t mean you’ll actually stick to it. It’s important to pay your debts in a way that keeps you motivated until you’ve wiped them out.

If you begin with the biggest debt, it’ll take a while for you to feel like you’re making any progress. Chances are, you’ll lose steam and give up before you even really get started. And we don’t want that!

With the debt snowball, the quick wins you get in the beginning will light a fire under you to pay off your remaining debts! Knocking out that smallest debt first gives you the momentum and the motivation to tackle the rest.

Trust us, we’ve helped enough people get out of debt to know the debt snowball is the best (and fastest) way to become debt-free.

What Debts Should I Include in My Debt Snowball?

Your debt snowball should include all of your nonmortgage debt. (And just so we’re clear, debt is anything you owe to anyone else.)

Examples of nonmortgage debt include:

- Student loans

- Medical bills

- Car loans

- Credit card balances

- Home equity loans

- Personal loans

- Payday loans

Yes, your mortgage is debt too, but you won’t tackle that big goal until later— after you’ve paid off all your nonmortgage debts and saved up an emergency fund of 3–6 months of expenses. (It’s all part of the 7 Baby Steps—aka the fastest way to pay off debt, save money, and build wealth!)

When Should I Start My Debt Snowball?

You’re ready to begin your debt snowball once you’ve saved your $1,000 starter emergency fund—what we call Baby Step 1.

We know $1,000 won’t cover every emergency (that’s why it’s a starter emergency fund). But it’s enough to take care of those ankle-biter moments (think dental emergencies or a flat tire) while you focus on working your debt snowball—which is Baby Step 2.

Ready to start your debt snowball? Run your numbers through our Debt Snowball Calculator and find out how soon you’ll be debt-free!

Pay off debt fast and save more money with Financial Peace University.

How to Speed Up Your Debt Snowball

Maybe you just plugged your debts into the Debt Snowball Calculator and your debt-free date seems forever away. We know how defeating that can feel. But there’s a lot you can do to move the finish line closer!

Here are some ways to speed up your debt snowball:

- Get on a budget. A budget is just a plan for your money. And you need a plan to make sure you’re throwing as much money as you can at your debt snowball each and every month. Start by creating your free EveryDollar budget. Today.

- Increase your income. Bring in extra money to go toward your debt snowball by picking up a side hustle or finding other ways to boost your paycheck.

- Sell things. You know you’re sitting on stuff you don’t need anymore—so sell it. And use the cash to fuel your debt snowball.

- Cut expenses. If you’re spending less each month, you can put more of your income toward your debt snowball.

- Take Financial Peace University. The debt snowball is just the beginning. Learn how to take control of your money for good with Financial Peace University (FPU). This course will teach you how to crush your debt, save for the future, and build wealth by following the Baby Steps plan. You can also take an FPU class with others (either in person or online) for even more support and motivation as you pay off your debt!

Okay, now that you’ve got a game plan, it’s time to stop dreaming about a life with no debt and actually make it happen. So, what are you waiting for? Get that debt snowball rolling!

The Best Personal Finance Class at the Best Price

Financial Peace University is the fastest way to beat debt and build wealth. Don’t miss this limited-time sale!