Financial Peace University is the #1 personal finance class that’s helped millions—on sale for a limited time. (Plus, it makes a great gift!)

Start FPU or Upgrade to Ramsey+

Take the class that’ll teach you step-by-step how to budget, beat debt, invest wisely, and take control of your money!

Get FPU, plus all our best tools, content and exclusive perks—everything you need to handle money the Ramsey way!

Three reasons you’re not where you want to be:

You think you’re doing “okay.”

But you’re not. That’s why you’re here, right? You’re in debt. You feel like a rat in a wheel—running and running but getting nowhere. That’s not okay.

You think you’ve heard all this before.

You can listen to every hour of The Ramsey Show for free. Know every Baby Step. So, why are you still stressed and in debt? You know what to do—you’re just not doing it.

You won’t invest in yourself.

For 80 bucks—less than you blew on pizza last month—we’ll help you get out of debt and become a millionaire. We’d call that a pretty amazing ROI.

Three reasons you’re not where you want to be:

You think you’re doing “okay.”

But you’re not. That’s why you’re here, right? You’re in debt. You feel like a rat in a wheel—running and running but getting nowhere. That’s not okay.

You think you’ve heard all this before.

You can listen to every hour of The Ramsey Show for free. Know every Baby Step. So, why are you still stressed and in debt? You know what to do—you’re just not doing it.

You won’t invest in yourself.

For 80 bucks—less than you blew on pizza last month—we’ll help you get out of debt and become a millionaire. We’d call that a pretty amazing ROI.

The proven system that works.

After our nine-week class, the average FPU grad is debt-free in two years or less! We’re not saying it’s easy, but it works—if you will.

Money simplified

Money simplified

FPU lays the entire foundation for handling money in just nine lessons—it’s the fastest, most streamlined way to get control.

Lasting change

Lasting change

Money isn’t a math problem—it’s a behavior problem. FPU will change your habits so you can transform your money and your future.

Real support

Real support

Your FPU coordinator and class members will put their arms around you (and kick your butt)—and it’s that kind of accountability that will cause you to win!

The proven system that works.

After our nine-week class, the average FPU grad is debt-free in two years or less! We’re not saying it’s easy, but it works—if you will.

Money simplified

FPU lays the entire foundation for handling money in just nine lessons—it’s the fastest, most streamlined way to get control.

Lasting change

Money isn’t a math problem—it’s a behavior problem. FPU will change your habits so you can transform your money and your future.

Real support

Your FPU coordinator and class members will put their arms around you (and kick your butt)—and it’s that kind of accountability that will cause you to win!

If you stick with us, we’ll help you . . .

If you stick with us,

we’ll help you . . .

we’ll help you . . .

30 years. Millions of lives changed.

30 years. Millions of lives changed.

You can’t afford

not to do this.

not to do this.

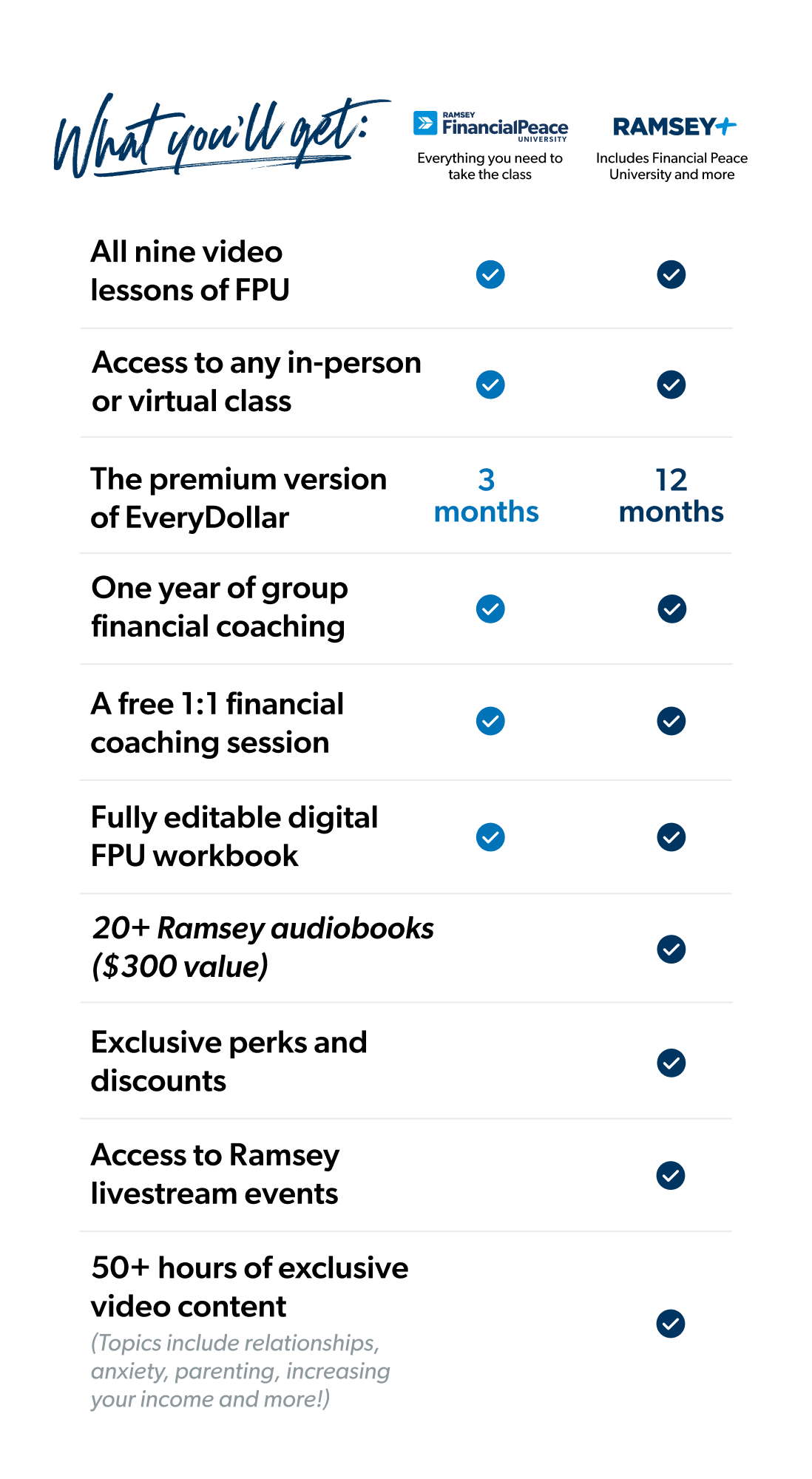

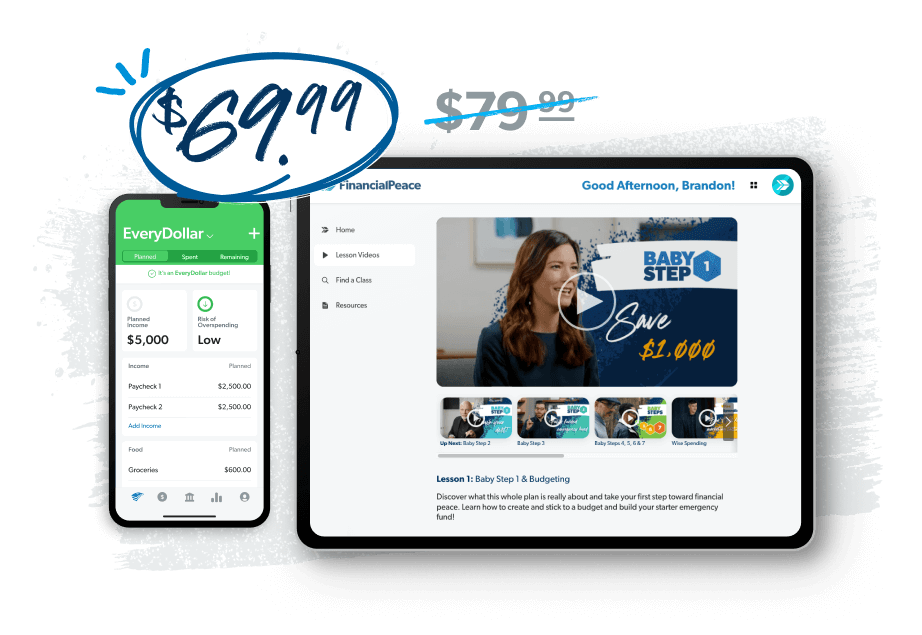

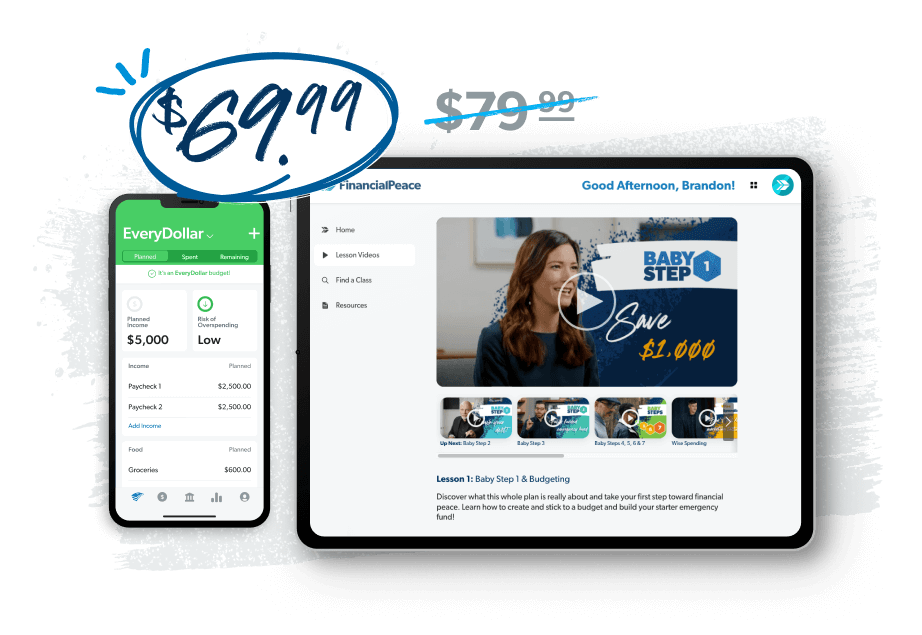

Stop doing the same thing and expecting a different result. FPU gives you everything you need to start winning with money:

• All nine on-demand video lessons

• Three months of premium access to the EveryDollar budgeting app

• A year of group financial coaching

• A free one-on-one financial coaching session

• Fully editable digital workbook

Common Questions (and Answers)

-

How does FPU work?

-

You’ll go through the class with a group of people either virtually or in person. Don’t worry—we’ll help you find the class that works best for you.

Once a week for nine weeks, you’ll watch a video lesson (each one is about an hour long) and then meet as a group for discussions and activities that drive each lesson home. (Aka, the most transformative part of FPU!)

And the results speak for themselves. FPU graduates pay off an average of $5,300 in debt and save an average of $2,700 in just 90 days. That’s a financial turnaround of $8,000—all for a few hours of your time over a few months. (Sounds like a no-brainer.)

-

Will this class work for me if . . . ?

-

It’s easy to feel like you’re the only one in your situation. But no matter where you are on your financial journey—sitting at rock bottom or just trying to do better—we’ve seen this class work for millions of people who:

- Have a huge amount of debt

- Have nothing saved for retirement

- Can’t get on the same page with their spouse about money

- Are facing a financial crisis

- Are newly widowed or divorced

- Are living paycheck to paycheck

- Have a low to average income

- Can’t keep up with their bills

In fact, the average FPU graduate is debt-free in two years or less!

Look, if you commit to FPU and don’t change your life, we don’t want your money. We’ll send it back to you—guaranteed.

-

Is Financial Peace University only for couples?

-

No way—FPU is for anyone! If you're married (or about to be), FPU is definitely one of the best ways to get on the same page with your spouse about money.

But if you're single, it can be tough to manage your money on your own. For better or worse, you have to answer to you. But in an FPU class, you'll get plugged into a community that will encourage you and hold you accountable—so you stay focused on your goals.

-

Can my spouse come with me to the class?

-

We can’t say yes loud enough here. Getting on the same page with your spouse about money is crucial, and FPU has been a game changer for millions of couples.

Plus, it doesn’t cost extra for them to come—you’re both covered when you buy FPU.

-

How long does the class last?

-

Financial Peace University has nine lessons. Most FPU classes meet once a week for nine weeks to go through one lesson each week. The sessions usually last one to two hours to give plenty of time for activities and discussions.

-

Will I get a workbook or other class materials?

-

Absolutely. Once you join a class, you’ll automatically get access to everything you need to go through the class—including a digital workbook. If you want a hard copy of the workbook (and we definitely recommend it), you can always order one.

-

Do I need to get my finances in better shape before taking FPU?

-

You know how the saying goes: “The best time to plant a tree was 20 years ago. The next best time is today.” The same goes for your money! Every day you wait to take control is another day you have to live with all this stress, fear and uncertainty about the future.

And we get it—you might be ashamed about some mistakes you’ve made with money. Or feel like you’ve wasted so much time. Or maybe you’re counting on a bigger income to fix the problem.

That’s okay! We’ve all been there!

In an FPU class, there’s no judgment. No shame. Just a bunch of people just like you all trying to figure this money stuff out together.

It doesn’t matter where you’re starting from. Just. Start.

-

How much does Financial Peace University cost?

-

Financial Peace University is $79.99, which includes everything you need to succeed in the class (and long after).

You have the ability to join any virtual or in-person class you want, plus you'll get a full year of access to all nine video lessons and a digital workbook. We've also thrown in three months of premium access to the EveryDollar budgeting app, as well as free group financial coaching for a year and a free one-on-one financial coaching session. -

Is there childcare available for classes?

-

Some classes offer childcare and others don’t. When you search for classes near you, you’ll be able to see the details of each class or reach out to the coordinator before you register.

-

What if I can’t find a class that works for me?

-

We’re not kidding—the hands-down, most effective way to change your situation with money is by taking this class with a group of other people. The accountability and support is that important!

But if you can’t find an in-person class in your area or a virtual class at a time that works for you, don’t let that stop you from taking control of your money! You can always go through Financial Peace University online at your own pace and join a class with others later.

-

Can I buy Financial Peace University as a gift for someone else?

-

You bet! Visit our store to purchase Financial Peace University. When you check out, just fill in the recipient’s information at the bottom of the form. After you purchase, they’ll immediately receive an email with instructions on how to set up their account and start watching the course.

-

Where can I find information about coordinating a class?

-

If you're interested in coordinating a Financial Peace University class, check out our Become an FPU Coordinator page. Here you can find all the information you need about signing up and coordinating classes!

-

I have an activation code. What do I do?

-

Redeem it here.

The next 5 minutes

can change everything.

can change everything.

This class works. And we believe that so deeply, we’re giving you a preview of Lesson 1—totally free. You’ve got nothing to lose.

(Except a freaking ton of debt.)