Whether you’re confident filing solo or you need support from a pro, we have all the tools you need to crush your taxes.

Let's face it, taxes are confusing. It can seem like you'll never get a grasp on them—and shouldn't even try—if you listen to what some tax services out there say. Or worse, you could get sucked into offers that won't help you win with money. But we think you're smarter than that—and you deserve tax services that are on your side.

With Ramsey SmartTax, you’ll get low, up-front pricing. All major federal forms and deductions. And no hidden fees. Switch, save and file with confidence today.

RamseyTrusted pros are top-notch CPAs and Enrolled Agents who support tax filing, bookkeeping and more. They include local and national pros who are available all year long.

Choose all that apply to you and see what we recommend to crush your taxes.

!["We used [Ramsey SmartTax] for the first time this year and it was quite easy. So much cheaper than using TurboTax as we have done in the past." - Jenn W.](https://cdn.ramseysolutions.net/cms/sites/daveramsey-com/tax/tax-services/quote-image-one.png)

See what we recommend to crush your taxes.

Ramsey SmartTax

Federal Classic

Easy-to-use online software at a low price and no surprising fees

Best if you:

- Have personal or self-employed income

- Feel confident using tax software

Main Features

- Includes all income types and federal forms (NO added fees)

- Covers all deductions

- Provides email and phone support

- Assists you if there's an IRS inquiry up to one year after your return is accepted

Ramsey SmartTax

Federal Premium

Everything in Classic PLUS extra support and resources

Best if you:

- Have personal or self-employed income

- Feel confident using tax software but want fast support for questions

Main Features

Everything in Classic plus:

- Lets you skip the line for email and phone support and use live chat

- Extends help to three years if there's an IRS audit

- Gives you a FREE financial coaching session after you file ($200+ value!)

RamseyTrusted

Tax Pros

Tax Pros

Fully vetted tax advisors who can do it all with top-notch service

Best if you:

- Have more complicated taxes

- Don’t want to take the time to do your own taxes

- Want expert advice

Main Features

- Connect with you quickly to get things started

- Save you the time and effort of filing your own taxes

- Give you a better understanding of your taxes and tax law changes

- Guide you if there are ways to improve your tax situation

!["We uses [Ramsey SmartTax] for the first time this year and it was quite easy. So much cheaper than using TurboTax as we have done in the past." - Jenn W.](https://cdn.ramseysolutions.net/cms/sites/daveramsey-com/tax/tax-services/quote-image-one.png)

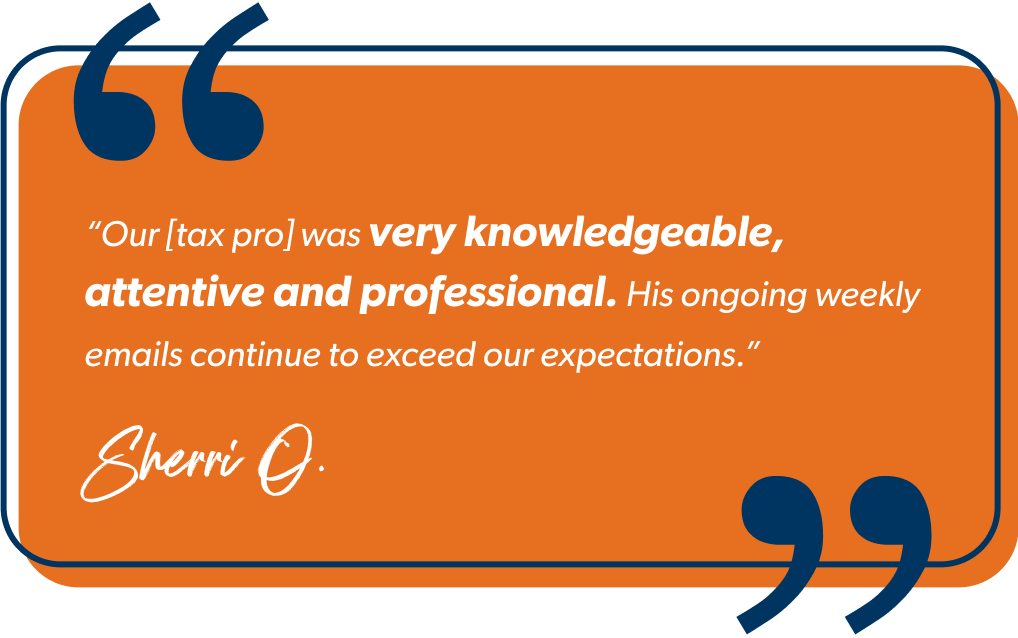

!["Our [tax pro] was very knowledgable, attentive and professional. His ongoing weekly emails continue to exceed our expectations." - Sherri O.](https://cdn.ramseysolutions.net/cms/sites/daveramsey-com/tax/tax-services/quote-image-two.png)

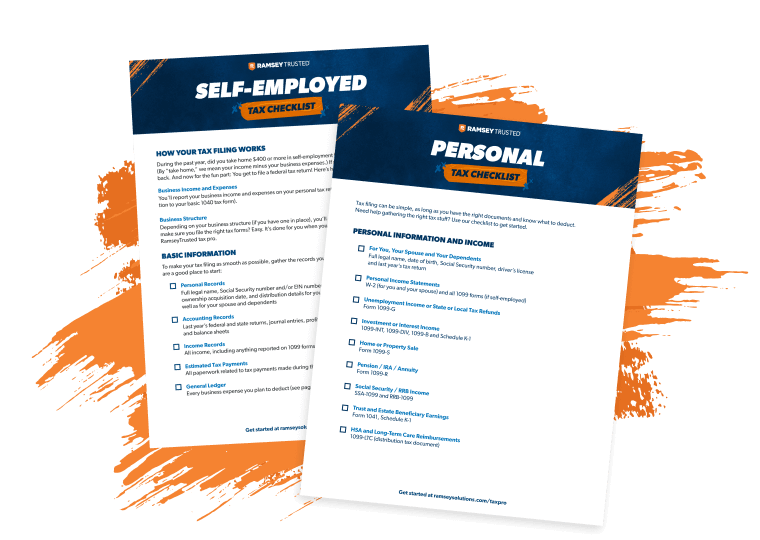

Tax Prep Checklists

Use them to get organized for tax filing.

Beginner's Guide to Taxes

See what you need to know.

Tax Prep Checklists

Use them to get organized for tax filing.

Tax Tips and Deals

Subscribe so you don't miss a beat.