So you’re dreaming of moving to Texas—and what’s not to love? You can rock out at free live music venues in Austin, cheer on the Dallas Cowboys, remember the Alamo at the Alamo, and eat all the brisket and Tex-Mex your heart desires.

If you want to know if you can afford to live in the Lone Star State, you’d have to compare the cost of living in your current city with the Texas city of your dreams. To help you make a confident decision on whether Texas is the right move for you cost-wise, we’ll show you how much Texas charges for “super fun” grown-up stuff like housing, food, taxes and bills.

Let’s giddyup!

What’s the Average Cost of Living in Texas?

Everyone knows everything is bigger in Texas. But does “bigger” mean more expensive? Well, as it turns out, the cost of living in Texas is surprisingly affordable!

In fact, the average cost of living in Texas is 7% lower than the national average.1

Keep in mind, Texas is the second largest state in the U.S.—only behind Alaska (but don’t tell Texans that)—so there’s a wide range. Some Texas cities rank 23% lower to 12% higher in cost when compared to the average U.S. city.2

To get these numbers, we use a cost of living index that compares dozens of cities in Texas with the average U.S. city for several expense categories. An amount below 100 means Texas has a lower cost of living than the U.S. average for that category—take a look!

|

Cost of Living |

Texas |

U.S. |

|

Total |

92.6 |

100 |

|

Housing |

84.4 |

100 |

|

Utilities |

103.3 |

100 |

|

Groceries |

90.8 |

100 |

|

Transportation |

92 |

100 |

|

Health Care |

94.8 |

100 |

|

Miscellaneous |

96.7 |

1003 |

To better understand this index, let’s take a closer look at each category.

Housing Costs in Texas

Okay, let’s start with the housing market. In the fall of 2021, median home prices in Texas were $350,000—about 8% lower than the national median of nearly $380,000!4 Meanwhile, the median monthly rent for a two-bedroom apartment was nearly 4% lower than the national median of almost $1,300.5

With prices like those, you might be wondering why you haven’t ridden off into the Texan sunset sooner! Well, don’t forget, not all of Texas costs the same. When you consider total housing cost factors, Texas ranges all the way from 43% lower than the national average in the southern city of Harlingen, to 27% higher in the city of Plano, north of Dallas!6

To find the Texas city that fits your budget, check out the cost differences between these cities:

|

City in Texas |

Average Home Price |

Average Apartment Rent |

|

Austin |

$409,079 |

$1,583 |

|

Dallas |

$387,379 |

$1,598 |

|

Houston |

$316,904 |

$1,095 |

|

San Antonio |

$285,073 |

$1,382 |

|

Amarillo |

$213,905 |

$9127 |

Don’t buy or sell without an agent you can trust.

There are RamseyTrusted real estate agents all over the country who are ready to help you win.

Utilities

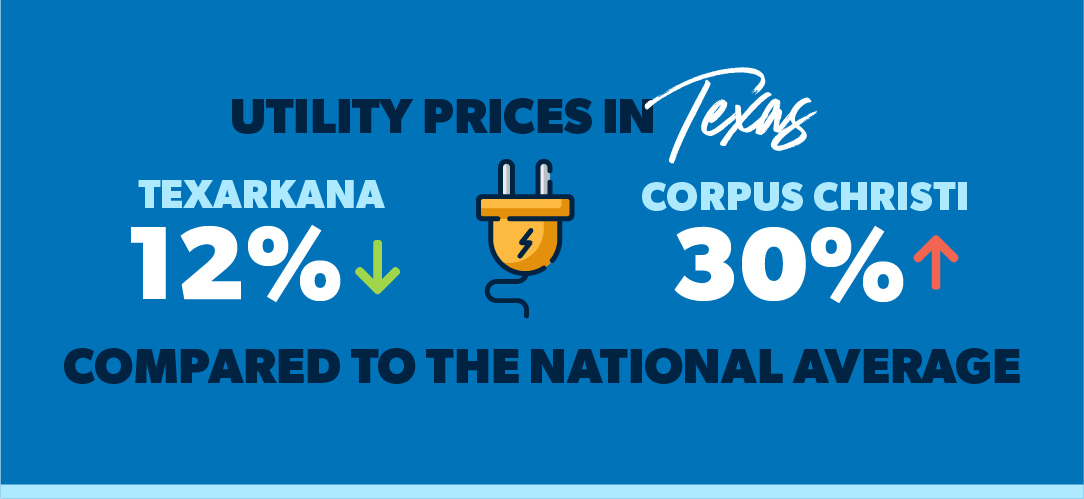

Utility costs like energy and phone use in Texas range from 12% lower than the national average in the eastern city of Texarkana, to 30% higher in Corpus Christi on the Gulf of Mexico! The Sherman-Denison area, located in North Texas, is somewhere in the middle range among Texas cities for utility costs at 5% higher than the national average.8

Trust us, you’re going to want to crank up the AC.

Groceries

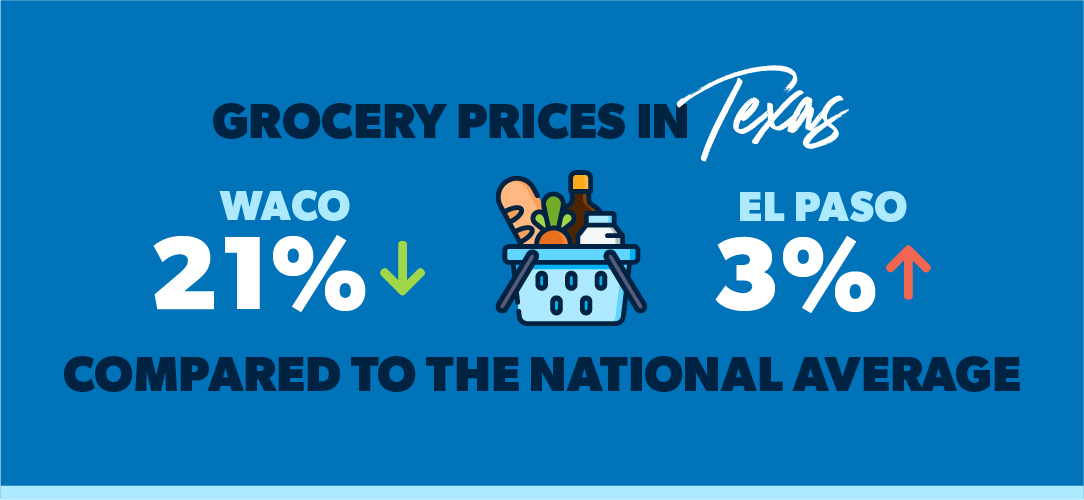

Groceries in Texas range from 21% lower than the national average in Waco, the homeland of Dr. Pepper just south of Dallas, to 3% higher in El Paso.9

Find expert agents to help you buy your home in Texas.

Speaking of groceries, you might find yourself shopping at H-E-B. The supermarket chain is headquartered in San Antonio, which just so happens to sit somewhere in the middle price range among Texas cities for groceries. In San Antonio, you can purchase a half gallon of milk and some cereal for a little more than $5, which is 16% less than the national average—cha-ching!10

Transportation

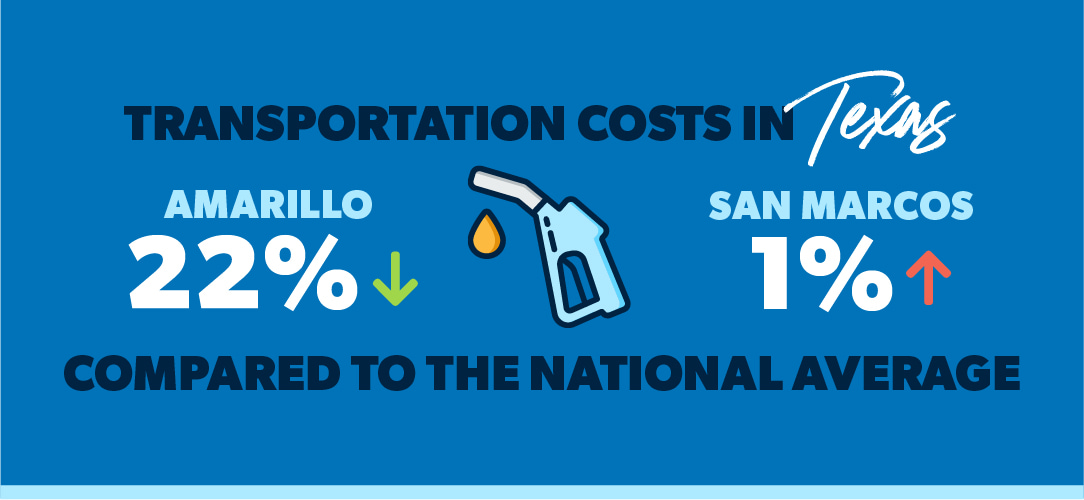

Rev up your engines! Texas transportation costs range from 22% lower than the national average in the northern city of Amarillo, to 1% higher in San Marcos, a city south of Austin. Again, San Antonio slides into the middle range for transportation costs among most Texas cities, which is 7% lower than the national average.11

Since Texas is mostly a driving state, you’ll want to keep transportation costs low by getting the right coverage. Try bundling your auto insurance for a discount by talking to one of the independent insurance agents we recommend.

Health Care

Texas health care costs range from 29% lower than the national average in the southern city of McAllen, to 13% higher in Dallas. Meanwhile, Longview, a couple hours east of Dallas, sits in the middle range among Texas cities, with health care costs almost 4% lower than the national average—not too shabby.12

Here’s a breakdown of how Longview health care costs compare to the average city in the country:

|

Health Care Type |

Longview, TX Cost |

Average U.S. City Cost |

Cost Difference |

|

General doctor |

$89 |

$117 |

24% |

|

Dentist |

$100 |

$101 |

1% |

|

Eye doctor |

$121 |

$109 |

10% |

|

Advil |

$10.24 |

$9.90 |

3% |

|

Prescription drug |

$505 |

$470 |

8%13 |

Taxes

Guess what? Texas has no state income tax!14 That’s right, if you don’t mess with Texas, Texas won’t mess with your taxes. Well, at least it won’t touch your paycheck. Texas still has a state sales tax rate of 6.25%—or 8.19% if you include its average local rate. That percentage ranks Texas as the 14th highest in the country for total sales tax—cue the eye roll.15

If all this tax talk makes you quake in your boots, don’t worry. You can find out exactly how moving to Texas will impact your taxes by connecting with one of our trusted tax advisors.

Miscellaneous Goods and Services

Miscellaneous costs refer to a wide range of goods and services including things like common restaurant foods, clothing, entertainment, activities and personal care. In Texas, these costs range from 21% lower than the national average in Harlingen, to 14% higher in Plano.16

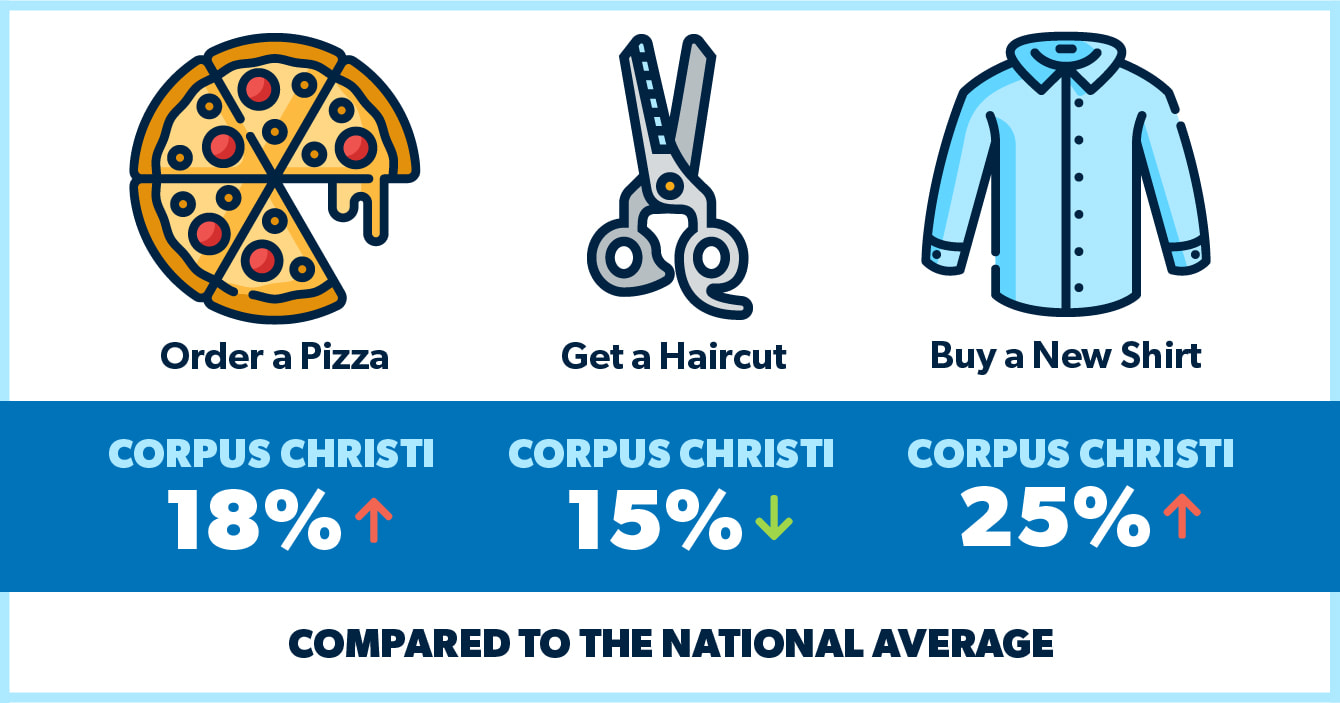

Corpus Christi represents most Texas cities for miscellaneous costs, which is 3% lower than the national average. In Corpus Christi, you can order a pizza for $13, get a haircut for $17, and buy a shirt for $38. For reference, those prices are $11, $20 and $31 for the average U.S. city.17 But if you want authentic kolaches for dessert, you’ll have to move to Texas.

How Much Money Do You Need to Live Comfortably in Texas?

In Texas, the median household income is $61,874.18 But if you make that much, it doesn’t automatically mean you can afford to live anywhere in Texas—at least not comfortably.

If you want to live comfortably in the Lone Star State, first make sure you can afford your biggest expenses—namely, your housing costs.

Whether you decide to rent or buy in your new city, stick to the 25% rule—never move into a home that comes with a monthly payment that’s more than 25% of your monthly take-home pay.

For home buyers who are getting a mortgage, that 25% limit includes principal, interest, property taxes, home insurance and private mortgage insurance (PMI)—and don’t forget to consider homeowners association (HOA) fees. Use our mortgage calculator to enter your down payment amount and try out different home prices within your budget.

For a mortgage you can pay off fast, talk to our friends at Churchill Mortgage about getting a 15-year fixed-rate conventional loan. Any other type of mortgage will cost you extra in interest and fees and keep you in debt for decades. Trust us, following the 25% rule will give you enough room in your budget to balance housing costs and your other living expenses with ease.

What’s the Cost of Living in Texas vs. California?

In case you’re curious, the top state people are moving to Texas from is California. In fact, 82,235 Californians moved to Texas in 2019—meanwhile, only 37,063 Texans moved to California, according to the latest data by the U.S. Census Bureau.19

One reason so many Californians might be moving to Texas is because the average cost of living in Texas is significantly lower compared to the cost of living in California (shocker!). To see for yourself, let’s use our cost of living index to find out what it’d be like, cost-wise, moving from a popular city in California to a popular city in Texas:

|

Cost of Living |

San Francisco, CA |

Austin, TX |

Cost Difference |

|

Total |

188.7 |

101.8 |

46% less |

|

Housing |

344.2 |

113.4 |

67% less |

|

Utilities |

133.9 |

95 |

29% less |

|

Groceries |

130.3 |

92.3 |

29% less |

|

Transportation |

146.4 |

87 |

41% less |

|

Health care |

123.6 |

105.8 |

14% less |

|

Miscellaneous |

122.7 |

101.3 |

17% less20 |

Wow! As you can see, moving to a new city with a lower cost of living can be an incredible way to transform your financial life! But a big move like that isn’t always the right choice for everyone—there are always more pros and cons to consider.

Compare the Cost of Living in Texas With Your Current City

Now you know the cost of living in Texas—but can you afford it? If you want to be sure, try our free Cost of Living Calculator to determine how much more or less expensive it would be for you to live in the Texas city that’s calling your name.

If Texas has a higher cost of living than you can currently afford, not all hope is lost. Try one of these ideas:

- Adjust your standard of living.

- Try to bump up your salary when you find a new job.

- Move to an affordable zip code that’s within range of your desired city.

Next Steps

- Figure out where you want to live in Texas and if you can afford it.

- Estimate how much it’ll cost to move, and make a plan to save up that amount.

- Work with a RamseyTrusted real estate agent. For a quick and easy way to find real estate agents in Texas and your current city, try our RamseyTrusted program. The agents we recommend have earned the Ramsey team's stamp of approval by always serving with excellence.

Where Did We Get Our Data?

The data that drives most of these numbers and our Cost of Living Calculator comes from the Cost of Living Index published by the Council for Community and Economic Research (C2ER). Since the cost of living in any area is constantly changing, you can always check our calculator to find the most recent data. If you want to learn more about C2ER, get the scoop here.