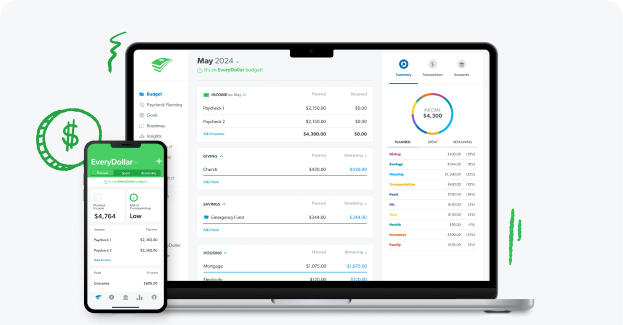

EveryDollar App

EveryDollar is your personal budget app. Create custom budgets, plan spending, track expenses, and more. For. Free.

A budget is a plan for your money: every single dollar that’s coming in (income) and going out (expenses). When you learn how to budget—and make one every month—you give your money purpose. You. Take. Control.

Write out every regular paycheck (and anything extra) coming in this month for you and your spouse, if married. Then add it all together to see how much you have to work with.

Jot down all the giving, saving and spending happening this month. (Think groceries, utility bills, mortgage/rent . . . )

This should equal zero (aka a zero-based budget). Put anything extra toward your current money goal or lower your planned spending—until you get to zero.

Stay on top of your spending by keeping track of every dollar that comes in or out of your budget.

If you overspent (or underspent!) on a budget line last month, make adjustments to next month. And don’t forget seasonal expenses.

Make your first budget in minutes. Track your monthly spending with ease. And know at a glance what’s left to spend—so you don’t overspend. Download the free EveryDollar budget app today!

If you’re new to budgeting—this calculator is a solid starting point. Just type in your monthly take-home pay, and you’ll get an example budget to help you begin.

Enter your income and the calculator will show the national averages for most budget categories as a starting point. A few of these are recommendations (like giving). Most just reflect average spending (like debt). Don't have debt? Yay! Move that money to your current money goal.

EveryDollar is your personal budget app. Create custom budgets, plan spending, track expenses, and more. For. Free.

Use our envelope system to pay cash for those hard-to-wrangle budget lines (like groceries, restaurants and entertainment).

Want to learn more? No matter where you are in your budget journey—fresh face or old pro—this guide’s got what you need.

If you’ve never budgeted before (or it’s been a while) jumping in can be challenging. You know what'll help you feel confident as you start? A budget template!

With an irregular income, your paychecks can be up one month and down the next. So how do you budget?

Budgets: Can't hit your goals (or fight inflation) without them. But man, it can be hard to get things just right. You know what you need? This list filled with 15 of our favorite budgeting tips.

A budget is a plan for your money—every single dollar that’s coming in (income) and going out (expenses).

Cover your Four Walls—food, utilities, shelter and transportation—before you budget for other essential expenses and fun.

This depends on what Baby Step you’re on (aka the proven path to saving money, ditching debt, and building wealth).

Once you are debt-free and have a fully funded emergency fund, start investing 15% of your gross household income in retirement accounts.

There are plenty of ways to budget: pencil and paper, spreadsheets, budgeting apps. Just make sure you budget every dollar, every month. If you want an easy, free way to create and keep up with your budget—check out our free EveryDollar app.

You’ve probably heard of the 50/30/20 rule or the 60% solution, but we use the zero-based budgeting method. This is when your income minus your expenses equals zero—aka you’re giving every dollar you make a job to do so none of it gets accidentally spent! It’s simple math that works no matter your household income.

It’s completely normal to have a few rocky budgets to start. It usually takes around three months to get comfortable with budgeting. You’ve got this.

Absolutely! When you’re listing your income, look over the last few months and pick the lowest amount you made as this month’s planned income budget line. You can adjust later in the month if you make more!