One of the best ways to wreck your day . . . is to wreck your car! But scary (and expensive) as collisions can be, there’s more than one way to damage your car—heck, it can get damaged when you’re not even driving it!

And when random car damage strikes, comprehensive insurance is there for you.

What Is Comprehensive Insurance?

Although the name comprehensive might make you think, Oh, this covers everything—think again! Comprehensive insurance helps you pay for any damage to your car not covered by your collision insurance, and covers damage to your car caused by other kinds of disasters—like fallen trees, wildfires or wildlife. (Seriously, why do deer run toward traffic?).

We’ll talk all about everything comprehensive insurance covers, how it works and if you need it. (Spoiler alert: You probably do!)

But first let’s go over a few key terms you’ll need to know when you’re learning about comprehensive coverage.

Key Comprehensive Insurance Terms

To really understand comprehensive insurance and what it does, it helps to know a few of the terms that might pop up when you’re shopping around. Here we go!

Actual cash value: Just like it sounds, this is the amount you’d expect to get for your car if you sold it in its current condition. Of course, that’s before it gets mauled by a bear lumbering across the highway.

Collision insurance: Think traffic accidents. This insurance coverage pays to repair or replace your car if you roll it, or if it’s damaged in an accident with another vehicle or a stationary object, like a fence or a guardrail.

Deductible: It’s the dollar amount you’ll need to pay out of pocket when you make a comprehensive insurance claim. The higher your deductible, the lower your premiums—and vice versa. (More on that below.)

Full coverage car insurance: When you have collision and comprehensive coverage, along with liability insurance, then you have something beautiful known as full coverage car insurance. Full coverage insurance can get expensive! But if you get a good rate, it’s worth the extra dollars to have peace of mind knowing damage to your car from all kinds of disasters is covered.

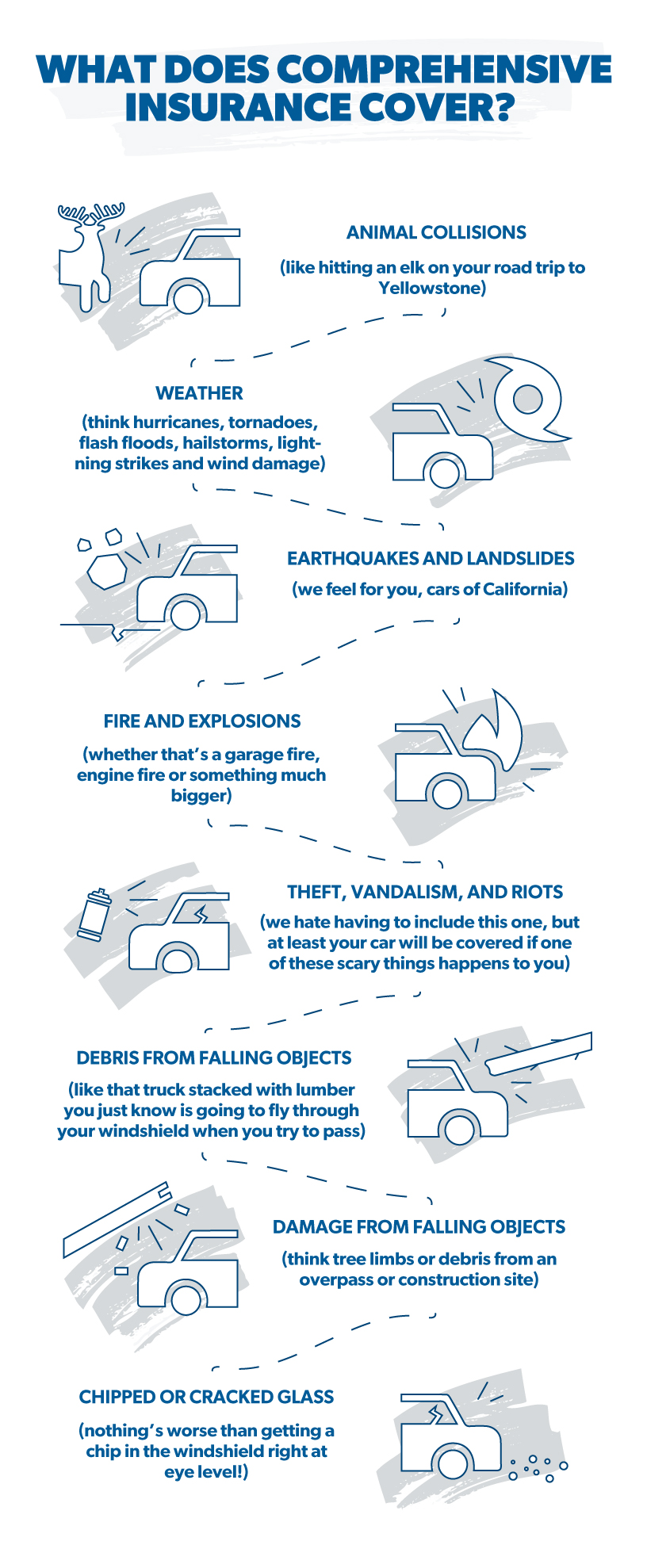

What Does Comprehensive Insurance Cover?

Like we already said, the comprehensive in comprehensive insurance is a little misleading. Instead of covering all the bad stuff your car goes through, it’s more like a catch-all coverage for damage not caused by colliding with another vehicle or stationary object. Here are some of the most common examples of what comprehensive coverage covers:

- Animal collisions (like hitting an elk on your road trip to Yellowstone)

- Weather (think hurricanes, tornadoes, flash floods, hailstorms, lightning strikes and wind damage)

- Earthquakes and landslides (we feel for you, cars of California)

- Fires and explosions (whether that’s a garage fire, engine fire or something much bigger)

- Theft, vandalism and riots (we hate having to include this one, but at least your car will be covered if one of these scary things happens to you)

- Debris from other cars (like that truck stacked with lumber you just know is going to fly through your windshield when you try to pass)

- Damage from falling objects (think tree limbs or debris from an overpass or construction site)

- Chipped or cracked glass (nothing’s worse than getting a chip in the windshield right at eye level!)

Basically, comprehensive insurance covers the cost to repair or replace your car if something really unlucky happens to it.

Comprehensive vs. Collision

There are several types of car insurance, so it’s understandable when people mix up comprehensive vs. collision. And they do work together to protect you financially if your vehicle is damaged, and you need both for complete protection on the road or in your driveway. To keep ’em straight, let’s look at both types side by side and find out where comprehensive insurance fits in.

Don't let car insurance costs get you down! Download our checklist for easy ways to save.

When you think of your collision policy, think:

- Crashes with other vehicles in traffic

- Collisions with objects (like a fence or lamppost)

- A single-car accident where you end up rolling over (yikes!)

That’s all!

And when you think of comprehensive? See it as a separate (but related) coverage policy that usually doesn’t kick in for damage caused by driving. It catches almost any other kind of automotive damage you can imagine—natural disasters, man-made mayhem and everything in between.

Here’s another helpful way to compare the two types. Think of collision as what you need when your car hits something else, and comprehensive as what you need when something else hits your car—other than some other guy’s vehicle!

Although collision is a totally separate coverage type, insurance companies often package it together with comprehensive. So don’t be surprised if buying one type requires you to buy the other one too.

Save Money With an Insurance Bundle

A RamseyTrusted pro can hunt down the best car and home insurance deals to get you quality coverage without breaking the bank.

How Does Comprehensive Insurance Work?

When you buy a comprehensive insurance policy, you’ll first need to choose a comprehensive deductible. Got hail damage? (Those ice balls can cut deep!) The deductible is the amount of money you’ll pay out of pocket to smooth out the dents or any other kind of damage from an event the policy covers.

After you pay the deductible, the insurance company will pay up to the policy limit. The policy limit is usually the amount the car is currently worth—not what you originally paid for it. (Sorry, but them’s the rules. That’s what gap insurance is for.)

Let’s look at some examples to see how that works.

Staying Under the Policy Limit

Anna’s car is worth $7,000. She hits a deer and causes $1,500 of damage to her car. The cost of repairs is less than the car’s total value, so the insurance company will actually pay less than the policy limit. In this case, Anna pays her $500 deductible, and the insurance company pays the other $1,000. (Thank goodness she has an emergency fund to cover her part of the repairs!)

Reaching the Policy Limit

Christy’s car is worth $10,000. One morning, she heads out to her car to leave for work. But her it’s been stolen. She has a $1,000 comprehensive deductible, so the insurance company writes her a check for $9,000—the value of the car minus the deductible.

Passing the Policy Limit

Jeff’s car is worth $3,000. He’s driving home and a ladder falls off the construction truck in front of him. The ladder hits him, doing serious damage under his car. Repair bill: $3,500. Since the cost to repair exceeds the value of the vehicle, the insurance company decides it’s a total loss, and not worth fixing.

At this point, Jeff has a choice to make. If he’s like most people with a totaled vehicle, he’ll opt to take the $2,000 payout from his comprehensive coverage (what the car is worth minus his $1,000 deductible). But maybe Jeff just can’t let go of his beloved wreck and he’s willing to binge-watch a DIY mechanic’s YouTube channel called “Overhaul Your Underbelly!” (Hey, these people exist, and they’ve got pretty impressive car repair skills, right?)

In that case, Jeff can make a deal with the insurer to keep the heap and get a salvage title—he’ll also get a much smaller payout since he’s basically buying the car back from the insurance company. Plus, he won’t be able to drive it until it’s repaired and issued a rebuilt title, but whatever floats his boat . . . err, car!

In each case, comprehensive insurance saved that person a lot of money. That’s why it’s so important!

Choosing a Comprehensive Insurance Deductible

Now you might be thinking, I want a low deductible like Anna so I don’t have to pay as much. After all, isn’t it better to pay $500 than $1,000?

Well, not always.

When your deductible is low, the car insurance company is more likely to lose money helping you pay for repairs. To offset that risk, they charge higher premiums. You’ll pay more for coverage—and the longer you go without filing a claim, the more money the insurance company makes from your premiums.

On the other hand, a high deductible may sound bad, because you have to pay more up front if you have to file a claim. But you’ll actually pay lower monthly premiums—so the longer you go without filing a claim, the more you save.

And don’t forget about your emergency fund! If you’re done with Baby Step 1, you can choose a $1,000 deductible, because that’s how much you have saved for emergencies. And if you’re on Baby Step 3 with a fully funded emergency fund, you can go for an even higher deductible and lower premiums! Choosing high deductibles with low premiums is one of the best ways to save money on insurance.

What are the Baby Steps? They’re a step-by-step plan millions of people have used to save money, pay off debt, and build wealth. You can learn more about the Baby Steps—and a ton of other money topics (like insurance) in Financial Peace University.

Is Comprehensive Insurance Worth It?

We think comprehensive insurance is almost always a good addition to your auto insurance. After all, auto accidents happen—and they don’t always involve another car!

Comprehensive Advantages

Comprehensive insurance protects you financially whenever those random types of accidents we mentioned above happen. Instead of paying all the costs to repair or replace your car from that freak mudslide or high-speed deer collision, you’ll get help from the insurance company—saving you money and keeping you focused on your big financial goals

Another sad but common situation where you’ll want comprehensive insurance: if you happen to be leasing or financing your car. (By the way, that’s something you shouldn’t have done anyway, since debt always slows your financial progress way down.) But if that’s you right now, your lender will probably require you to have comprehensive coverage.

Comprehensive Disadvantages

The only disadvantage we see with comprehensive coverage is that it could potentially cost you more than it’s worth—but that’s a pretty unusual situation. For example, your vehicle could lose so much actual cash value that it dips below the amount of your policy deductible. Would your jalopy be lucky to fetch $1,000 on Facebook Marketplace? Then a $1,000 deductible means you’re paying for a policy that would pay you nothing even if your car was totaled. (By the way—if your vehicle really is valued under a provider’s lowest deductible, they probably won’t offer you comprehensive coverage on it anyway.)

So if you’re driving a hooptie to get through Baby Step 2, you get a pass on this . . . for now. But the second you get a car that’s worth a little more, get comprehensive insurance to go with it! And if you’ve already got a car that qualifies, you need comprehensive coverage ASAP.

Is Comprehensive Insurance Right for You?

Comprehensive coverage is usually right for everyone. It’s especially important if you live in an area where natural disasters are common—like wildfires in California, hurricanes in Florida or tornadoes in Oklahoma—or if you live in a big city where other people are likely to be careless and damage your car (hello, Chicago). And it’s definitely important if you’re in Baby Step 1 or Baby Step 2, when you don’t have enough cash laying around to replace your car.

Find the Best Comprehensive Insurance Policy

Comprehensive car insurance is a necessity, but that doesn’t mean you have to pay an arm and a leg for it (or a lung and a kidney, if your insurance company sucks). It can actually be downright affordable! With our trusted network of insurance pros, you can find an independent insurance agent in your area to get the best deals on comprehensive coverage.

Connect with a RamseyTrusted insurance pro to make sure you’re covered and find out how you can save on your car insurance.

Frequently Asked Questions

-

What if my car is gone from a parking lot?

-

If your car is missing when you get back to the place you left it, it might have been towed for being illegally parked. Be sure you figure out what happened before calling your comprehensive insurance provider. But it also could have been stolen! In that case, dial away. Comprehensive insurance definitely covers theft—just remember you’ll be responsible for the deductible to replace it.

-

What if someone keys my car?

-

Comprehensive insurance would include any kind of vandalism to your car, including if it gets keyed.

-

What about an animal that runs into the road?

-

If an animal runs into the road and you crash into it or run into a ditch trying to avoid it, any resulting damage will be covered by a comprehensive insurance policy.

-

What if my car is tossed around in a tornado?

-

When tornadoes strike, any resulting damage to your car would be included in a comprehensive insurance policy.

-

What damage is not covered by comprehensive coverage?

-

Comprehensive coverage will not cover any damage to your car that happens from hitting another vehicle or stationary object. That’s what your collision policy is for. Other costs that you will not be able to cover through comprehensive include any normal wear and tear, like windshield wipers, belts and hoses, tires or brakes.

-

Does comprehensive insurance cover damage from potholes?

-

Believe it or not, insurers categorize vehicle damage from running over a pothole as a collision event—not an event covered by comprehensive damage. Just be sure you have both types of coverage in place.