You’ve been playing the game for years now. You’ve had it for so long, it’s almost like a buddy. You live and breathe those three life-altering digits.

That’s right—we’re talking about your credit score. And it’s time to start thinking about it in a whole new light.

But what is a FICO score anyway? What is this thing you’ve allowed to rule your life? And when did everyone start using it as the ultimate measure of how successful you are? It’s time to break down everything you need to know about the FICO score—and why you don’t really need one.

What Is a FICO Score?

Your FICO score is a kind of credit score that’s used to figure out if you’ll be approved to borrow money. Lenders use this credit scoring system to decide if they can count on you to pay back your debts. The higher your score, the more “trustworthy” you are in the lender’s eyes.

So, who do we have to thank for the “almighty” FICO score? That would be the company that used to be called the Fair Isaac Corporation. Founded back in 1956 by Bill Fair and Earl Isaac, FICO has become a powerhouse of credit reporting over the years.

In today’s world, most people probably think the FICO score is as old as time itself. But that’s just what the powers that be at FICO want you to think. In reality, the FICO score didn’t even become a thing until 1989—and that means it could be younger than you! Kind of makes you think twice about how much people rely on this thing, doesn’t it?

In reality, a FICO score doesn’t measure how good you are with money, how wealthy you are, or how successful you are. All it really says is how good you’ve been at making payments to banks and lenders over and over again.

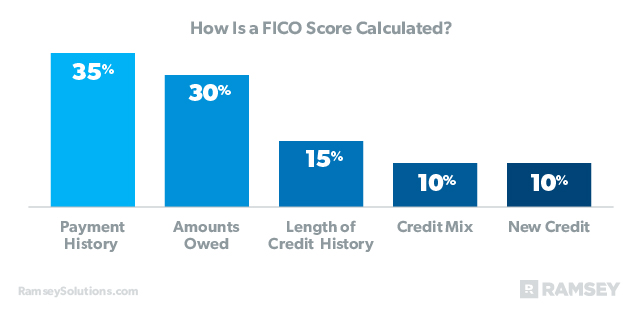

How Is a FICO Score Calculated?

The folks at FICO love to keep their cards close to the chest on this one. In other words, no one outside the company really knows exactly how they calculate the scores. But here are the factors we do know they use to figure out your credit score:1

- Payment history (35%)

This makes up the biggest chunk of your credit score, coming in at a whopping 35%. Your payment history is exactly as it sounds. They take a detailed look at how you’ve handled your debt over the years. Have you missed payments? Are you in good standing with your creditors? Have you filed for bankruptcy?

- Amounts owed (30%)

Amounts owed (or credit usage) just looks at the percentage of debt you have in comparison to your credit limit. Turns out, creditors don’t want you borrowing up to your credit limit (at least we have that in common). But they also don’t like it when you’re not using enough. If this gives you a head tilt, you’re in good company.

- Length of credit history (15%)

This category factors in the average age of all of your credit accounts (including the newest and the oldest).

- Credit mix (10%)

The credit bureaus want to know what kinds of credit you’re juggling. And usually, those fall into two categories: installment accounts and revolving accounts. Installment accounts include things like your mortgage, a car loan or personal loans. Credit cards would fall into the revolving account category.

- New credit (10%)

Here, credit bureaus are looking into your recent activity. Have you opened up a bunch of new credit cards recently (or tried to)? They really look into everything

Get help with your money questions. Talk to a Financial Coach today!

What doesn’t a credit score take into consideration? Oh, you know, just the really important things, like how much money you have in savings and what your net worth is.

Yeah, they don’t pay any attention to those things. They aren’t all that interested in how well you handle money. What they really care about is how good you are at juggling debt.

FICO Score vs. Credit Score

Believe it or not, the FICO score is actually just one type of credit score—it’s not the only kind of credit score out there. Sure, the FICO credit score is the most commonly used across the board, but it’s not the only credit score in town.

Your credit score can actually be different depending on what scoring model is used and whether it’s Equifax, Experian or TransUnion reporting the information.

Still, FICO has such a presence that when someone is talking about their credit score, they’re pretty much just talking about their FICO score (whether they even know it or not).

FICO Score vs. VantageScore

Another type of credit scoring system is VantageScore. It works just like FICO, except the people at TransUnion, Equifax and Experian created this one. That’s right—everyone’s got their hands in the cookie jar when it comes to credit scores.

FICO and Vantage pretty much use the same kind of information to determine your credit score, but the VantageScore is used more when someone doesn’t have enough credit history to generate a FICO score report.

To get a FICO score, you usually need to have one open account with at least six months of history.2 Vantage now uses machine learning technology (nothing creepy about that at all) to evaluate and give credit scores to consumers with limited credit history.3 But make no mistake about it—whether it’s Vantage or FICO, it’s still a credit score and you still don’t need it.

What Are the VantageScore Ranges?

VantageScore ranges and FICO ranges are similar, but there are a few differences. The first difference you’ll notice is the names. VantageScore wanted to get fancy with their categories, so each category is based off the word prime. Basically, super prime means excellent and deep subprime means terrible.

Here’s the breakdown of VantageScore ranges:

- Super prime: 781–850

- Prime: 661–780

- Near prime: 601–660

- Subprime: 500–600

- Deep subprime: 300–499

The categories of VantageScore seem a bit more forgiving than FICO’s ranges, but like we said earlier, they’re pretty similar.

What Are the Types of FICO Scores?

When we talk FICO, a lot of people assume there’s only one score. But that’s not the case. Truth be told, there are actually a few different types of scores with different scoring ranges.

Base FICO score: 300–850

You’re probably most familiar with the base FICO score. This is the number that usually gets pulled when you apply for a credit card or loan. This score looks at all the different types of debts you’ve ever had and your history paying on them.

Industry-specific FICO score: 250–900

This one is just like it sounds: It’s a credit score that applies directly to the industry you’re looking at. Did you know there are specific credit scores for auto loans that are actually different from an overall FICO score? Yep, it’s true. They use the base type of credit score and then build another one that says how creditworthy you are specifically for a car loan. Crazy stuff, right?

UltraFICO score: Can raise your overall score by 20 points

You might have already heard, but we have some really strong thoughts when it comes to the UltraFICO score. In a nutshell, the UltraFICO score is designed to “boost” the credit score of people who already have a low score. These are people who might have trouble paying back a loan or keeping up with their credit card payments.

But thanks to UltraFICO, they can now be approved for more credit. So, if they’re denied for a loan or credit card, they can ask the lender to pull their UltraFICO. This means the lender will rummage through their checking, savings and money market accounts to figure out if they qualify for an artificial boost of up to 20 points.

Taking advantage of people who are already struggling and trying to dish out more debt to them? That’s ridiculous!

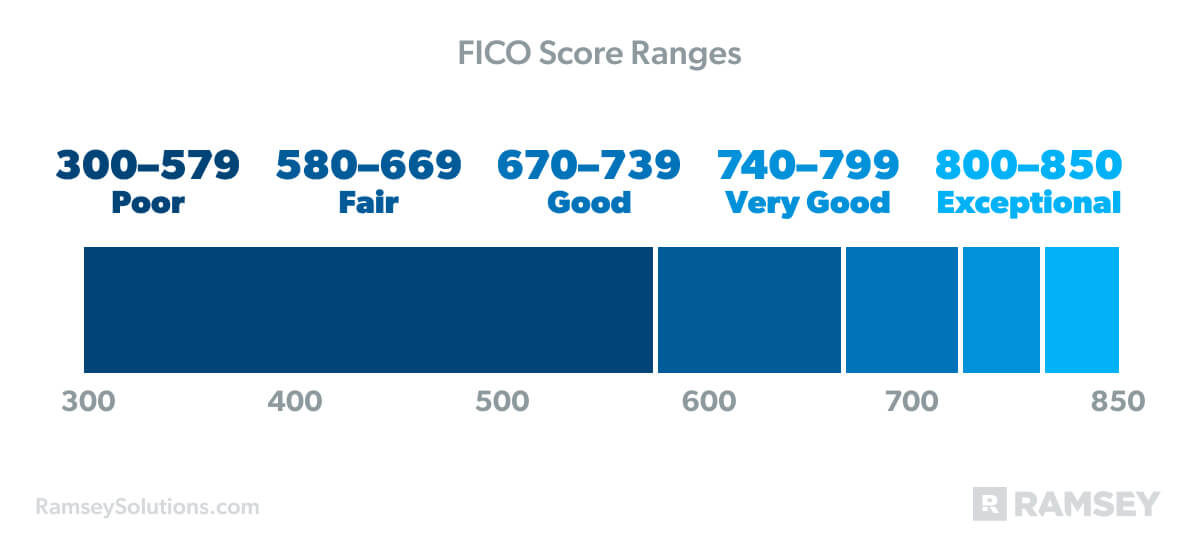

What Are the FICO Score Ranges?

Here’s the breakdown of FICO score ranges:

- Exceptional: 800–850

- Very Good: 740–799

- Good: 670–739

- Fair: 580–669

- Poor: 300–579

FICO scores range from being called exceptional at the top to poor at the very bottom of the barrel. The higher the credit score, the less the credit risk for lenders (supposedly). They assume that if you’ve taken out enough debt to get a high credit score, then surely you’re less likely to default on your debt.

What Is Considered a Good vs. Bad Credit Score?

If you really want to put a label on it (and most people do), a good credit score falls into FICO’s range of 670-739. Anything below 670 would be considered bad, and you might have trouble getting approved for more debt at those numbers. (Which isn’t really a bad thing.) And if you’re in the market for a house, don’t worry. You don’t even need a credit to become a homeowner! But more on that later . . .

If your FICO score falls into the poor or fair range, don’t panic. There are ways to take control of your money and gain financial peace . . . no matter what that silly three-digit number says. Hear us loud and clear: Your FICO score doesn’t matter, and it’s definitely not a number you should base your worth on.

A Low Score Is Not the Same as No Score

Let’s make sure we’re being perfectly clear here: We’re not preaching that you should have a low credit score. What you want is no credit score to speak of at all. Zip. Zero. Nada. Well, technically it would read as indeterminable. But still, that’s what you want.

The important thing is that once you have zero debt to your name, that magical indeterminable credit score will find you. The longer it’s been since you paid your last debt and closed your cards, the closer you’ll be to that highly desirable indeterminable score.

(Just in case you’re wondering: Yes, Dave Ramsey’s credit score is indeterminable. And he wears that accomplishment with pride!)

Does Your FICO Score Matter?

If you’re applying for a credit card, yes. Getting a car loan? Sure, you’ll want a credit score.

But hold on to your seats. We’re about to make a really bold statement: You don’t need a credit score.

Cue the shock, the awe and (for some) the horror! People who “need” a credit score are people who plan to take on more debt. That’s not what we want for you. The goal here is to become completely debt-free, and debt-free people don’t need a credit score. Why? Because they aren’t taking on more debt!

Around here, we like to say a credit score is just an “I love debt” score. Think about it. A credit score doesn’t reflect your salary increases, the amount of money in your savings account, or how well you budget each month. If you inherited a million dollars tomorrow, your credit score wouldn’t change one single point.

In other words, a credit score has nothing to do with how well you handle your money. Your credit score rates how much you juggle debt . . . which would be great if debt was a bunch of soft, squishy juggling balls. But when it comes to your financial future, those juggling balls are actually flaming chainsaws that could cause a ton of damage if you ever dropped one!

But wait—don’t you need a credit score to buy a house?

Nope.

Despite what your real estate agent might say, you can buy a home without having a credit score. There are other ways to prove you pay your bills that don’t require you to have debt or a credit score at all.

Allow us to introduce you to a wonderful thing called manual underwriting. You can get a mortgage without a FICO score as long as you find a company that still does manual underwriting. Yes, they’re out there!

Manual underwriting isn’t anything tricky. It’s just the process of making sure you’re a human who pays bills and has a job. They’ll verify your income, employment and payment history on things like rent and utilities. Sounds pretty straightforward, right? That’s because it is.

You Can Live Without a Credit Score

Seriously. You can. And you should.

How? Draw a line in the sand and decide you’re done with debt forever. Start living on a budget, and pay for things with money you actually have. Then make a plan to pay off whatever current debt you have as fast as you can. Pretty soon, you’ll be able to focus on building your net worth instead of your credit score. It’s as simple as that.

When you’re paying off debt or you’re debt-free and know you’ll never mess with debt ever again, it’s easy to stop bowing down to your credit score. You don’t need debt anymore.

So, hit the road, credit score!

Are you ready to live life with no debt and finally have true financial peace? Millions have done it with Financial Peace University, and you can too! Get started today.