State Income Taxes: Everything You Need to Know

10 Min Read | Dec 21, 2023

Doing your taxes is like the chore no one wants to do. In some houses, it’s scrubbing the toilet bowl. In others, it’s folding laundry. So you put it off. But when you finally do the chore you hate, you usually feel a sense of accomplishment.

So, you finished your federal taxes and you’re feeling fine. But wait. There’s another toilet to scrub: your state income taxes. Yep, Uncle Sam isn’t the only one who takes a cut of your paycheck. A total of 41 states collect state income taxes and require you to file a state tax return. The amount you owe is based on how much you make and where you live.

Key Takeaways

- A state income tax is a tax on income earned in that state.

- Nine states have no state income tax.

- Some states have a flat rate system, while others use a progressive rate system similar to the federal income tax system.

- You may be required to file more than one state tax return if you work remotely or moved to a different state during the tax year.

What Is a State Income Tax?

Let’s start with the basics. A state income tax is a tax on any income you earn in that state. Pretty simple, right?

A few states have no state income tax, but most have either a flat or progressive income tax system (more on those terms later). So where does your state income tax money go, exactly? More than half of state tax revenues are used to fund education and health care. The rest of it goes to other services, like transportation, public assistance and prisons.1

How Do State Income Taxes Work?

As we mentioned above, a state income tax is a tax on earned income in that state. But how do life changes, like taking remote work or moving to a new state halfway through the year, affect your state income taxes?

Let’s discuss a few different scenarios that might apply to you:

- You lived and worked in the same state all year. You probably only need to file one state return.

- You lived in one state but worked in another (this includes working remotely). You have to pay state taxes on all your income to the state you live in (if that state has a state income tax). You’ll file as a resident for the state where you live, and if taxes are withheld by the state where you work, you’ll file a nonresident return for that state. Typically, you can claim a tax credit for the amount paid to your nonresident state, so your income won’t be taxed twice.

If your home state doesn’t charge a state income tax, check your W-2 and see if any state withholdings are listed. If so, it means state income taxes have been withheld from your income. In that case, you’ll need to file a return in the state where you earned your income.

- You moved to a new state. Moving to a new state can muddy the waters when it comes to state income taxes. But here’s the deal: You will generally be considered a state resident for tax purposes when you spend more than half of the year (that’s more than 183 days, to be exact) living there. And if you’re a resident of a state that has a state income tax, you’ll typically owe taxes to that state on all your income, regardless of whether it was earned in that state or elsewhere.

You may also need to file a separate return as a part-year resident in a state (if you’ve lived there less than half the year). You can also be considered a nonresident of a state and still owe taxes. The difference is that a nonresident owes taxes only on the portion of income earned in that state.

Taxes don’t have to overwhelm you. See what’s best for your situation—and services you can trust.

Okay, folks. That’s a broad overview of how state income taxes work in a few common scenarios. But keep in mind that each state has its own rules about residency, taxes on remote work, and filing returns. That’s why it’s so important to work with a tax expert who can help you navigate your specific tax situation.

States With Income Taxes

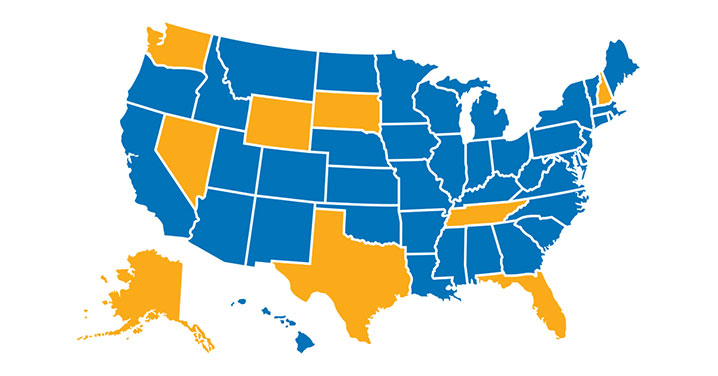

As of 2023, there are 41 states in the good ol’ USA that have state income taxes. That means if you picked a state at random, you’d have an 82% chance of hitting one with a state income tax on wages and salaries. And each of those 41 states have different tax laws, so the amount you owe varies quite a bit from state to state.

Some states have flat income tax rates, while others have a range of rates—called progressive tax rates—where the rates increase as your income grows. (More on flat versus progressive rates in a minute.)

And of course, there are a few states with no state income taxes at all.

States With No Income Taxes

There are nine states with no state income tax:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Just because you don’t pay state income taxes doesn’t mean you don’t pay anything. After all, your state has to fund their annual budget somehow. Many of these states raise money through other taxes, like sales taxes, property taxes and excise taxes on things like gasoline. But still, it’s a pretty sweet deal to be off the hook for income taxes.

New Hampshire is a little bit of a gray area. While it doesn’t have an income tax on earned income, it does tax interest and dividend income. But good news: New Hampshire is phasing out the tax by 1% a year beginning in 2023 until it’s gone.2 Sweet!

Now, if you don’t live in a state without income taxes or are planning to move to a new state, keep reading . . .

Types of State Income Taxes

The 41 states that do have state income taxes either have a flat or progressive tax structure. Check out the differences:

Flat Rate

Eleven states have a single-rate income tax structure, also known as a flat tax. This simply means that everyone pays the same percentage of their income, no matter how much or how little they earn.

Here are the 11 states with flat taxes and their rates for 2023:

- Arizona (2.5%)

- Colorado (4.4%)

- Idaho (5.8%)

- Illinois (4.95%)

- Indiana (3.15%)

- Kentucky (4.5%)

- Michigan (4.25%)

- Mississippi (5.0%)

- North Carolina (4.75%)

- Pennsylvania (3.07%)

- Utah (4.85%)3

We already mentioned that New Hampshire is a bit of a grey area, but it’s worth repeating: Regular income is not subject to New Hampshire’s state income tax, but dividends and interest income are taxed at a flat rate of 5% on amounts over $2,400 a year ($4,800 for married couples).4

Washington’s 7.0% flat state income tax only applies to capital gains income that you made from certain kinds of assets—it doesn’t apply to the rest of your income. You’ll pay this tax on stocks, bonds, business interests, or other investments and tangible assets that you held for at least one year and then sold. There are several exceptions—like real estate and assets held in certain retirement accounts—plus deductions and credits that can reduce the taxable amount.5

Progressive Rate

A progressive income tax means that as you earn more money, you’ll pay a larger percentage in taxes. You can figure out what percentage you’ll pay by finding your tax bracket—that’s a range of income that gets taxed at a specific rate.

Currently, 30 states (plus Washington, D.C.) have a progressive income tax, and they all do it differently. Some states, like Kansas, have just three tax brackets based on your income, but California has 10 brackets and Hawaii has a dozen!6 It takes some serious math skills to figure out your tax bill in a 12-bracket system.

Here’s a look at those 30 states (and the District of Columbia) that have a progressive income tax, plus their 2023 tax brackets and rates for single filers. Tax brackets will be different for those married filing jointly, so always check with your state’s tax office website for more information.

|

State |

Tax Rates |

Lowest and Highest Tax Bracket |

Number of Brackets |

|

Alabama |

2–5% |

>$0 – >$3,000 |

3 |

|

Arkansas |

2–4.9% |

>$0 – >$8,500 |

3 |

|

California |

1–13.3% |

>$0 – >$1 million |

10 |

|

Connecticut |

3–6.99% |

>$0 – >$500,000 |

7 |

|

Delaware |

0–6.6% |

>$2,000 – >$60,000 |

7 |

|

District of Columbia |

4–10.75% |

>$10,000 – >$1 million |

7 |

|

Georgia |

1–5.75% |

>$0 – >$7,000 |

6 |

|

Hawaii |

1.4–11% |

>$0 – >$200,000 |

12 |

|

Iowa |

4.4–6% |

>$0 – >$75,000 |

4 |

|

Kansas |

3.1–5.7% |

>$0 – >$30,000 |

3 |

|

Louisiana |

1.85–4.25% |

>$0 – >$50,000 |

3 |

|

Maine |

5.8–7.15% |

>$0 – >$58,050 |

3 |

|

Maryland |

2–5.75% |

>$0 – >$250,000 |

8 |

|

Massachusetts |

5–9% |

>$0 – >$1 million |

2 |

|

Minnesota |

5.35–9.85% |

>$0 – >$183,340 |

4 |

|

Missouri |

1.5–4.95% |

>$1,121 – >$7,847 |

8 |

|

Montana |

1–6.75% |

>$0 – >$21,600 |

7 |

|

Nebraska |

2.46–6.64% |

>$0 – >$35,730 |

4 |

|

New Jersey |

1.4–10.75% |

>$0 – >$1 million |

7 |

|

New Mexico |

1.7–5.9% |

>$0 – $210,000 |

5 |

|

New York |

4–10.9% |

>$0 – >$25 million |

9 |

|

North Dakota |

1.1–2.9% |

>$0 – >$458,350 |

5 |

|

Ohio |

2.765–3.99% |

>$26,050 – >$115,300 |

5 |

|

Oklahoma |

0.25–4.75% |

>$0 – $7,200 |

6 |

|

Oregon |

4.75–9.9% |

>$0 – >$125,000 |

4 |

|

Rhode Island |

3.75–5.99% |

>$0 – >$155,050 |

3 |

|

South Carolina |

0–6.5% |

>$0 – >$16,040 |

3 |

|

Vermont |

3.35–8.75% |

>$0 – >$213,150 |

4 |

|

Virginia |

2–5.75% |

>$0 – >$17,000 |

4 |

|

West Virginia |

3–6.5% |

>$0 – >$60,000 |

5 |

|

Wisconsin |

3.54–7.65% |

>$0 – >$304,170 |

47 |

When Are State Income Tax Returns Due?

The deadlines for most state income tax returns are the same as the federal deadline. (For 2024, Tax Day is Monday, April 15.) But we’re talking about the government here, so of course, there are a few exceptions. Always check with your state’s department of revenue for its income tax return deadlines.

Deducting State Income Taxes

One small benefit of paying state income taxes is that you can get a tax deduction for them on your federal taxes. The state and local tax (SALT) deduction lets you deduct up to $10,000 a year in SALT.8 So, the SALT deduction is helpful, but it’s really nothing to jump up and down about.

Keep in mind, you can only use the SALT deduction if you itemize deductions instead of taking the standard deduction, and about 87% of taxpayers use the standard deduction instead of itemizing.9 So for most of us, it’s no SALT for you!

Before the Tax Cut and Jobs Act of 2018 capped the SALT deduction at $10,000 and nearly doubled the standard deduction, SALT was a valuable deduction if you lived in an area with high state and local taxes. This provision is scheduled to expire after the 2025 tax year, so it’s something to keep an eye on in the future.10

Get Some Quality Guidance on Your Taxes

Hey, we get it. Taxes are hard. And adding a state income tax return can make it unbearable. If you’re looking for tax software to handle both your federal and state tax returns, check out Ramsey SmartTax. It’s simple software with no hidden fees!

If you can’t bear to look at more tax forms, a RamseyTrusted tax pro can help. They’re experts who know the ins and outs of state-specific tax code so you don’t have to worry about it.

Federal Classic Includes:

- All major income types and federal forms

- Prepare, print and e-file

- Phone and email support

- 1 year of audit assistance

Federal Premium Includes:

Everything in Classic plus:

- Live chat

- Priority phone and email help

- Free financial coaching session

- 3 years of audit assistance