You might be wondering where you stand in comparison to average American debt, or maybe you’re curious about the financial status of our country. Either way, the numbers and research we’ve gathered here from multiple sources will reveal and clarify the present state of debt in American households.

How Many Americans Are in Debt?

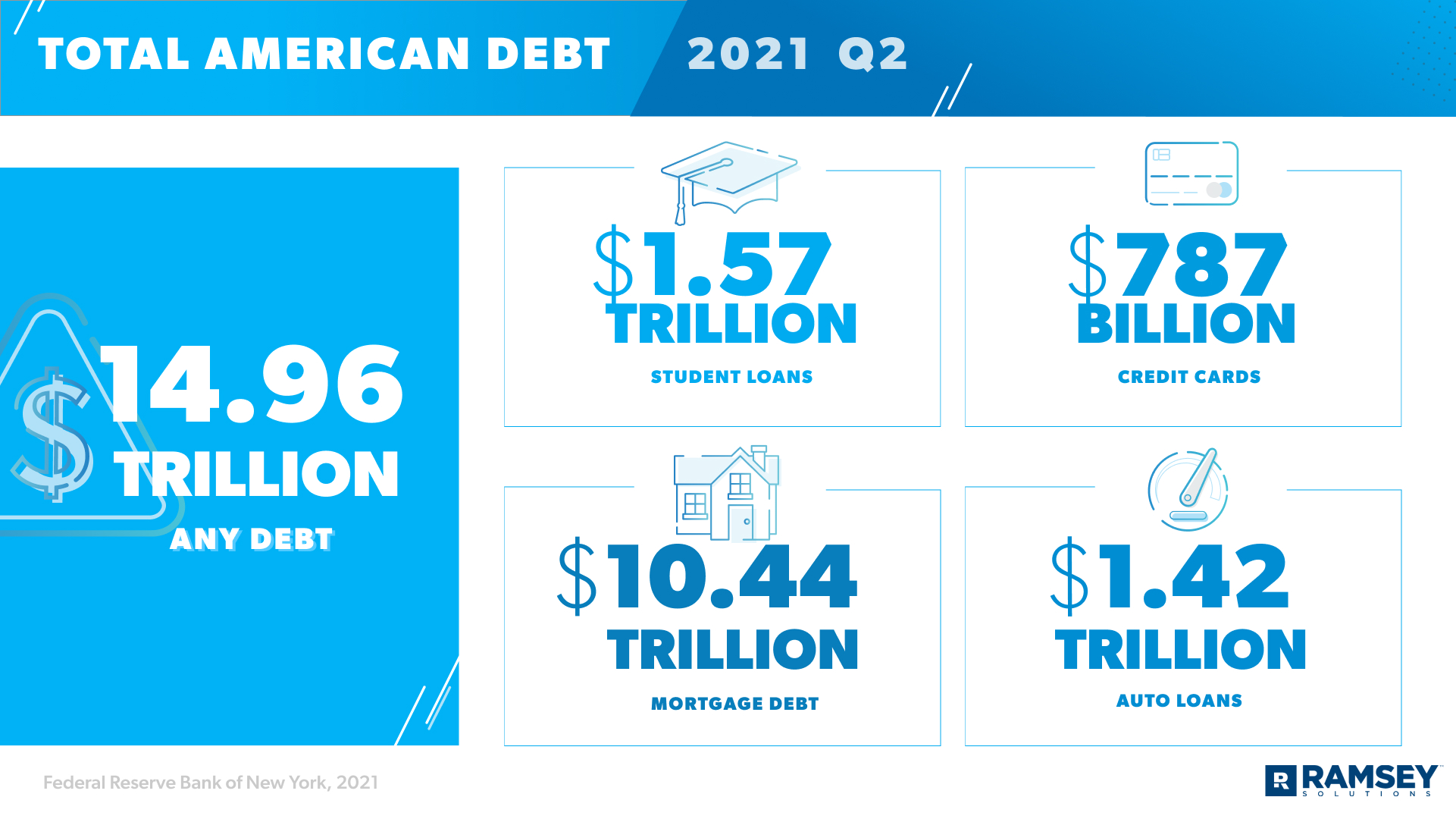

Even though household net worth is on the rise in America (at $141 trillion in the summer of 2021)—so is debt.1 The total personal debt in the U.S. is at an all-time high of $14.96 trillion.2 The average American debt (per U.S. adult) is $58,604 and 77% of American households have at least some type of debt.3,4,5

Let’s pause a second to define debt. Plain and simple, debt is owing any money to anybody for any reason. If you have debt, you’ve most likely agreed on terms of repayment, and those terms mean specific payments at specific time periods until the debt is paid off—typically with interest (the extra cost the lender charges you for borrowing their money).

Some of the most common types of debt in America include credit cards, student loans, auto loans, home equity lines of credit (HELOCs), and mortgages. Though each impacts Americans of all ages, some age groups are more impacted than others—so we’ll look at not only American totals and averages, but also at debt across various age groups.

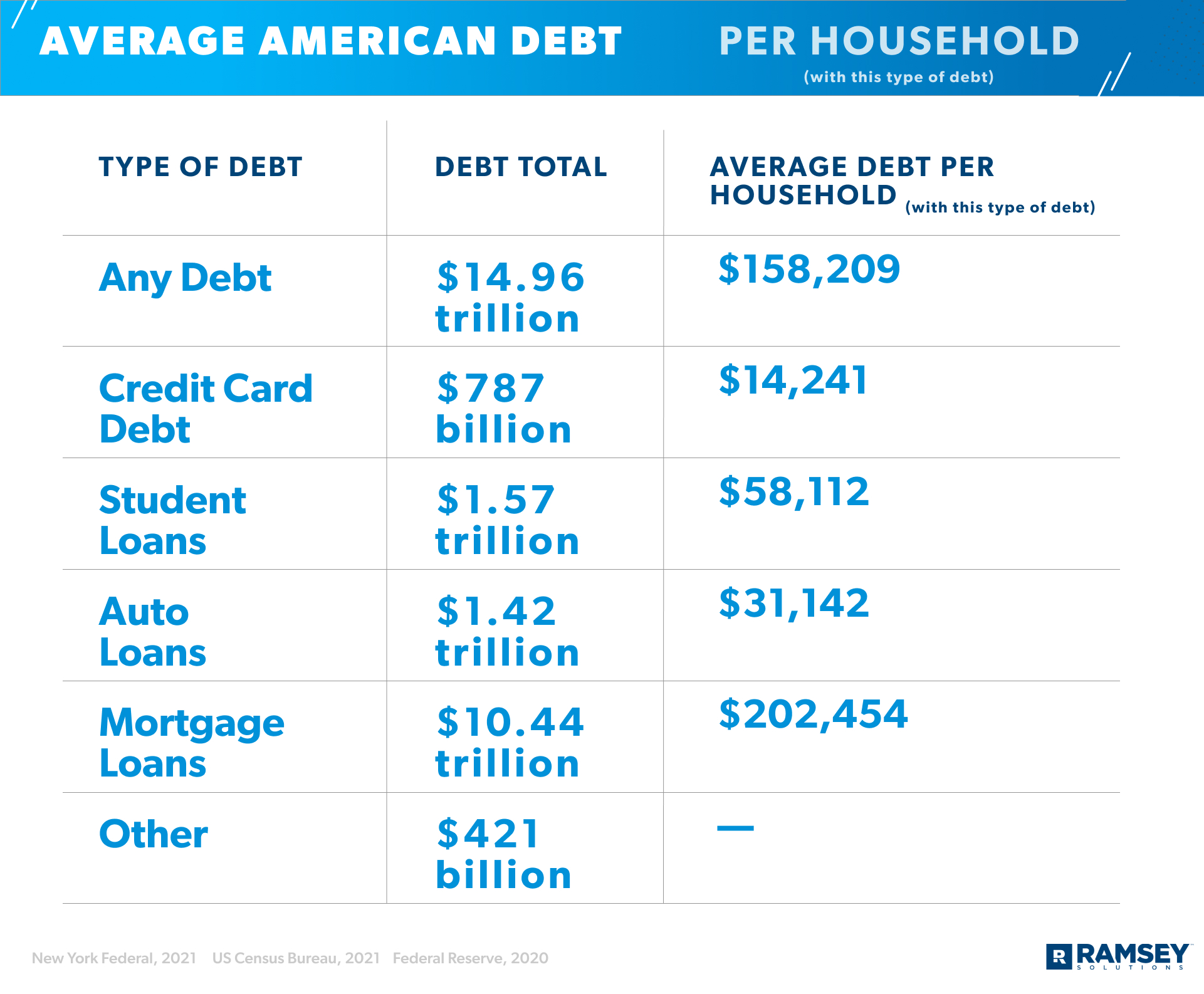

Average American Debt at a Glance

Let’s look at the overall totals for American debt and the average debt per household in five categories.

How Much Debt Does the Average American Have?

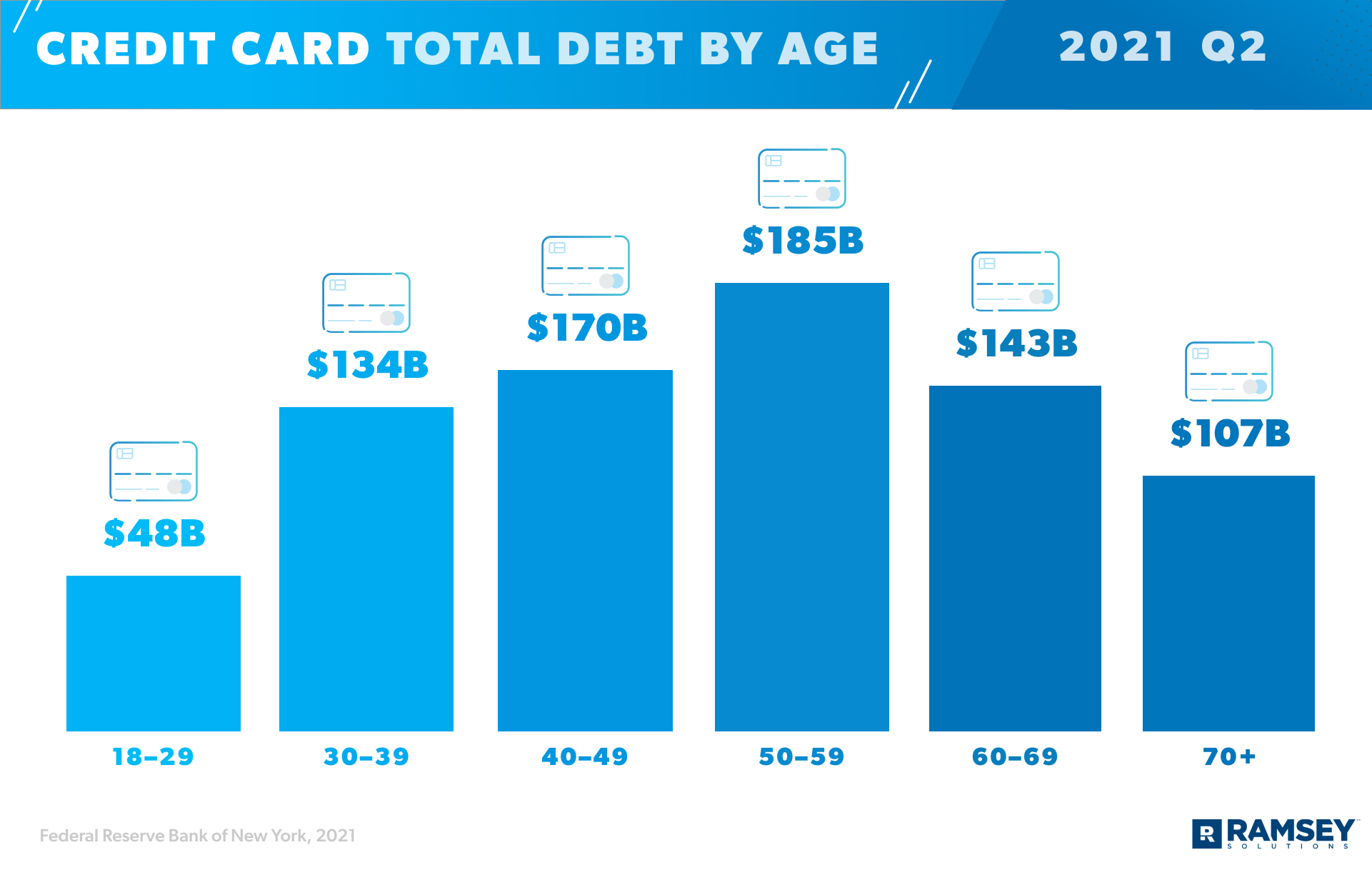

Credit Card Debt

Eight out of 10 adults in America have at least one credit card, and 45% of American households carry a balance (meaning they don’t pay their credit cards down to zero each month, so they have credit card debt).6,7,8 That’s just over 55 million households with this kind of debt.9,10 The average credit card debt per household with this type of debt is $14,241—with the total in America hitting $787 billion.11,12,13

The average APR (annual percentage rate, or interest rate) on credit cards is 17.13%.14 And those 55 million households who have credit card balances pay that average interest.

Think of it like this: If you multiply 17.13% by the $787 billion Americans owe, that’s about $134.81 billion credit card companies will make on interest alone.

You may hear credit card holders say they don’t carry a balance, but more than half of them do. The Federal Reserve shares that only 48% of Americans with credit cards pay their bill in full every month.15 The other 52% are carrying debt and adding to those interest fees and that $787 billion statistic.

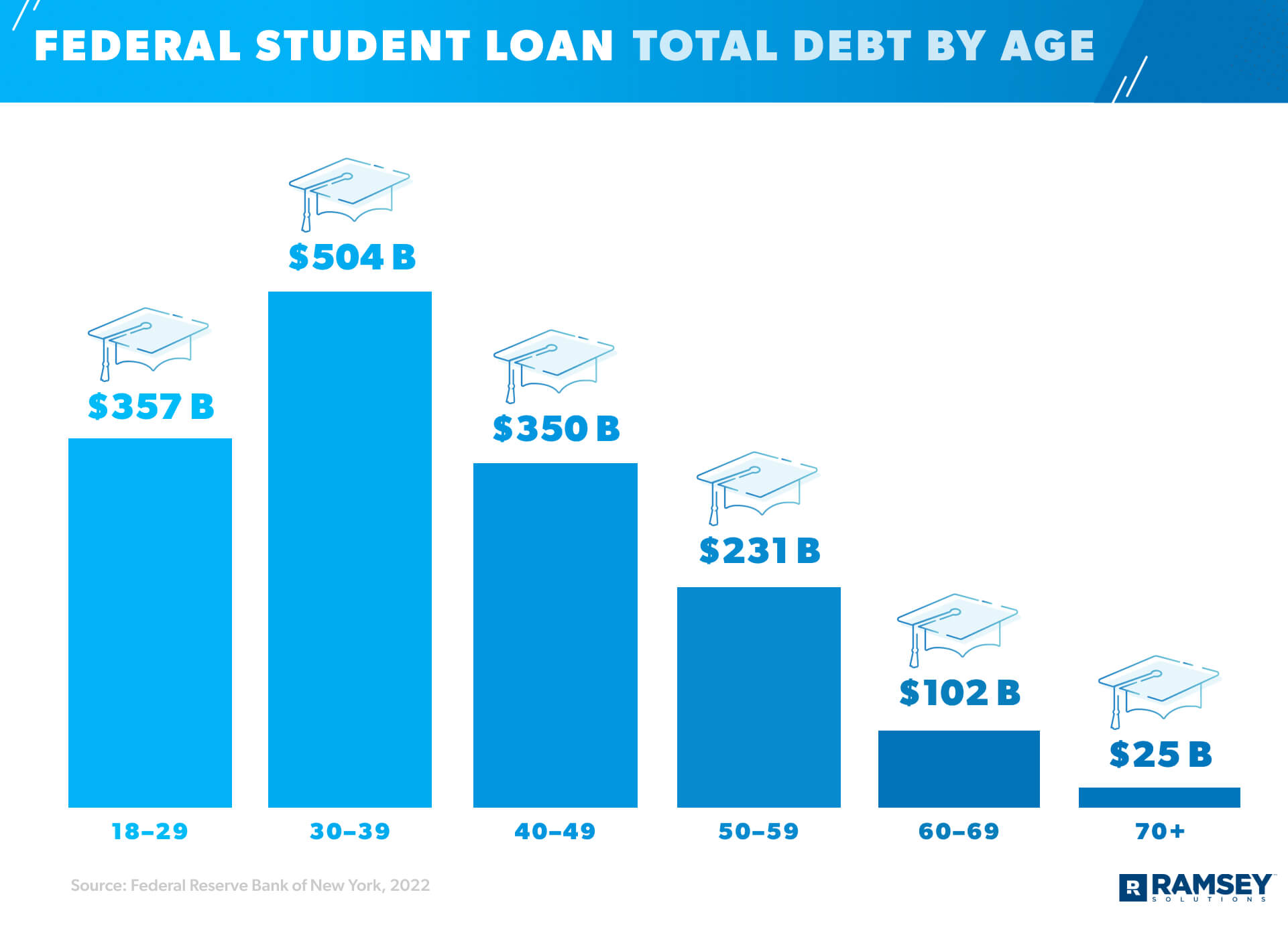

Student Loan Debt

The total student loan debt in America is currently at $1.57 trillion, with each borrower owing an average of $38,792 (as of summer 2021).16,17 The fastest-growing debt in America (increasing in growth at almost 157% since the Great Recession), student loans make up 11% of the country’s debt total.18 That’s the second largest percent, just after mortgages.19

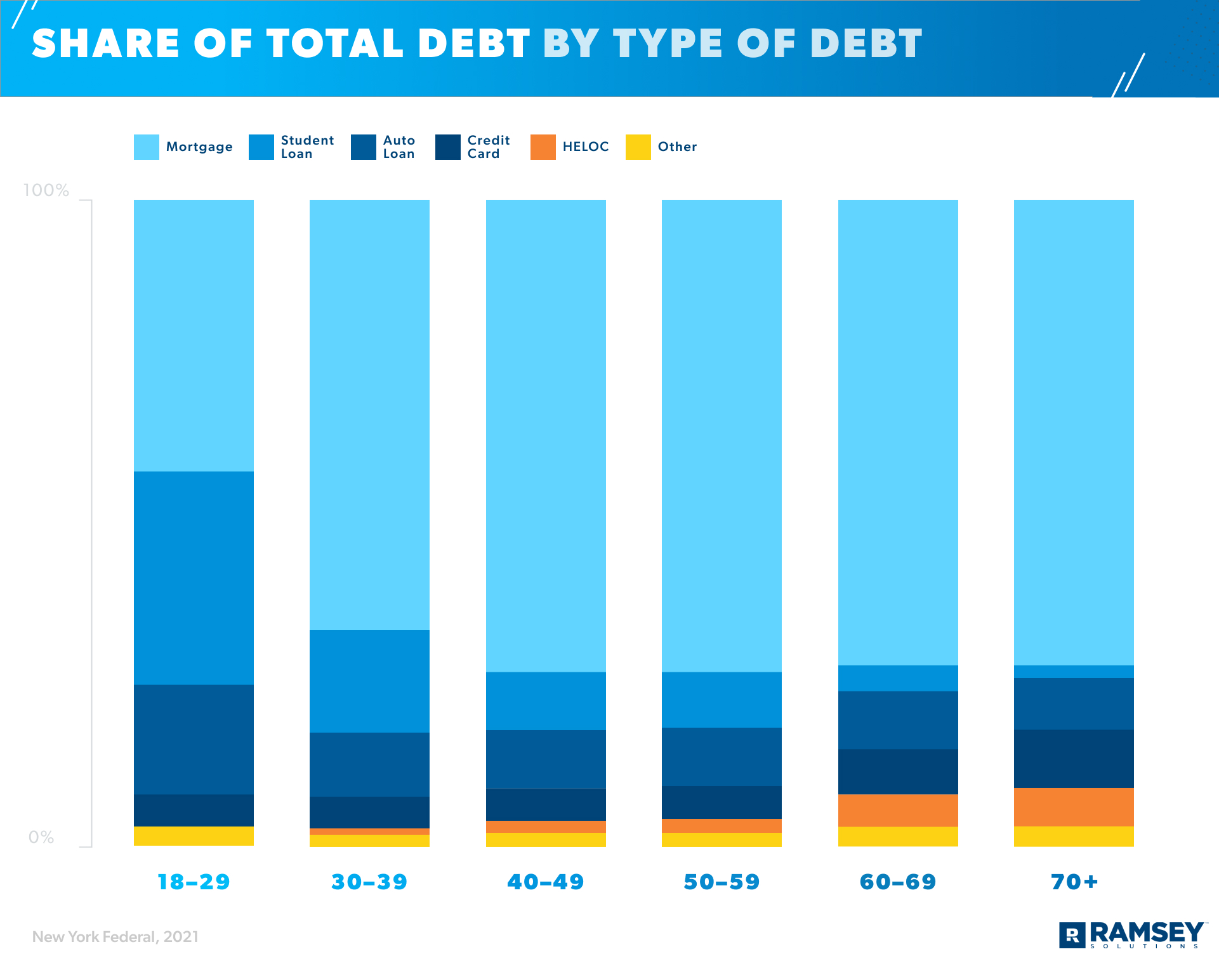

Student loan debt for Americans age 18–29 is at $333 billion. And though student loans account for around 2% of debt for Americans age 70+, they collectively owe $27 billion.20,21,22 (Yes, some 70-year-olds are paying for college—theirs or someone else’s. Let that sink in.)

Young adults say the weight of student loans keeps them from basic financial and life decisions. For example, 40% delay investing in retirement, and 47% put off buying a home. And 21% even wait to get married because of their student loan debt.23

Auto Loan Debt

Total American auto loan debt is $1.42 trillion.24 Thirty seven percent of households in the United States (that’s about 45.4 million households) have this kind of debt, with an average of $31,142 per household.25,26,27

So, how much are these people paying each month? Well, the average monthly car payment is $577 for new vehicles and $413 for used.28

HELOC Debt

A HELOC (home equity line of credit) is a loan that allows you to borrow cash against the current value of your home, using the equity you’ve built up in your home as collateral. In other words, you’re giving up the equity you’ve earned and trading it in for more debt.

Pay off debt fast and save more money with Financial Peace University.

There are over 4.7 million HELOCs (totaling $349 billion) in the United States, with the average American household with this type of debt owing $73,685.29,30

Older Americans have the highest percentage of HELOC debt. HELOCs take up less than 1% of the debt held by those age 18–29, and 1% of the debt held by those ages 30–39, but that percentage rises to 6% for those 70+.31,32,33

Mortgage Debt

For most people, housing is their biggest monthly expense. That means they pay a larger percentage of their monthly income to rent or mortgage than any other budget category (think of categories like utilities, groceries, insurance, etc.).

Americans with a mortgage pay a median monthly payment of $1,595.34 Accounting for 70% of all American debt, mortgage debt carries the highest total at $10.44 trillion.35 Forty-two percent of households have mortgages. (That’s over 51.5 million total American households). And the average mortgage debt in our country is $202,454.36,37,38

Average American Debt by Age

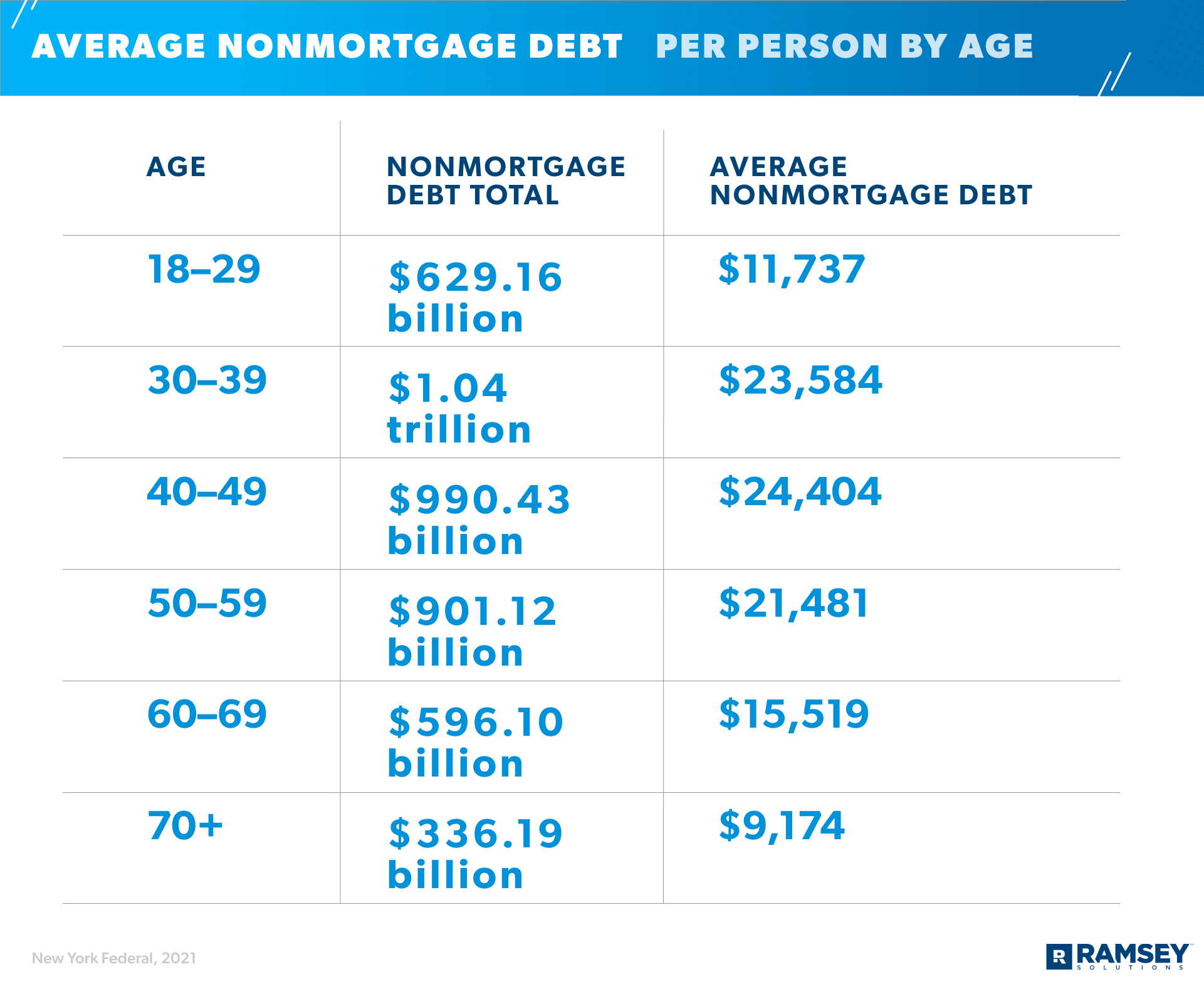

So, we’ve broken out some of the average American debt totals by age already, but here’s an overview of debt totals and averages by age. Note: These averages include all American adults, both those with and without debt.

First, here’s an overview of consumer (or nonmortgage) debt by age (as of February 2021).

Now we’ll look at each age group’s total debt broken into percentage by debt type (as of February 2021). Notice younger Americans have a higher percentage of student loans, but older Americans have a higher percentage of mortgage debt.

For more information on debt levels across generations, check out our research study.

Did COVID-19 Impact the Average American Debt?

COVID-19 had, and continues to have, many effects on American finances. (That’s probably the understatement of the year.) Businesses have closed, and job loss has become far too common. If you haven’t been affected directly by these changes, you probably know someone who has.

COVID-19 and 2020 Debt

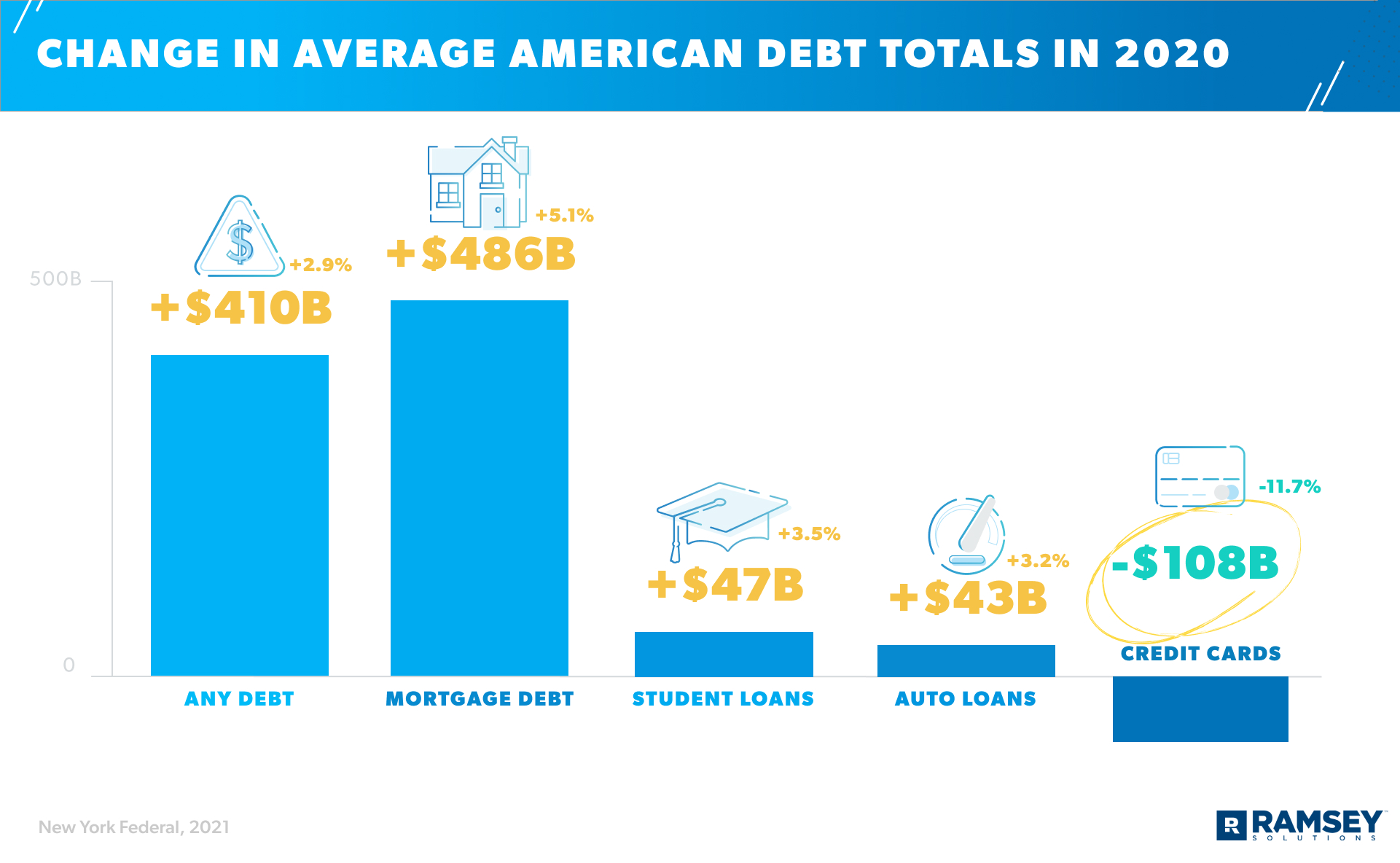

Inside the roller coaster of change that was 2020, debt totals weren’t left untouched. And while the changes we’ll share aren’t necessarily because of the pandemic, they happened during the pandemic and are therefore interesting to see.

You’ll notice the largest percentage increase through COVID was in mortgage debt, up 5.1%.39 Despite a real estate drop in May 2020 (often the hottest sales month in the industry), by the end of the year both home sales and home prices were rising above the trends of 2019.40,41 This unexpected real estate boom in the middle of a pandemic is considered quite the financial surprise.

On the other end, you’ll see credit card debt dropped 11.7%, from $927 billion at the end of 2019 to $819 billion at the end of 2020.42

The Consumer Financial Protection Bureau questioned that decline. In their research, they suggest one cause of the drop in credit card balances during 2020 is simply that consumers were spending less. The Bureau looked for evidence to support another theory—that those with secure employment might be decreasing their credit card debt at a large enough rate to cover up the increase in debt of those in financial distress. The Bureau explains they couldn’t test that idea directly. But in an indirect test, they saw “the decrease in average credit card balance holds for all groups” in their data.43

In other words, throughout 2020, credit card debt appeared to be dropping all over—no matter the consumer’s employment status.

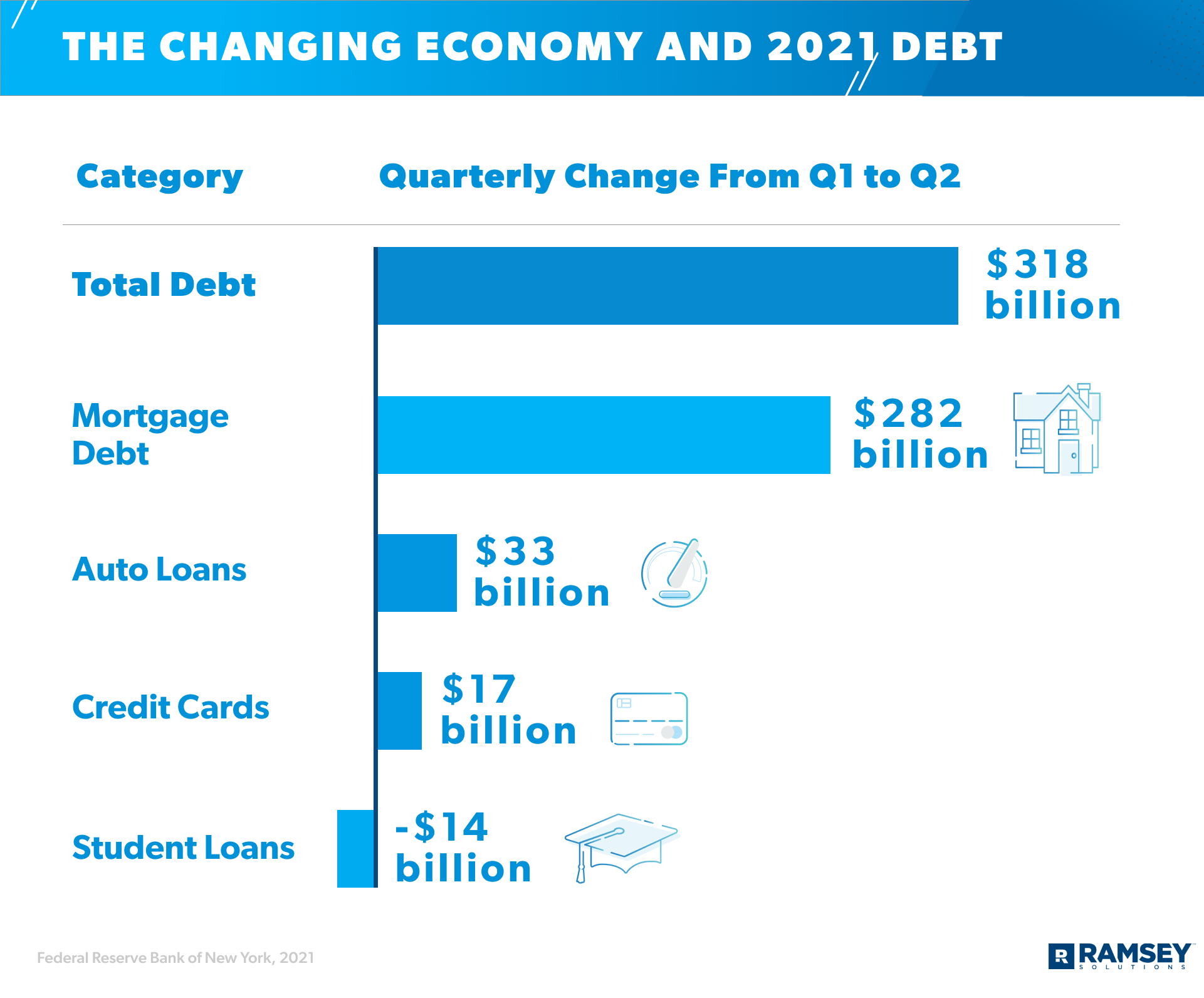

The Changing Economy and 2021 Debt

Credit card debt dropped again in Q1 of 2021, falling to $770 billion. But by the end of summer 2021, it was back on the rise at $787 billion. Note below that mortgage, auto loan and credit card debt all increased to over $300 billion collectively in Q2 of 2021.44

The uptick in these major debt categories could be from a variety of factors:

- Overall Inflation: As of August 2021, the inflation rate in America had climbed to 5.3% over the previous year.45

- Rising Home Costs: Going into 2021, the median home price in America was $340,000, which is 13.4% more compared to last year!46

- The Auto Shortage and Rise in Auto Prices: From October 2020 to October 2021, the price of a used car rose 29%.47

- Increase in Credit Card Interest Rates: The average interest rates for credit cards in 2021 went from 15.91% in Q1 to 16.30% in Q2 to 17.31% in Q3.48

- Increased Consumer Spending: Consumer spending in America increased 12% from Q1 of 2021 to Q2.49

The changing economy in 2021 is reflecting a rise in costs, spending and debt in at least three major debt categories.

What to Do If You’re in Debt

If you’re in debt, these numbers show you’re not alone. Still—if you’re part of these statistics, you don’t have to stay there. You don’t have to continue throwing $577 each month into an auto loan (for a car that loses 60% of its total value over the first five years of its life).50 You don’t have to continue carrying student loan debt into what should be your restful retirement years.

Listen, your income is your greatest wealth-building tool. But when you have debt, you can’t build wealth, because you’re spending part of this month’s income to pay for something last month, last year or even last decade.

When you get out of debt and finally take back your income—all of it—you can move forward with your finances. And paying off whatever amount of debt you have probably won’t take nearly as long as you think it will.

Here’s how you get debt out of your life once and for all:

1. List out all your debts.

It might not be pretty, but it’s got to be done! People sometimes get so scared of this first step that they stop right here. Don’t. You can do this.

Our own Ramsey Solutions research found that nearly half (46%) of Americans say their debt level creates stress and makes them anxious. Yes, looking your debt in the eye might be difficult, but when you finally face the facts, you can follow a plan to attack it head on. You’re on the path away from money stress. So, keep walking.

2. Save a starter emergency fund.

Before you attack your debt, make sure you’ve got $1,000 saved as a starter emergency fund. Why? As you’re paying off debt, life will happen—we’re talking about the flat tire, leaking refrigerator and unexpected medical bill. If you don’t have money saved up to pay cash for emergencies, you’ll be tempted to pull out a credit card—and go deeper in debt.

3. Pay off your debt with the debt snowball method.

Next, pay off all nonmortgage debt from smallest to largest with the debt snowball method. Don’t argue with our math and ask about interest rates. The point of the debt snowball method is momentum and motivation. You pay the minimum payment on all debts except the smallest—that’s the one you go after hard.

When it’s out of the way, you put all the money you were throwing at it onto the next-smallest debt. Repeat until you’re debt-free. You’ll get quick wins all along the way. And those quick wins will keep you moving.

Use our Debt Snowball Calculator to see how it’s done.

4. Get the help you need along the way.

Say it again: You’re not in this alone. And guess what? You don’t have to figure everything out on your own either. Learn the ins and outs of debt (and the best ways to handle your money) in Financial Peace University.

This nine-lesson course will teach you the plan to get out—and stay out—of debt, and get you pumped up to pay it off forever.

And listen: It actually works. The average debt paid off in the first 90 days of working this plan is $5,300.

When you've built a solid foundation of knowledge, it makes the debt-free journey quicker and easier. That’s a true win-win.

5. Don’t give up.

Some days, paying off your debt will be harder than others. But don’t give up. It will be so worth it.

Here’s the deal: Debt is common—but it’s holding you back from living your financial dreams, both today and far into the future. You’re worth this investment of time and energy to break away from debt. We said it before, and we’ll say it again because we 100% believe it: You can do this!

Start Financial Peace University and begin your debt-free journey.

About the Stats

At times we used multiple sources for data on debt in average U.S. households, percentages of U.S. households with certain types of debt, and differences in these debt totals and types across age categories. In these cases, we interpreted data from across these sources to provide our best approximation of average debt. There are limitations to working across multiple sources, and we attempted to account for these limitations when possible. Still, variations from source to source could affect the precision of our results.