How to Create a Zero-Based Budget

11 Min Read | Jan 16, 2024

If you’re in the market for a budgeting method that’s the best for your money, might I suggest the zero-based budget? (I might. I will.) But what makes it the best? And how do you make (and keep) a zero-based budget?

Let’s answer all that. Right now.

What Is Zero-Based Budgeting?

Zero-based budgeting is when your income minus your expenses equals zero. Perfect name, right?

So, if you make $5,000 a month, everything you give, save or spend should add up to $5,000. Every dollar that comes in has a purpose, a job, a goal. Nothing is left hiding or getting mindlessly spent on grande, no-whip, half-caff, white chocolate mochas with a single pump made with soy. You know what? Scratch that. Coconut milk. You’re doing full keto, remember?

But I want to be clear: A zero-based budget doesn’t mean you have zero dollars in your bank account. It just means your income minus all your expenses equals zero. Keep yourself a little buffer of $100–300!

How to Make a Zero-Based Budget

Before you start making your zero-based budget, log in to your bank account or grab those bank statements out of the drawer you shoved them into thinking, I’ll need that one day. (Guess what: One day is here!) Having this in front of you will come in handy when you’re wondering how much you normally make or spend on stuff. You can also check out these budget percentages and averages if you’re wondering what the typical household is spending.

Okay, here’s how to do a zero-based budget:

1. List your monthly income.

Of course you can do this the old-fashioned way with a sheet of paper, but I like to use EveryDollar. (Trust me, the math that’s coming up is way easier with our free budgeting app.)

What counts as income? Your regular paychecks and anything extra you plan to bring in during the month, like all that cash from your side hustle as a pizza delivery driver or weekend balloon artist for kids’ parties. Write it all down and add it up! That’s your total monthly income, aka what you’ve got to work with this month.

P.S. If you want to start getting your numbers down with our budget template and then switch over to EveryDollar, that’s cool too.

2. List your expenses.

Okay, now you know what’s coming in—so it’s time to plan for what’s going out. Think of everything you spend money on during the month. And I mean everything. List out your expenses like this:

- Giving (This should be 10% of your income.)

- Savings (This depends on your Baby Step, which I’ll explain in a moment.)

- The Four Walls (These are the top expenses to cover: food, utilities, shelter and transportation.)

- Other essentials (I’m talking about insurance, debt, childcare, etc.)

- Extras (Here’s the fun part: entertainment, fun money, restaurants—you get the idea.)

- Month-specific expenses (Plan for any holidays, celebrations or semiannual expenses due this month.)

Pro tip: Don’t forget to give yourself a miscellaneous category too so you’ve got a little extra cushion in your spending. That way, anything that pops up unexpectedly isn’t a problem—it’s in the budget.

Double pro tip: When you’re putting expenses in the budget, start with needs (those Four Walls) before wants (like fun money).

3. Subtract your expenses from your income to equal zero.

When you subtract all those expenses from your income, it should equal zero. If you don’t hit zero at your first pass, welcome to the majority! Yep, that’s right. Practically no one gets this right the first time. That. Is. Fine. But let’s talk about how to fix it!

Start budgeting with EveryDollar today!

Got money left over? First, throw some confetti and do a celebration dance. (Or if you’re like me and can’t dance to save your life, a hearty fist pump will do.) Then, put that money to work!

Where?

On your current Baby Step!

What’s that?

I told you I’d come back to this. It’s definition time: The 7 Baby Steps are the proven, guided path to save money, pay off debt, and build wealth (aka win with money). They are the seven money goals that will take you from where you are to where you want to be. Putting your money here will give you the most bang for those leftover bucks.

But what happens if you don’t have money left over? Let’s talk about what to do if you subtract your planned expenses and end up with a negative number. This means you’re spending more than you make, and that just won’t work. But don’t freak out. You can get the number to zero.

Get out your metaphorical hedge clippers, and trim that budget. You can lower your planned spending amounts where you’re able or cut some spending out completely. (FYI, start with the restaurant line! Then take up meal planning to save on groceries and keep from being tempted to hit the drive-thru each night.)

You can also up your income by starting a side hustle, selling stuff, or finding some other way to make extra money. (If you aren’t already a weekend balloon artist, it could be time to start. Heck, maybe you take this gig into weeknights for even more extra income.)

That’s it for making the zero-based budget, but I’ve got two more steps that’ll help you actually stick with it.

Budget Calculator

Enter your income and the calculator will show the national averages for most budget categories as a starting point. A few of these are recommendations (like giving). Most just reflect average spending (like debt). Don't have debt? Yay! Move that money to your current money goal.

Income

Expenses

Difference

Total Expenses

$0.004. Track your expenses (all month long).

So, you can’t just set up that budget and leave it. That gets you literally nowhere with your money. You’ve got to get in there and track your transactions. Every single one. That means any money that comes in or goes out gets put into the right budget line.

When you make $100 from your side hustle, add that money to your income category. When you pay the rent, subtract that expense from housing. When you fill up the gas tank, subtract that from the gas budget line under transportation.

This is how you stay on top of your spending. This is how you keep from overspending.

By the way, you can streamline this process with the premium version of EveryDollar. You’ll connect your bank to your budget so transactions stream right in. Then, you just have to drag and drop them into place!

5. Make a new budget (before the month begins).

While it’s true your budget won’t change a ton month after month, it will change some. So, create a new zero-based budget every single month. Remember those month-specific expenses I mentioned in the second step? This is where they really come into play.

Also, do this before the month begins so you’re ready, ahead of time, for what’s coming your way.

By the way, if you want some more info on how to start, play around with our Budget Calculator.

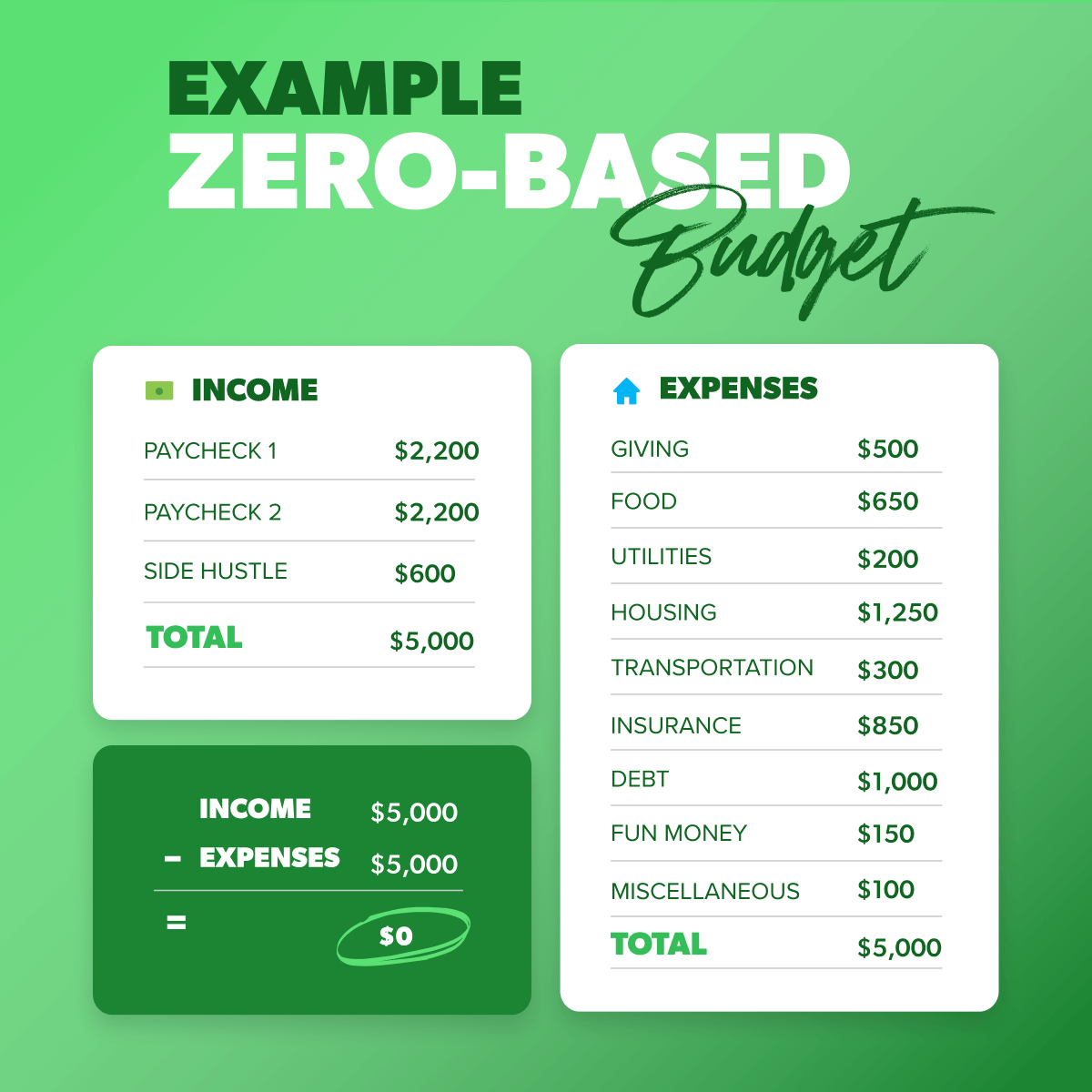

Example of a Zero-Based Budget

Here’s a super basic example of a zero-based budget so you can see how the math works out.

Advantages of Zero-Based Budgeting (Over Other Budgeting Methods)

1. 50/30/20 Rule

The 50/30/20 budgeting rule follows these percentages: 50% of your income goes toward your needs, 30% goes toward wants, and 20% goes toward savings. Of course it’s nice to have some numbers to help you start budgeting, but these numbers leave a lot to be desired. And I mean a lot.

First of all, if you’re using our Baby Steps (which you really should), you aren’t always putting money toward savings. You’re taking your goals one (baby) step at a time. That kind of focus brings quick wins and lasting wealth.

Second, the 50/30/20 rule lumps debt into needs—but requires you to make minimum payments only. You can’t make maximum progress with minimum payments.

Third, those three percentages stay the same no matter where you are in life. If you’ve got a ton of student loan debt—50/30/20. If you’re debt-free and investing in retirement—50/30/20.

And finally, when you do the math on average income minus average expenses, the average American spends way more than 50% on needs. It’s more like 80%. This method doesn’t even work, people. (My Smart Money Happy Hour co-host and friend Rachel Cruze breaks down the math on that and everything else about the 50/30/20 rule, if you’re interested.)

2. 60% Solution

In the 60% solution method, you cover all your wants and needs with 60% of your budget. The other 40% is for saving. Then, that 40% gets divided up into three savings categories (10% for retirement, 10% for long-term savings, 10% for short-term savings) with 10% left for “fun.”

First of all, that’s a lot of dividing. Second, I love savings—but if you’ve got debt, you shouldn’t be putting 40% of your money into savings. You should be destroying that debt. Hardcore. And after that, you should put as much as you can into building your fully funded emergency fund. And after that, you should invest 15% in retirement.

Also, remember—the average American is spending around 80% on needs. The 60% solution math doesn’t work. And this method just doesn’t account for every budgeter’s individual situation.

3. Reverse Budgeting

Many budgeting methods have you set aside money for spending first and savings second. With reverse budgeting, it’s the opposite. (Hence the name.)

In this method, you set your budget for saving and investing first. Then you put everything else in there (like housing, gas, food, insurance, debt and the nonessentials).

So, I love the emphasis on savings not being an afterthought! Because it’s honestly quite easy to forget about it.

But again, this method locks you into a strategy that might not fit the money goal you’re in the middle of! If you’re on Baby Step 2, you aren’t thinking savings first. You’re focused on kicking debt out of your life forever.

4. Set It and Forget It

Okay, you’ve got to start somewhere with a budget. If you’ve never made one, getting all your numbers down (income and expenses) is your first step. But you don’t stop there. You don’t just leave those numbers on the page and hope you’ll live by them.

This is the “set it and forget it” budgeting method. And it really doesn’t work. It helps you see where your money should go—but it doesn’t make you accountable for where it actually goes. And it’s a great way to overspend. No, thank you.

5. Zero-Based Budgeting

You can probably see why I’m such a huge fan of zero-based budgeting. It’s way more customizable for where you are in your life. You get to decide how much to put toward debt, savings, retirement, and everything else. Every. Single. Month.

You can also adapt your zero-based budget as you go through the Baby Steps. That’s what it’s made for! Every single dollar is working for you. Always.

Can You Make a Zero-Based Budget With an Irregular Income?

Why, yes. Yes, you can! If you have an irregular income (meaning your income isn’t the same each paycheck or comes at different times in the month), you can still use zero-based budgeting. It’ll just look a little different for you.

- When you’re listing your income, find out what you’ve made the last few months. (This is another place your bank statements are helpful.)

- Take the lowest amount you made in that time and list it in the budget as this month’s planned income.

- You can adjust the income later in the month if you make more.

When you’re listing your expenses, follow the list from earlier. Just know that the extras might have to wait until you know you can afford them. Cover the most important things first. If you get paid more than you planned, do a little fist pump—then add that extra money to your Baby Step or another budget line.

You can use our Irregular Income Budget Planning form to get started!

So, Why Is Zero-Based Budgeting Important?

Here’s the deal. If you want to make any progress with your money, you need to make a monthly budget. People say budgeting takes them from wondering where their money went to telling it where to go. That. Is. Empowering.

And a zero-based budget? Even better. Because you’re telling every single dollar where to go. You work hard for your money—all of it. So all of it should work hard for you.

And don’t forget EveryDollar—the free way to create your zero-based budget. You make the money, and it does the math. What a beautiful relationship.

Listen: Whatever your money goal, whatever your Baby Step, wherever you are in your personal finance journey—a zero-based budget is what will get you (and keep you) moving forward.

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)