What Is an Annuity and How Does It Work?

12 Min Read | Jan 15, 2024

Thinking about buying an annuity? At first glance, it might seem like a good retirement investment. But wait! Don’t sign that dotted line just yet. There are a few things you need to understand about annuities before you commit.

Key Takeaways

- The goal of an annuity is to provide a stream of income over your lifetime or a set period.

- There are two main types of annuities: fixed and variable.

- You can choose to receive payments right away (immediate) or in the future (deferred).

- Annuities often come with hefty fees, including commission and surrender charges.

- Annuities are financial products sold by insurance companies

What Is an Annuity?

An annuity is basically a contract between you and an insurance company. It’s designed to provide a guaranteed income for the rest of your life. You make a payment (or payments) to the insurance company. In return, they promise to grow your money and send you payments during retirement. Annuities are often marketed as financial products (like stocks, bonds, etc.).

The ultimate goal of an annuity is to give you a steady stream of income throughout your retirement, which sounds great at first. But are annuities really the best way to secure a stress-free retirement?

Let’s take a closer look at what annuities are, how they work, and whether they should be part of your retirement savings strategy. Spoiler alert! In most cases—the answer to that last question is no.

But despite that, annuities are more popular than ever. Why? Well, with uncertainty swirling around the economy, Social (In)Security and pension plans drying up, many people are looking for stable income streams for their retirement.

Only 18% of American workers say they’re very confident they’ll have enough money to live comfortably throughout their retirement years.1 That might explain why more than half of workers would be very interested in an annuity if it was offered through their employer’s retirement plan.2

Insurance companies sell a lot of annuities by playing on people’s fear of outliving their retirement savings. But when you boil it down, annuities are an insurance product. You’re paying an insurance company to take on the risk of you running out of money.

That’s the simple version of what an annuity does. In reality, annuities are super complicated and come in several different shapes and sizes. It’s enough to make your head spin. But stick with us. We’ll break it down for you.

How Do Annuities Work?

Putting an annuity together is a lot like ordering a burrito at Chipotle, just not as tasty. The annuitant (you) can create an annuity based on your preferences and your own personal situation, minus the chips and guac. Here are the different ways you can put an annuity together.

Single vs. multiple premiums: How do you want to pay for the annuity?

If you have a big pile of money—maybe through years of saving or an inheritance—you can pay for an annuity in one big payment. Or you can pay for the annuity with a series of payments over many years. This period when you’re contributing money is called the accumulation phase. And the money you put in grows tax-deferred—which means you only pay taxes on that money when you start getting your payments in retirement.

Immediate vs. deferred: When do you want to start getting payments?

You can choose whether your annuity pays you right away (immediate annuity) or at some point in the future (deferred annuity). Keep in mind, if you take any money out of your deferred annuity before age 59 1/2, you’ll get hit with a 10% early withdrawal penalty on top of the income taxes you’ll owe!3 And we haven’t even touched on annuity fees yet. Just you wait.

Lifetime vs. fixed period: How long will you keep getting annuity payments?

In addition to choosing when you’ll start receiving annuity payments, you’ll also need to decide how long those payments will last. One of your options is a lifetime annuity that pays you a certain amount per month for the rest of your life. Or you could go with a fixed period annuity that’ll send you payments for a set amount of time—anywhere from 5 to 25 years.

Types of Annuities

Now that we’ve laid out how annuities are set up, let’s look at the different kinds. There are two main types of annuities—fixed and variable.

Fixed Annuities

Fixed annuities are basically savings accounts with an insurance company. They’re like a certificate of deposit (CD) you can get at most banks. They come with guaranteed interest rates (currently between 5.5% and 6.5%), and that’s super attractive for people who want a predictable and “safe” place for their money.4

Market chaos, inflation, your future—work with a pro to navigate this stuff.

In exchange for your premium, you can choose to receive a payout from your annuity for the rest of your life or a specific amount of time. Sounds pretty good, right? Well, not so fast. That’s pretty much where the good stuff ends.

We’ll get into all the downsides later, but we’ll just tell you right now: Annuities aren’t worth your time. The low rate of return won’t even keep up with inflation. Stay away! You can do much better with good growth stock mutual funds that have a 10–12% rate of return over time.

Variable Annuities

Variable annuities, on the other hand, are a bit different. They’re basically mutual funds stuffed inside an annuity. So, unlike fixed annuities, your payments in retirement will depend on how well the mutual funds you choose perform. That’s why they’re variable.

With a variable annuity, the account grows tax-deferred. That means you’ll have to pay income taxes on whatever growth the annuity makes when you start taking money out in retirement. We’ll talk more about variable annuities in a minute.

What Are the Benefits of an Annuity?

When it comes to a fixed annuity—there are no benefits. Just don’t. There’s never—ever—a case where fixed annuities are the best option. Zilch. Zero. Big goose egg!

Now, there are some benefits to having a variable annuity (though they don't outweigh the cons). For starters, you can choose a beneficiary for your annuity so the payments you were getting can go to a loved one when you die.

Some variable annuities even offer a guarantee on your principal investment. So basically, if you put $200,000 into an annuity and the value of the investment drops below that, you’ll still get your $200,000 when you take your money out.

And unlike a 401(k) or an IRA, annuities don’t have yearly contribution limits, so you can put as much money into an annuity as you’d like.

Not so bad, right? But pump the brakes for a minute. There’s a reason why many people who look into an annuity stop dead in their tracks and run the other way before signing on the dotted line.

What Are the Downsides of an Annuity?

Annuities are bogged down by a lot of fees that cut into the return on your investment and keep your money tied up. Yep—if you want to get your hands on the money you’ve put into an annuity, it’ll cost you. That’s a big reason why we don't recommend annuities.

Remember, annuities are basically an insurance product where you transfer the risk of outliving the money you’ve saved for retirement over to an insurance company. And that comes at a steep price.

Annuities have way too many fees.

If you want to know, here are just some of the fees and charges you’ll see attached to an annuity:

- Surrender charges: These can really trip you up if you’re not paying attention. Most insurance companies set a limit on how much you can take out for the first several years after you buy an annuity, called the surrender charge period. You’ll be charged a fee on any money you take out beyond that limit, and those charges can cost you a pretty penny. And that’s on top of the 10% tax penalty you have to pay if you take out your money before age 59 1/2!

- Commissions: One of the reasons why insurance salesmen love pitching annuities to folks is that they get big commissions from selling annuities—even up to 10%. Sometimes those commissions are charged separately, and other times those surrender charges we just talked about cover the commission. When you’re listening to a sales pitch for an annuity, make sure you ask how much of a cut they’re getting.

- Insurance charges: These might show up as mortality and expense risk charges. Basically, these charges cover the risk the insurance company takes on when they sell you an annuity, and they’re usually 1.25% of your account balance per year.5

- Investment management fees: These are just what they sound like. It costs money to manage mutual funds, and these fees cover those costs.

- Rider charges: Some annuities offer extra features you can add to your annuity—things like long-term care insurance and future income guarantees. These extras are called riders, and they’re not free—there’s a fee for them too.

See what we mean? Look at all those fees! Insurance companies make it practically impossible to get to your money without paying an arm and leg. All these sneaky charges for a monthly check? No. We’ll take our cash up front when we retire, thank you very much.

Annuities probably won’t keep up with inflation.

Like we talked about before, annuities (especially a fixed annuity) most likely won’t keep up with inflation. The rate of return is just too low, and fixed payments will lose their value as the price of just about everything increases over time.

Annuities are very hard to transfer.

There’s a reason why insurance companies use the wording surrender period. You’re essentially surrendering your money to them! And then, if (or when) you find a better investment—like a Roth IRA or a Roth 401(k)—you can’t even transfer your money out without paying big fees! You have much more control (and better returns) with other retirement options.

Annuities are confusing.

For having a simple definition, annuities sure are confusing, aren’t they? Insurance companies, salespeople and even your “savvy” brother-in-law will throw a lot of buzzwords at you when they’re trying to sell you an annuity, like risk-free, guaranteed and safe. You might even hear fear-tactic questions like, “What if you outlive your retirement savings?”

Look, anything that has to be sold to you this hard probably isn’t the best idea—especially if it makes your head spin. There are so many details, extra fees and additional features to consider. And frankly, they just aren’t worth the trouble.

Here’s the thing: If you follow the 7 Baby Steps and invest 15% of your income (Baby Step 4) in your 401(k) and Roth IRA (with good growth stock mutual fund options), you’ll retire with a nice nest egg. A 10–12% rate of return will more than keep up with inflation, and you can grow your money without paying insane fees. Simple, right? We like simple.

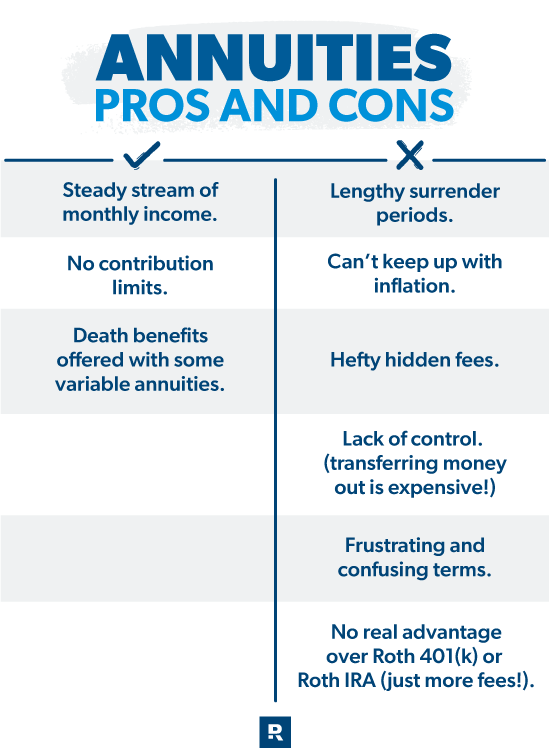

Pros:

- Steady stream of monthly income

- No contribution limits

- Death benefits offered with some variable annuities

Cons

- Lengthy surrender periods

- Can’t keep up with inflation

- Hefty hidden fees

- Lack of control (transferring money out is expensive)

- Frustrating and confusing terms

- No real advantage over Roth 401(k) or Roth IRA (just more fees!)]

Example of an Annuity

Meet Sally. Sally is 50 years old and has had a good career. She plans to retire at 60, and she maxes out her Roth 401(k) and Roth IRA contributions every year. She gets an inheritance of $10,000 (let’s keep the numbers simple) and decides to buy a deferred variable annuity, using her inheritance as the premium.

Now, because Sally bought a variable annuity, the insurance company invests her premium in mutual funds. During the accumulation phase, her money increases or decreases based on the fund’s performance. Let’s say the fund averages a 10% rate of return—once Sally retires, she should have just over $27,000 in her annuity.

Sounds great, right? But keep in mind: Sally will pay commissions, insurance charges, and investment management fees on her money—not to mention any extra rider fees. Since Sally has already invested in other traditional accounts, this doesn’t hurt as much. But her annuity payouts end up just being sprinkles on the sundae of the retirement savings she built herself.

Are Annuities Ever a Good Idea?

We're going to come right out and say it: For most people, an annuity just doesn’t make sense. While a guaranteed income is great, you have way more earning potential with mutual funds through your 401(k) or Roth IRA. In fact, we found that the number one contributing factor to millionaires’ high net worth is investing in workplace retirement plans.6

Still, a variable annuity might make sense for some people who are further along in their investing. The only time you should even think about adding a variable annuity to your investment strategy is when you’ve already paid off your house completely and maxed out all your other tax-favored retirement plans. That means you’re contributing up to the limit on your 401(k) and Roth IRA.

Even then, there are a few other investment options you should look into before annuities—like health savings accounts, taxable investment accounts or even real estate. You can sit down with an investing professional who can help you sort through the good, the bad and the (sometimes) ugly of each option. Remember, never invest in anything you don’t understand.

Annuities are not a replacement for traditional tax-advantaged retirement accounts. And never put a retirement account that already has tax advantages into an annuity. You don’t get any extra tax benefits from putting your 401(k) or IRA funds into an annuity—only more fees. Pass!

Talk With an Investment Professional

At the end of the day, it’s up to you to secure your financial future, not an insurance company. If you want the retirement of your dreams, you need to use an investment strategy that works and stick to it. If you’re ready to get started, check out SmartVestor. It’s a free, easy way to get connected with investment professionals in your area who know their stuff—and they’re eager to work with you!

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

Frequently Asked Questions

-

Who buys annuities?

-

Annuities are attractive to people who want a steady income stream when they retire. An annuity might also be an option for those further along in their investment journey or have received an inheritance.

-

What is a nonqualified annuity?

-

In a nonqualified annuity, you contribute money after paying income taxes. This means that when you’re ready to withdraw your money, you’re only taxed on your earnings. But remember, if you withdraw your money before you turn 59 1/2, you’ll have to pay an IRS early withdrawal penalty.

-

What is a surrender period?

-

A surrender period is a set amount of time before you can withdraw funds from your annuity without paying a fee. If you withdraw your funds before the surrender period ends, you’ll have to pay hefty surrender charges. The surrender period can last years.

-

What’s the difference between annuities and life insurance?

-

An annuity is designed to provide a steady stream of income while you’re alive. A life insurance policy is designed to protect your loved ones financially after you die.

-

How much does an annuity cost?

-

The cost of an annuity depends on which kind you buy. Keep in mind, the premium isn’t the only cost when it comes to annuities. You also have to pay commissions, insurance charges, rider fees and possible surrender charges.

-

Do annuities have beneficiaries?

-

The type of annuity you buy—and its payout plan—determines whether your loved ones receive money after you die. Some annuities come packaged with death benefits. Others offer add-on riders for death benefits (you pay extra for them). And some annuities offer no death benefits—the payments just stop.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.