Credit cards have become about as American as apple pie, baseball, tipping culture and Kid Rock. In fact, 8 in 10 American adults (84%) have at least one credit card.1

But do you know what else is very American? Credit card debt.

We’re breaking down what the average credit card debt in America looks like, what it means for you, and what to do if you’re trapped in credit card debt. Heads up: These stats aren’t pretty, but it’s important to know the facts. Let’s dive in!

How Much Credit Card Debt Do Americans Have?

How Many Americans Have Credit Card Debt?

What’s the Average Credit Card Debt Balance?

What’s the Average Credit Card Interest Rate?

How Many Americans Are Behind on Their Credit Card Payments?

Which States Have the Highest Credit Card Debt?

How Much Do Credit Card Companies Make in Interest and Fees?

How to Get Out of Credit Card Debt

How Much Credit Card Debt Do Americans Have?

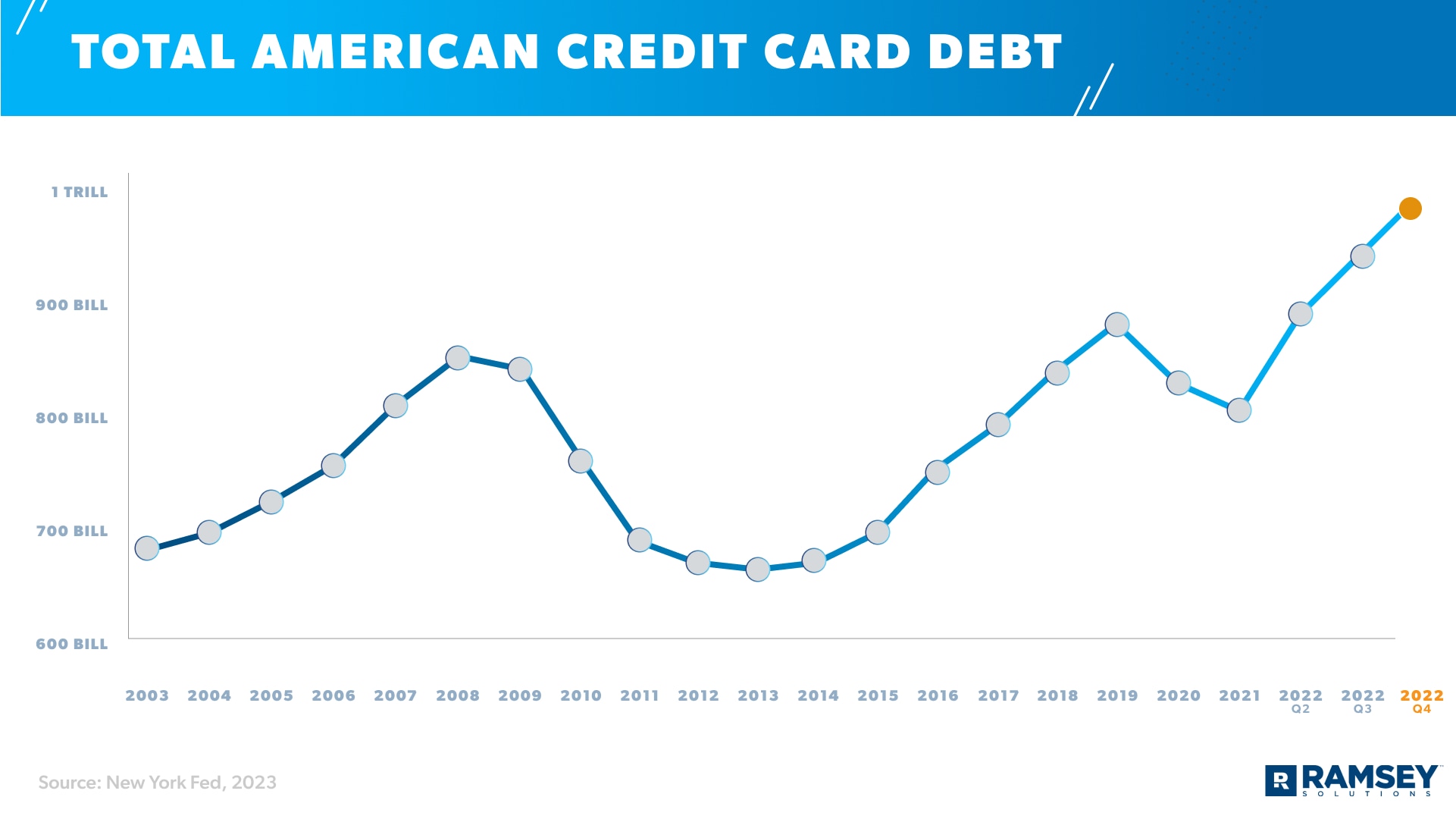

The total credit card debt in America is $986 billion—the highest it’s ever been!2 Because if there’s one thing Americans are great at, it’s racking up a huge tab (not just with credit cards, but debt in general).

The national credit card debt actually dropped in 2020 during the pandemic. That was when student loan relief paused federal student loan payments, which meant millions of borrowers suddenly had more money to put toward other debts. And many card holders used their stimulus checks to pay down their credit card balances during that time.

But Americans are now making up for that dip—and fast. In fact, there was a $61 billion jump in overall credit card balances between the third and fourth quarter of 2022—a 15% year-over-year increase!3 In fact, the current credit card debt balance has blown past the record of $927 billion set in 2019.

How Many Americans Have Credit Card Debt?

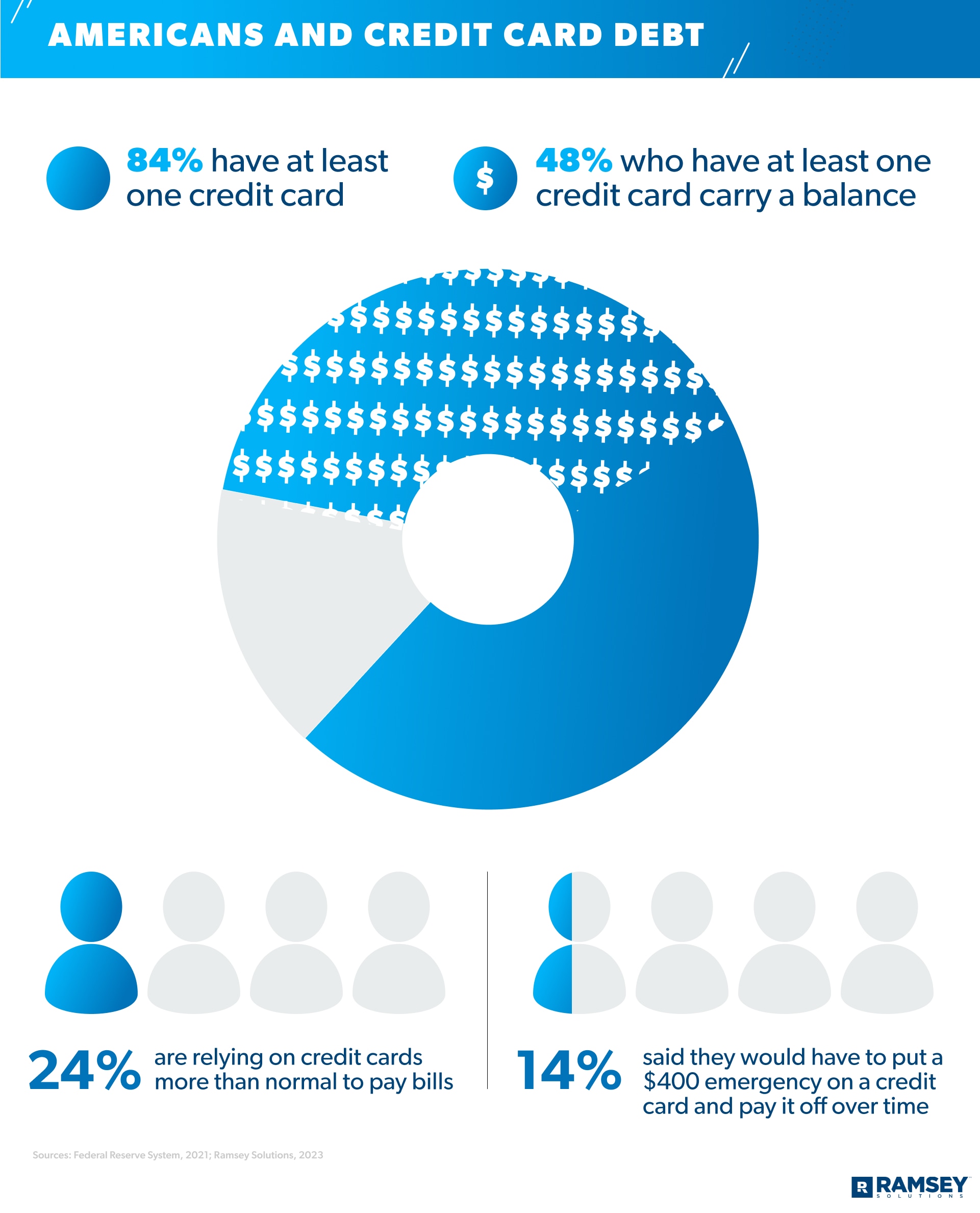

So, how does credit card debt spread out across individual Americans? Well, there are around 218 million American adults with at least one credit card, and 48% of those with a credit card carried a balance at least once in 2021.4,5 So, roughly 104 million Americans have credit card debt!

Ramsey Solutions also found that 24% of Americans are relying on credit cards more than normal to pay their bills. And 14% of Americans said they would have to put a $400 emergency expense on a credit card and pay it off over time.6

With so many people leaning more on credit cards to survive, it’s no wonder credit card debt is shooting up so fast!

What’s the Average Credit Card Debt Balance?

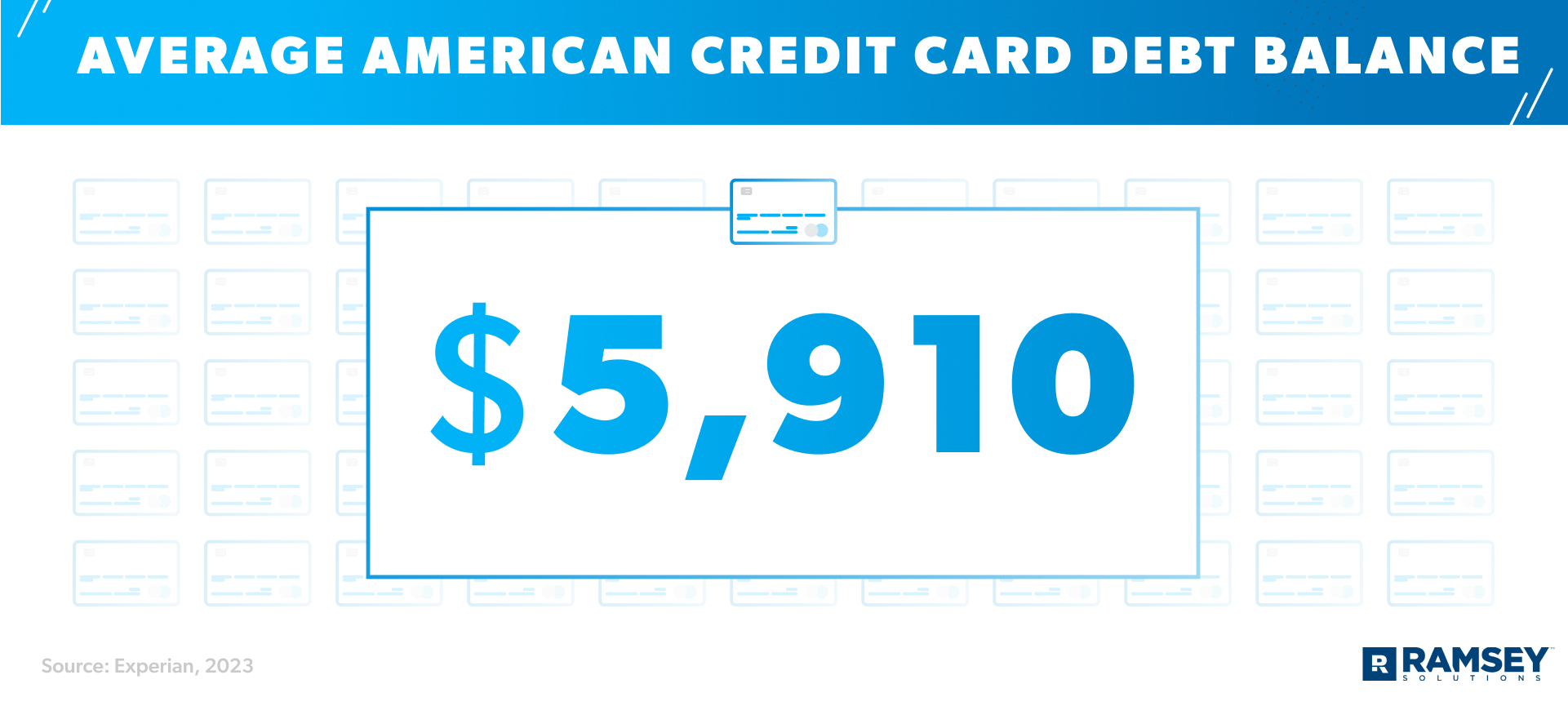

The average credit card debt balance per borrower is $5,910 (as of fall 2022).7 That’s more than three times the average mortgage payment!

And that number will probably go up thanks to inflation and nationwide layoffs, as well as federal student loan payments starting back up sometime soon.

In fact, since the total credit card debt is higher than it was before the pandemic, the average credit card balance could get as high as $6,870, which is what happened in 2019.8,9

What’s the Average Credit Card Interest Rate?

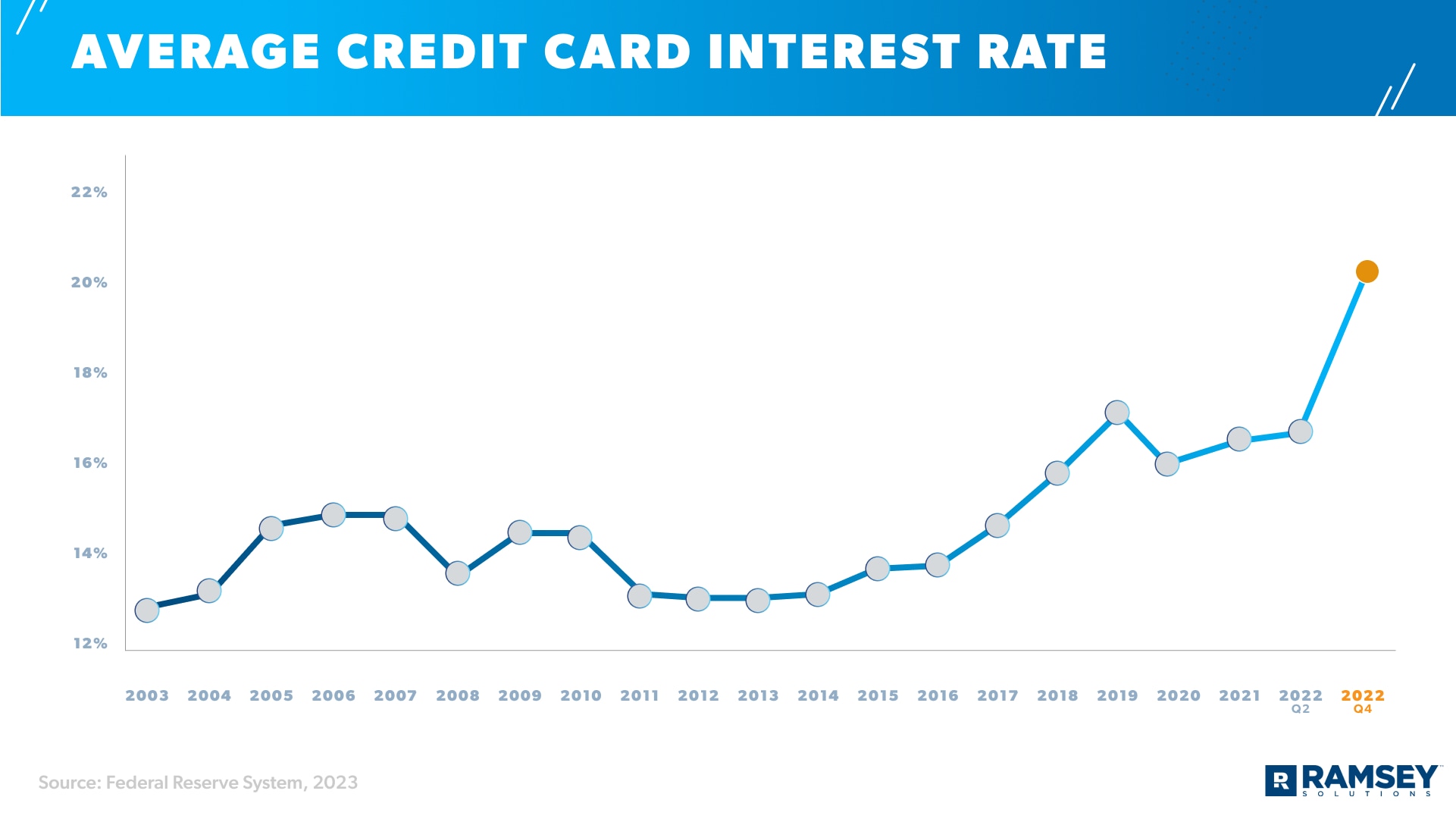

Do you know what happens when you carry a balance on your credit card from month to month? You get charged credit card interest. And right now, credit card interest rates are the highest they’ve ever been!

Don’t let credit control your life! Learn the proven plan to win with money.

The average credit card interest rate (or APR) is currently at 20.4%.10 If you were drinking a glass of water when you read that, you probably just did a spit take! In case you’re wondering, that’s 36% more than it was five years ago. And with federal interest rates increasing, that number isn’t likely to come down for a while.

But that’s just the average. Credit card interest can range all over the place, depending on the type of credit card.

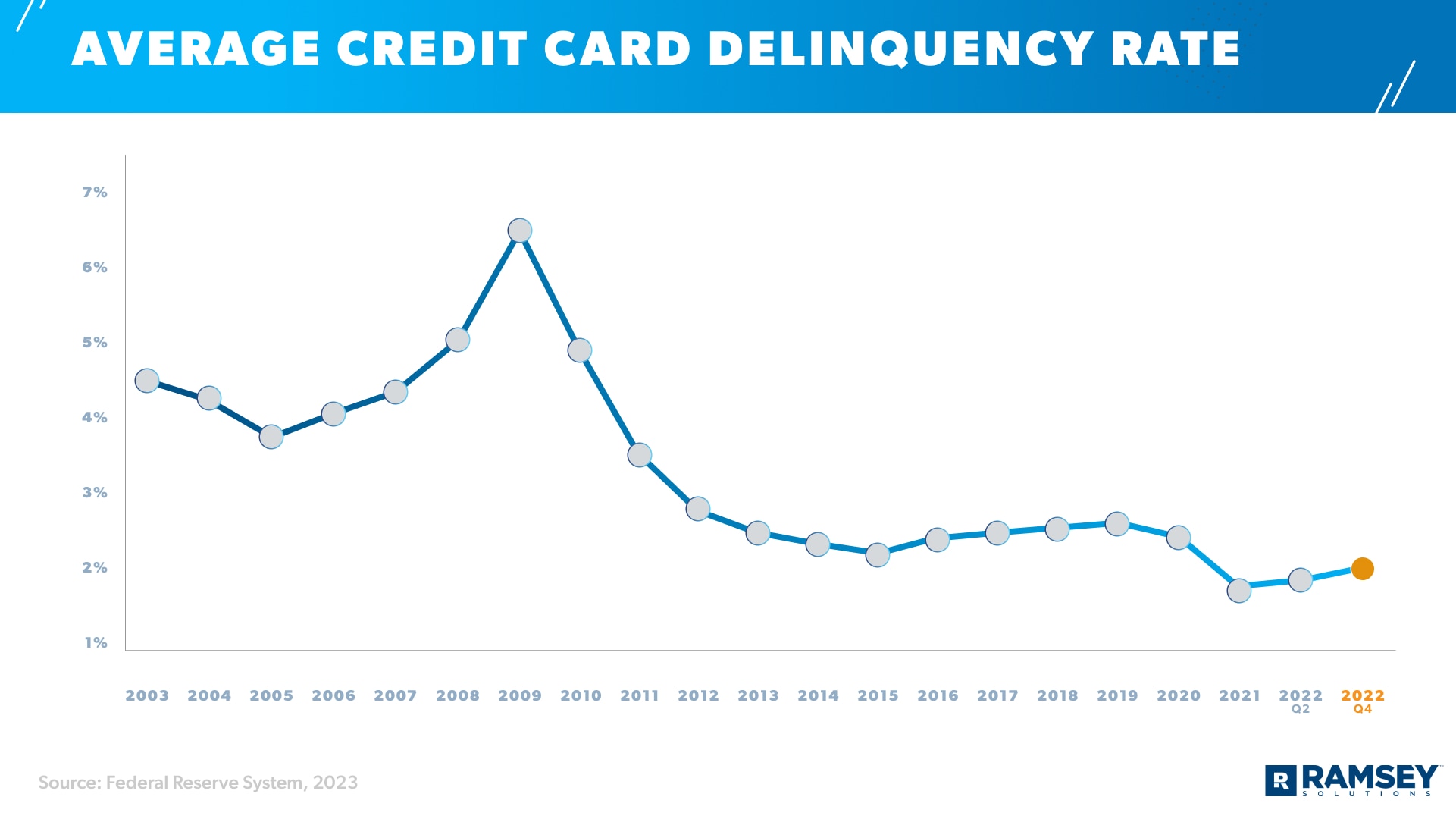

How Many Americans Are Behind on Their Credit Card Payments?

Just like everything else in credit card world, credit card delinquencies are also on the rise. (By the way, Credit Card World is definitely the worst idea for a theme park.)

As of fall 2022, the credit card delinquency rate is at 2.25%.11 Credit card delinquencies went down in 2021, but they’re spiking back up (again, thanks to factors like inflation).

Keep in mind, you can still have credit card debt even if you aren’t delinquent. Your credit card account becomes delinquent if your minimum payment is late by 30 days or more (the typical billing cycle). When that happens, you get slammed with late fees and penalty APR. Plus, credit card companies can report your delinquency to the main credit bureaus—which means it also shows up on your credit report.

Miss enough payments in a row, and your credit card debt will go into collections. But while paying the minimum payment will keep you out of delinquency with the credit card company, you can still pile on credit card debt if you don’t pay off your entire balance every month.

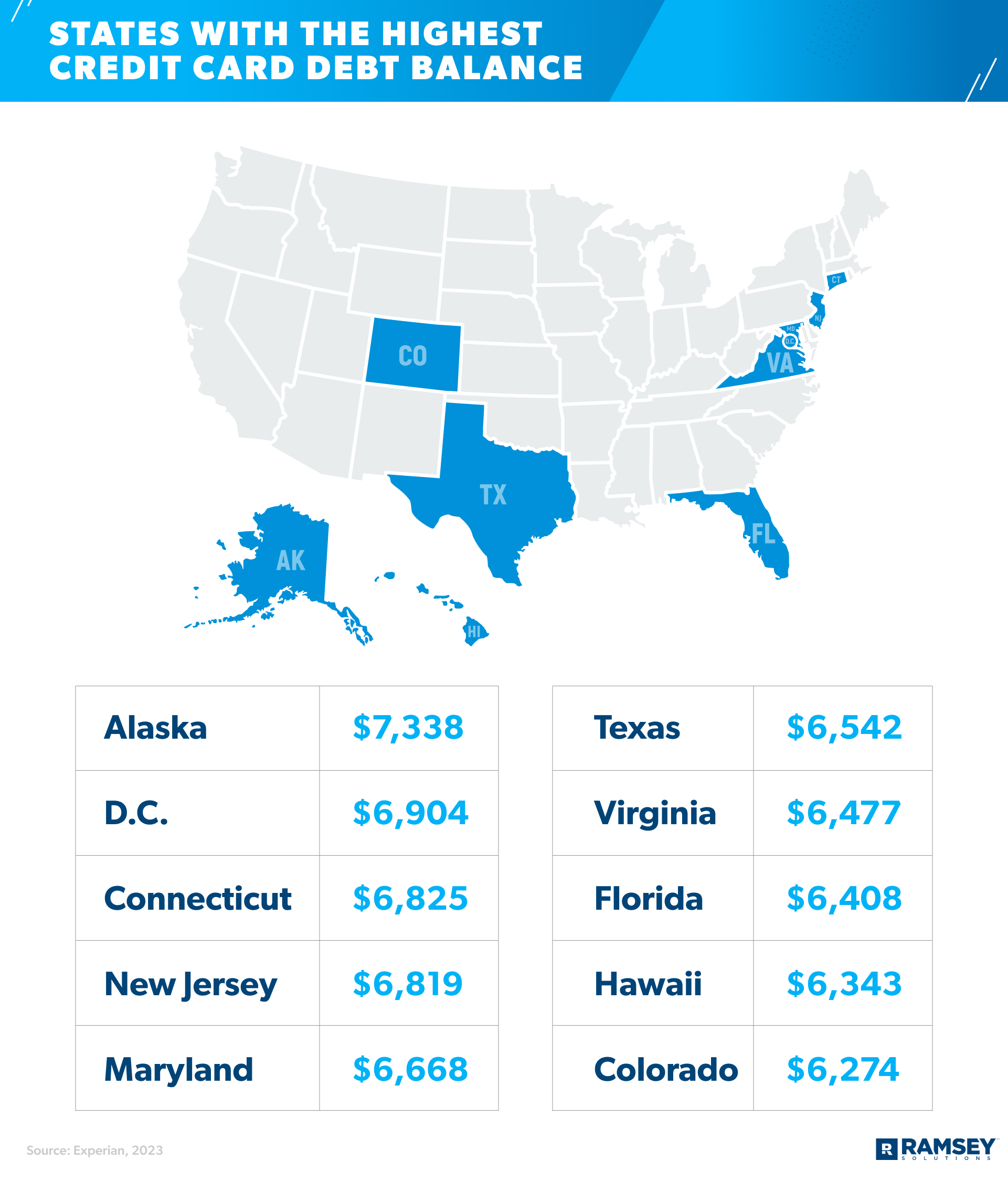

Which States Have the Highest Credit Card Debt?

America’s got credit card debt from sea to shining sea. But just like each state has its own accent and food (taco seasoning on watermelon, anyone?), they also have their own credit card debt numbers. Here are the states that carry the highest credit card balances in the country.12

How Much Do Credit Card Companies Make in Interest and Fees?

You know who benefits from all that credit card debt? The people handing out the credit cards!

Banks made $106.7 billion off credit card interest and fees in 2021.13 Yep, fees and interest are the bread and butter of credit card companies.

Oh, and all those credit card points and rewards? They’re not really free. They’re just sneaky ways of getting you to charge more to your card. Because the more credit card companies can get people to use their cards, the less likely people are to pay them off and the more money lenders can charge. And any cash back you do manage to get comes at the expense of someone else. The credit card industry is straight-up predatory, folks!

How to Get Out of Credit Card Debt

Everyone loves to say you need a credit card to survive in this country, but the stats tell a different story. It’s pretty clear America’s relationship with credit cards is more toxic than Britney Spears’ 2003 hit song—and it’s literally titled “Toxic.”

The national credit card problem is only going to get worse if we keep swiping our cards like there’s no tomorrow. But the good news is, you don’t have to be part of these statistics! Here’s how to pay off your credit card debt once and for all.

Quit the Credit Card Game

Because that’s exactly what the credit card industry is: a game. Problem is, it’s rigged so the credit card company comes out on top while you get stuck paying the tab.

If you want to pay off credit card debt, you’ve got to chop it off at the root. That means literally cutting up your credit cards. Every. Single. One. They’re not doing you any favors. They’re only holding you back.

We know that might sound terrifying, especially if you’ve been relying on credit to cover your bills. But you can live (and thrive) without credit cards! In fact, quitting the credit card game will actually free you up to make more progress with your money.

Get on a Budget

When you’re used to just charging your purchases on a credit card, it can be hard to actually keep track of your spending or know how much you have left for the month. But when you have a budget, you can know exactly where your money is going because you already made a plan for it.

Creating a monthly budget is a total game changer. Instead of worrying about your card being declined at the grocery store, you can feel confident that you have enough. Seriously, you need a budget if you ever want to get your spending (and your sanity) under control.

Go ahead and create your free budget right now with EveryDollar.

Have a Game Plan

There are a lot of “methods” out there for paying off credit card debt. But most of them only move your debt around (yeah, real helpful). What you need is a plan that works that you can actually stick with—and that’s the debt snowball method.

This method helps you prioritize your debts, gain quick wins, and attack your credit card debt without losing motivation! You can learn all about the debt snowball method, living without credit, budgeting and more in Financial Peace University (FPU). This course has helped millions of people ditch credit card debt. And now it’s your turn!

Don’t Let the Credit Card Stats Define You!

Learn how to pay off debt, save more money, and build wealth that lasts.

Start FPU today.