Key Takeaways

- The average credit card balance in the U.S. is $6,501.

- Total credit card debt in America has reached $1.13 trillion.

- Credit cards charge an average interest rate of 22.63%.

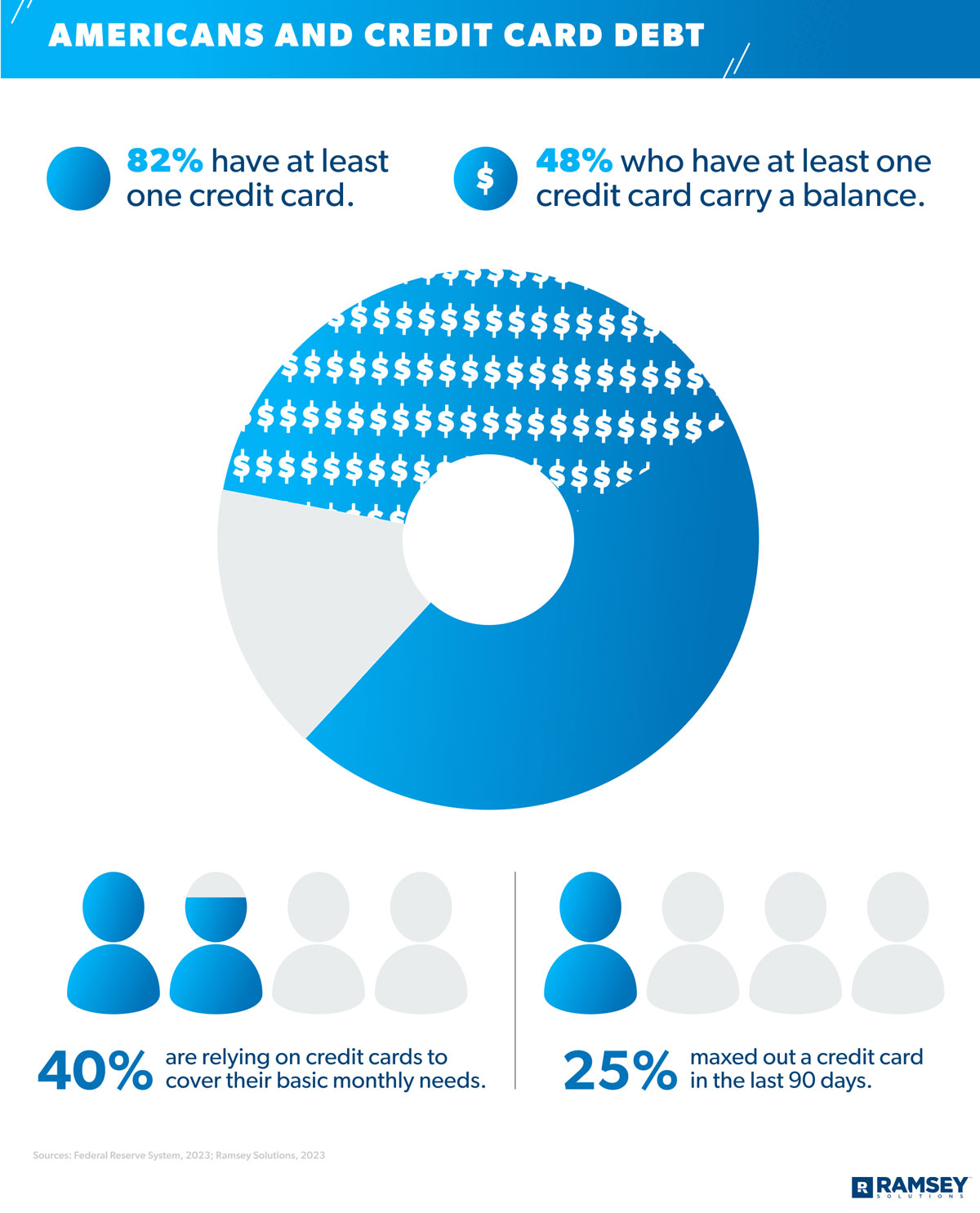

Credit cards have become about as American as apple pie, baseball and reality dating shows. In fact, 8 in 10 American adults (82%) have at least one credit card.1 Unfortunately, all those credit cards have led to a whole lot of credit card debt across the country. How much, you ask? Great question! We’re about to break it all down.

Let’s see what the average credit card debt in America looks like, what it means for you, and what to do if you’re trapped in credit card debt. Heads up: These stats aren’t pretty, but it’s important to know the facts. Let’s dive in.

How Much Credit Card Debt Do Americans Have?

How Many Americans Have Credit Card Debt?

What’s the Average Credit Card Debt Balance?

What’s the Average Credit Card Interest Rate?

How Many Americans Are Behind on Their Credit Card Payments?

Which States Have the Highest Credit Card Debt?

How Much Do Credit Card Companies Make in Interest and Fees?

How to Get Out of Credit Card Debt

How Much Credit Card Debt Do Americans Have?

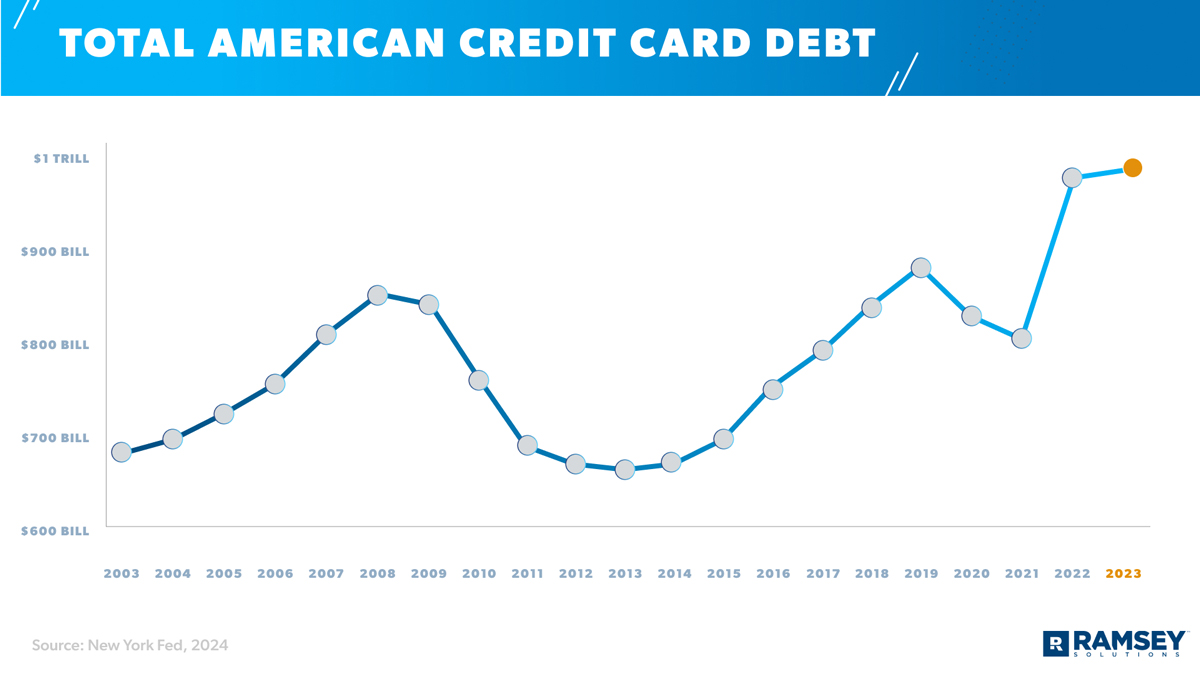

The total credit card debt in America is $1.13 trillion—the highest it’s ever been!2

For some perspective on how quickly that number is growing, total credit card debt at the start of 2020 was $890 billion.3 That means this type of debt across the country has leapt by nearly 27% in just the last four years.

How Many Americans Have Credit Card Debt?

So, how does credit card debt spread out across the American population? Well, there are around 215 million American adults with at least one credit card, and 48% of those with a credit card carried a balance at least once in 2022.4,5 So, roughly 103 million Americans have credit card debt!

A Ramsey Solutions research study also found that almost 40% of Americans rely on credit cards to cover their basic monthly needs, and 1 in 4 Americans have maxed out a credit card in the last 90 days. With so many people using credit cards to survive, it’s no wonder credit card debt is shooting up so fast.

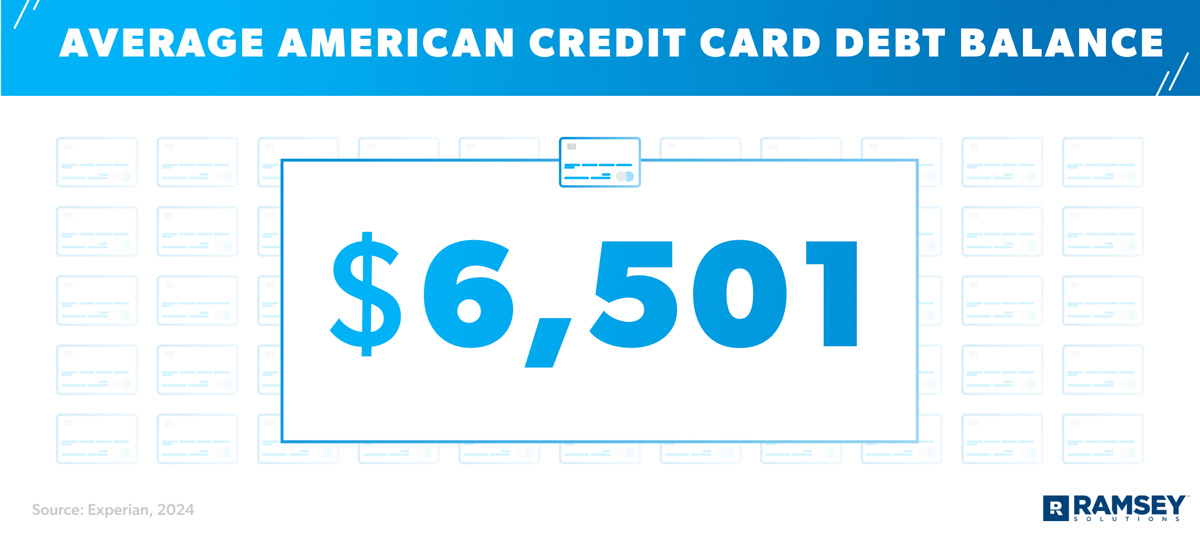

What’s the Average Credit Card Debt Balance?

The average credit card debt balance per borrower is $6,501.6 And that’s not a huge surprise, considering we saw earlier that total credit card debt in America has grown by a whopping 27% since the start of 2020.

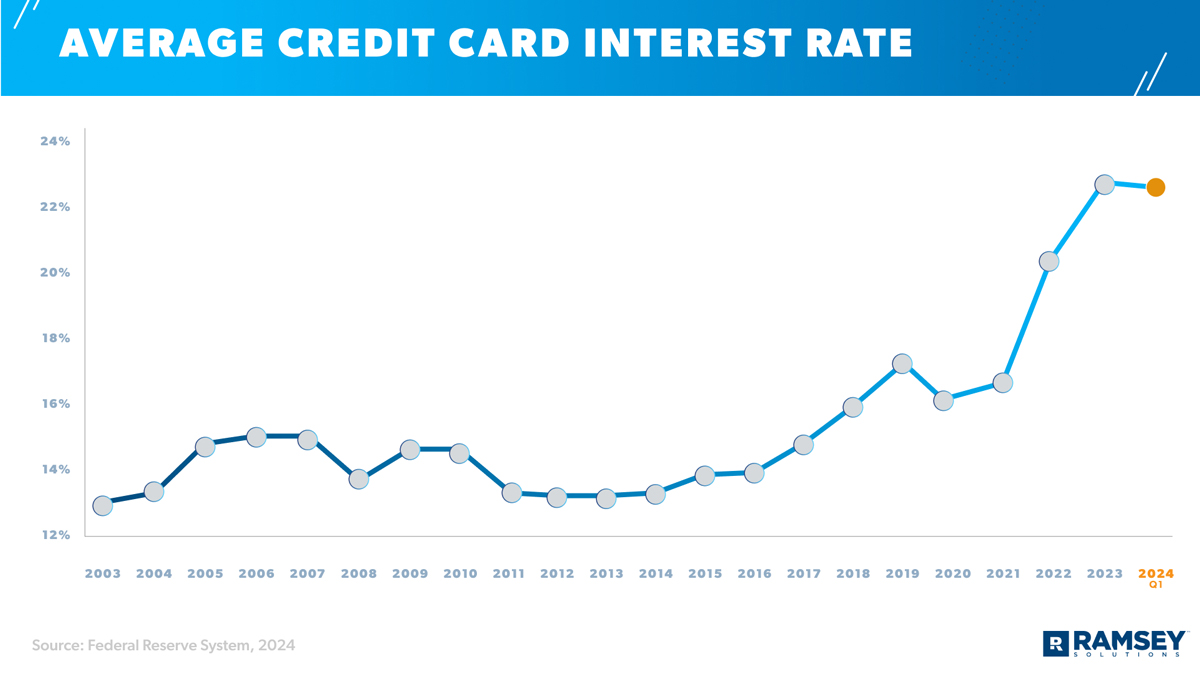

What’s the Average Credit Card Interest Rate?

Do you know what happens when you carry a balance on your credit card from month to month? You get charged credit card interest. And right now, credit card interest rates are some of the highest we’ve ever seen!

The average credit card interest rate (or APR) is currently at 22.63%. And in case you’re wondering, that’s a jump of over 6% since the start of 2020.7

That’s just the average, though. Credit card interest can range all over the place, depending on the type of credit card.

How Many Americans Are Behind on Their Credit Card Payments?

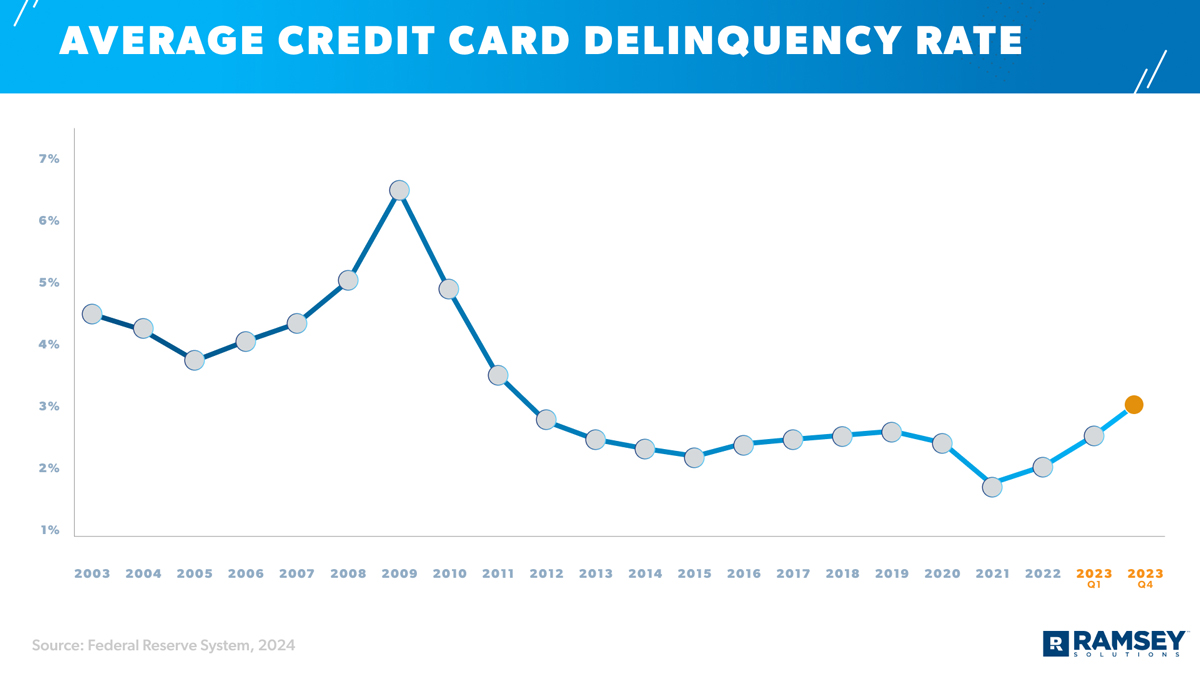

Just like everything else in the world of credit cards, credit card delinquencies are also on the rise. The current credit card delinquency rate is 3.1%. That’s the highest rate we’ve seen since 2011!8 (That’s not a great record to break!)

Don’t let credit control your life! Learn the proven plan to win with money.

Keep in mind, you can still have credit card debt even if you aren’t delinquent. Your credit card account becomes delinquent if your minimum payment is late by 30 days or more (the typical billing cycle). When that happens, you get slammed with late fees and penalty interest rates. Plus, credit card companies can report your delinquency to the main credit bureaus—which means it also shows up on your credit report.

Miss enough payments in a row, and your credit card debt will go to collections. And while paying the minimum payment will keep you out of delinquency with the credit card company, you’ll still pile on credit card debt if you don’t pay off your entire balance every month.

Which States Have the Highest Credit Card Debt?

America’s got credit card debt from sea to shining sea, and each state has its own credit card debt numbers. Here are the states that carry the highest credit card balances in the country.

|

State |

Avg. Credit Card Debt |

State |

Avg. Credit Card Debt |

|

Alaska |

$7,863 |

Florida |

$7,112 |

|

New Jersey |

$7,401 |

Hawaii |

$7,107 |

|

Connecticut |

$7,381 |

Virginia |

$7,002 |

|

Maryland |

$7,282 |

Colorado |

$6,996 |

|

Texas |

$7,211 |

Nevada |

$6,9879 |

How Much Do Credit Card Companies Make in Interest and Fees?

You know who benefits from all that credit card debt? The people handing out the credit cards! (There’s a reason they can afford to build all those skyscrapers.)

Banks made $113.1 billion off credit card interest and fees in 2022.10 Yep, fees and interest are the bread and butter of credit card companies.

How to Get Out of Credit Card Debt

These stats may make it seem like everyone uses credit cards these days, but that’s just not true! After all, we said earlier that 82% of Americans use credit cards—which means there’s a tiny-but-mighty 18% that will never owe a dime to credit card companies.11

And we’ve got some good news: You can be in that same position! It’s true. Even if you currently feel like you’re drowning in credit card debt, you can ditch your credit cards and say goodbye to debt for good. Here’s how to pay off your credit card debt once and for all.

Quit using credit cards.

If you want to pay off credit card debt, you’ve got to chop it off at the root. That means literally cutting up your credit cards. Every. Single. One. They’re not doing you any favors. They’re only holding you back.

Oh, and all those credit card points and rewards? They’re not really free. They’re just sneaky ways of getting you to charge more to your card. Credit card companies know that the more they get you to spend with their cards, the less likely you are to pay them off—which means more money in their pockets. This industry is straight up predatory, folks!

Now, we know ditching your credit cards might sound terrifying, especially if you’ve been relying on credit to cover your bills. But you can live (and thrive) without credit cards! In fact, quitting the credit card game will actually free you up to make more progress with your money.

Follow the debt snowball method.

There are a lot of “methods” out there for paying off credit card debt. But most of them only move your debt around (yeah, real helpful). What you need is a plan that works that you can actually stick with—like the debt snowball method.

This method helps you prioritize all your debts (not just credit cards) and gain quick wins so you don’t lose motivation! Here’s how it works:

- List all your debts, except your mortgage, from smallest to largest.

- Make minimum payments on all those debts except the smallest debt.

- Put as much money as possible toward your smallest debt every month until it’s gone.

- Then, take what you were paying on your smallest debt and add that to your payment on the next-smallest debt until it’s gone too.

- Repeat the cycle until each debt is paid in full and you’re completely debt-free!

It’ll take patience and hard work, but you can make it happen. You’ve got this!

Get on a budget.

When you’re used to just charging everything you buy on a credit card and hoping for the best, it can be hard to actually keep track of your spending or know how much you have left for the month. But when you have a budget, you can know exactly where your money is going because you already made a plan for it.

That’s why getting on a monthly budget is a must if you want to pay off credit card debt. It’s a total game changer! Instead of worrying about whether you’re actually making progress on your debt or—worse—whether your card will get declined at the grocery store, you can feel confident.

Seriously, you need a budget if you ever want to get your spending (and your sanity) under control.

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)