It was only three years ago, on January 1, 2012, that my husband and I began our debt-free journey.

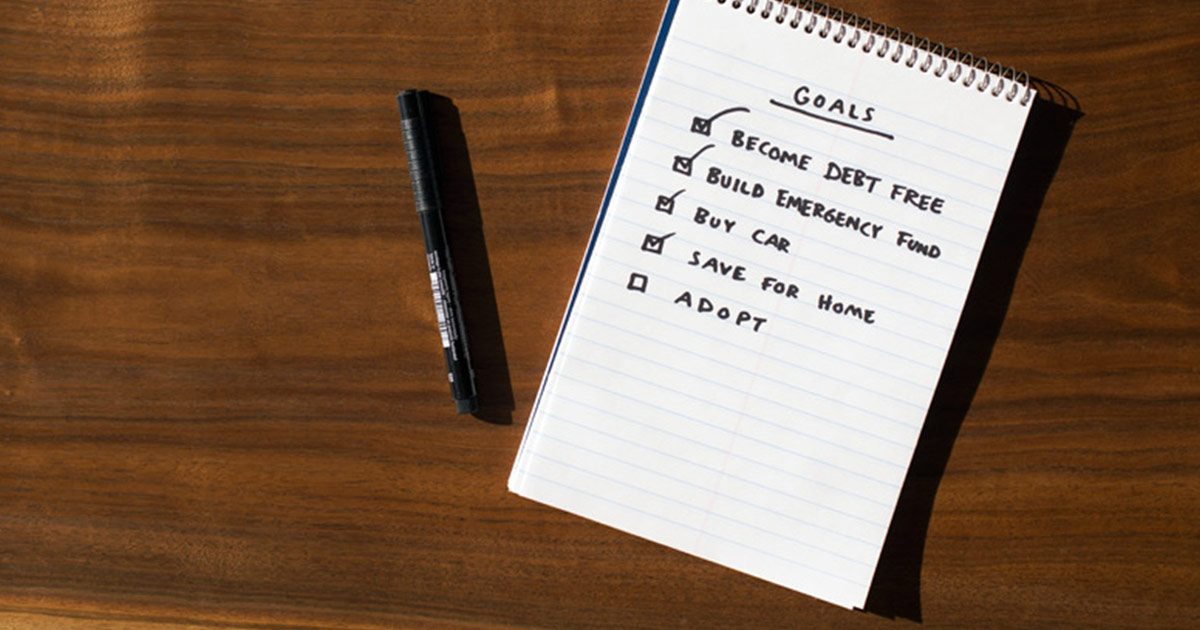

In just three short years, we became debt-free, built our emergency fund, purchased a new-to-us vehicle, saved a down payment for our first home, and adopted our first child.

And we cash-flowed everything.

It’s amazing how much can change in three years. That’s the story we are here to share with you today.

Debt reared its ugly head once we got engaged. Between the two of us, we had $24,500 in debt!

Here's the breakdown:

Amanda: $8,000 student loans

Jonathan: $13,000 student loans + $3,500 on a credit card

My dad had given me Dave Ramsey's The Total Money Makeover, and we both began reading it. All the testimonies from individuals and families who had worked Dave's plan and obtained financial freedom were inspiring.

Dave always says the first step to getting out of debt is saying, "I'VE HAD IT!" and being sick and tired of being sick and tired. We had arrived at that point.

We got married on October 22, 2011, and sat down for our first Teixeira Budget Committee Meeting on December 30, 2011. Looking back, it was hilarious—we fumbled our way through varying categories and were really bad at estimating the cost of things.

Despite being bad at budgeting from the first go, we had tremendous amounts of zeal and passion for it. We were finally a team. We were on the same page. Nothing could stop us from getting that very first baby step done: $1,000 in a mini emergency fund.

Even though it felt impossible, we were on track to paying off our student loans within one year's time.

With Baby Step 1 under our belts, we turned toward that pile of debt. As the months crept by, we not only got better at creating a budget but also sticking to the budget! Our desire to become debt-free was so intense we were willing to sacrifice everything but necessities to meet that goal. We would rather suffer a short but intense time of delaying gratification than several years of lukewarm spending/paying debt.

Sometimes we rode bikes to work when we were almost out of gas money. Or we would make PB&J sandwiches for days on end with baby carrots and celery on the side when we wanted to stretch the grocery funds. We sold dozens of items on eBay and Craigslist. Instead of buying a new mattress, we slept on a (clean!) donated mattress from someone's old RV.

We were officially weird and gazelle-intense. Friends and family thought we were taking things just a little too far . . . and that is exactly where we wanted to be!

The debt started falling rapidly, and with every dollar thrown at it, our confidence and excitement grew. We quickly went from first-time fumbling budgeters to budget pros with a goal no one could stop us from reaching!

In late July, we saw the numbers really plummeting, and we were just itching to get it all paid off the next month. We continued living on a bare-bones budget and scraping money out of thin air, hoping we could have an August debt-free date.

On August 15, 2012, we had finally scrounged up enough to sink our last loan and become debt-free! What once was a one-year stretch goal took just over seven months to accomplish.

In November of that year, we got to do our debt-free scream live from the lobby of Financial Peace Plaza. It was one of the best memories of our marriage thus far. Hear our debt free scream on my blog!

Pay off debt fast and save more money with Financial Peace University.

A few months later we scraped up our fully funded emergency fund, and, shortly thereafter, we began saving for a down payment. In June 2014 we purchased our first home according to Dave Ramsey’s home-buying principles.

This past year we also felt drawn to growing our family through adoption, which is both a blessing and a costly endeavor. In July (two weeks after buying our home), we found out we had been selected to adopt a baby due in November. We scrimped, saved, and fundraised our way to pay the $20,000+ price tag for adoption in only a short three months. Our daughter, Josephine Rose, was born November 10, 2014, and our lives have been forever changed.

We are only one family whose lives have been impacted and changed by the biblical principles Dave Ramsey teaches. We couldn’t be more grateful for his ministry, and we can’t wait to see how it will continue to bless and impact our lives for years to come.

Read more about Amanda and Jonathan's journey at truegoodandbeautiful.net. Ready to change your family tree like the Teixeira family? Buy your copy of The Total Money Makeover and check out Dave's life-changing Financial Peace University class.