Term vs. Whole Life Insurance: What’s the Difference?

16 Min Read | May 17, 2024

Key Takeaways

- There are two main life insurance options out there: term life insurance and whole life insurance.

- Term life insurance offers simple and affordable coverage for a specific amount of time, usually 10–30 years. If you die within the set term, your beneficiaries receive the policy’s payout. Simple as that.

- Whole life insurance has higher premiums because it combines insurance and investing—your money is paying for lifetime coverage and cash value options.

- If you pass away with a whole life policy, your beneficiaries receive the policy’s original payout amount. But if you don’t take out your cash value savings before you die, the insurance company keeps it.

Rocky vs. Apollo.

Batman vs. the Joker.

Pepsi vs. Coke.

Why am I listing epic rivals? Because we’re about to witness the biggest, baddest showdown yet:

Term life vs. whole life.

Alright, maybe it’s a stretch to compare term life insurance to your favorite soft drink, but it’s definitely not too far to call whole life insurance the villain. It’s some of the worst stuff out there, with whole life agents watching and waiting for disaster to strike before they swoop in to “help.”

Am I being dramatic? Slightly. But to be fair, social media is crawling with these people calling themselves “wealth strategists” while peddling whole life and its even nastier siblings (universal and indexed universal life insurance) as “infinite banking” and “risk-free growth” plans.

In this fight, term and whole will go head-to-head on everything:

- Cost effectiveness

- Coverage length

- Premiums

- Cash value component

- Death benefit

- Investment and savings

- Flexibility

- And policy renewal.

So, grab a seat and prepare to leer and cheer as term takes whole life insurance to the mat.

Okay, I’m done. Joe Rogan can have his ringside mic back.

What Is the Difference Between Term and Whole Life Insurance

Here’s the difference in a nutshell: Term life has a set premium that stays the same throughout the life of the policy, and it only lasts for a defined number of years (aka a term). If you die during that term, your beneficiaries receive a payout.

On the other hand, whole life is intended to last your whole life (hence the creative name). While the premiums also stay the same, they are way more expensive. And you’ll pay those premiums your . . . whole life . . . even after you’re past the age when you’d need a death benefit for your dependents. The other big difference between term and whole is whole life tries to do more than just insure you by tacking on an investment or savings component called a cash value account. The whole thing ends up being overcomplicated (and overpriced).

I’ll give it to you straight—term life insurance works and whole life doesn’t. The reason is simple: The true purpose of life insurance is to replace your income if you die, and to do it as cheaply as possible. And that’s exactly how term life works: It’s simple, affordable and reliable. But whole life? It tries to shove insurance and investing together, usually making an expensive mess.

|

Term vs. Whole Life Insurance |

|

|---|---|

|

Term |

Whole |

|

Cheaper premiums |

Expensive premiums |

|

Lasts for a set term (10, 20, 25 for 30 years) |

Lasts your whole life |

|

No (crappy) investment component |

Cash value account attached |

|

Not taxable |

Cash value taxable |

|

Beneficiaries get everything when you die |

Beneficiaries get policy value, but nothing in the cash value account |

Now, let’s look closer at term life versus whole life.

What Is Term Life Insurance?

Term life insurance provides you with coverage for a specific amount of time (hence the word term). Let’s say you buy a $500,000 policy (I usually recommend getting 10–12 times your annual income in coverage) with a 20-year term. If you die at any point during those 20 years, your beneficiaries receive a life insurance payout of $500,000. Yes, it really is that simple.

Compare Term Life Insurance Quotes

What Is Whole Life Insurance?

Whole life insurance (sometimes called permanent life insurance) is coverage that lasts your whole life. It comes with a side of investments in the form of a cash value account. The idea behind whole life is it’s doing double duty: protecting your loved ones financially in case you die and building wealth for retirement.

Whole life policies are overly complicated, cost you hundreds more per month, and the returns are often very low. Let’s continue the tea spilling.

Here's A Tip

You should get a term life insurance policy worth 10–12 times your annual income for term of 15–20 years.

Cost-Effectiveness of Term Life vs Whole Life

Cost is a big motivator for a lot of people. I mean, that’s why places like Burger King are so popular even though Michelin star restaurants exist. But there’s usually a tradeoff—you either get better but more expensive, or cheaper but not as good. But when it comes to life insurance, you get to have it all your way: cheaper and better!

Term life: Offers the most life insurance coverage for the lowest price.

Whole life: Provides life insurance coverage at a high price along with a low return investment feature.

Term life policies are much more affordable because they’re not trying to build cash value. They’re doing one straightforward job and they’re doing it well. You pay a small monthly premium for only what your loved ones need if the unthinkable happens—nothing more, nothing less.

Another reason they cost less is because they don’t last until you die. There’s a good chance you won’t die during the policy term, so the insurance company won’t have to pay out at all. That’s good news because it means they don’t have to charge as much but you’re still protected.

With whole life, you get to have it . . . a way. You get a burger that’s exactly the same size as term life, but you pay a ton more because it’s fully loaded with fees and comes with a side of poor investments. And if you die, only the burger goes to your loved ones, not the investments. I don’t know about you, but I’d keep driving.

Whole life also costs more because it lasts longer—your whole life. Because a whole life policy covers you until you die, the insurance company is going to pay out, it’s just a matter of time. So they charge higher premiums for that too.

Monthly Estimate

0 - 0

Coverage Length Difference Between Term and Whole Life Insurance

At this point, you’ve already heard it, but I’ll go over it again in case someone skipped ahead. Term life provides coverage for a specific term, usually 10, 20, 25, or 30 years. Whole life lasts your whole life so long as you keep paying your premiums.

Term life: Provides coverage for a set term and then it ends.

Whole life: Offers coverage for the rest of your life.

But let’s get clear on this: If you follow Ramsey’s 7 Baby Steps, you won’t need life insurance forever. Ultimately, you’ll be self-insured. Why? Because you’ll have zero debt (yep, house and everything), a full emergency fund, and a hefty amount of money in your investments to enjoy and leave behind for your loved ones.

Here's A Tip

The goal is to build enough wealth that by the time you die, anyone you leave behind will be well taken care of without a life insurance payout.

Premiums are where term life really shines. I kind of got into this with the cost effectiveness, but let’s dig deeper into how premiums for term versus whole policies stack up.

Term Life Insurance: Offers much lower premiums compared to whole life insurance, especially for younger people. Premiums also remain level throughout your term.

Whole Life Insurance: Has very high premiums that usually remain level.

So, it’s easy to see term is the budget-friendly choice. If you buy a policy for $30 a month, it’ll be $30 a month until the policy term ends. You only pay for life insurance while you need it. If you need to renew your policy for another term, your premiums will likely be higher because you’re older and there’s a greater chance you could die within the term. But if you invest right, you shouldn’t need to renew!

Whole life, on the other hand, has much higher premiums than term because of the lifetime coverage and cash value features. Premiums also remain level, but they’re high—I’m talking Dolly Parton’s hair high. And you’ll be paying that massive premium for the rest of your life.

Some of the other types of permanent life insurance (those nastier siblings like universal life or indexed universal life) offer adjustable premiums. For instance, if you start finding the premium too high to afford, you can “lower” them by taking the difference from your cash value account (reducing the money you’ve saved over there). So you’re still paying sky high premiums, your money is just coming out of two different accounts.

Cash Value Component (No Thanks)

This is the biggest difference between term life and whole life insurance. Whole life comes with a cash value component where part of your massive premium is funneled each month. Term life, thankfully, has no such graveyard for your hard-earned cash.

Term Life: Has no cash value—just insurance.

Whole Life: Accumulates piddly cash value in an attached savings component.

The cash value component builds over time, providing a savings or investment feature in addition to the death benefit. Part of your monthly premium goes in there and earns interest. After a lifetime of paying into it, you’ll have wealth beyond your wildest dreams. At least that’s the idea they sell you. In reality, you might end up with enough to buy a very used RV.

A nifty feature whole life salespeople like to call out is you can borrow from your cash value at a low interest rate. But just stop and think for a minute. That’s your money in there. You’d be paying them interest to borrow your own money! These salespeople must come from a long line of bridge sellers.

Something whole lie—oh, I’m sorry—whole life salespeople don’t like to shout from the rooftops is that the interest you earn on your savings is usually a measly 1–2% and they take a lot of your cash in fees. But wait, there’s more . . . awful features! With most policies, if you die without using that cash value, the insurance company gets to keep it. Yeah, all that extra money you paid in for years is gone in a puff of smoke from a candle at your funeral. Call it a parting gift. But the opposite.

Here's A Tip

Life insurance has one job: to help your loved ones replace your income if you die.

Death Benefit

Both term life and whole life come with a death benefit. That’s about the only solidarity here. The death benefit is the policy value that gets paid out to your loved ones if you die.

Term Life: Provides a death benefit to your loved ones if you pass away during the term of the policy.

Whole Life: Provides a death benefit to beneficiaries whenever you pass away, as long as you pay the premium for your whole life.

With term, your loved ones will get the death benefit if you die within the set term of the policy.

Because whole life lasts your whole life, your loved ones will get a payout whenever you die—no matter how long it takes. But your death benefit could be smaller or nonexistent if you borrowed any of the cash value and died before paying it back. That’s because the insurance company will take money from your death benefit to make up the difference in your cash value. Because remember, your cash value is their cash cow.

Investment and Savings (No Thanks)

Frankly, a life insurance policy isn’t a money-making scheme. I know you’re probably interested in building wealth and protecting your family along the way. And those are both legit goals! But each requires its own tool for the job, and you’ll see much better results if you keep them separate.

Term life: Just provides insurance and nothing else.

Whole life: Offers an investment feature on top of life insurance coverage.

Term life is sleek and streamlined and doesn’t come with any investment or savings component. In case you haven’t figured it out yet, that’s a good thing! You don’t want insurance agents investing your money—they’re not good at it.

Whole life mixes life insurance with a savings account that grows at a fixed rate over time. Even if the company puts your cash value into investments that grow at a higher rate, you’re locked into the low rate forever. It’s kind of a forced savings or investment plan, which could sound good to someone who lacks discipline. Unfortunately, it’s terrible.

Investment and Savings Example

Let’s look at an example of these two in action.

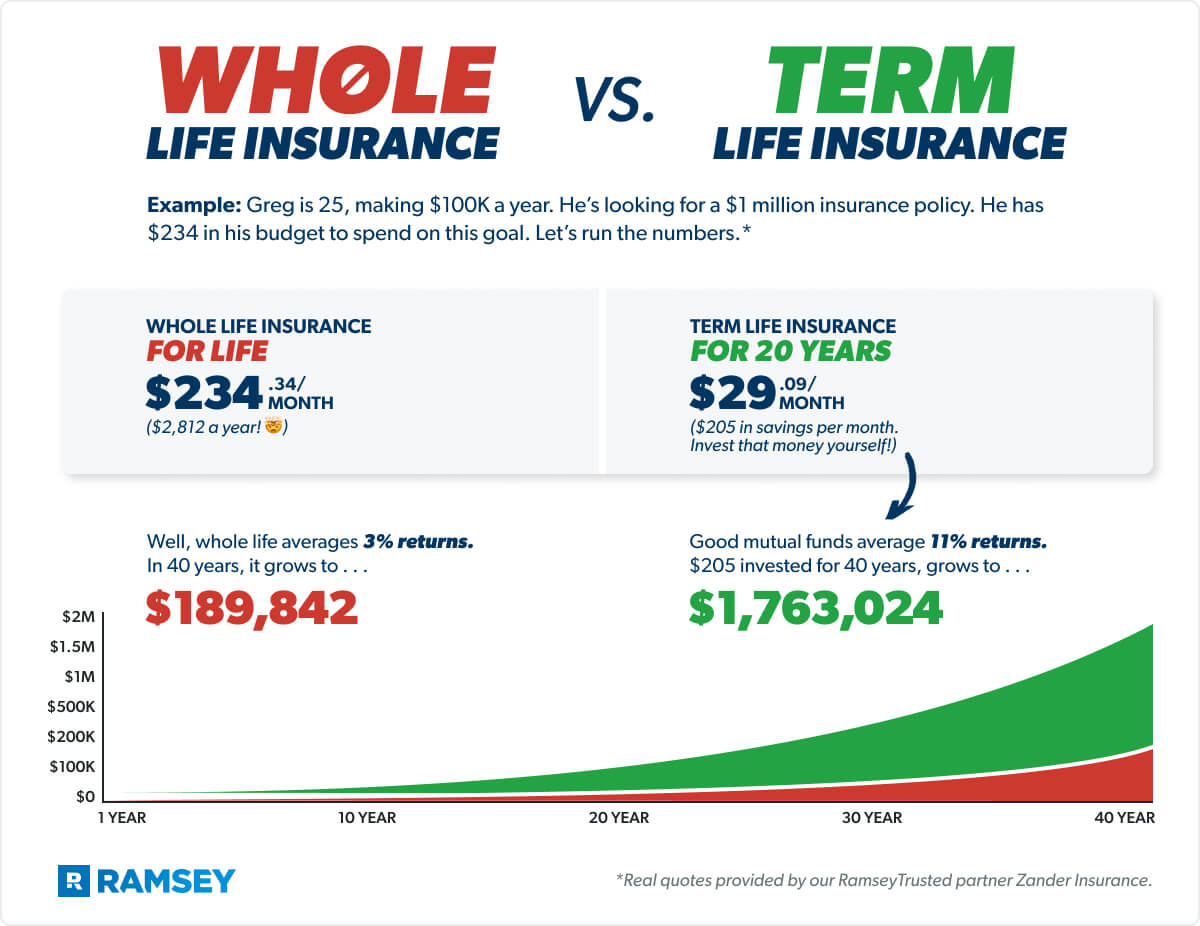

Meet Greg. He’s 25 and wants to get $1 million of life insurance so his family will be okay if he unexpectedly passes away. A whole life agent pitches him a $234-per-month policy that’ll include the insurance coverage he wants and build up savings for retirement. On the other hand, a term life agent tells Greg he can get a simple 20-year term policy with $1 million of coverage for about $29 per month—an over $200 difference.

Let’s say Greg goes with the whole life cash value option. He now has a hefty insurance premium to pay every month. But he’s okay with it because most of that money goes toward his cash value “investments,” right? Well . . .

In truth, the additional $205 per month disappears into commissions and expenses for the first three years. Then, the cash value portion will offer a horrifically low rate of return for his investments (we’re talking 1–3% here!).

After paying way too much for 40 years, Greg’s 3% returns have built roughly $190,00 in cash value in addition to the $1 million of insurance. Then, Greg dies. How much does the insurance company pay out to his family? $1 million. But wait! What happened to Greg’s $190,000 in cash value?

You see, only Greg is entitled to that money. And Greg died before he had a chance to cash it out. So where do all his hard-earned savings go? The insurance company keeps the money.

Yep. Greg gets to roll over in his grave while his insurance agent enjoys Instagram-worthy vacations on Greg’s dime. Sound like a legal scam? That’s because it is.

So let’s go back in time. What if Greg chose the 20-year term life policy instead? He’d only pay $29 a month and could invest the money he saved by not choosing the whole life plan (roughly $205 per month).

If he invests in good growth stock mutual funds with an 11% average annual rate of return, he’ll have about $177,500 in investments by the time his 20-year term life policy expires and more than $1.8 million at age 65. That’s a lot of bang for his buck! We think Greg will rest much easier knowing his family will be taking selfies at that five-star resort.

Monthly Cost by Age

| Term Life | Whole Life | Savings |

|---|---|---|

| $12.18 | $142.12 | $129.94 |

| Term Life | $12.18 |

| Whole Life | $142.12 |

| Savings | $129.94 |

Flexibility: Whole Life vs. Term Life

At this point, whole life is in a corner crying. The coach is wiping off the blood and snot but it’s not helping. Term life, on the other hand, doesn’t even look winded. Round seven, here we go (it’s not going to get any prettier).

Term Life: Offers flexibility because you get to choose how long you want to be covered.

Whole Life: Gives no flexibility on coverage length—you’re locked in to paying your whole life or losing coverage.

Term life takes all the points on flexibility. You get to choose your coverage duration based on your specific needs, like covering mortgage payments or providing income replacement during working years. Did you just turn 25 and have your first kid? You can pick a 25-year term that takes you through Billie’s graduation and the three more kids you plan on having. Are you 40 and doing pretty well for yourself but just got married? You can get a 10-year term that takes you through the last few years to becoming self-insured.

Whole life locks you in to paying massive premiums for the rest of your life or losing coverage if you stop paying. Salespeople might try to convince you it offers flexibility in its other features like policy loans and withdrawals, but when you take a close look at it like we have here, you see that’s just hogwash.

Policy Renewal

Okay, so term life has to be renewed—but is that a bad thing? No! It’s the other side of the flexibility coin. You have the choice whether to continue paying for life insurance or not.

Does whole life give you that option? No. Whole life is not designed to be renewed because it’s supposed to last your whole life. If you don’t need life insurance anymore you can cancel it, but the sucky thing is you’ve been paying the pricey premiums of a policy meant to last your whole life.

Term Life: Offers the option to renew the policy at the end of the term (if you’re under 80), but premiums will increase a lot.

Whole Life: Does not require renewal since it provides coverage for the insured person's entire lifetime as long as the hefty premiums are paid.

Now keep in mind you don’t really want to renew a term life policy unless absolutely necessary. Term life is a really good deal when you buy a policy in your 20s and 30s because premiums are low. But if you don’t buy a long enough term to get you to the point of being self-insured, you’ll be paying much higher premiums when you renew your policy.

Learn the Smarter Way to Do Life Insurance

Life insurance can feel freakin’ confusing. Sign up to get Ramsey’s no-nonsense advice, including free access to Dave’s video from Financial Peace University (normally $80), plus guides and resources sent right to your inbox.

Don’t Wait Until You Need Life Insurance to Get It

Ding! Ding! Term life takes the title. It wasn’t even a contest really.

Let’s recap the fight:

Term life is more cost effective, flexible, cheaper and simple by covering you just for your selected term and then ending when you don’t need life insurance anymore.

Whole life bungles its mission by trying to do too many things (insurance and investing) and failing at all of them.

So, now that the fight’s over and the winner’s clear, what are you going to do? If you’re thinking what I’m thinking, the answer is: Get a term life policy. There are lots of options out there, but if you want to know where I get mine, it’s our RamseyTrusted partner Zander Insurance.

They’ve been serving Ramsey fans for over 20 years (my family included!). Ryan B. from the Baby Steps Facebook Community Group is one of them. When he switched to Zander, Ryan saved $19 a month.

“Seeing how Zander got me about 30 quotes in 30 seconds and I got to choose the best one, I’ll roll with Zander,” he said.

Whether you go with Zander or shop on your own, don’t go without making sure your loved ones will be taken care of if the worst happens. Think of term life as the family guard dog—you hope you’ll never need him to do his thing, but you’re sure happy to have him around just in case.

Next Steps

- Learn more about term life insurance.

- Check out how much a term life policy might run you based on your age.

- Get a free term life insurance quote from Zander today.

Frequently Asked Questions

-

Is term life better than whole life?

-

Yes, it is far better to get term life than whole life. We don’t want you to get ripped off, we do want to see your family well protected, and we for sure want your financial future to include wealth and the chance to become self-insured. The only kind of policy that lets you hit all those goals is term life. But whole life misses the mark in every department.

-

How much life insurance do I need?

-

That’s easy. You need policy coverage equal to 10 to 12 times your annual income. Say you’re making $50,000 a year. You need at least $500,000 in coverage. That replaces your salary for your family if something happens to you. You can run the numbers with our term life calculator. Quick note: Don’t forget to get term life insurance for both spouses, even if one of you stays at home with the kids. Why? Because if the stay-at-home parent was gone, replacing that childcare and home upkeep would be expensive! If you want to make sure your family is covered, take our 5-Minute Coverage Checkup.

-

How long do I need term life insurance?

-

We recommend a policy with a term that will see you through until your kids are heading off to college and living on their own. That’s anywhere from 15 to 20 years depending on your kids’ ages. Why so long? Well, a lot of life can happen in 20 years.

Let’s say you get term life insurance in your early 30s, when you and your spouse have an adorable 2-year-old toddler. You’re laser-focused on paying off all your debt (including the house), but you have an eye on retirement planning in the future. Fast-forward 20 years—you’re both in your 50s and that little pint-sized toddler is now a college grad. The years went by fast.

But look where you are! You’re debt-free—and with your 401(k), savings and mutual funds, you’re sitting at a cool net worth of $500,000 to $1.5 million! By working the plan, you built up your net worth and your peace of mind. Now if the unthinkable should happen, even without life insurance, the surviving spouse could live off your savings and investments. Congratulations, you’ve become self-insured! Your need for life insurance has shrunk or vanished by now.

-

What happens to term life insurance at the end of the term?

-

It’s nothing sensational. The policy will just expire, but you won’t notice. You’ll already be in the money.

-

What information do I need when getting a life insurance policy?

-

Applying for life insurance will mean providing some personal info, so let’s look at a few of the things you’ll need to answer as you look for coverage.

- Do you already have any existing life insurance?

- How’s your overall health?

- Any medical history of serious illness?

- What’s your household income?

- How much are your monthly expenses?

- How much debt do you have, including a mortgage?

- What plans have you made toward retirement?

- What are your plans to cover college for your children?

- Have you thought about how you want to pay for funeral expenses?

- What’s your strategy around estate planning and tax?

- Do you have a will, and does it include plans for a trust?

- What’s your age?

- The ages of your children?

-

What Are Alternatives to Term Life and Whole Life?

-

Your alternatives to term life and whole life are other versions of permanent life like universal life and indexed universal life along with guaranteed issue life insurance, group life insurance, and becoming self-insured. There are many types of life insurance that are all variations of these but the only one you want is term life (and eventually to become self-insured)—the others are a last resort.

-

Can I withdraw cash from a term or whole life policy?

-

You can withdraw cash from a whole life policy, but not a term life policy. Whole life comes with a cash value component that can be withdrawn or borrowed from. Just beware, there are lots of fees and early withdrawal penalties that come with it.