How Do I Invest in Retirement, Save for College, and Pay Off the Mortgage at the Same Time?

9 Min Read | Sep 6, 2023

Managing multiple money goals can feel like a balancing act. Because it is—with your money! How do you invest in retirement, save for your kid’s college, and pay off the house early, all at the same time?

Yes, it’s a lot to go after at once. But thankfully, you don’t need to walk a tightrope to make it work. What do you need? Let’s jump in and see.

How You Can Reach Your Financial Goals

No matter the financial goal you’re going after, the first step to making it happen is budgeting.

A budget is a plan for your money, everything coming in (income) and going out (expenses). And we mean everything: the electric bill, gasoline for your car, your kid’s xylophone lessons, groceries, your pup’s flea medication, HOA fees, coffee (because being an adult is tiring)—plus all the other stuff . . . and your money goals. It’s a lot to wrangle, but you and your budget are the dream team to do it.

Important note: When you make your first budget, you may realize you can’t hit those goals the way you’re spending right now. Or you might want to speed up your progress. Either way, you’ll need more money to move those goals ahead, which means you need to increase your income or decrease your expenses—or both!

Again, a budget is your BFF here. Because when you get extra money, you have to plan for it to go toward your goals. That way you don’t accidentally spend it.

How the Baby Steps Help You Prioritize

Figuring out how to prioritize your goals can feel more overwhelming than deciding where to go for dinner. (Tacos are always a good option.) But when it comes to big-picture planning, there’s a proven plan to follow called the 7 Baby Steps. Here are the first three steps:

- Baby Step 1: Save $1,000 for your starter emergency fund.

- Baby Step 2: Pay off all debt (except the house) using the debt snowball.

- Baby Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

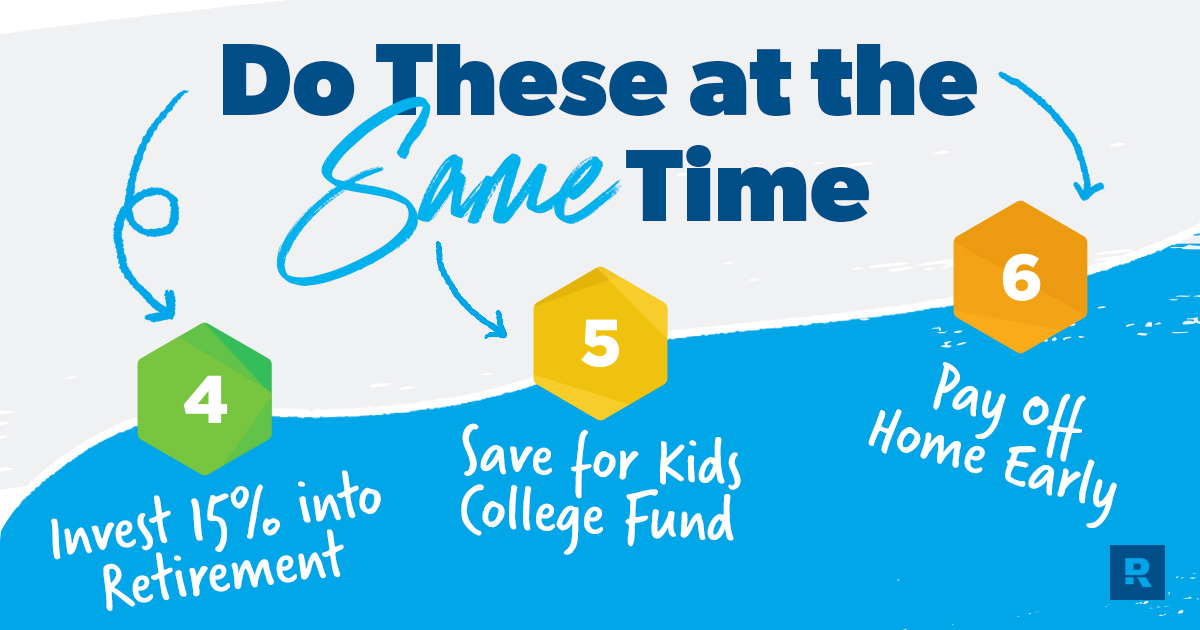

When you’re working through those first three steps, you do them in order. One step at a time. But with Baby Steps 4–6, it works a bit differently. First off, here’s a quick definition of them:

- Baby Step 4: Invest 15% of your household income in retirement.

- Baby Step 5: Save for your children’s college fund.

- Baby Step 6: Pay off your home early.

You start with Baby Step 4 because investing for retirement comes first—it’s the priority. Then, if you have kids and a mortgage, put any extra cash you can toward those Baby Steps while you’re saving for retirement.

When the mortgage is paid off and the kids are through college, you can put check marks next to all three of those and move to Baby Step 7: Build wealth and give. This is when you’re stashing tons of cash away in investments and savings—and being outrageously generous, which is the most fun you’ll ever have with your money.

It sounds simple—and it is. But to help you avoid any roadblocks, let’s answer a few of the top questions about Baby Steps 4, 5 and 6.

Why Should You Invest 15%?

People always want to know: Do I really need to invest 15% in retirement? Why not 6% or 8%? There are a couple of reasons.

- Industry standard. Most financial advisors agree if you invest 15% now, you’ll build up enough savings to enjoy a comfortable retirement. Now, we’ll add this: If you’re behind on your retirement planning, that 15% won’t be enough. It’s a good place to start while you’re paying off the house, but after you write that last mortgage payment, throw everything you can at your retirement fund.

- College and mortgage. If you’re investing 15% of your income, you can still put money toward Baby Step 5 (saving for your kids’ college) and Baby Step 6 (paying off your home early). Yes, you could invest a lot more than 15%—and you will later—but until you get Baby Steps 5 and 6 out of the way, just stick to the 15%.

The next logical question is “How can I free up 15% of our household income?” The answer goes right back to what we mentioned earlier about your budget. Yes, it may mean cutting back where you can (who needs five TV streaming services?).

How much will you need for retirement? Find out with this free tool!

But remember, you’re debt-free and you have a fully funded emergency fund. You’ve done the hard work to free up your income and financially prepare for any emergencies. The money’s there in your budget—you may just need to get real about trimming your spending. And this is your future we’re talking about! It’s. Worth. It.

Why Should You Put Investing Before the Kids?

A lot of parents have a tough time emotionally with putting 15% away for their retirement because that leaves them with little (or nothing) to put toward their kids’ college. We get it: Every parent wants to provide the best for their kids. We all want them to start out on solid ground.

But here’s the deal: There’s no guarantee that your kids will go to or graduate from college. They could find an awesome career path that doesn’t require a degree! College isn’t the only way to live a purpose-filled, financially successful life!

Now on the other hand, if you’re blessed with a long life, you will retire. And if you don’t have retirement savings, then what will you fall back on? Social Security? More like social insecurity. Don’t bank on it.

Kids can go to college without debt—even if you don’t have the cash to pay for it. (And that doesn’t make you a bad parent, by the way.) They can apply for scholarships and grants. They can work to cash flow their way through college. They’ve got options. But there’s no massive scholarship fund out there to pay for your retirement needs.

And who will most likely feel financially responsible for you in retirement if you haven’t been saving up? Probably your kids. In that case, you haven’t really helped them in the long run anyway!

This is not selfish. This is responsible.

College Fund vs. Mortgage Payoff: Which Comes First?

You’re investing 15% of your income and you still have some money left in your budget. Do you put money in the college fund or put extra toward the mortgage? The answer is yes. Both!

Here’s what we mean: There’s no hard-and-fast rule about how you approach Baby Steps 5 and 6. Every person’s situation is different, so we can’t tell you a definitive answer.

If you’ve been putting away money for your kids’ college since birth, then you can leave that alone and hit your mortgage. However, if you’re five years away from retirement and there’s still 10 years left on your mortgage, then go crazy to pay off the mortgage. You don’t ever want to go into retirement with any kind of debt. No mortgage payment, no car loan, nothing.

Also, maybe your kids are already in college, and you’re cash flowing those bills each month. Take some time to see where you can cut costs there (is an apartment with roommates cheaper than the dorm and a meal plan?) and encourage your kid to take a job (it’ll teach them time management, which is a necessary real-life career skill!). These tips can help you work on all three of these Baby Steps at once.

If you want a more concrete answer on this, talk with a financial advisor. They’ll know the specifics of your situation and can crunch some numbers for you and give you a cost analysis both ways.

Why Not Tackle the Mortgage First?

We know you’d love to get out from under the weight of a mortgage. Being completely debt-free feels so liberating! You’ll get there, we promise.

But by investing first, you’re giving time and compound interest the opportunity to work. (Just play around with our Investment Calculator to see for yourself.) Not only that, but you’ll also earn a lot more in interest in an investment than you’d be saving if you paid off your house first.

Let’s crunch the numbers, starting with our Mortgage Payoff Calculator.

Pretend you have a $100,000, 15-year fixed-rate mortgage at an interest rate of 5%. You’d be making monthly mortgage payments of about $790. In 15 years, you’d pay around $42,000 in interest. If you paid $300 extra per month, you’d save about $16,000 in interest and pay it off about five years sooner. Not bad.

But what if you put that $300 into a retirement fund instead? For this math, we used our Investment Calculator. Here’s what we learned: After 15 years, you’d have over $136,000, assuming an 11% rate of return. Now here’s where it gets fun. If you left that money in the investment account for another 10 years, you’d have almost $408,000. Compound interest does its best if you give it lots of time to work.

Will you work to pay off your house early? Absolutely. As you hit the prime of your career, you’ll be making a lot more. After you invest your 15% every month, you should have money left over to put toward extra mortgage payments.

If you maintain a steady balance as you put your income toward investing, saving for college, and paying off your mortgage, you’ll win with money.

A Real-Life Example

It often helps to hear from someone else in a similar situation to your own. Watch this clip to see money expert Rachel Cruze walk through a real-life example with someone figuring out how to manage these Baby Steps. Your situation might be somewhat different, but her questions shed a lot of light on this topic!

Need Help? Reach Out to a SmartVestor Pro!

If the thought of retirement, college and paying off the mortgage early has you feeling, well . . . overwhelmed, don't worry. You don't have to go it alone! Working with a financial advisor or qualified investment professional can help you tackle each step of the process without sabotaging your overall goals. An investment professional like those in our SmartVestor program can help answer any questions you may have about planning for retirement and staying on track.

Find a pro in your area today! And know this: Your goals may big, but you’ve got what it takes to make them happen!

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.