Life happens. But you can be cash ready with an emergency fund.

When you crack a tooth on a popcorn kernel, feel the AC go out in the middle of summer, or even lose your job—you won’t worry about how to cover the bills. You can rest easy at night knowing you’ll be okay in those life happens moments.

If this kind of financial security sounds like a fairy tale that’s too good to be true, you’ve got to believe me: It. Is. Possible!

Let’s break down everything emergency fund—from what it is to where to stash it—so you can start living in the peace that savings will bring.

What Is an Emergency Fund?

An emergency fund is money you set aside for life’s unexpected expenses, like car repairs, hospital visits and even job loss. This money gives you the power to hand over cash to cover the big and small surprises that come your way.

Why Do I Need an Emergency Fund?

I can think of so many reasons why you need an emergency fund. Here are a few:

- You’ll be prepared. When you make a budget each month, you’re prepping for all the expected expenses that will come. When you have an emergency fund, you're prepping for all the unexpected expenses that might come.

- You’ll save money. Don’t use a credit card as your emergency fund. Ever. Emergencies are expensive enough without you paying interest on them for months and months. Having cash in hand means emergencies are paid in full and you can move on.

- You’ll feel peace. I mentioned feeling peace earlier, but I want to bring this home. Ramsey Solutions did a research study that showed 54% of Americans worry daily about their financial situation. And 34% of them have no savings at all. That’s enough to keep anyone up at night. But you don’t have to live like that! Cash in the bank brings peace of mind.

Your grandmother probably called her emergency fund a rainy day fund, and with good reason! It’s going to rain. And sometimes, it’ll flood. With an emergency fund, you’ll be ready. Interest (and worry) free.

How Much Should I Save for My Emergency Fund?

Let’s talk about how much to save for an emergency fund. That answer depends on a few things.

Starter emergency fund: If you have consumer debt, you need a starter emergency fund of $1,000. This might not seem like a lot, but it’s just a temporary buffer while you pay off that debt.

Fully funded emergency fund: Once that debt’s gone, you need a fully funded emergency fund of 3–6 months of expenses. (This follows the 7 Baby Steps, the proven plan for getting out of debt and building wealth that my fellow Ramsey Personalities and I really break down in Financial Peace University.)

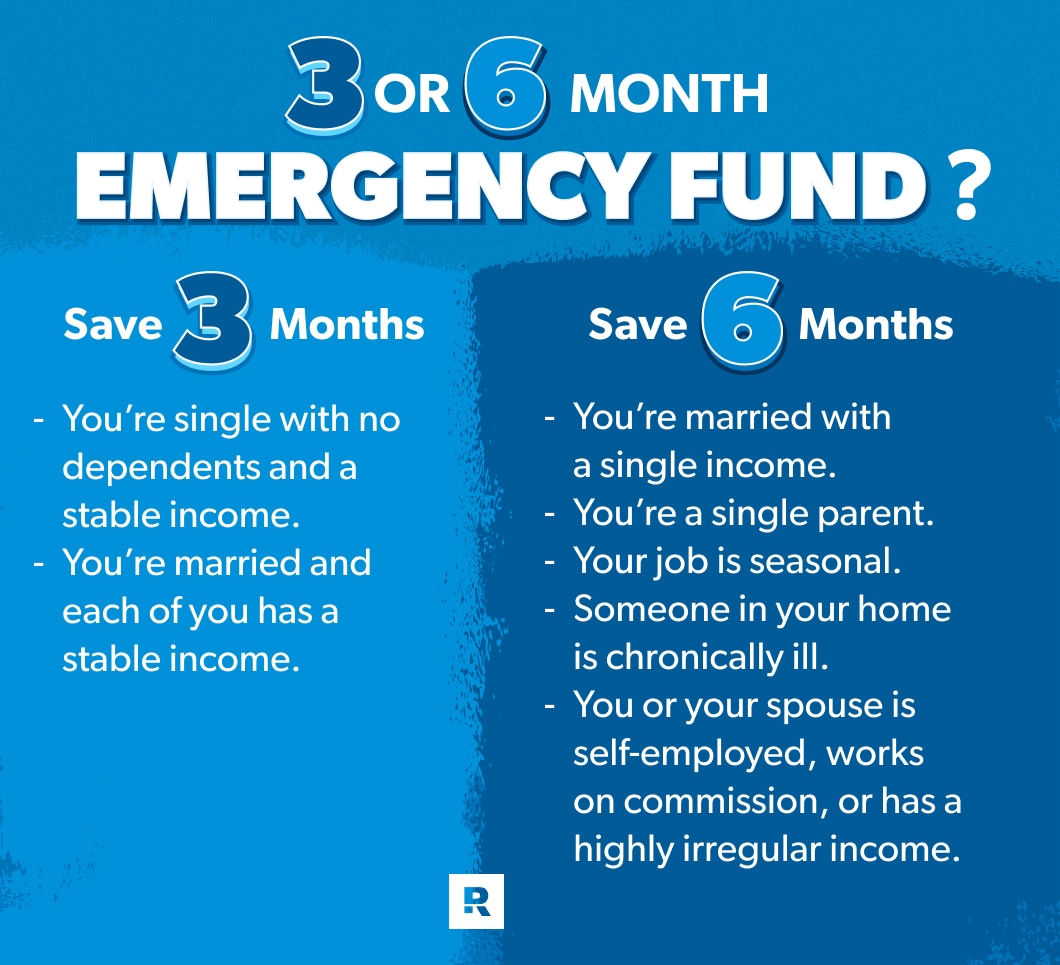

Okay, but how do you know if you should save up three months or six months of expenses? It’s not as complicated as you might think. Just follow the info on this chart!

But how much should you save? Start by taking a look at your bank account to see what you usually spend each month. Then multiply that number by three or six to get an idea of how much you should save for your emergency fund. (As an example, the average monthly expenses in America range from about $4,000 for singles and up to nearly $8,600 for a family of four.1)

Are you prepared for life’s emergencies? Learn how to get there with Financial Peace University.

Now, those numbers are based on everything in the budget—including streaming services, eating out, haircuts, etc. But if (worst-case scenario) you lose your job and need to live off your emergency fund for a couple months, you’ll want to get on a bare-bones budget that just covers the essentials. It’s not the time to pay for fancy extras.

With that in mind, make sure you’ve got enough in your emergency fund to pay your bills, put food on the table, and fill up the gas tank. And if you need a bigger cushion for added peace of mind, that’s okay too!

Where Should I Keep My Emergency Fund?

Now that you know the why and how much, you might be wondering about the where. As in where do you keep all this money?

Make sure your emergency fund is liquid, meaning you can get to it easily and quickly. Try one of these options:

- A simple savings account connected to your checking account

- A money market account that comes with a debit card or check-writing privileges

- An online bank that pays a higher interest rate and where you can still transfer money quickly and directly to your checking account

- Not a shoebox in your sock drawer or buried in the backyard

- Not in an investment account where it could lose value in the short term (your emergency fund is insurance—not an investment)

The key is security and accessibility. You want to be able to pay that doctor or mechanic quickly with zero hassle and headaches. But you don’t want the money so easy to get to that you’re dipping into it for every little reason. Which brings me to my next point.

When Should I Use My Emergency Fund?

So, a sudden expense pops up, and it feels like an emergency—but how do you know if it’s really time to tap into your emergency fund?

First off, can you simply adjust your budget this month to cover the expense? Skipping some extras for a few weeks to avoid dipping into savings is totally worth it. Because remember, once you spend from the emergency fund, you have to rebuild the emergency fund!

If moving things around in this month’s budget won’t cut it, simply ask yourself these three questions:

- Is it unexpected?

- Is it necessary?

- Is it urgent?

If you can answer yes to all three of those, you’ve got a real emergency—and a real need to use your emergency fund.

How to Build an Emergency Fund

If you don’t have an emergency fund yet (or you’re realizing right now that yours isn’t big enough), it’s time to start saving. Here’s how:

Set a total savings goal.

Okay, what are you looking to save: that $1,000 starter emergency fund or the 3–6 month fully funded emergency fund? Before you can reach that number, you’ve got to set it!

If you’re working on that fully funded emergency fund, the key to setting your amount is to look at the chart from earlier, do your own math, and pick a savings goal that makes you feel confident. If that means saving a bit more to have extra financial security, go for it.

Of course, if you’re married, make sure it’s a number you both agree on. You’ll be working together to save it up, and that’ll be so much easier if you’re on the same page.

Make a budget.

Once you know the full amount you’re aiming for, you can start breaking down how to get there. And that means you’ll need a budget.

Remember, a budget is how you plan out where your money will go. So if you want to put money into savings, you have to plan for it—aka put it in the budget.

If you’re trying to save $1,000, get intense and knock this out in a month.

If you’re working on your fully funded emergency fund, create a savings budget line and work on this goal one month at a time.

And if you need help making this happen, check out our budgeting tool, EveryDollar. It’s the tool my family uses every single month, and you can get started today—for free!

Decrease your expenses.

No matter how much you’re trying to save, if you don’t have extra money in your budget already, something’s got to give.

Start by decreasing your expenses, either by spending less or cutting some costs out completely. Need some inspiration? Try one (or all) of these:

- Buy generic brands to save on food and household expenses.

- Meal plan to save on groceries.

- Learn cheap lunch ideas, and skip the midday restaurant runs.

- Join a grocery rewards program—not a credit card—to save on gas.

- Shower quicker (not less often, please) to lower your water bill.

- Cut your TV streaming services down to one (or none!).

- Have a no-spend month where you buy essentials only.

Increase your income.

Another way to ramp up your savings each month is by increasing your income. Here are a few ways to do that:

- Work overtime.

- Grab a side hustle, like delivering food or tutoring online.

- Pick up some freelance clients.

- Sell stuff for a quick boost in income.

I ran a poll with The Ramsey Show audience to see which of those is their go-to method. Guess what won? Working overtime!

But hey, whichever you pick, remember to get that extra income in the budget. You don’t want to accidently spend it elsewhere. You’ve got goals to hit and an emergency fund to build.

Automate your savings.

One last tip on building your emergency fund: You know that monthly amount you decided to stick into savings? Go ahead and set it to transfer into your savings automatically from your paycheck. That way, you won’t even think about sending it on a detour from your checking account to concert tickets, store sales or whatever other temptation might come your way each month.

That money has a job: going into savings. So help yourself by sending it straight there!

Start Saving Your Emergency Fund Today

You’ve got the info you need to start saving—so figure out your savings goal, download EveryDollar to get that goal in the budget, and put in the work to build up your emergency fund.

That peace of mind I keep talking about isn’t a fairy tale. It’s real. And you’re really going to live it. Take those first steps and start saving today!

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)