Monthly Expenses to Include in Your Budget

11 Min Read | Sep 29, 2023

If you make a monthly budget (or you’re ready to start), first off—that’s awesome. I mean it! Budgeting is the first step to taking control of your money, and you’re taking that step!

But maybe you’re wondering if you’ve got everything you need in your budget. This can help: a monthly expenses list of top budget categories. Plus, I’ve got some bonus tips to help you budget for those tricky expenses that don’t pop up every single month.

Let’s jump right in.

11 Budget Categories for Each Month

Giving

Saving (or Debt Payoff)

Food

Utilities

Shelter/Housing

Transportation

Insurance

Household Items

Health and Fitness

Fun and Entertainment

Miscellaneous

1. Giving

I always start my family’s budget with giving (10% of our income). It’s the best way to get my head (and heart) straight before I start working through the rest of my budget. Generosity takes the focus off me and shifts it on to thinking about others. And honestly, it helps me start each month feeling way more grateful for what I have.

2. Saving (or Debt Payoff)

Emergency Fund

Depending on what Baby Step you’re on, you might need to make saving a priority. Let’s break that down.

If you’re in debt, start by saving a $1,000 starter emergency fund (I call this Baby Step 1). Then pause saving and throw everything extra you’ve got at paying off that debt with the debt snowball method (aka Baby Step 2).

Once you’re debt-free, you’ll be in Baby Step 3 and saving up 3–6 months of expenses in case of a bigger emergency, like an unexpected sickness or job loss.

Retirement Savings

When your fully funded emergency fund is, well, fully funded, it’s time for Baby Step 4—retirement savings! Start prepping for your future by investing 15% of your income.

Wherever you are on your Baby Steps journey, make sure your budget aligns with that money goal. Because your budget is the first step to making any Baby Step a reality.

3. Food

Groceries

Now let’s start talking about those monthly expenses! The first ones to cover are what I call the Four Walls—which are the basic necessities you need to survive. Those are food, utilities, shelter and transportation.

And it all starts with groceries.

If you’re wondering, the average family of four in the “thrifty” range spends $975.80 a month on groceries. A thrifty single adult is spending somewhere around $224.50 to $311.30.1 Yeah, inflation has done a number on food costs.

Pro tip: If you’re having trouble taming this budget line, check out my free meal planner to help you get that number down.

Restaurants

Okay, people. This is important. Make sure groceries and restaurants each have their own budget lines. Because you have to eat—but you don’t have to eat out.

That’s right: Restaurants fit nicely under your food budget category, but they aren’t an essential and they aren’t one of the Four Walls. If you need to free up cash for one of the Baby Steps or get more margin in your budget, this is a great place to cut spending and save money!

4. Utilities

In this monthly budget category, include all the services that keep your house running:

- Electricity

- Water

- Natural gas or propane

- Trash services

- Phone bill

- Internet

Remember, these utility bills might change from month to month, so think about that as you plan.

To be safe, budget on the higher side in each of these budget lines—and if you don’t end up needing the money, throw the extra at your current Baby Step!

Also, some of those aren’t essential (like if your phone bill includes unlimited everything). So again, if you need to save more money each month, cut the fluff here.

5. Shelter/Housing

Just including your rent or mortgage payment isn’t enough when you budget for your housing costs. Don’t forget homeowners insurance and property taxes (if they aren’t already included in your mortgage payment) or renters insurance and HOA fees—if those things apply to you.

Start budgeting with EveryDollar today!

I know: It adds up quick! To keep your housing costs from taking over your budget, keep these expenses to 25% or less of your take-home pay.

6. Transportation

This budget category might include gas, public transportation costs, routine maintenance, your state’s required auto insurance—really just anything you’d pay that month to get where you need to go.

Of course, the amount you budget each month might change up. Think about any special occasions like a trip to Grandma’s or an out-of-town soccer tournament for the kids. You’ll need to budget more for gas in a month that has more driving!

Okay, we’re past giving, saving and the Four Walls. The rest of these monthly expenses aren’t in a perfect order, but they’re common things people spend money on every month. Even if you don’t have some of these bills, this list will be handy as you create your own budget.

7. Insurance

Yeah, I know insurance isn’t fun to spend money on, but don’t skip this. Insurance helps protect the people and the things you love.

We’ve already talked about home and auto coverage, but when you’re budgeting for monthly expenses, don’t forget to include monthly premiums for these other insurances you can’t do without:

- Term life insurance

- Health insurance

- Long-term disability insurance

- Long-term care insurance (if you’re 60 or older)

- Identity theft insurance

- Umbrella policy (if you’ve got a net worth of $500,000 or more)

8. Household Items

Toothpaste, shampoo, dishwasher detergent, paper towels. They’re not necessarily the most exciting things on this monthly expenses list, but household items are a part of life—and they need to be in the budget.

9. Health and Fitness

Medicine, vitamins, supplements, gym memberships, workout apps, therapy—it all counts here. Make sure you’re taking care of yourself. But at the same time, remember: You can be fit and healthy on a budget.

10. Fun and Entertainment

Fun (or Personal) Money

Now it’s time for the fun stuff. I want you to put aside some money each month to spend on whatever you want. Planning this amount ahead of time helps you spend guilt-free and avoid overspending on impulse buys.

My husband Winston and I each have our own fun money lines—and you should too if you’re married. I don’t have to check in when I see something in the $5 Target bin I want, as long as there’s still $5 left in my line! It keeps us accountable to our budget and to each other—but it also gives us freedom to spend. And really, that’s what budgeting is all about!

Here's an important callout, though: If you’re in debt, your fun or personal money will be pretty small until the debt is gone. But it’s just a season, and it’ll be totally worth it.

Entertainment or Recreation

Tickets to a concert. A ballgame with your kids. Bowling with friends. It’s great to spend money on things you enjoy—if it’s in the budget! (Because you can have plenty of fun without spending a single dollar, you know.)

Streaming Services

If you pay for any TV or music streaming services to avoid the ads, get those in the budget too! Some of these are a monthly expense, so they need a budget line every month. Others are a yearly subscription, and we’ll talk about how to cover those in a minute.

It all comes down to this: When you’re budgeting for all the fun stuff, don’t let FOMO take over and tempt you to say yes to all the things. Your money goals are too important for that. Plan how much you can spend each month on all these extras. And then stick to it.

11. Miscellaneous

The last-minute goody bags for a school party. The haircut appointment you forgot about. All these forgotten extras won’t send you into panic mode because you can just slip them into your miscellaneous category. But if a certain expense keeps falling here, it’s time to give it a special budget line all its own.

Easily Forgotten Monthly Expenses List

When does the Amazon Prime membership renew? What about the car tag renewal? And when is your pet’s annual checkup?

Even though these expenses only pop up every once in a while, you don’t want them to surprise you and throw off your monthly budget.

So, take some time to update your calendar with any renewal or appointment dates. Then look at your calendar when you make your budget! (Also, if you’ve got our free budgeting app, EveryDollar, you can always peek back at last year before you make each monthly budget!)

Here are a few forgotten or overlooked expenses to think about:

1. Pest Control

Whether it’s once a quarter or once a year, call in the professionals or do a DIY job to get your home protected from termites and pests.

2. Organization Dues

If you’re in a club that has annual membership fees or your kids are in sports, don’t get blindsided by those seasonal expenses! Get them in the budget.

3. Annual Checkups and Copays

No amount of laughing gas will ease the pain of an unbudgeted dental cleaning. And for those annual checkups or specialist appointments, don’t forget to budget for the copays!

4. Home Maintenance

Home expenses don’t stop at utilities and mortgages. Don’t forget the stuff like gutter cleaning and HVAC inspections. Some expenses you can plan for. So be budget-ready for those. And for the complete surprises, well, that’s what your emergency fund is for!

5. Special Occasions and Gifts

Surprise parties are fun, but not when it’s, “Surprise! It’s your anniversary!”

Make sure you’ve got all those upcoming holidays, birthdays, weddings, baby showers and all other special occasions in your budget. Maybe just have a monthly gift line. That way, you’ll always have money ready for presents. Also, don’t forget your anniversary. Just don’t.

6. Taxes

It’s everybody’s favorite thing—taxes! Okay, you know I’m joking. But they still happen. Every single year.

If you’re a business owner or freelancer, or if you’re working a side hustle, don’t let taxes sneak up on you. And don’t forget to budget for your tax pro’s services or for your tax filing software when it comes time to file.

7. Annual Subscriptions and Memberships

Those big-ticket subscriptions and memberships that come out annually (or even quarterly)—make sure you’ve got them covered too!

For any of these easily forgotten budget categories you can:

- Use that miscellaneous line

- Set up a sinking fund to save a little each month for a large expense

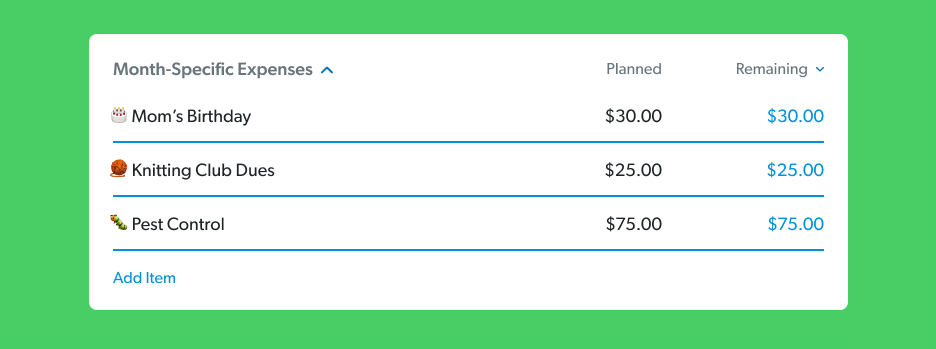

- Create a month-specific budget category that stays in your budget always—just change out the budget lines under it to help you cover whatever needs you have that month (see below)

And remember: Don’t use your emergency fund, unless it’s an actual emergency. Period.

How to Budget Your Monthly Expenses

So, that’s an overview of what your monthly expenses could be. Now you need to know how to create your monthly budget!

Step 1: Write down all your income in a typical month. (If you have an irregular income, put in your lowest estimate. You can bump it up later if you make more!)

Step 2: Make a list of all your monthly expenses (yes, even the easily forgotten ones).

Step 3: Subtract your expenses from your income—and that number should equal zero. This method is called zero-based budgeting.

Now, a zero-based budget doesn’t mean you have zero dollars in your bank account. (Keep a little buffer of $100–$300 in there.) It also doesn’t mean you spend everything you make.

Nope. It simply means you’re giving all your money a job to do. It means you plan how you give, save, spend and invest all of your income. This way you never get to the end of the month and wonder where all your money went— you know.

When you budget, you are in control of where every single dollar goes. This gives you confidence that you’re spending and saving well.

By the way, if you don’t have a budgeting app yet, try EveryDollar! It’s how my family makes our monthly budget, and you can get started for free.

And remember, you’re the one in charge of your money, and you can make all your money goals a reality—one monthly budget at a time!