Millionaire Spending Habits That Will Surprise You

5 Min Read | Jan 13, 2022

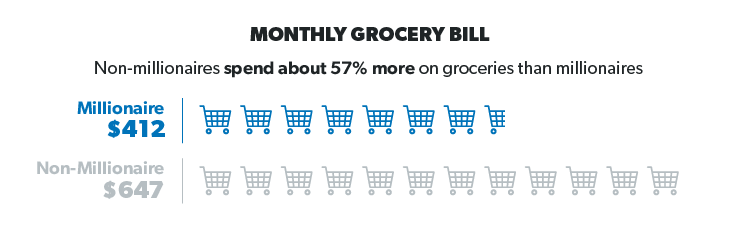

Most American families are spending more than the average millionaire on groceries . . . every single month. Get this: The average monthly grocery expense for millionaires is $412,1 while a comparable non-millionaire American family spends $647.2 That means non-millionaires spend about 57% more on groceries than millionaires. Let that sink in for a minute.

When it comes to common beliefs about the millionaire lifestyle, pinching pennies on something as normal and everyday as groceries never comes to mind. Most of us probably imagine a designer-clad person shopping for organic everything at the highest-end grocery store in town. You know, the one that costs your whole paycheck? You might even be surprised that millionaires shop for their own groceries at all.

But here’s the truth: Millionaires are just like us—normal people. They go to work, they grocery shop (with coupons), and they even live on a budget . . . and we’ve got the research to prove it.

Let’s Talk Groceries

Look, we all need to eat to survive. And if we don’t want to blow the budget every month by eating out, we’ve got to shop for our groceries and make our meals at home. Your average millionaire does not have their own live-in chef. This can only mean that they, too, go to the grocery store, meal plan, and even save money with . . . coupons. Yup, millionaires clip coupons too.

In The National Study of Millionaires, we found that more than one-third (36%) of millionaires surveyed spend less than $300 each month on groceries, almost two-thirds (64%) spend less than $450, and less than one in five millionaires (19%) spend more than $600 on groceries. The study even breaks down grocery expenses by region, area, household size, net worth, employment status and age.

You would think that your carefree attitude would increase along with your net worth. But that’s not reality.

- Millionaires in the $1–1.99 million range spend $417 per month on groceries.

- Millionaires in the $2–2.99 range spend $27 less, or $390 per month.

- Millionaires in the $3–3.99 range spend $361 per month.

- Millionaires in the $4–4.99 range spend $388 per month.

- And millionaires whose net worth is over $5 million spend the most: $505 per month.

Check out those numbers! Those with a net worth of over $5 million spend only $88 more than those worth $1 million. Even the millionaires with the highest net worth are still spending less than the average American family. Millionaires are onto something with this spending less and saving more business.

Let’s Talk Restaurants

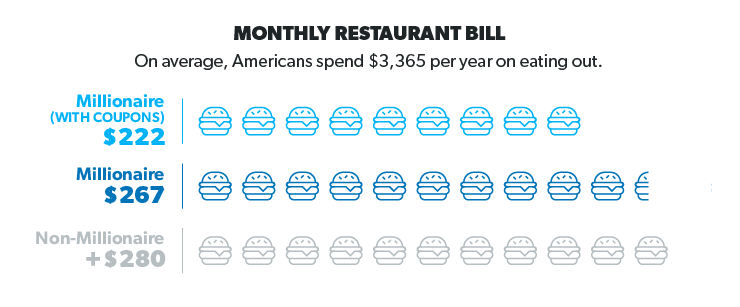

To the average person, a millionaire could just walk into a restaurant and pay for everyone’s meals without blinking an eye, right? Come to think of it, they could probably find the owner and make an offer on the restaurant itself—in straight cash! But instead of making these extravagant purchases, the average millionaire is actually going out to eat and spending way less than we would ever think.

If you haven’t caught on yet, these millionaires are frugal with their money. They worked hard for their money, and they're not going to spend all their hard-earned dollars in one place.

On average, Americans spend $3,365 per year on eating out.3 That’s more than $280 per month! The average millionaire spends $267 monthly on eating out.4 And if they use coupons, it goes down to $222.

We’ll give you a second to digest that. Yup—millionaires do actually use coupons when they go out to eat too! Who said the love for bargains has to end when you’re rich?

You Have What It Takes

No, really, you do!

Get Rachel Cruze's new book to learn why you handle money the way you do!

You can become an everyday millionaire. It really isn’t about having a trust fund or getting an inheritance. It’s about sticking to your budget, investing and working hard—over a long period of time.

The National Study of Millionaires takes a deep dive into their backgrounds, demographics, family and relationships, education, and careers, plus money and purchasing habits. And when it comes to millionaire stereotypes, get ready for some shattering. This study breaks apart one millionaire myth at a time and shares the truth behind those high net worths.

The Largest Study of Millionaires . . . Ever

Chris Hogan and our Ramsey research team conducted the largest study ever (yep—ever) on 10,000 U.S. millionaires. In this study, we found two major truths:

- Most millionaires don’t even come close to the stereotypes we give them.

- With hard work, smart money decisions, and time, anyone can become a millionaire—even you.

Did we catch your attention there? We hope so.

Want to learn more? Dave's new book, Baby Steps Millionaires, will show you the proven path that millions of Americans have taken to become millionaires--and how you can become one too! Pre-order your copy today to learn how to bust through the barriers preventing you from becoming a millionaire.