If you’re a millennial, then you already know you get a bad rap—what with the stereotypes about avocado toast and job hopping. And sure, there are plenty of 25–40-year-olds living fake “rich” lives on social media who are real broke in real life. But they don’t represent your entire generation! We talk to millennials all the time who are laser-focused on making smart money choices today so they can retire a millionaire.

Whether you’re still battling debt or going full throttle toward your retirement goal, there's a set path we recommend to anyone aiming to become a millionaire millennial.

Millennials and Money: The Issues Shaping Your Financial Future

First, millennials, you all have faced some big financial challenges in your lifetime. Some you couldn’t help (like a recession and a pandemic), but others you could (credit cards, bad mortgages, student loans). A lot of you are getting your money on track, and that’s a really good thing for your retirement. In a survey commissioned by Ramsey Solutions we found that 58% of millennials are already saving for retirement. Of those savers, about 70% of them wish they were saving more, and 80% of them plan on saving more later.

We want to call out some of the unique factors shaping your generation’s financial future.

Job Changes. A whopping 49% of millennials say they would quit their job within two years.1 The reasons vary, but job changes do affect wealth building. Moving from job to job can mean missing out on perks reserved for long-term employees, like bonuses, profit-sharing pools and pay raises.

Debt. Our survey also found that millennials reported an average debt of $30,580 with a household income of $55,200. That’s a small shovel for a big hole! If you’re starting out in the red, you might believe becoming a millionaire is impossible. But we promise you it’s not.

FOMO and YOLO. That’s “fear of missing out” and “you only live once.” Nobody wants to miss out on life’s adventures or the finer things, but those things come with time. When you take a trip you can’t afford, buy that expensive car, or put designer boots on a credit card, you’re taking a big loan out against your future.

Lifestyle Expectations. Here’s some truth: When you graduate from college, you’re not supposed to be living in a condo overlooking the city. You’re not supposed to have a closet full of expensive clothing. The retail industry has baited our culture with lies about status and possessions, and we’ve swallowed them—hook, line and sinker. The reality is that as your career grows, so will your income. But diligence and consistent hard work will always be required.

Digital Spending. It’s no secret that the younger you are, the more likely you are to take advantage of technology, even when it comes to spending and saving. With more and more people choosing a debit card for everyday spending and preferring online shopping to in-store shopping, it’s no wonder overspending is such a problem. When we don’t physically hand over the cash, we’re likely to spend more.

Convenience Lifestyle. Who doesn’t love a meal prepared by someone else, then packaged up and delivered right to you? But all those on-the-run to-go orders, straight-to-your-front-door deliveries, or just a quick stop at the gas station or drugstore cost money that you don’t have to be spending. You can choose to live differently and reap the rewards of swimming upstream against the current of debt and commercialism.

The truth is, reaching big money goals—like getting out of debt, paying off your home or retiring a millionaire—takes a whole lot of saying no now so you can say yes all you want later.

5 Steps to Becoming a Millionaire Millennial

Okay, now it’s time to get an intentional plan to move you from fantasy to reality.

Step 1: Know the “why” behind your wealth building.

No plan can truly be effective without a “why.” What’s a why? It’s the thing that drives you. The reason or outcome that motivates you and pushes you to tell yourself over and over again, “This is worth it. I can do this.” Maybe your why is for your kids to be able to join the travel soccer team. Or so your spouse can be a stay-at-home parent. Or so you can retire a millionaire millennial and know comfort and freedom in your later years. Choose a why that helps you stay focused no matter what roadblocks may be up ahead.

Step 2: Start saving now.

When should you start saving for retirement? Well, the best answer is yesterday. Since we don’t have time machines yet, the next best time to start saving for retirement is now—as in today. That is, once you’re out of debt.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

If you’ve got all your debt paid off except your mortgage and a fully funded 3–6-month emergency fund, then it’s time to invest. We call that Baby Step 4, and it means investing 15% of your household income toward retirement.

Building wealth takes time, but as a millennial, you’ve got a major leg up. Time is on your side. The sooner you start saving for retirement, the younger you’ll be when you hit millionaire millennial status and the less of your own money you’ll have to invest to get there (more on that in just a second). First, let’s take a look at how investing now versus later plays out.

Depending on the definition, millennials typically range from those born around 1981–1996, give or take a year. Let’s assume Megan is a millennial on the younger side. If Megan puts away 15% of her $40,000 salary, or $500 a month, here’s how much she’ll make by age 65 based on when she starts investing:

Began Investing Account at Age 65

Age 25 $2.9 million

Age 35 $1 million

Age 45 $378,000

Age 55 $105,000

Let’s look at this a different way:

Age Mark Began Amount Invested Amount at Age 55

25 $500 $1 million

35 $1,400 $1 million

45 $5,000 $1 million

See the importance of investing early? The earlier you start investing for retirement, the sooner you hit that million-dollar mark. If you wait to invest, you’ll need to invest more each month (which means you need an even bigger income) or invest for a longer period of time (which could mean working into your “retirement years”). Even if Megan starts later, at 35, she still winds up a millionaire.

Step 3: Switch your savings gears.

When it comes to retirement, and specifically reaching seven-figure status, we’re talking about getting very strategic with our investments. But strategic does not have to mean confusing! So first, set yourself up for success by talking with a financial advisor ASAP. And while you’re doing that, go ahead and start reframing what it means to save.

This is not your mama’s money market account or the savings account that came with your checking account. You want to put your money where it can earn the greatest compound interest. Remember when we said earlier that an advantage to saving for retirement earlier means having to put less of your own money in the pot? Well, here’s where that comes into play.

Think about it like this: Say you put $1,000 into a money market account and don’t touch it for a year. With average annual interest rates on money market accounts hovering around 0.10–0.15%, that means you’ll make about $1.50 in interest at the end of the year with interest compounding monthly. Not sure what you can get for $1.50 these days, but that won't get you a trip to Tahiti.

But say you put that same $1,000 in good growth stock mutual funds with average return rates of around 10–12%. Not only are you safely spreading your risk across a lot of companies with strong track records, but you’re also building your balance so much quicker thanks to higher compound interest rates. At the end of the year, even if you added nothing else to your account, you’d have something closer to $126 in interest. Sure sounds a whole lot better than $1.50.

The only investment option we recommend is growth stock mutual funds with a history of strong returns. That’s it.

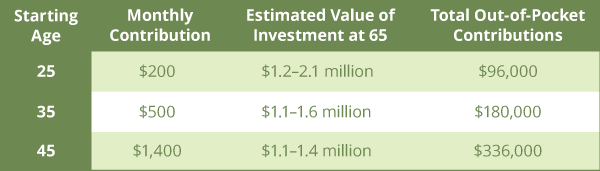

If you start investing when you’re 25, you could hit your retirement goal—maybe even break the $2 million mark—with just $200 a month. That’s less than half of the average car payment!

And here’s an even bigger takeaway: Only $96,000 of that million-dollar nest egg will come from your own pocket. The rest is compound interest working hard for you. Here’s what it looks like to start investing at different ages and how much of your own money you’ll need to invest to get to a million bucks.

So, what happens if you delay your retirement savings for a decade or two?

- Wait until you’re 35 and you’ll have to shell out $500 a month to reach $1 million. You’ll pay almost twice as much out of your own pocket by the time you retire.

- Hold off until you’re 45 and the gap grows even wider. You’ll have to contribute seven times more each month, funding nearly a third of your nest egg yourself.

Step 4: If you change jobs, roll over your retirement.

Sixty percent of millennials say they’re open to a new job opportunity—that’s 15% more than non-millennials.2 Plus, more than 20% of millennials report they’ve changed jobs within the past year.3 That’s three times more than non-millennials who report changing jobs.4

So if you’re a millennial and you find yourself changing jobs every couple of years, don’t forget about your 401(k)—aka your company-sponsored retirement account. You should always roll your 401(k) from your former employer into an Individual Retirement Account (IRA). A traditional 401(k) rolls into a traditional IRA. A Roth 401(k) rolls into a Roth IRA. Don’t leave your retirement investments hanging out in a black hole. Put them to work!

Step 5: Be active in your wealth-building plan.

Investing feels overwhelming to most people at first. But it doesn’t have to be. If your goal is to become a millionaire millennial, then follow the steps above.

Yes, it’s better to get started now than later. But no matter where you are in your money journey, we’ve got a plan that works. Knock out all your debt, get that 3–6-month emergency fund in place, then start investing 15% of your household income for retirement. And get your money in the right places.

To become a millionaire millennial, you can’t have a set-it-and-forget-it mindset. Take your money and your future into your own hands (with the help of a financial advisor). Keep an eye on your investment accounts. Keep your dream and your why alive.

What Millennials Are Getting Right About Retirement

One thing we see millennials getting right about retirement these days is asking for help. No, not help from mom and dad to pay off student loans, but help from professionals who can navigate the financial stuff very few of us were taught at home or in school. A good financial advisor is worth their weight in gold. Millennials who lean on a pro for help with their investments stand a really good chance of winning with money.

If a financial advisor can’t explain the big picture around retirement to you in a language you can understand, then they’re not the right financial advisor for you. Period. Their number one goal should be to help you, not to get you to buy things you don’t understand or don’t want.

Get with a SmartVestor Pro. They’ll help you choose your own mutual funds and show you how to manage your accounts.

Find your investing professional today!

And if you're looking to learn more, Dave's newest book, Baby Steps Millionaires, doesn’t just tell you what to do. It also tells you why to do it, how to do it, and when to do it. Grab a copy today to learn how to bust through the barriers preventing you from becoming a millionaire.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.