5 Tips for Millennial Home Buyers

6 Min Read | Aug 30, 2022

Remember when people used to think millennials would never buy homes? Well, surprise! Millennial home buyers have passed baby boomers and Gen Xers for the seventh year in a row.1

While I love seeing more and more of my generation making this big decision, I also want them to make sure they are doing it the right way!

So if you’re a millennial looking to buy a house, here are five things you can do to make that dream come true.

1. Pay Off Student Loans and Other Debt

What’s the biggest challenge facing millennial home buyers? Student loans. Over 44 million Americans are paying off a national student loan debt of $1.6 trillion.2 And in 2019, the average student loan debt was $35,000 per graduate!3

As if student loans weren’t enough, consumer debt has postponed the home-buying dreams of many millennials. In fact, the National Association of Realtors (NAR) found that, after student loans, the two expenses that delayed saving for a down payment were car loans (37%) and credit card debt (34%).4

Since buying a house is the most expensive purchase you’ll make, you need to be debt-free before you buy one. If you have any debt, get on a budget and pay it off faster using the debt snowball plan. Only then will you be ready for the next challenge: the down payment.

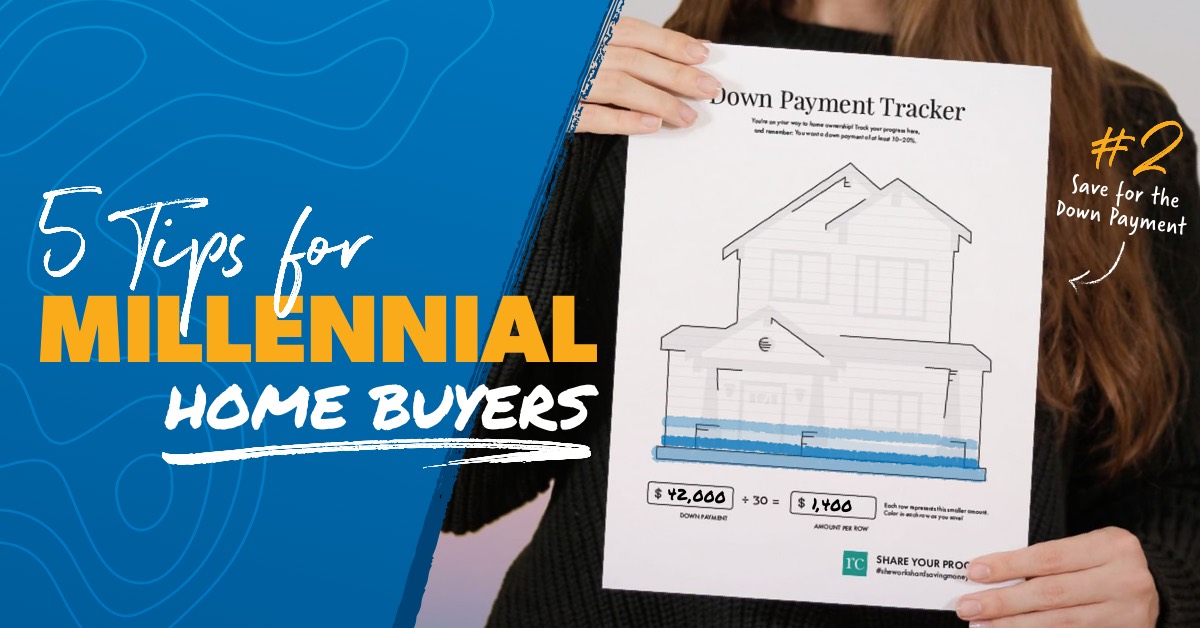

2. Save for the Down Payment

Most of us don’t pay cash for our first home. In fact, 97% of millennials buy with a mortgage.5 That’s why it’s important to have a strong down payment—not only to lower your interest rate, but also to help you pay off your mortgage even faster. I recommend putting down 10–20%. If you have 20% tucked away, you’d bypass private mortgage insurance (PMI)—additional insurance lenders make you have that protects them if you stop making mortgage payments.

If you’re struggling to save for the down payment, you’re not alone. Almost a fourth of millennial home buyers couldn’t do it by themselves and accepted a money gift from a friend or relative.6 And it’s no wonder why: It now takes an average of 14 years to save a 20% down payment!7

That’s why, if you’re still saving, be patient and stay the course. Keep saving! Start with a clear plan. Know how much house you can afford. After you have a goal in place, it will take less time than you think. In fact, you can save a five-figure down payment in one year by following our Saving for a Down Payment Guide.

3. Stand Out in a Competitive Market

If you’ve already paid off your student loans and saved for your down payment, good work! The next step is to get into the housing market. In the past few years, the housing market has had a shortage of sellers, which has not only raised home prices, but also has caused competition among buyers. Gen Xers are typically buying more established homes instead of starter homes, so your competition is other millennials—and your parents.

Yep, that’s right. Just as millennials are finally moving out, empty-nesting baby boomers are downsizing into the very starter homes that millennials are trying to buy. You might find yourself in bidding wars with buyers who have a bigger budget and more home-buying experience.

While you should expect competition—especially in hot housing markets—that doesn’t have to derail your home-buying budget. Download our free Home Buyers Guide to walk you through the process and stay in the game with these tips:

- First, get preapproved for a home loan before you make an offer. A preapproved loan means that your lender has looked over your finances and decided that you can cover the down payment and the mortgage payments. Though it can take some time to get, a preapproval letter sends a powerful message to the seller that you’re a serious buyer.

- Second, act decisively. Do everything to keep the process moving. For example, tighten the timeline of your home inspection by scheduling one quickly after your offer is accepted. Never ask a motivated seller to wait weeks for a home inspection if you can get it done in days.

- Lastly, be human with the seller. Send a handwritten letter explaining why you and your family like the home. Selling a home can be emotional for homeowners, so you never know how far a personal letter can go.

4. Find an Affordable House in a Seller’s Market

Another challenge facing millennials is the rising value of homes. For many of us—especially those who’ve just managed to pay off student loans and land a stable job—rising home prices could be the most frustrating hurdle we face.

See how much house you can afford with our free mortgage calculator!

On the plus side, mortgage interest rates are super low. In June 2020, the average interest rate for a 15-year fixed-rate mortgage dropped to 2.6%—the lowest it’s been since Freddie Mac started reporting nearly 30 years ago!8 A low rate means a lower monthly payment and less of your money going toward interest over the life of the loan. That’s awesome news, you guys!

Still, my best advice is patience. Once you start shopping, don’t give in to the temptation to stretch your dollars and buy a home that’s out of your price range. No home is worth sacrificing other financial goals like your retirement or your kid’s college fund.

So make sure to choose a 15-year fixed-rate conventional mortgage—the cheapest type of mortgage and the only kind I recommend. And keep your monthly housing payment to no more than 25% of your take-home pay, including principal, interest, property taxes, homeowner’s insurance and PMI—and don’t forget to consider homeowners association (HOA) fees.

5. Gain Experience With the Buying Process

One of the best things you can do as a first-time home buyer is familiarizing yourself with the buying process.

That’s why it’s extra important for millennials to work with experts who know what they’re doing. Look for an agent who brings many years of experience to the table, one who knows the market well enough to find a great deal on the home that’s right for you.

Partner with a real estate pro who has the heart of a teacher and takes time to listen to your needs and answer your questions. A good agent is more concerned about your bank account, not theirs.

If you’re looking for an agent to guide you to a smart first home purchase, we can help! Our Endorsed Local Providers (ELPs) are real estate experts with top-notch customer service. They can help you find a home you love in your budget!

Find a top real estate agent near you!

Frequently Asked Questions

-

Will Millennials Be Able to Buy a House?

-

Yes—and they do it all the time! Millennials actually made up the largest share of home buyers in 2022, according to a report by the National Association of REALTORS®.5 Sure, you might get sticker shock while house hunting, but buying a house as a millennial is possible. You just need a good home budget to make sure you’re on track to save up a down payment.

-

What Is the Process of Buying a House?

-

Here are the basic home-buying steps: Determine how much house you can afford, get preapproved for a mortgage, find an experienced real estate agent, research neighborhoods for best fit, go house hunting, make a competitive offer within your budget, finalize your financing, and prepare for closing.

-

What Do I Need as a First-Time Home Buyer?

-

As a first-time home buyer, you need to make sure you’re debt-free and have an emergency fund of 3–6 months of living expenses. That will set you up for success as you save money for a house and become a new homeowner.

-

How Much Should First-Time Home Buyers Budget?

-

Ideally, you’ll want to save a down payment of at least 20% of the home price to avoid private mortgage insurance (PMI). PMI is a fee you pay that protects your lender (not you) if you stop making mortgage payments. If you’re a first-time home buyer, a 5–10% down payment is okay too—but get ready to pay PMI. You’ll also need to save up enough cash to pay for closing costs, which typically make up 2–7% of a home’s price.