Should I Buy or Build a House? The Pros and Cons

13 Min Read | Feb 7, 2024

Getting brand-new things—especially when they’re custom-made—feels good, right? You can tell a designer or builder exactly what you want, and voila! They’ll make it just for you. The problem is, custom-made things tend to cost more and take longer to make than anything store-bought or mass produced—especially when it comes to houses.

Time and money are two important things to consider when you’re deciding whether you should buy or build a house. To help you make the best choice, I broke down the costs and pros and cons of building a house.

Let’s check them out!

Is It Cheaper to Buy or Build a House?

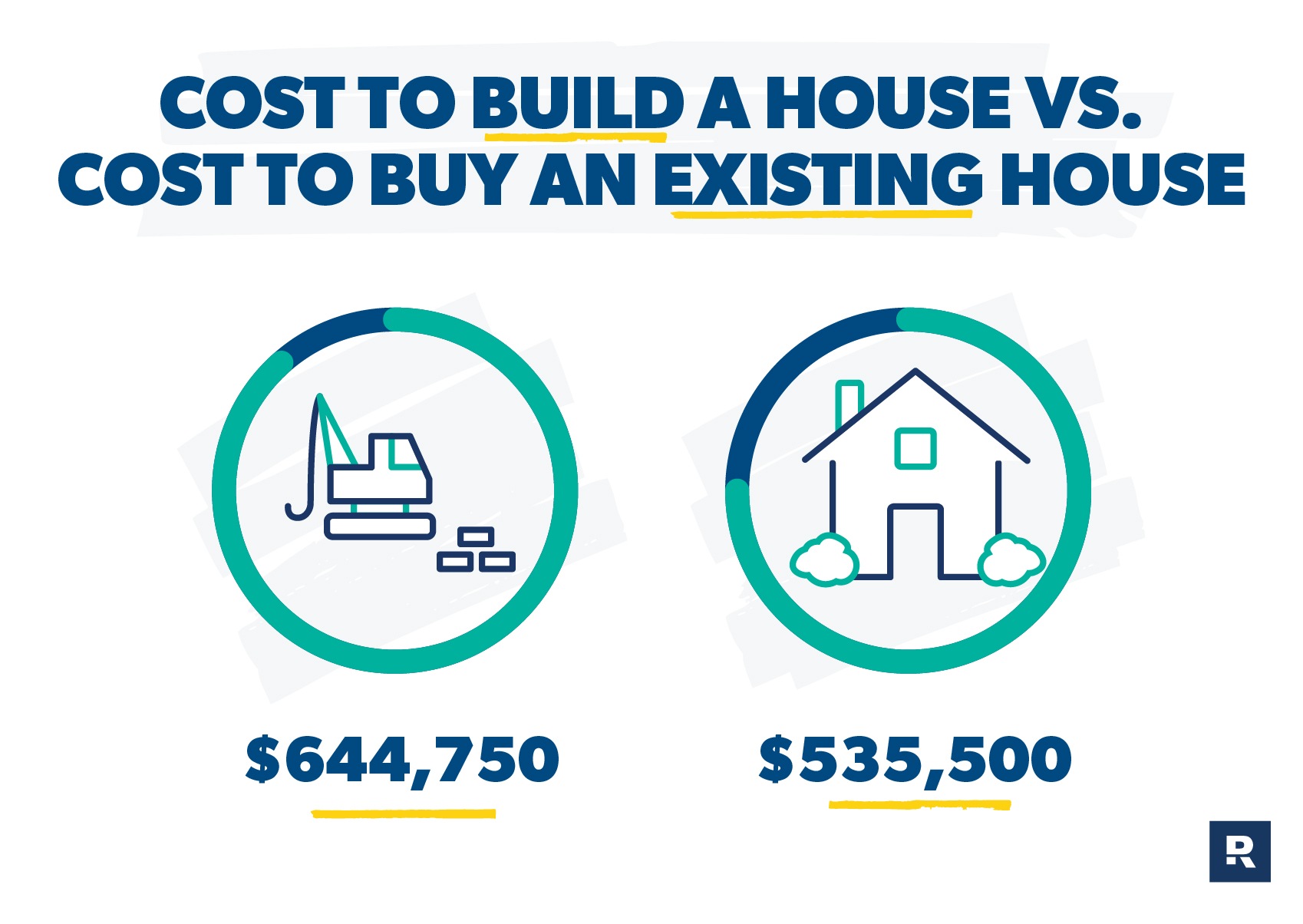

In a survey by the National Association of Home Builders, the average cost to build a new home in 2022 was $644,750.1 (New home means one you build yourself or one a builder constructs.)

Meanwhile, the average cost to buy an existing home (one that’s already built) in 2022 was about $535,500.2 When you do a little quick math, you’ll see buying an existing home instead of a new one could save you about $109,250. That’s a lot of money! (Just think of all the Disney trips you could take with the difference.)

Now, prices have gone up for both existing homes and new builds in the last couple of years. But building a new house is usually going to cost you more than buying one. And that makes sense, right? Buying something new (whether it’s a purse, a car or anything else) is almost always more expensive than buying something pre-owned. Think about what a pair of jeans from a thrift shop costs compared to buying them new from a department store. That’s an extreme example, but you get the idea—it’s cheaper to buy used!

And thanks to inflation and supply chain problems, builders are also paying more for building materials and resources they need to build houses, like workers and fuel. All that to say, building a house is not cheaper than buying!

With the right agent, taking on the housing market can be easy.

Buy or sell your home with an agent the Ramsey team trusts.

Building Your Own House vs. Buying a House

Now, you’re probably checking out Zillow listings and wondering, How much does it cost to build a house? Is it better to build or buy a house? Maybe the price tag is worth it . . . And you may be right! Or building a house could be a terrible idea for you. Whether building or buying a house is a better option really depends on your situation.

Whenever I have a big decision to make (and what’s bigger than buying a house?), I like to weigh the pros and cons. So, here are some pros and cons of building a house to help you decide if that’s the best way to go.

Pros of Building a House

To start off, let’s look at why building a house can be a good idea.

- Customization: Building a house from the ground up lets you personalize it to suit your lifestyle and tastes—everything from the layout, cabinets and flooring to the sinks, lighting and doorknobs can be custom picked! Even tract homes built within subdivisions allow for some customization in color choices, flooring and certain finishes. So, whether you’re after a rustic feel or a fancy art deco vibe, you can make these style choices early on.

- Low to no competition: The real estate market isn’t as competitive as it was in 2022 when some homes sold just days after getting multiple offers. But when you own land to build your home on, you obviously have zero competition with other buyers!

- Little maintenance: Since new homes must meet current building codes and have up-to-date technology, you probably won’t have to worry about big repairs or maintenance issues for the first few years—no leaky roofs or failing HVAC systems for you. Plus, you don’t have to worry about finding the last owner’s bad duct-tape repairs.

- Low energy costs: New homes often feature the latest energy-efficient systems and materials, which usually lead to lower energy bills—woo-hoo!

- Newness: You get to start fresh as the first owner of your home and enjoy brand-spanking-new everything. I love that new house smell, don’t you?

Get a Real Estate Game Plan With Dave’s New Book

Learn Dave Ramsey’s roadmap to buy, sell and invest in real estate the right way, so your home can be a blessing, not a burden.

Cons of Building a House

Okay, we already know one disadvantage of building a house is that it costs more than buying an existing home. That’s not so bad if you’re able to budget for it, but that extra expense can be a real hang-up for some people. Let’s consider the other cons of building a house:

- The wait: It takes an average of seven months to construct a new house—not counting the planning and approval stages.3 But closing on an existing house usually only takes 30 to 45 days. Plus, you’ll have to pay to live somewhere until your new home is ready—that means if you’re building, you could get stuck paying your current rent or mortgage plus the construction costs for several months. Ouch.

- Nonnegotiable price: Most buyers go into an existing home purchase hoping to negotiate a lower price. While that’s super common in the resale market, there isn’t much leeway on closing costs or purchase price with a newly built home—unless your real estate agent gets creative at the negotiating table. But even then, you’ll probably get more bang for your buck with an existing home.

- Noise and mess: If you build a house where other new homes are being built, you might have to deal with construction noise, traffic and globs of mud along your commute. Worse yet, you could end up with a roofing nail or a screw in your tire. Sure, the neighborhood will eventually calm down as other homes get completed, but it’s something to think about if loud noises and neighborhood construction get on your nerves.

- Stress: When you build a house, you’ll have to purchase land, decide on a home design, and pick out flooring, fixtures, cabinets, countertops, interior trim, exterior trim, and on and on—all while staying within your budget. Managing all the details and nickel-and-dime expenses of building a house takes time and effort. Don’t underestimate the stamina and patience you’ll need to make sure it’s all done the right way.

And be careful! All those little details and decisions caused Jayson, a member of our Ramsey Baby Steps Community on Facebook, to get caught up in the excitement of building a new home and spend more money than he originally planned.

Find expert agents to help you buy your home.

“During the building process I got so stuck in the moment with how everything was looking and wanted higher-end furnishings, tile lines in the showers and extra details that cost more,” Jayson said. “I figured why not? If I'm going to do it, I might as well do it now.”

- Hidden costs: Those dollar signs you see on things like countertops, fixtures and appliances are just the tip of the iceberg. Upgrades and unforeseen problems can quickly drive up the price of your new home, and those costs may or may not be rolled into your contract price. Play it safe by budgeting to pay cash for those unexpected expenses. And don’t forget about post-move costs like landscaping and blinds—they’ll sneak up on you too.

For Sarah, a member of our Baby Steps Millionaires Facebook community, building a house in a rural area came with expenses she wouldn’t have had if she had bought an existing home. Before construction even began, she spent about $100,000 on land, a barn, running utilities (electric and water) and installing a septic system.

All right, now let’s look at the pros and cons of buying an existing home.

Pros of Buying an Existing House

I already mentioned the biggest advantage of buying an existing home—the price! An existing home with similar features to a new home will cost you less. But when you compare the price of a new home to an existing home, make sure it’s an apples-to-apples comparison. Don’t just consider square footage or number of bedrooms. Location also plays a huge factor in price! Here are some other benefits of buying an existing home:

- Quick close: When you buy an existing home, you won’t be stuck waiting around for your builder to install cabinets or floors before you move in. Most transactions close within 30 to 45 days. (That’s just enough time to start packing!)

- Room to negotiate: As a buyer, you can negotiate the price with the seller. You can also negotiate on things like repairs that need to be done to the house.

- Location: The money you save by buying an existing home could help you afford a home in that neighborhood you’ve always loved. And as they say in the real estate biz, the three most important things to consider when buying a house are: location, location, location.

Cons of Buying an Existing House

There are two sides to everything, and buying an existing home isn’t all sunshine and roses. Here are some of the cons you might not have considered:

- Repairs: As homes get older, they need repairs. Jobs like a new roof or HVAC system could set you back thousands of dollars. So always keep the age of a house in mind when shopping. An old, inefficient HVAC system could also cost you a lot more when it comes to your utility bill.

- Compromises: You probably won’t find a house that checks off every single need and want on your wish list, and you might have to settle for some things you don’t like.

- Updates: The previous owner loved their purple bedroom with a stenciled horse border, but that’s just not your taste. Same goes for the golden swan faucets and a seashell sink in the bathroom. So, expect to spend some money updating your new space (just don’t paint anything neon green).

- Environmental concerns: If you buy a really old home, you might run into a situation where you have to take care of harmful chemicals, like lead paint or asbestos tile.

- Hidden problems: Even though you got a home inspection, you could still find problems the inspector missed. And I 100% recommend getting a home inspection before you buy a house. Don’t skip that part!

I hope you’re getting a better idea of whether you want to buy or build a house. Next up, let’s look at the cost of building a home.

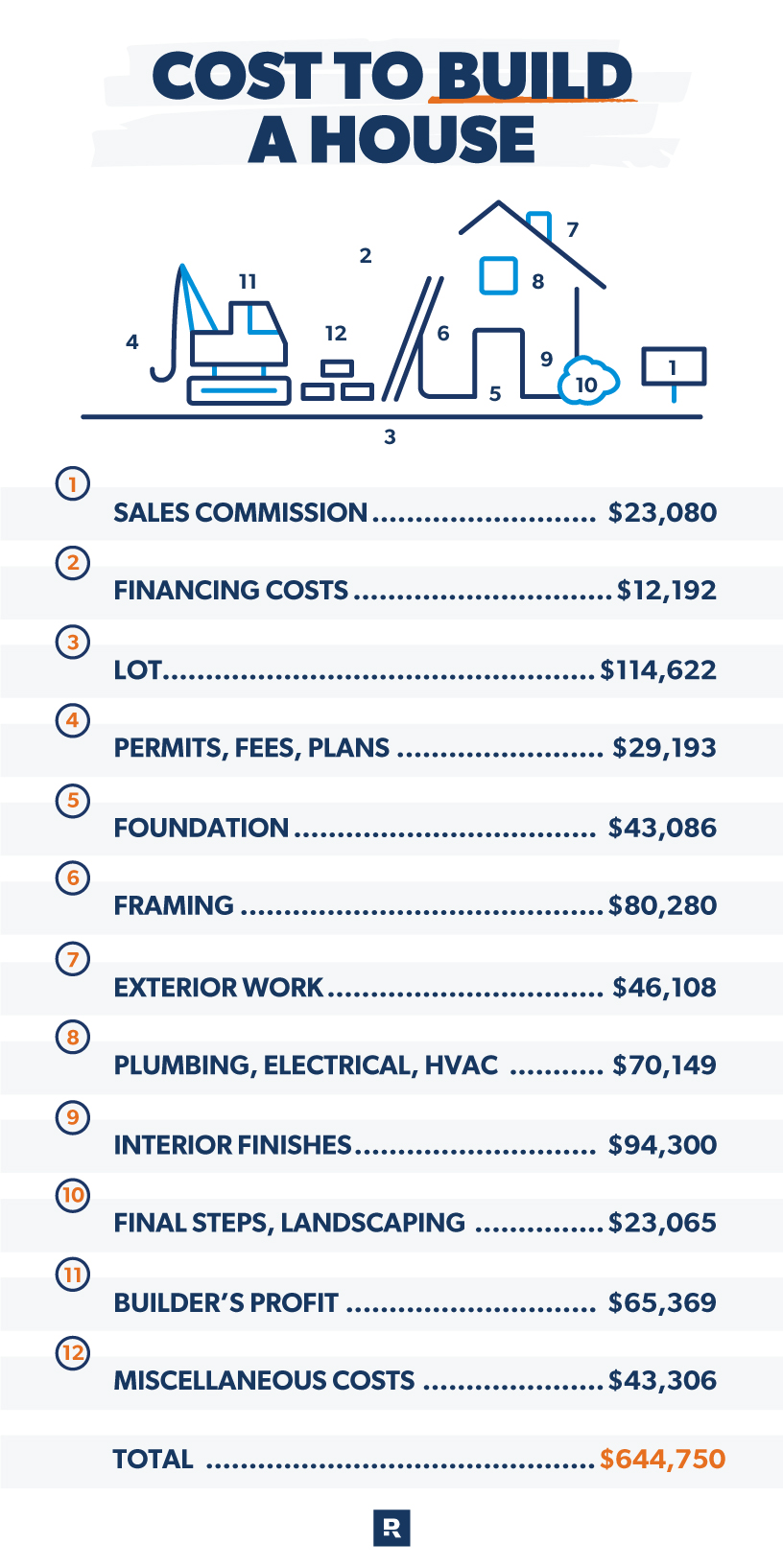

A Breakdown of the Average Cost to Build a House

Like I said earlier, the average sales price for a newly built home is $644,750. That’s a big price tag, but keep in mind this is the average cost. Plenty of homes are built for less than this, but the larger, more expensive custom homes skew the average cost.

So, here’s a rundown of the costs of building a house.

Average Cost Based on Location

Average Cost Based on Location

A lot of a home’s price is based on its location. Building a house in a desirable neighborhood could be twice the price of building the same house somewhere out in the sticks.

The cost of living—and that includes the cost of housing—also fluctuates a lot from city to city and state to state.

If you’re looking to relocate to a state with a low cost of living, I’ll give you a tip: Stay away from the East and West coasts. Midwestern and Southern states usually have a lower cost of living. Also, work with a local real estate agent who knows the market.

But let’s not focus too much on the nitty-gritty details, because you’re probably just wondering, Rachel, what’s the best way to pay for a home?

Tips to Pay for a Newly Built Home or an Existing Home

Whether you build or buy, make sure you stick to a house you can actually afford. That means getting a house with a monthly payment that’s no more than 25% of your take-home pay—otherwise, you’ll be house poor!

That 25% limit includes principal, interest, property taxes, homeowners insurance and, if your down payment is lower than 20%, private mortgage insurance (PMI). And don’t forget to budget for homeowners association (HOA) fees if your new home is in an HOA.

Want to see what home prices fit your budget? Try our free mortgage calculator. And for a mortgage you can pay off fast, talk to our RamseyTrusted friends at Churchill Mortgage about getting a 15-year fixed-rate conventional loan. (We only recommend these loans because any other type of mortgage will drown you in interest and fees and keep you in debt for decades.)

Should I Buy or Build a House?

Maybe you’re still on the fence about whether to buy or build a house. I get it—it’s a big decision, and you want to make the right choice!

If you’re a first-time home buyer, I like to recommend going the more affordable route and buying an existing house. You’ll save money and get some homeownership experience before you take on the challenge of building a new house. It’ll also give you time to build equity (your home’s value minus how much you owe on it). When you sell your first home, you can use that equity to help pay to build your next home.

If you’re an experienced home buyer, then building a house could be a fun adventure for you (just as long as you can stay within that 25% limit and still handle all the other homeownership costs like maintenance and utilities).

Ginny, a member of our Baby Steps Millionaires Facebook community, and her husband saved money on their new home by doing a lot of work themselves.

“We contracted it out ourselves and did some work ourselves—trim, painting, stained concrete floors, installed cabinets, etc.” she said.

So, if you’re handy, getting your hands dirty with some DIY projects could be a great cost-saving option!

Whether you buy or build, owning a house you can afford is an incredible way to build wealth.

Buy or Build With Confidence

The best way to decide whether you should buy or build a house is to talk it over with an experienced real estate agent. They’ll know where to find the best deals in long-standing neighborhoods or in up-and-coming communities. And they’ll help you decide if building a house or buying an existing home will suit your needs best.

If you want a real estate agent who will do whatever it takes to help you find the perfect home or lot to build on, try our RamseyTrusted agents. They’re top performers who share our mission to help you reach your financial goals!

Next Steps

- Write down how much you have saved for a down payment.

- Decide where you want to live—are you relocating or staying local?

- Ask an expert if buying a home in that area is a smart choice or a bad move.

Frequently Asked Questions

-

What is the most expensive part of building a house?

-

Lots of things go into building a house. Some big expenses include laying the foundation, framing, plumbing, and finishing the interior. But your biggest expense might have nothing to do with construction—it’s land! The median price for a lot is $55,000.4 But depending on the size of your lot and its location, you might spend over six figures for it.

-

Do I need a special type of loan for building a house?

-

If you’re borrowing money to build your house, you’ll need to get what’s called a construction loan. This is a short-term, high-interest loan that allows you to draw out funds for each phase of construction—site prep, framing, finishing, etc. Once the house is finished, most homeowners convert the loan into a home mortgage.

-

What are the hidden costs of building a house?

-

When you’re building a house, you should expect some unexpected costs. Building permits could set you back a couple of thousand dollars. Or your builder might hit rock while digging your basement—and that could add thousands of dollars in excavation costs. Raw materials also could jump in price. (Lumber prices have been especially crazy the last few years.) Whatever the case, make sure you have money in your budget for hidden and unexpected costs.