What Are Target Date Funds? Should I Invest in One?

7 Min Read | Sep 6, 2023

Setting your money aside in mutual funds and letting them grow over the long term is one of the proven ways ordinary people can become everyday millionaires and live the retirement of their dreams.

Of course, you’ll want to invest in a mix of the best mutual funds—those with a history of strong returns. That can seem like a tall order, especially when you begin to sort through the thousands of mutual funds available. If you search for a simple solution, you might hear someone mention target date funds—a one-size-fits-all option that lets you set up your investments and forget about them until retirement.

But can it really be that easy? We're about to show you.

What Are Target Date Funds?

A target date fund is an investment fund that automatically changes the direction of your investments from high-risk, high-reward to low-risk, low-reward options as you near retirement. Let’s take a closer look at what those options mean:

-

High-risk, high-reward: This option is known as an aggressive investment strategy. Aggressive investments—like single stocks—are riskier and more volatile than conservative options, but they have the potential to earn higher returns.

-

Low-risk, low-reward: This option is known as a conservative investment strategy. Conservative investments—like some bonds, certificates of deposit (CDs) or money market funds—are less risky than aggressive options. However, they only earn modest returns.

The goal behind the change in investment direction, or asset allocation, over a target date fund’s lifetime is to build a big nest egg first and then gradually become more concerned with protecting that nest egg as you approach retirement. The idea is to keep you from losing a chunk of your savings right before you retire.

You might hear target date funds grouped in with dynamic-risk, age-based or lifecycle funds since they’re designed to reduce risk the closer you get to your retirement age.

How Do Target Date Funds Work?

Suppose your employer offers a tax-advantaged retirement plan, like a Roth 401(k). You aren’t sure what kind of investment options to pick, so you go with a target date fund.

Let’s say it’s 2020, and you’re 45 years old. You want to retire at age 67, so you select the 2040 Fund so you can access it in 20 years. Over that 20-year period, your money will first be put in aggressive, high-risk, high-return stock mutual funds, then move gradually to conservative, low-risk, low-return bond funds.

Here are some real examples of target date fund options (as of 2020). Notice how the funds with a closer target date are invested less in stocks and more in bonds:

-

2065 Fund: 90% in stocks; 10% in bonds1

-

2040 Fund: 85% in stocks; 15% in bonds2

-

2020 Fund: 55% in stocks; 45% in bonds3

The gradual change in asset allocation over time is often referred to as the glide path. Like an airplane coming in for a landing, the glide path allows your investment to make a gentle landing into retirement by reducing the risk of a (market) crash that could destroy your nest egg.

Should You Invest in Target Date Funds?

The concept of moving from aggressive to conservative investments over time is widely accepted in the financial community. The problem is, the one-size-fits-all approach of target date funds can keep your nest egg from reaching its full potential.

We don’t believe in the target date fund method because people live longer than they think they will after retirement, and switching your investment mix to be more conservative won’t give your money a chance to grow above the rate of inflation. That means you could outlive your savings—and no one wants to end up in that position.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

Instead, we tell people to invest in growth stock mutual funds and meet with an investing professional who knows your personal situation and goals. That way, they can help you manage your retirement investments—and the risk of those investments.

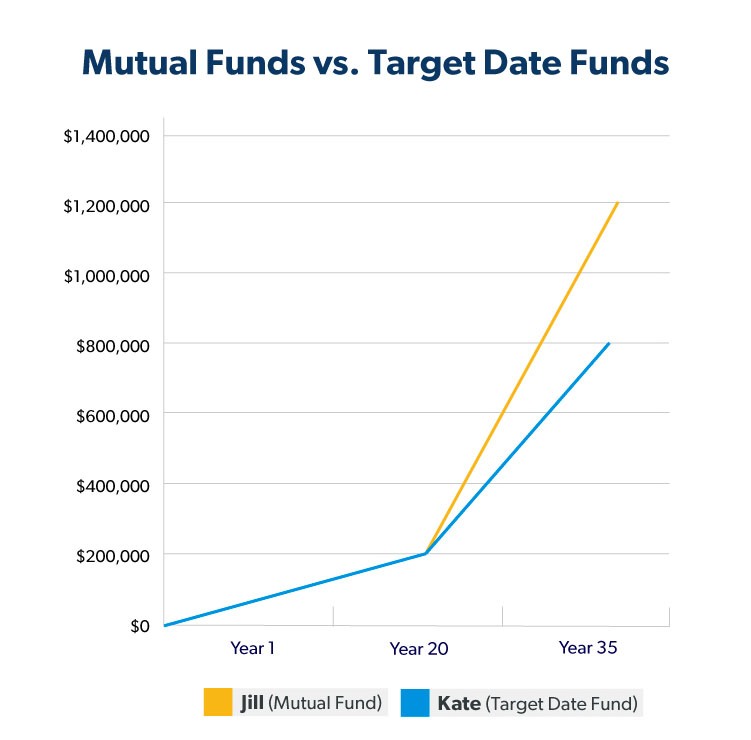

To show the difference, I’m going to walk you through an investing scenario. Imagine two investors, Jill and Kate, start investing at age 30 and contribute $250 a month to a Roth IRA, but they choose different fund options.

-

Jill invests in individual growth stock mutual funds after discussing her options with her investing professional.

-

Kate invests in a target date fund.

Both investors come out of the gate with a similar strong start. But over time, Kate’s target date fund begins falling behind. By the time they retire 35 years later, Jill’s nest egg has averaged an 11% rate of return and grown to roughly $1.2 million. Because Kate’s target date fund became more conservative the closer she got to retirement, her rate of return dropped to 8% in the last 15 years.

Kate’s nest egg is only worth around $800,000. That’s $400,000 less than what Jill earned with mutual funds! And that’s because of a mere 3% difference in return in the last 15 years.

Will Your Retirement Savings Last?

Maybe you’re okay trading savings today for security tomorrow. But your investments don’t have to stop growing just because you retire. Your golden years could last another 20–30 years. Giving up on growth at this stage could mean giving up on returns that can sustain you through retirement.

Sure, you’ll start dipping into your nest egg to cover life expenses. But the money that’s left can still harness the power of compound interest. This is where individual mutual fund investing outshines target date funds.

If your investments are making little to no money during your retirement years, you could easily blow through your nest egg in a short amount of time. For example, let’s take another look at Kate’s target date fund that totaled nearly $800,000 and switched to super conservative investments at the time she retired at 65. Suppose she withdrew $50,000 per year. Her nest egg will be gone in roughly 30 years, give or take. What happens if she has a major medical expense or outlives that timeline?

On the other hand, if your investments are still growing throughout your retirement years, your money will last a lot longer. Remember Jill’s mutual fund investments? They earned about $1.2 million by the time she retired at 65. If she left her money invested so it continued to grow at an 11% annual rate of return, she could withdraw twice the amount that Kate does per year ($100,000) without ever touching the principal balance. Her investments could build wealth long after she’s gone and leave a legacy for her family!

Bottom Line: You Can Do Better Than Target Date Funds

Target date funds aren’t the worst way to invest your money, and they’re better than not investing at all. But you can do better.

Investing isn’t a one-size-fits-all venture. And you should feel confident your money’s going to work for you in retirement. So does that mean you have to fly solo? Nope.

There’s a middle ground that gives you power over your portfolio without having to figure it all out on your own.

Partner With an Investing Professional You Can Trust

The middle ground is as simple as sitting down with an investing professional you trust. Don’t settle for a know-it-all who tells you what to do and where to put your money so they can cash in on your success. You deserve to be treated like a partner—not a paycheck.

That’s why it’s so important to work with an investing pro who helps you build a plan that fits your goals. It’s not a onetime conversation. It’s an ongoing relationship that keeps an eye on the prize. You decide if and when to adjust your risk based on their professional advice. Remember, the final decision should always be yours.

If you’d like to be the expert in charge of your future, our SmartVestor program will match you with an investing professional who can help you reach your financial goals. Find an investing professional you can trust!

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.