How to Save for Retirement When You're a Stay-at-Home Parent

6 Min Read | Sep 6, 2023

As a stay-at-home parent, you might think saving for retirement isn’t an option for you. But we’ve got some great news: Just because you aren’t the primary breadwinner doesn’t mean you can’t save for retirement thanks to two magic words—spousal IRA.

We'll show you how!

The Spousal IRA: No Personal Income Needed

First, let’s be clear: When you’re married, it’s not his and hers money anymore, folks. It’s our money, and you should be working toward a shared financial dream. But what about the nonworking spouse who wants to feel more empowered about contributing to the financial goal?

This isn’t uncommon. Take Rich P. for example, an investment professional in Albany, New York. Rich’s wife has been a stay-at-home mom for 27 years. "I wouldn’t trade it for the world," he says. "The fruit it produces is amazing."

But no matter how hard Rich’s wife worked to keep the household running, one concern kept popping up.

"My wife would feel like she wasn’t contributing enough," he says. That’s because she was looking at it from a purely financial standpoint. "Even though my wife and I see the money I earn as our money, there’s still some part of her that sees it as money she can’t spend."

Rich realized setting up a spousal IRA could help his wife feel more empowered. "Having an IRA in her own name helps her see that she’s building her own wealth," he says.

"My wife would feel like she wasn't contributing enough—because she was looking at it financially. Having an IRA in her own name helps her see that she's building wealth on her own." — Rich P.

Simply put, a spousal IRA enables a stay-at-home husband or wife to set up a retirement account in their own name. As long as one person in your household brings home a paycheck and you file a joint tax return, you’re good to go!

When setting up a spousal IRA, you have a choice between a traditional and a Roth IRA.

- A traditional IRA works much like a 401(k). It’s tax-deferred, which means you don’t pay taxes on the money you invest until you withdraw it.

- A Roth IRA uses after-tax dollars, so your investment grows tax-free. Any money sitting in a Roth IRA at retirement is all yours.

We recommend the Roth option because once you take care of the taxes up front, you don’t have to worry about them later on—which saves you more money. You can contribute up to $6,000 ($7,000 if you’re 50 or older) to a Roth IRA this year.1 But there are some income limits—so check with an investment professional to make sure this can work for your situation.

Breaking Down a Spousal IRA

Now, where does all this investing money come from if you don’t get paid for all your hard work as a stay-at-home parent? We recommend putting 15% of your total household income toward retirement. If your spouse brings in 100% of your household income, then it’s just a matter of how you allocate that 15%.

If your household income is $60,000 a year, you should invest $9,000 a year—or $750 a month—toward retirement for both of you. Here are two ways you could break that investment down.

Option 1: Invest the Entire 15% in Your Spouse’s Name

Let’s say Tom works full time making $60,000, and his wife Jenny stays home to care for their two kids. He gets a 3% match on his 401(k) contributions, and they decide to invest their entire 15% under his name.

Tom’s 401(k) is a traditional tax-deferred plan that offers good mutual fund options, so they come back to it after maxing out his Roth IRA.

| Option 1 | % of Income | Monthly Contribution | Annual Contribution |

| 1. Invest up to the match in Tom’s 401(k) | 3% | $150 | $1,800 |

| 2. Max out a Roth IRA in Tom’s name | 10% | $500 | $6,000 |

| 3. Return to Tom’s 401(k) to invest the rest | 2% | $100 | $1,200 |

| Total | 15% | $750 | $9,000 |

Option 2: Split 15% Evenly Between His and Hers Investments

Now let’s see how things would look if Tom and Jenny split their 15% evenly, giving them each 7.5% to invest for retirement.

| Option 2 | % of Income | Monthly Contribution | Annual Contribution |

| 1. Invest up to the match in Tom’s 401(k) | 3% | $150 | $1,800 |

| 2. Put the rest of Tom’s retirement cash in a Roth IRA | 4.5% | $225 | $2,700 |

| 3. Contribute 7.5% in a spousal Roth IRA for Jenny | 7.5% | $375 | $4,500 |

| Total | 15% | $750 | $9,000 |

How much will you need for retirement? Find out with this free tool!

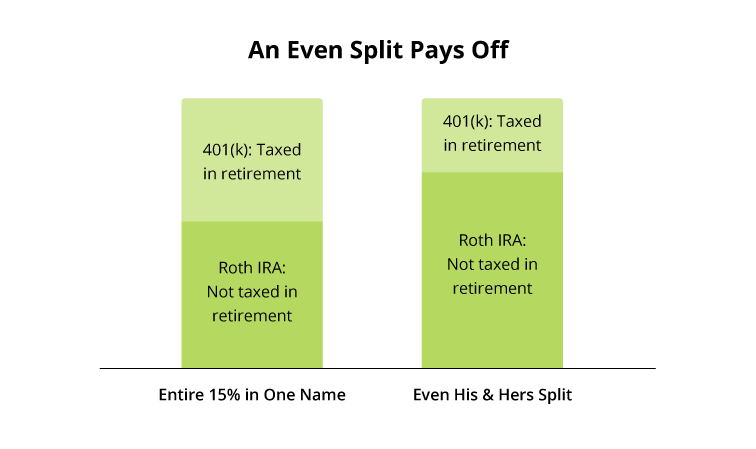

Dividing their retirement investments evenly doesn’t just enable Tom and Jenny to build equal stakes in their future. It also means more of their nest egg is safe from taxes in their golden years. Let’s look at the numbers.

If we compare these two examples side by side, you’ll see that putting all of Tom and Jenny’s retirement cash under one name means nearly twice as much is invested in a 401(k), making it subject to taxes when they withdraw it. But if they have separate Roth IRAs, less of their money will be taxed when it’s withdrawn in retirement.

Of course, everyone’s situation is different. Your spouse’s 401(k) might offer a Roth option or have terrible mutual funds to choose from. Or you might have a home-based business, which opens up even more investing possibilities. A good investing professional can help you sort through your options and find a retirement plan that’s right for you.

Work With an Investment Professional

There’s no higher calling on the planet than parenthood. If you work as a stay-at-home parent, you work seven days a week and never leave "the office." With no paycheck—and often no recognition—it can be easy to lose sight of the tremendous value you bring to your household. Just don’t let the everyday to-do’s keep you from being fully bought in and excited about your financial dream.

Want peace of mind for your family and your future? Our SmartVestor program helps you find financial advisors and investment professionals who will help you follow the financial principles we teach. Your investing pro can guide you in creating a plan. But remember, your retirement is up to you!

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.