How to Save for a Vacation in 6 Easy Steps

7 Min Read | Apr 27, 2023

Ah, vacation. The time to get away from it all, sleep in a different bed, eat food someone else makes, and see new sites.

It’s fun. It’s relaxing. It’s budget-busting. Hold up! Wait a minute on that last one, because it doesn’t have to be. You don’t have to—and you shouldn’t—overspend or go into debt to enjoy a getaway.

That’s right—you can cash flow your trip! It just takes planning ahead. We’re here to help by sharing how to save for a vacation in six easy steps.

1. Decide when to travel.

We’re going to be really frank here. (Frank as in honest. Not as in Sinatra.)

If you’re currently crushing your debt with Baby Step 2, this is not the time to take a vacation. You need to buckle down and drive debt out of your life. Get furious. Get intense. Get debt-free.

So, the first “when” you need to consider is “when you’re out of debt.”

Once you’re debt-free and trying to decide when to travel, try some of these hacks:

- Look into off-season rates to the places you want to go.

- Fly on Tuesdays or Wednesdays for cheaper plane tickets.

- Set up your trip so you check in to your hotel on a Sunday (the cheapest day) instead of a Friday (the most expensive). That’s right—staying during the week rather than the weekend is usually cheaper.

And of course, there might be an event you’re headed to (or time off from school or work) that helps you narrow down dates. Just keep all this good stuff in mind as you start planning.

2. Pick a destination.

Whether you like to spend your vacation firmly planted in a lounge chair by the beach or exploring national monuments, there's a vacation waiting that’s perfect for you (and your budget!).

As you’re picking a destination, remember this trip is for you (and your friends and family, perhaps). The goal is to make memories and enjoy the time away, not impress others or fill your social media feed with flashy photos. Pick a spot you will love and can afford.

3. Determine the cost of the trip.

Once you know the when and the where, start breaking down the how much.

Let’s say your dream vacation is a trip to Washington D.C. This is a super smart destination because the place is packed with free attractions. It’s like the sweet land of liberty wants us to know more about our history. Win-win.

Here are some common vacation costs:

- Transportation: airfare, car rental, train tickets

- Lodging: hotel, Airbnb, hostel

- Food: groceries, restaurants, snacks

- Fun: tours, attraction tickets, souvenirs, tips

- Miscellaneous: unexpected fees

For example, let’s say you did your research and figured out you’d need a flight for two ($800), train passes ($60), Airbnb for four nights ($600), food ($500), fun ($100), and miscellaneous ($50). These numbers are just examples from some light online searching we did. Don’t base your budget on them!

Total expenses look like they’ll be around $2,110 for a couple.

Do the same kind of math with your own real-life trip to find out your grand total. Too much too soon? If you push your trip to a later date, you’ll have more time to get this big expense in your budget and save up for your vacation.

Also consider shopping around for more deals or tweaking a couple of your plans. Aim for a doable date and reasonable costs.

4. Start budgeting for your vacation.

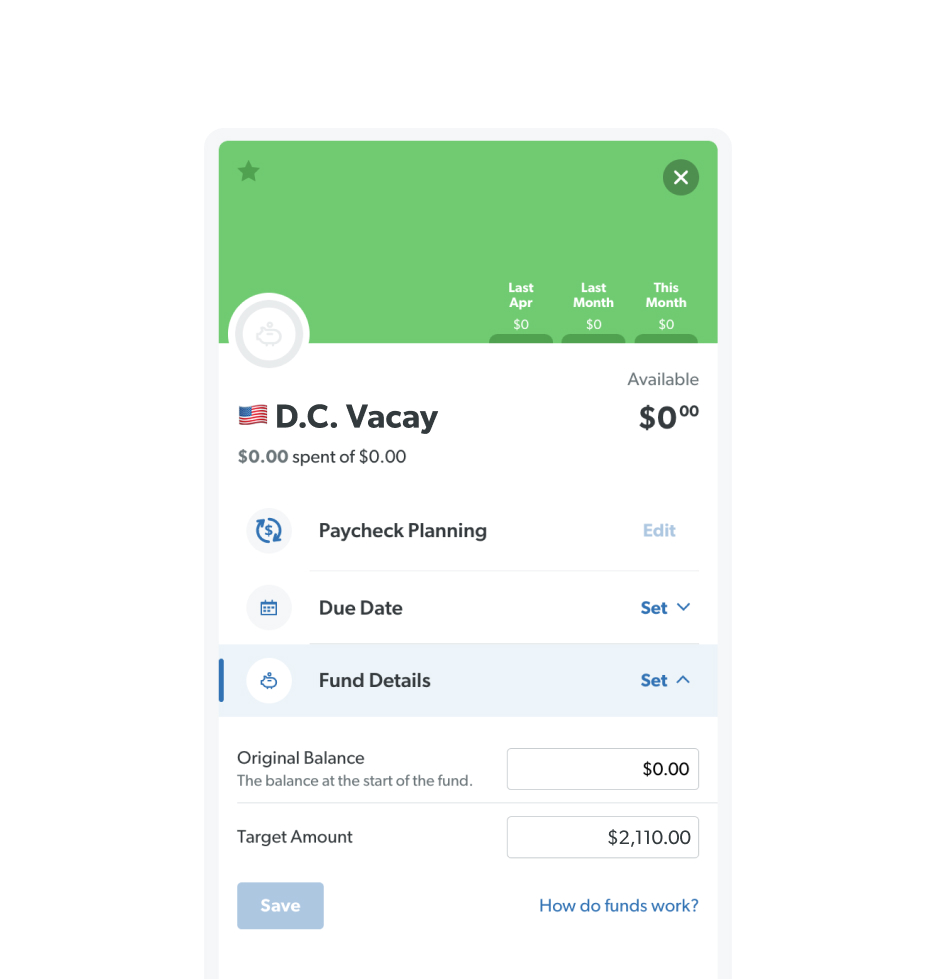

It’s time to get down to business. The business of budgeting. This is the literal saving-for-your-vacation step. And it’s way easier if you set up a fund in your EveryDollar budgeting app.

Here’s how:

- First, find your Savings budget category.

- Then click Add Item and label your fund—we called ours D.C. Vacay. And we even added in a patriotic American flag emoji.

- Tap to open your new budget line.

- You’ll see a piggy bank next to the word Fund. Click this and the next button that says Make This a Fund.

- Scroll down and put the total you need for this big expense as the target amount.

5. Work to make your vacation savings fund grow.

You’ve got a plan. Now let’s make it happen! Grow that fund bigger and stronger than Bruce Banner when he gets angry. But unlike the Hulk, you’re totally in control of your green.

Every savings goal starts with a budget. Create yours today with EveryDollar.

How many months do you have until your trip? Divide the total amount you need by the months until you travel. This is how much you should budget to save each month (aka the amount you set as your Planned amount in the fund for each month).

And where does that extra money come from? Here are some ideas for bulking up your vacation savings:

- Drop to one streaming service. Pick just one budget-friendly streaming service—this will help you save for the trip and free up cash in your budget every month.

- Go on a spending freeze. Try a no-spend challenge. Pay for essentials only for a week (or really ramp it up with a whole month).

- Cut out extra expenses. No more concert tickets, spur-of-the-moment day trips, or fancy restaurants. Remember: This is temporary!

- Find a side hustle. Make some extra cash you can throw directly toward your vacation savings.

- Work overtime hours. Put in extra hours at work. Your boss will love you, and your vacation fund will too!

- Sell your extra stuff. Go online to sell all those clothes you don’t wear anymore or clean out your entire house and host a garage sale.

- Save on groceries by meal planning. Decide up front what you’ll eat for each meal throughout the week, and watch your vacation fund soar.

As you add money to your vacation fund throughout the month, all you have to do is type it into the Planned section! Every time you add money to the Planned section of your sinking fund, it immediately adds that amount to your fund.

6. Track your spending on the actual trip.

Listen—budgets aren’t just numbers you put down on paper and never think about again. If you want your money plans to happen, you’ve got to interact with your budget.

That means you need to track all the spending that happens for your vacation—before and during the trip!

Before you head out for all the fun, set up budget lines for each of the main categories of your trip.

You’ll see in our example below that we made separate budget lines for flights to get there, trains passes for around town, lodging and food. Plus there’s a small budget line for fun (since those free museums and memorials can be the main attractions) and that miscellaneous line for any surprises.

![]()

Thank goodness EveryDollar has a mobile version, so you can keep up with it all on the go. This means you can hop into that app to follow these steps for how to save for a vacation and log your spending throughout the trip to make sure you don’t overspend.

Just remember: What you don’t do—at all, ever—is put any of this on a credit card. And don’t be tempted to take out a credit card for points or miles. In the end, it’s not worth it. You don’t want to still be paying off the trip months after it’s over.

Make it a debt-free vacation by saving cash and paying cash. Bring home memories, not debt!

Budget for Vacation

Set up your fund in EveryDollar today so you can soon enjoy all the relaxation of your vacation.

Download EveryDollar