Here’s something you should know about us: We hate credit scores. Yep—they’re bogus. But even though they’re nothing more than a measly “I love debt” score, you shouldn’t ignore them altogether . . . especially since your score is tied to your credit report. Even if you’re debt-free and don’t care what big banks and lenders think of you, you still need to check your credit report for errors or signs of fraud at least once a year.

But sifting through your report can be pretty confusing, especially if you don’t know how to read a credit report or what kind of red flags to look for. It can be a lot to take in. But don’t worry! We’ve done the heavy lifting so you don’t have to.

Ready, set, let’s walk through everything you need to know about how to read your credit report.

What Is a Credit Report?

A credit report is kind of like a report card for your credit history. It can be used by potential lenders to determine how risky it is to lend you money, which is basically just how likely you are to pay your monthly payments on time. Your credit report can tell them:

- The date you opened any credit accounts or took out any loans

- The current balance on each account

- Your payment history

- The credit limits and total loan amounts

- Any bankruptcies

- Your identifying information (name, address, Social Security number)

A credit bureau or credit-reporting company like Equifax, Experian or TransUnion will provide your information to whatever company may be considering giving you a loan or credit account. These bureaus all operate independently, so their reports may be slightly different depending on the information provided by the lenders they used.

How to Get a Credit Report

You’re allowed one free copy of your credit report every year from each of the major credit-reporting agencies we just talked about. But the reports aren’t automatically mailed to you—you have to ask for them! And since each agency keeps different details about you on file, it’s worth checking with all three. If you play your cards right, you can even stagger them so you’re getting a free report nearly every quarter.

Now that you know how to get a credit check, we’ll walk you through the four major areas you need to inspect for any red flags. These could help you spot potential identity theft situations, so listen up!

How to Read Your Credit Report

Identifying Information

This section has any personal information that could be used to identify you, including:

- Name

- Address

- Social Security number

- Date of birth

- Phone number

Red Flags: Everything in this section needs to refer to you and not someone else who happens to share your name (looking at you, Mr. Smith). And while you’re at it, go ahead and double-check the Social Security number—just in case.

Make sure all the addresses listed are places you’ve actually lived. If you’ve never been to Waxahachie, Texas, but the report says you lived there for seven years, you definitely want to follow up on that. Later, we’ll share what steps to follow if you do find errors in your report.

Credit History

The bulk of the report is in this section. Your credit history includes:

- Open and paid credit accounts, like credit cards, mortgages and loans

- Accounts shared with someone else

- Total loan amounts

- Remaining loan balances

- Late payments

- Accounts that have been sent to collections

Red Flags: Read and reread this section to make sure everything listed is correct. Got it? Okay. Now check again. Seriously. Look for any unfamiliar accounts and check for payments being noted as late (when they actually weren’t).

Get help with your money questions. Talk to a Financial Coach today!

If you’ve closed a credit card account, confirm it’s showing up as closed on your credit report. Also, make sure no lines of credit have been opened in your name without your consent—that’s a huge red flag and might mean you’re at risk of identity theft.

Public Records

You want this part to be blank. The financial activity listed here—like bankruptcy and judgments—is taken from public records, and some of it can stay on your credit report for 7–10 years.

Red Flags: It’s pretty rare to find an error in this part of the report, but it’s worth scanning anyway. Mistakes in this section should be cleared up ASAP.

Inquiries

Here you’ll see detailed listings of every business that has requested your credit report. There are two types of credit inquiries: soft and hard. Soft inquiries are just from companies wanting to send you promotional materials or current creditors checking your financial status. Hard inquiries are made when you actually apply for a credit card, loan or mortgage.

Red Flags: If you’re not doing debt anymore, you shouldn’t have any hard inquiries on your report. Any hard inquiry you didn’t authorize is a sign someone might be using your information to sign up for debt. Any old inquiries should disappear from your report after about two years.

What Does an “Open Account” Mean on My Credit Report?

An open account is any line of credit you’ve opened and never officially closed. You know, like that paid-off department store credit card you forgot to call about and cancel. Even if you haven’t used a credit card for years, it will still show up as an open account on your credit report until you close the account. It’s time to just go ahead and close it for good.

What Does a “U” Stand for on a Credit Report?

The “U” on your credit report stands for “unclassified,” meaning that the account hadn’t been updated at the time the report was pulled. It’s one of many status codes that can appear next to an account on your credit report. Codes like this usually indicate a problem with the account, like it being past due or sent to collections.

You might also see a “U” if the account is new and you haven’t made any payments on it yet. Again, if you didn’t open the account, that’s a warning sign you need to look into.

Who Can See My Credit Report?

Most people can’t legally use your personal information to access your credit report. However, there are several types of organizations that are allowed to pull your credit: banks, creditors, lenders, insurance or utility companies, potential landlords, collections agencies, potential employers and the government.

The laws about who can access your credit score are different from state to state. If you’re worried at all, do some research and find out what the law is where you live.

Where Can I Find My Credit Score?

If you got a free credit check, don’t be surprised when it doesn’t include your credit score. To see that, you’ll have to use a free web service or pay for it through myFICO or another credit bureau.

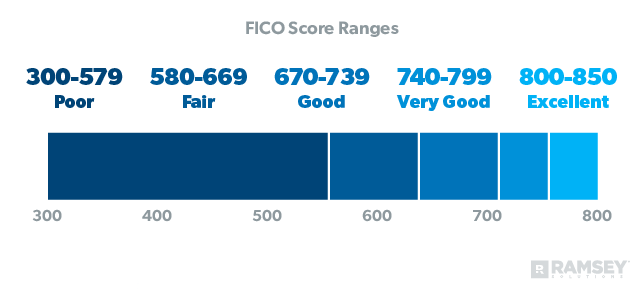

Remember, when it all comes down to it, a credit score is really just an “I love debt” score. That’s right, a “good score” simply shows how well you’ve played the debt game. It doesn’t reflect your actual net worth or the amount of money you have in the bank. In other words, it’s really nothing to be proud of. The only way to keep your stellar credit score is to live in debt and stay there—no, thanks!

It is possible to live life without a credit score, which is exactly what Dave recommends. But that doesn’t mean you should trash your credit to lower it! Just start paying off your debt, close your credit accounts once they’re paid off, and don’t take on any new debt. If you’re following the Baby Steps, you should reach that indeterminable score (the term the credit bureaus use for folks who don’t use credit) within a few months to a few years. Remember: No credit is not the same as having a low credit score.

Can Someone Run a Credit Report Without Me Knowing?

It depends. Like we said earlier, there are soft inquiries and hard inquiries. Soft inquiries happen all the time without you even knowing—a company might check your credit score if they’re planning on mailing you a promotional offer. These inquiries don’t affect your credit score at all.

But hard inquiries require your actual consent before they can happen. These impact your credit score and can’t legally be done without you knowing, so breathe easy—but don’t slack off when it comes to keeping an eye on your credit. Check your credit report at least once a year, and if you notice a hard inquiry you didn’t authorize, you’ll need to dispute it with the credit agency.

How to Dispute Inaccuracies

Any mistakes on your credit report need to be taken up with the agency that shows the error. Write a letter that lists each incorrect item you found and why you’re disputing it.

Let’s say you closed a credit card, but it still shows up as an open account on your credit report. Here’s what you need to do: Gather up documents and any evidence you have to prove it’s a mistake. Then, send all of this by certified mail to the credit reporting agency—and don’t forget a return receipt! The agency has only 30 days to respond, so you should see some movement pretty quickly.

Avoid Identity Theft

Learning how to read a credit report might seem complicated at first, but now that you know what to look for, it’s not so daunting. And like we said earlier, it’s a good idea to do a credit check at least once a year. Why? Because staying on top of your credit report is a great way to guard yourself from identity theft, so make sure you’re protected!