Recession.

Just hearing that word can cause some people to clutch their chest and run to the bank to cash out all their money.

But how do you prepare for a recession without going into full-blown panic mode?

Well, it’s a good idea to have your finances in order—no matter what’s happening with the economy. But there are some things you can do now to prepare for a recession and stay on track with your money goals.

How to Prepare for a Recession

You’ve probably heard rumblings that an economic recession is looming. Or maybe the news about failing banks and tech layoffs has you worried.

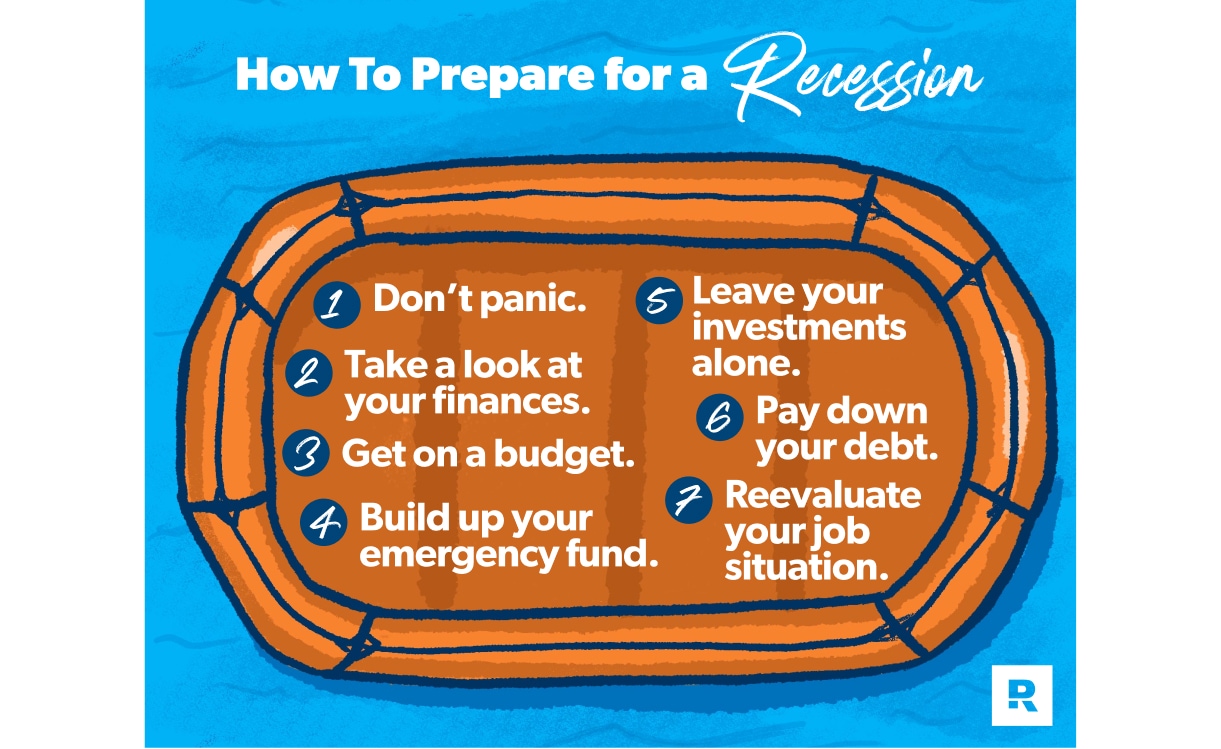

Listen, you don’t need to build a bunker, buy a bunch of gold, or stock up on toilet paper to survive a dip in the economy. Here are seven steps to help you prepare for a recession:

1. Don’t panic.

Being concerned about what might happen in a recession is normal, especially when it has to do with your hard-earned money. But it’s important to not give in to all the fear out there—because people can make some really stupid decisions when they’re afraid.

Instead of focusing on what’s out of your control, focus on what’s in your control. You decide how you handle your money. And if you can make the right decisions when times are good, you’ll be able to manage your money well during a recession.

And know that even if a recession does happen, you can get through it.

2. Take a look at your finances.

It’s a good idea to know exactly what’s happening with your money and get organized before the economy takes a turn.

Take inventory of your monthly bills and debt payments. How much do you have in savings and investments? Do you have any money tied up in real estate?

Go ahead and lay it all out. If things get crazy, you don’t want to be scrambling to get your finances in order. What’s happening in your own house is going to matter a lot more during a recession than what’s happening on Wall Street or at the White House.

3. Get on a budget.

Okay, this one is huge! You need to get on a written budget. Why? Because if you don’t have a plan for how you’re spending your money now, a recession will decide for you later—and not in the way you want.

Start by listing out all your sources of income and subtract your monthly expenses. (Pro tip: The EveryDollar budgeting app makes it super easy to create your free budget. And it does the math part for you!)

You want to make sure you’re able to cover the basics (food, utilities, rent and gas). If not, see what spending you can cut to get more breathing room in your budget.

And if you’ve been relying on credit cards to make ends meet, it’s time to nip that habit in the bud! The sooner you learn to live on less than you make (and avoid debt), the more prepared you’ll be in times of crisis—whether that’s a recession, a job loss, or another emergency. And speaking of emergencies . . .

4. Build up your emergency fund.

If a recession is an economic flood, an emergency fund is your life raft. Having cash piled away in your savings “just in case” gives you peace of mind, even while everyone else is freaking out. And that’s true always—not just when there’s talk of a recession.

Start budgeting with EveryDollar today!

Now is the time to save up an emergency fund if you don’t already have one. Start by saving $1,000 as fast as you can. And if you don’t have any debt, continue to save until you have at least 3–6 months of expenses. A nice, cushy emergency fund will help you ride out a recession and make the best decisions for you and your family.

5. Leave your investments alone.

When the stock market is trending down, you might be tempted to sell your mutual funds at a loss and put the money into something safer to weather the storm. But hold on, take a deep breath, and don’t let fear cause you to make a costly mistake.

We say it time and time again: Investing is a roller-coaster ride, and the only people who get hurt on a roller coaster are the ones who jump off early.

Instead, wait. Ride it out. Stocks rise and fall all the time. And even if you’ve seen a loss in your investments, you’ll only feel that loss if you take the money out. Investing is a long game. So leave your money alone! Keep your investments where they are and wait for the upswing to happen. Because it will happen.

And when the market is down, mutual funds get real cheap. That means if you’re in a position to keep investing (as in your job is stable, you’re out of debt, and you have your fully funded emergency fund), you’ll be getting way more bang for your buck. And when the market picks back up (because it will) and you see the big returns roll in from your on-sale investments, you’ll be so glad you didn’t jump off that roller coaster with everyone else.

Remember, investing is a marathon, not a sprint. And don’t pull your money out just because some dude on the news told you to. If you’re still feeling stumped when it comes to investing, connect with a SmartVestor Pro who can talk you through your options and help with your investment decisions.

6. Pay down your debt.

If an emergency fund is your life raft, debt is a weight pulling you under water. And you need to cut ties with it! The last thing you want to worry about during a recession—or any time of uncertainty—is how you’re going to make your car payment (or any payment).

So, once you’ve got your $1,000 emergency fund squared away, focus on paying off your debt using the debt snowball method. By knocking out your debts one at a time, you’ll have fewer payments to worry about and more money in your budget—both of which come in real handy during a recession!

Plus, being debt-free gives you an overwhelming sense of freedom and peace. And when you aren’t spending most of your paycheck on debt payments, things like higher grocery prices—or a dip in the stock market—won’t hurt as much.

7. Reevaluate your job situation.

A big factor in surviving a recession is your job. And losing your source of income when things are already feeling haywire is downright scary!

So, use this time to put yourself in a position where you can confidently get through a recession. Do you feel secure at your current workplace, or do you need to snag a more stable job?

If you’re out of work or have good reason to think you might get laid off soon, pause extra payments on your debt snowball, focus on covering the basics, and stockpile cash. Then, get to job hunting! Maybe you need to revamp your resumé, improve your interview skills, or completely switch careers to a recession-proof job. You can also find a good side hustle to earn some fast cash in the meantime.

And remember, no matter how scared you might feel if you lose your job, don’t take on more debt. You’re already in a rough patch, and debt is only going to make it worse and leave you in a bigger pinch down the road. Debt is a bad decision—even when you’ve lost a job, even when you’re scared, and even in a recession.

Are We Going Into a Recession?

Recessions are kind of like tornadoes. It’s hard to predict when they’ll hit and how much damage they’ll cause. You might not personally feel the effects of a mild recession (though you’ll definitely hear about it in the news 24/7). But a moderate or severe recession will absolutely get your attention—via your wallet or layoffs.

But is a recession near? Just so we’re clear, a recession means the gross domestic product (GDP) has been down for two quarters in a row. But it’s not officially a recession until the National Bureau of Economic Research says it is—and they haven’t yet. In fact, the GDP has actually gone up in 2023.

With federal interest rates on the rise, some people might feel like we’re heading into a recession. But the unemployment rate is still relatively low, inflation seems to be leveling out, and the stock market is trending up. This has a lot of economists believing we’re currently in a rolling recession, which is when some parts of the economy go south while some parts improve.

But recessions are a natural part of the economy—and they’re temporary. We’ve actually had 13 recessions since World War II, and the average length of each was about 10 months.1

Bottom line: If you stay calm and follow the steps above, you’ll be better prepared for whatever happens.

Recession-Proof Your Life

The U.S. economy will continue to go up and down, just like it always has. But the money decisions you make every day are what matter the most.

If you want to know what to do with your money all the time (not just when things are crazy), check out Financial Peace University (FPU). This nine-lesson class will teach you how to beat debt, save for emergencies, build wealth—and confidently take the next step toward your money goals.

You’ll learn the tried and true principles that have helped millions of people survive crises, job losses, pandemics and, yes, recessions. And these principles can help you too!

Don’t wait for a recession to get your finances in order. Take control of your money today with FPU!

Expert Advice Delivered Straight to Your Inbox

Our weekly email newsletter is full of practical advice you can easily apply to your daily routine so you can win with your money, relationships and career.