Everyone loves a good bonus or raise—and we understand why! That extra income not only helps you feel rewarded at work, but it also just makes life a little bit easier. And if you’re working on financial goals like paying off debt or investing for your future, a little bump in your paycheck can help you accomplish those goals that much faster.

Most working Americans can expect a 3% bump in pay this year, similar to the average raise reported in previous years.(1) On a $45,000 annual income, a 3% raise works out to $1,350, or $112.50 per month.

While it may not sound like all that much, it’s extra money you didn’t have before. And what you do with that money really matters. There are lots of different ways to spend that raise, some better than others. Take a look at these common choices to find out how to get the most out of your raise or bonus this year.

1. Take a Vacation: Not a Terrible Idea

One popular way to spend an annual raise or bonus is on travel and vacations. Let us be clear, we're all for vacations when the bills are paid and you don’t have any debt hanging over your head. But if you’ve got some other priorities to take care of first, maybe a getaway shouldn’t be your top priority as you decide how to spend your raise.

Take Rick and Carla, for example. They’re each making close to $45,000, so they’re expecting the average raise of $110 or so per month for each of them. But there’s some bad news. That $110 increase is based on their gross pay. Their actual take-home pay increase will be less—a lot less depending on the state they live in and their tax filing status. Since Rick and Carla live in a state with no income tax, their raises work out to about $80 a month each, making their $2,640 income boost look more like $1,920.

The average domestic vacation costs around $600 per trip, according to the Bureau of Labor Statistics, so Rick and Carla could cover a quick getaway for two without putting a dent in their budget.(2) To truly enjoy their vacation, however, Rick and Carla need to make sure their financial bases are covered and they aren’t using money that should go toward debt or their emergency fund. And that emergency fund should never, ever go toward a vacation—no matter how much you think you need it!

2. Catch Up on Bills: Huge Mistake

Darlene can’t wait to get her raise. She’s been struggling to make ends meet for several months. With her $45,000 income, she can’t figure out how she’s gotten behind. But she’s sure this raise is the answer she’s been looking for.

Darlene’s plan to use her raise to catch up on her bills and cover other household expenses is another common choice. While this seems responsible, using her raise to fund the past won’t help Darlene get ahead. The root of her problem probably isn’t her income—it’s budgeting.

Instead of just treating the symptom, Darlene needs to deal with the problem. She needs to create a budget and decide how to spend each dollar she makes before it hits her bank account. Once she has a plan to cover her everyday expenses with the income she already has, she can use her raise to get ahead financially by paying down her debt.

3. Pay Off Debt: Great Idea

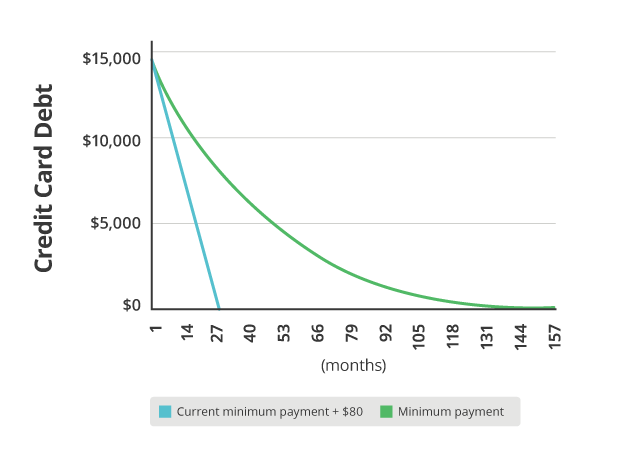

Some people use their extra income to pay off debt—and that’s a great idea! Let’s look at Darlene again as an example. If she gets her spending under control and applies her $80 monthly increase to her minimum payment on her $15,000 credit card debt, she’ll be debt-free in a little more than two years and save more than $4,000 in interest!

Want to earn extra cash but don't know where to start? Take this quiz to find the best side hustle options!

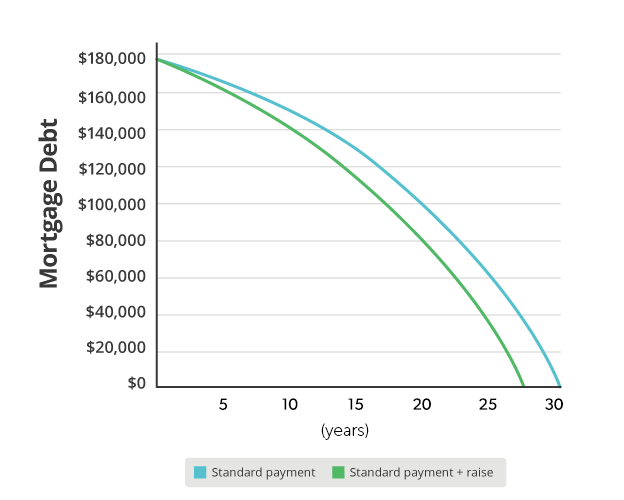

Glenn and Deanna, on the other hand, are working on paying off their mortgage. Deanna doesn’t work outside the home, so the couple will use Glenn’s 3% raise on his $45,000 income to attack their home loan. By adding that $80 to their regular monthly payment, they’ll pay off their $168,000, 30-year mortgage four years faster and save more than $21,000 in interest.

That $80 per month is starting to look more important now, don’t you think?

4. Save for Retirement: Great Idea

When it comes to retirement, your raise or bonus can do even greater things. Say Margaret gets a 3% raise on her $45,000 salary. She’ll have two options:

- Option #1: Bump Up Her Take-Home Pay. Margaret can enjoy having an extra $80 per month in her paycheck.

- Option #2: Put the Raise to Work in Her 401(k). Since her 401(k) contributions are pre-tax, Margaret can get more out of her raise by putting it toward her retirement. That $80 bump turns into about $110 when it’s invested before taxes. Over 30 years, that could add nearly $250,000 to her nest egg!

Would you rather add $80 to your monthly paycheck or almost $250,000 to your retirement savings? That’s an easy choice! By contributing more to her retirement account, Margaret lowers her taxable income and puts the full power of her raise toward building her nest egg. What a difference it could make!

Margaret plans to talk to an investing pro to see if her 401(k) is the best place to use her raise to build up her retirement fund. She could also open a Roth IRA outside her workplace plan. While she won’t get the same initial tax benefits with a Roth IRA as she could with her 401(k), her Roth investments will grow tax-free and she’ll be able to use her savings tax-free when she retires.

A Raise Is Just the Beginning

If you’re using your raise or bonus to pay off debt or grow your retirement fund, you can be confident you’re making a choice that will positively impact your financial future. What could be better than that?

An investing pro is the ideal teammate to help you make smart moves that pay off in the long term. And with our SmartVestor program, it’s easy to find qualified advisors to partner with as you build wealth. They can help you understand your options so you feel confident making smart decisions about your future.

Want to take control of your money but don’t know where to start? Take this quiz to get a free customized plan for your money.

3-Minute Money Quiz