How to Build a Nest Egg

5 Min Read | Sep 6, 2023

Do you know how much you’ll need to be able to retire? According to a recent study, about 63% of American workers believe they will need $500,000 or more to live comfortably in retirement.1 Knowing that, you might assume most Americans are working on building a nest egg. But that’s not quite the whole story.

According to a study conducted by Ramsey Solutions, half of baby boomers have less than $10,000 saved for retirement.2 And that generation has had the longest to save! It’s no wonder 56% of working Americans lose sleep thinking about retirement.3 When it comes to retirement savings, most people are way behind and they know it.

If you want to have options in your golden years, you need a sizable nest egg. But let’s face it, saving for retirement is hard work, and it doesn’t happen overnight.

But here’s the great news: You’ve got two powerful tools when it comes to building your retirement savings.

Curious about what they are? Let’s dig in.

Build Your Nest Egg With These Two Tools

Building a nest egg takes time and work, but it’s not complicated. All it takes is harnessing your two most powerful wealth-building tools: your income and compound growth.

Here’s how those two tools create a winning game plan for your retirement savings.

#1: Leverage Your Income

The first key to building a nest egg is pretty obvious: You’ve got to actually save money. If you never set aside any money for your future, you won’t find it magically waiting for you when you retire.

It’s easier said than done though, right? We get it. Setting aside part of your income for the future is tough, especially when your budget already feels stretched thin. That’s why it’s so important to get out of debt and build a full emergency fund before you start investing.

Getting rid of your debt frees up your budget to save for the future. And when you’ve got three to six months of expenses saved, you don’t have to steal from your retirement to pay for an unexpected roof leak or car repair.

How much should you save for retirement?

We recommend saving 15% of your gross income toward retirement. If your workplace offers a match on your 401(k) contributions, that’s the place to start.

Once you’ve invested up to any company match in your 401(k), invest the remaining percentage in a Roth IRA. A financial advisor can help you choose good growth stock mutual funds and keep your investing portfolio diversified.

#2: Harness the Power of Compound Growth

When it comes to your retirement savings, don’t underestimate the power of time. The earlier you start investing, the longer your money has to grow. That’s right, we’re talking about compound growth!

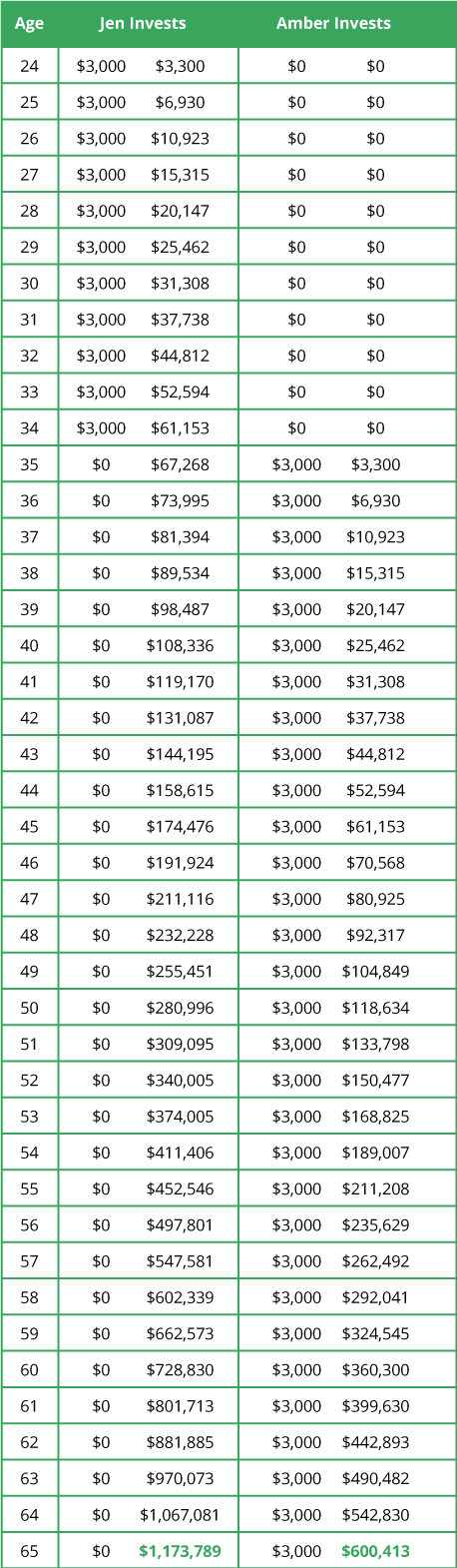

Consider Jen and Amber. They both know the importance of saving for retirement, but they take two different paths to get there.

- Jen gets a jump on her retirement fund as soon as she becomes eligible to open a 401(k) account at her first job. She starts throwing $3,000 a year toward retirement at age 24. On her 35th birthday, she decides she’s saved enough and doesn’t put another penny toward retirement from then on. She has invested $33,000 of her own cash over the course of 11 years.

- Amber waits until she’s more established to start saving for retirement. By the time she’s 35, she has bought her first home and finally feels ready to focus on the future. She stockpiles $3,000 a year in her 401(k) and keeps up that pace until she turns 65. Thirty years of investing brings Amber’s out-of-pocket total to $93,000.

After the retirement party, Jen and Amber compare their nest eggs. Let’s assume both of their investment accounts grew at the historical average return rate of the S&P 500 over the life of the investment. Who do you think comes out on top? The results may surprise you.

How much will you need for retirement? Find out with this free tool!

Crazy as it may seem, Amber shelled out nearly three times more money than Jen yet retired with only half the nest egg. How did Jen end up with nearly $1.2 million, while Amber only has around $600,000?

It all comes down to the power of compound growth.

Both Jen and Amber invested in growth stock mutual funds that earned the market average. But Jen gave her money more time to grow—and that made all the difference in the size of her nest egg. With compound growth, time really does equal money.

Getting a Late Start on Your Retirement Savings?

This example is clear proof that every day you put off saving for retirement, you lose the chance to earn free money.

But all’s not lost if you still haven’t started investing. That’s because compound growth isn’t the only tool you have. How much you invest matters just as much.

Let’s say you’re 40 years old with no retirement savings. Can you still retire a millionaire? Absolutely! You’ll just have to contribute more cash to get there. If you invested around $650 a month, you could have just over $1 million in retirement. It’s not too late to get started!

Start Building Your Nest Egg Today!

Building a nest egg isn’t rocket science. You just need to harness your most powerful tools: your income and compound growth. Of course, the sooner you start saving, the quicker you’ll reach your goal—with less money out of your pocket.

If you’re not sure what it will take to reach your retirement goals, ask an investing pro you trust to show you your options. Not only will a pro help you understand your investments, but they can also help you build an overall retirement plan.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.