So, you’re looking ahead to the new year and ready to start setting goals for 2024. How exciting! Maybe you’ve made up your mind to finally pay off your student loans by the time next Christmas rolls around. Or maybe you’ve decided you need to spend the new year working on your faith and getting closer to God.

But if you’re like most people, you’ve set goals in the past that just didn’t work out. After all, research shows that the average New Year’s resolution barely even lasts into the spring.1 So you’re probably asking an important question: How do I set goals for 2024 that I’ll actually be able to accomplish?

Well, we’ve got some good news: Setting high-quality goals—and crushing them—is more than possible. In fact, it’s well within your grasp. You just need to keep a few important things in mind at the beginning of the process. We’ll go over the biggest ones to make sure you’re set up for success.

Let’s dive in!

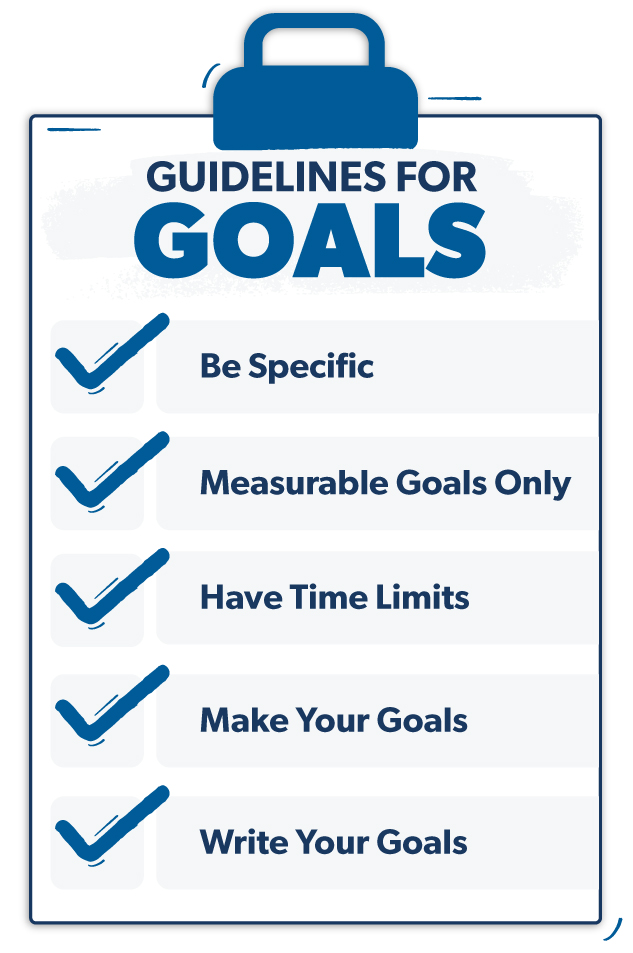

How to Set Goals for 2024: 5 Essential Guidelines

1. Be specific.

What do you want to achieve? Get down to the nitty-gritty and be super specific when you answer that question. Goals like “eat healthier” or “read more” are too vague, and they won’t give you the clarity you need to follow through. Instead try something more specific like “cut eating out to twice a week” or “read for at least 30 minutes every night before bed.” Also, look out for any roadblocks that could keep you from reaching your goal, and make a plan to knock them out of the way.

Questions to ask yourself: What am I trying to accomplish here? Why do I want to make this goal happen?

2. Make goals measurable.

This one goes hand in hand with making your goals specific. If a goal isn’t measurable, then you have no way of knowing when you’ve accomplished it. A goal like “lose weight” has no target attached to it, but “lose 20 pounds” has a clear finish line.

You can also break your New Year’s goal setting into bite-size chunks. Give yourself daily, weekly and monthly steps to take. Focus on those. And when you accomplish one, tackle the next one.

Questions to ask yourself: How long will it take to reach my goal? How do I know when I’ve reached my goal?

3. Give goals a time limit.

It’s important to set a time limit—because you need a finish line. Take that goal of yours, create a plan, and break it all the way down into daily activities. Then, give yourself a deadline. Hint: Planners like the 2024 Ramsey Goal Planner are perfect for this. They’ll help you manage your schedule, grow as a person, and crush your goals—no matter what they are.

For example, you might say, “I want to lose 20 pounds by December 31, 2024.” To lose those 20 pounds by your deadline, figure out things like how many times you need to work out each week and how many calories you need to eat in a day. Now you’ve got an action plan to hit that goal by your target date.

Questions to ask yourself: Do I have a deadline for reaching my goal? When will I hit this goal? How many times will I achieve this goal?

4. Goals need to be yours.

Let’s be honest—trying to go after someone else’s goals for your life never works out. Sure, your mom might want you to take night classes and switch careers. But it won’t happen unless you want it to. Why? Because working hard to win isn’t for the faint of heart. It’s tough. And you won’t have the drive to stick with it if you’re working toward a goal you’re not even passionate about.

Get a FREE customized plan for your money in 3 minutes!

Just because your spouse wants you to get out of debt doesn’t mean you will. You have to want it too. The goals you set have to be your goals. When push comes to shove, you’re the one who has to fight to make them a reality.

Questions to ask yourself: Is this my goal? Or is it someone else’s goal for me?

5. Put goals in writing.

Something special happens when you write down specific goals. There’s a reason God said, “Write the vision, and make it plain,” in Habakkuk 2:2 (KJV). So get those goals down on paper, along with all the steps it’ll take for you to make them happen.

Our Goal Tracker Worksheet is a handy tool for getting your goals in writing. Seeing your goals in black and white will help you hold yourself accountable and track your progress along the way.

Questions to ask yourself: Do I know the steps to reach my goal? Have I laid out a blueprint for how to get there?

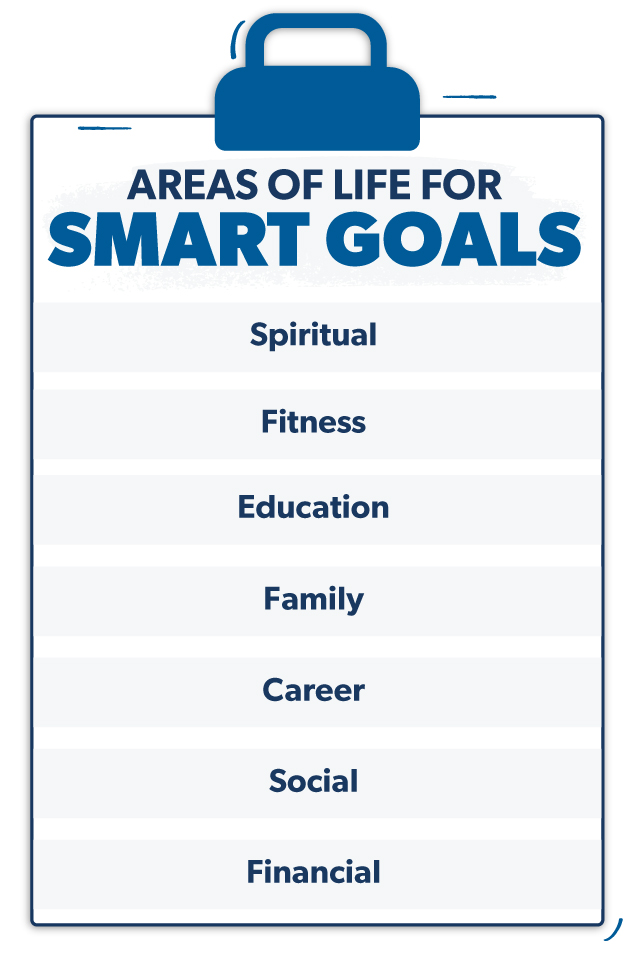

7 Areas of Life to Set Goals

Need a good place to start for goal setting? To create a good balance for your life, you should set goals in these seven meaningful areas:

- Spiritual: Finish a new devotional, start journaling every morning, or begin attending church every week.

- Fitness: Hit the gym after work three times a week, commit to only taking the stairs, or begin a new diet plan.

- Educational: Read one nonfiction book per month, go back to school, or replace scrolling on social media with listening to a leadership podcast.

- Family: Plan monthly one-on-one outings with your kids, keep a standing date night with your spouse, or make it a point to call your mom and dad on Sunday nights.

- Career: Earn a promotion or raise, learn something new about your line of work, or discover what you’re passionate about.

- Social: Find (and use!) new ways to connect with others, or commit to saying yes whenever someone invites you out to lunch.

- Financial: Increase the monthly amount you’re saving for retirement, get out of debt, or start using a monthly budget.

When it comes to that last one on the list—your money goals—you might not even know where to start. That’s why we made a super simple assessment that will tell you exactly where you are and what your next steps should be.

Take our free three-minute assessment and get started knocking out your money goals when the clock strikes midnight on New Year’s Eve (or start today—that’s an even better idea).

And hey, don’t beat yourself up if you get off track. Life happens. We all know 2023 had its speed bumps and roadblocks—just like any year. And guess what? 2024 probably will too. That’s real life. Just remember to keep your chin up. As long as you stay focused on the end goal and keep taking small steps toward getting there, you’ll be on your way to big life-change.

Now go take 2024 by storm!

Ready to Finally Reach Your Goals?

If you have big-time goals for 2024, the Ramsey Goal Planner is a great way to track your progress. It’s more than just some empty calendar pages or a to-do list—it’s a guide to crushing your spiritual, financial and relationship goals.

Rachel Cruze, Jade Warshaw and Dr. John Delony will teach you how to set strong, achievable goals that you can crush—no matter what time of year it is.