How to Budget by Cash Stuffing Envelopes

9 Min Read | Apr 16, 2024

Want to keep more of your hard-earned money each month? Try cash stuffing envelopes!

The cash stuffing trend may have gotten popular on TikTok, but it’s actually been around for decades (just under a different name—the cash envelope system).

I’m going to show you exactly how the cash envelope system works and how to start using it this month. (And if you hang with me until the end, I’ll tell you how to make cash stuffing envelopes more fashionable than ever!)

Key Takeaways

- The cash envelope system (aka cash stuffing) is a way to manage your spending by putting cash in physical envelopes labeled for specific budget categories.

- The goal of cash stuffing is to only spend what’s in your envelopes for the month.

- Cash stuffing envelopes can help you stick to a monthly budget and be more intentional with your spending.

What Is Cash Stuffing?

The cash envelope system—also known as cash stuffing—is a way to track exactly how much money you have in each budget line for the month by keeping your physical cash tucked away in labeled envelopes.

If you’re constantly going overboard in a certain area of your budget (hello, food), then cash stuffing can help get your spending under control!

You just take the exact amount of cash you’ve budgeted for each category and stick it in individual envelopes. Then throughout the month, you check your envelopes to see what’s left to spend—because you’ll see the literal amount in cash. Right there. How easy is that?

When you shop, use what’s in your cash envelope. Nothing more. And once your envelope money is gone, it’s gone—so this will force you to stop overspending and help you achieve your money goals faster.

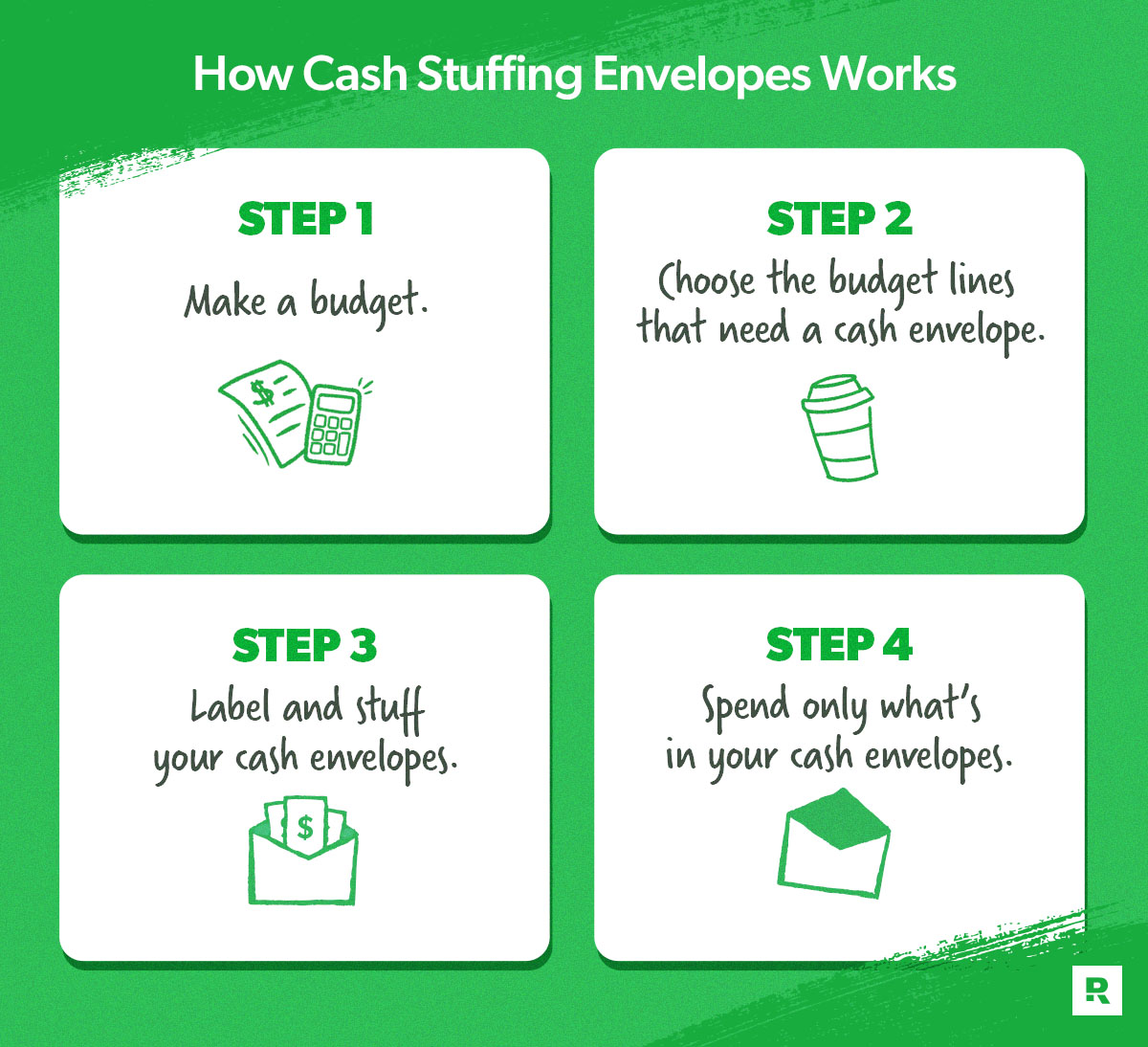

How Cash Stuffing Envelopes Works

One of the reasons we overspend is because there’s nothing telling us when to stop. That’s where your cash envelopes come in! They’re a great tool that’ll help you stick to your budget. Here’s how to use them:

1. Make a budget.

First things first, you need to make a budget. List out your income (everything coming in for the month), and then list out all your expenses. You’re aiming for a zero-based budget—meaning income minus expenses equals zero . . . meaning you’re giving every dollar a job to do (whether that’s giving, saving or spending).

If you want to do this part with a budgeting app, check out EveryDollar. It’s free!

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)

2. Choose the budget lines that need a cash envelope.

When you’re making your budget, think about those areas that usually become budget busters. You know, the ones where you tend to overspend month after month. These are the perfect spots to use the cash-stuffing method.

Here are a few budget lines I find most helpful to make envelopes for:

- Groceries

- Restaurants

- Gas

- Medicine/pharmacy

- Hair care/makeup

- Car maintenance

- Personal

- Entertainment

- Gifts

3. Label and stuff your cash envelopes.

Okay, now it’s time for the fun part—stuffing your envelopes!

Once you’ve gotten the cash you need from the bank, grab your envelopes and label them with the categories you chose in the previous step. Then count out the amount you’ve budgeted for each category and put it inside the corresponding envelope.

Start budgeting with EveryDollar today!

Now, let’s say you’ve budgeted $700 a month for groceries and you get paid twice a month. When you get your first paycheck of the month, take out $350 from your bank account and put the cash in an envelope. On that envelope, write out “Groceries.” When you get your second paycheck, do the same thing again and put that $350 in the envelope. That’s your $700 food budget for the month.

4. Spend only what’s in your cash envelopes.

Take your envelopes with you when you head to the grocery store, run errands, or go out to eat. And (here’s the super important part) only use the assigned cash to make your purchases.

During the month, no money (and I mean zero money) comes out of that groceries envelope except to pay for food at the grocery store. If you leave the envelope at home by mistake, turn your car back around.

Also, if you spend most of your grocery envelope in the first week, you’re going to have to cut back the rest of the month (try meal planning, shopping sales, and couponing). I know, I know—it’s hard. But it’s better than constantly overspending.

And when your money’s gone, it’s gone. If you want to go to the store but don’t have anything left in your envelope, raid your fridge for leftovers. Or dig through your pantry to see what you can find to make dinner.

Because here’s the deal: The cash envelope system only works if you stick to it. You can’t just use the envelopes some of the time—you’ve got to use them the whole month. That’s how you build better spending habits.

Advantages of Using the Cash Envelope System

- It keeps you on track.

- It enforces discipline.

- It holds you accountable.

- It makes it pretty hard to overspend.

Disadvantages of Using the Cash Envelope System

- You have to get cash out of your bank account.

- You have to juggle cash.

- You have to spend only what you have.

- Wait—that last one just seems like a challenging advantage.

What if I Pay Some of My Expenses Online?

Here’s the thing with the envelope budgeting system: It works better when you have to physically walk into a store to make a purchase. Shopping at the grocery store, going out to eat, getting a haircut or oil change—these are all times when cash stuffing is really helpful.

You can still use cash envelopes for online purchases, but it does get a little trickier:

- Write the amount you’ve budgeted for on the outside of the envelope, and don’t spend more online than the amount you’ve jotted down.

- Keep track of how much you’ve spent, and write it on the back of the envelope, just like if you were balancing a checkbook.

What if I Run Out of Money in My Cash Envelope?

When it comes to the envelope system, it can be really tempting to shuffle cash from one line item to fund another. But try not to borrow from the other cash envelopes.

Remember, the whole purpose of using cash envelopes is to control your spending and help you stick to your budget.

So, let’s say you used up all the money in your restaurants envelope for the month. Instead of dipping into your other envelopes or busting your budget on tacos, take that empty envelope as a sign to stay home and eat leftovers.

If you see your gas money slipping away faster than you planned, it’s time to use some gas saving tips—like limiting your trips or carpooling to work. Find creative ways to make your money stretch when the envelopes are getting low.

And don’t just spend, spend, spend until your cash envelope is empty. Pay attention to how much is left and plan ahead! This will help you spread out your spending and keep you from getting to the end of the envelope before the end of the month.

What About Emergencies?

If you have a crisis come up in the middle of the month or something happens and you have absolutely no choice but to shift your cash envelopes around, figure out how to adjust your budget.

If you’re married, talk with your spouse and decide together on the best course of action. Both of you need to be involved—it’s a joint decision. Or if you’re single, run the amounts by someone you trust to hold you accountable to your money goals. Just don’t drain other envelopes for every surprise expense.

This is also when having an emergency fund comes in real handy. So, if you don’t already have at least $1,000 saved and set aside for emergencies, go ahead and make that a priority!

What if I Have Money Left in My Cash Envelope at the End of the Month?

If you’ve got money left in an envelope at the end of the month, congrats! Coming in under budget is the best feeling. And it’s okay to celebrate (with a budget-friendly reward, of course).

But it’s also important to make that extra money work for you by putting it toward your current Baby Step (aka the proven way to save money, pay off debt, and build wealth).

If you don’t already have Baby Step 1 set up (aka that starter emergency fund I mentioned), get on it! And if you’re on Baby Step 2 and paying off your debt, take that extra cash and put it toward your debt snowball. Every little bit helps!

Cash envelopes are powerful weapons in the fight against overspending. They can help you manage your money better than you ever have—and help you reach your money goals faster. Put the cash envelope system to work and get intentional about how you’re spending your money.

Take Cash Stuffing to the Next Level

Okay, guys, since we’re talking about cash stuffing envelopes, I want to tell you about the wallet I created! This beautifully designed wallet will empower you to use your cash envelopes and budget the way you want to.

I love so many things about this wallet! For starters, it’s got:

- Four interior envelopes for cash

- 10 slots for debit cards and gift cards

- A zippered pouch for coins, coupons or receipts

- A high-quality genuine leather exterior (aka it looks good and it’s built to last)

- Wristlet with zip-top closure

- Multiple color choices (black, camel, metallic blush and more!)

And honestly, my favorite part is the partnership with JOYN, the company that makes these wallets. JOYN provides fair-trade jobs to vulnerable locals in India so they can have dignity, a livelihood and a future.

So, while you’re saving money and working to change your family tree, so is each person handmaking this wallet. As much as I believe using these wallets can change your life for the better, I know it will do that for the people making them as well. Get yours today!

And remember: Whether you call it cash stuffing or the cash envelope system, this method is all about being intentional with your spending so you can start creating a life you love. It’s totally worth it.

Now, go stuff some envelopes!