How to Retire Early: Everything You Need to Know

14 Min Read | Apr 11, 2024

Can I retire early?

A lot of people have asked this question (and if you’re reading this article, our guess is you’re one of them), but is retiring early a pipe dream in this crazy economy?

The answer is no! Not at all—it’s 100% possible. That’s the good news!

The not-quite-so-good news is that for many of us, no matter our age, reaching a goal of early retirement will take some major mindset adjustments and lifestyle changes. Think cutting back on expenses and getting our income up.

Will it be easy? Probably not. Will it be worth it? Absolutely.

Whatever amazing reasons you have for wanting to leave your full-time career early, you can start making changes today that will set you up financially for an early retirement.

Key Takeaways

- Early retirement is retiring before you’re eligible for Medicare at age 65.

- Retirement is a financial number, not an age.

- How much you need to save for retirement depends on your retirement goals and lifestyle.

- The road to retiring early starts with getting and staying out of debt.

- Investing in a bridge account and real estate can help you “bridge” the gap between early retirement and when you can start pulling from your retirement accounts without penalty.

What Is Early Retirement?

Early retirement is generally defined as retiring before you’re eligible for Medicare benefits at age 65.1

For a lot of people interested in retiring early, their goal is to retire in their 50s, 40s or even earlier! There’s even a new wave of younger workers who are trying to take early retirement to another level. Heard of the F.I.R.E. movement? It stands for Financial Independence, Retire Early.

And we’re talking really early. The goal of people in the F.I.R.E. movement is to save and invest aggressively—somewhere between 50–75% of their income—so they can retire in their 30s or 40s! That kind of goal takes some serious dedication to keeping expenses low, paying off and staying out of debt, and making saving and investing a priority.

But those are some of the steps it takes if you want to retire early, whether you want to jump on the F.I.R.E. movement bandwagon and retire by age 35 or if you’re wanting to retire in your late 50s.

A Gameplan for Retiring Early

A goal this big requires a big plan. If you’re serious about retiring early, here are some steps to take to set you on the path to an early retirement:

- Determine what your goals are for early retirement.

- Create a mock retirement budget.

- Evaluate your current financial situation.

- Invest in a bridge account.

- Invest in real estate.

- Get serious about lifestyle changes.

- Play it smart when you retire early.

- Meet regularly with a financial advisor.

If you’ve already checked off some of these steps—awesome! You’re ahead of the game. If not, then it’s time to roll up your sleeves and get to work.

Step 1: Determine what your goals are for early retirement.

Before you start running the numbers on how to retire early, you need to know what you want to do in retirement. That dream will determine your budget.

Do you want to travel the world? Then you’ll need a big budget. Want to travel to see grandkids? Open a business? Do volunteer work? Take the family on a huge vacation?

Having a good idea of what your retirement goals are will help you with the next step, which is . . .

Step 2: Create a mock retirement budget.

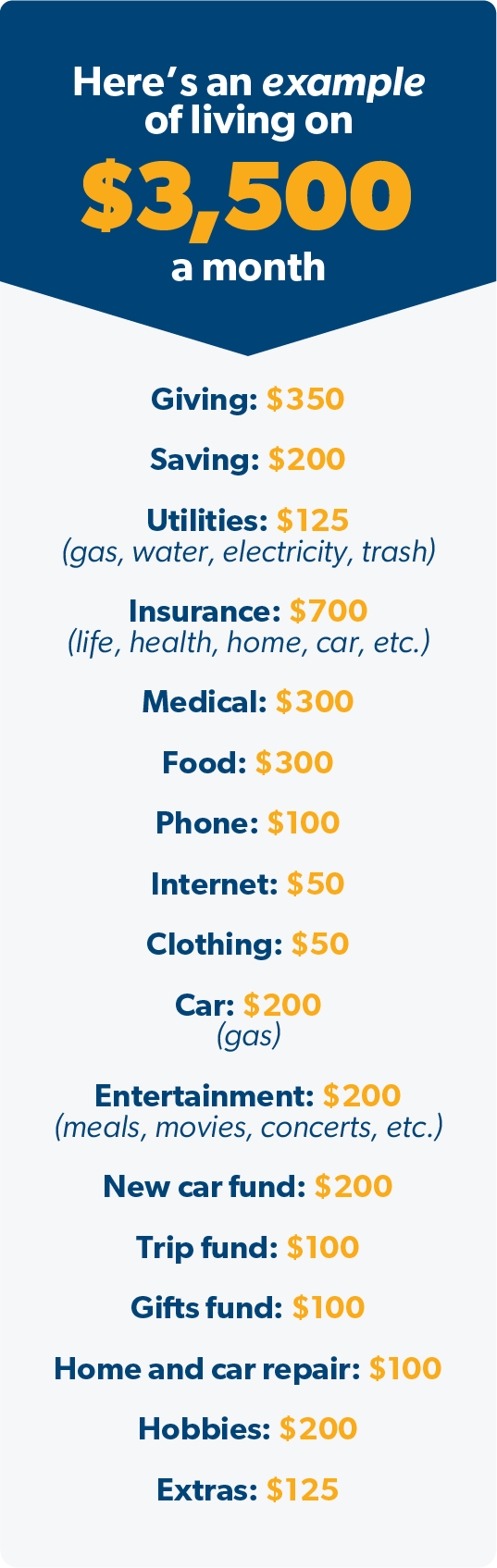

Here’s a pro tip for your early retirement gameplan: You need to get specific about the amount you think you’ll need to live on every month in retirement.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

The best way to do that is to create a mock monthly retirement budget. To make things simple, just ask yourself: If I retired today, what would my budget look like?

Notice that this budget doesn’t include a mortgage payment. That’s because you want to pay off the mortgage (and any other debt) before you retire. Debt will destroy your plans to retire early! It will eat up your monthly income and drain your retirement savings faster than you can say “foreclosure.”

Something else you may notice is that we budgeted a pretty large amount for insurance—$700. It’s a reminder that your budget will look different at different phases of your life, like when you drop life insurance and add long-term care insurance.

You may also want to travel a lot at first (which will cost more) and stay closer to home as you age. Medical expenses will vary during a long retirement too—we’ll talk more about that later.

Oh, and one last thing! Remember that since essentials like gas and groceries usually get more expensive over time (thanks, inflation), the amount you’ll need to budget to maintain the lifestyle you have now will look a little different than it will in 10, 15 or 20 years.

If all these numbers are giving you pause, don’t stress. We have a free tool that tells you exactly how much money you’ll need to retire and how much you need to save each month to make that number a reality!

Step 3. Evaluate your current financial situation.

Planning for an early retirement is sort of like planning a long road trip. Simply knowing your destination isn’t enough—you have to know where you’re starting from and how far you need to go to get there.

If you’re not sure where you stand financially, Ramsey’s 7 Baby Steps are the perfect place to start. These steps are like a GPS for your finances. When you know what step you’re on, you’ll know exactly what your next best move is. Here’s a quick look at the Baby Steps:

- Baby Step 1: Save $1,000 for your starter emergency fund.

- Baby Step 2: Pay off all debt (except the house) using the debt snowball.

- Baby Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

- Baby Step 4: Invest 15% of your household income in retirement.

- Baby Step 5: Save for your children’s college fund.

- Baby Step 6: Pay off your home early.

- Baby Step 7: Build wealth and give.

No matter what Baby Step you’re on, there are plenty of things you can do to close the gap between where you are and retiring early. Here are just a few:

- Pay off your house early. According to The National Study of Millionaires, it took millionaires about 10.2 years on average to pay off their homes. There’s a reason for that! Just imagine how much faster you could reach your goals if you didn’t have a mortgage payment to worry about and invested that money instead.

- Lower your retirement budget. That means you decide to live on less each month than your original number. You may have to take fewer trips to Maui or cut back on some expensive hobbies, but if your goal is to retire early, those sacrifices might be worth it!

- Get a second job. Let’s say you get a part-time job that brings in an extra $1,000 a month. If you invested that extra income into good growth stock mutual funds month after month, year after year, that could add hundreds of thousands of dollars to your retirement nest egg. Now that’s progress!

Step 4: Invest in a bridge account.

If you’re debt-free (everything except the house) and have a fully funded emergency fund (enough to cover 3–6 months of expenses), you should be investing 15% of your income for retirement. But if you want to retire early, you need to put every extra dollar you can toward that goal.

But here’s the deal. If you’re saving for retirement through tax-advantaged retirement accounts like your 401(k) or a Roth IRA, you won’t be able to take money out of those accounts until you reach age 59 ½ (unless you want to pay a hefty early withdrawal penalty that will quickly eat into your retirement savings . . . yeah, we didn’t think so).

So, what’s the solution? After you’ve maxed out your retirement savings options and paid off your house—and only after that—it’s time to build a bridge! No, not an actual bridge. We’re talking about a bridge account that will help you bridge the gap (get it?) between your early retirement and the time when you can start taking money out of your retirement accounts without a penalty.

That’s where a brokerage account (also known as a taxable investment account) comes in. Brokerage accounts are your best option to serve as your bridge account.

Now, brokerage accounts don’t have the same tax benefits as Roth (tax-free growth and tax-free withdrawals) or traditional (tax-deferred contributions) retirement accounts.

Instead, any profits you make from selling investments inside a brokerage account will be taxed as capital gains in the same tax year you sold them. And if your investment pays dividends, you’ll probably owe taxes on those payouts too.

However, brokerage accounts do come with two really nice perks that make them perfect for planning an early retirement!

- First, there are no contribution limits—meaning you can invest as much or as little as you want into your account.

- Second, you can take money out of your account whenever you want. No need to worry about early withdrawal penalties! That’s exactly the kind of flexibility you want in a bridge account.

What investments should you choose for your bridge account? We recommend investing in low-turnover mutual funds inside these accounts. Turnover refers to how often the investments within the fund are bought and sold.

Funds with a low turnover ratio of 10% or less—like an S&P 500 index fund—are ideal because they often have lower expenses and are less likely to lead to capital gains taxes, which would be passed on to the investor (that’s you).

Before you open a bridge account, make sure you talk to your financial advisor who can help you understand everything you need to know.

Step 5: Invest in real estate.

There is another path to early retirement that doesn’t involve a bridge account, and that’s investing in real estate. Real estate investing isn’t for everybody, but if done the right way, rental properties can provide you with a steady flow of income.

But before you try to make it big as a real estate mogul, there are some general rules you need to follow.

- First, invest in real estate only after you’ve already paid off your own home (in other words, after you’ve completed Baby Step 6). At that point, you’re completely debt-free with an emergency fund of 3–6 months of expenses saved. And you should also already be investing at least 15% of your income into retirement accounts, like a 401(k) or Roth IRA.

- Second, always pay for investment properties in full, with cash—no exceptions! Remember, debt always equals risk—and putting down 100% reduces your risk dramatically. Paying in full will also help you make money faster—you’ll pocket all the profits instead of sending a chunk of your income to a lender (plus interest).

- Last (but certainly not least), don’t try to do this alone. When you’re ready to buy a property, make sure you hire a real estate agent who knows what they’re doing. A great agent knows the area so well that they can probably drive around town in their sleep and can help you get the best deal possible on a property. This is one of the biggest investments you ever make, so having a pro in your corner is the way to go!

Step 6: Get serious about lifestyle changes.

The question you need to ask yourself is, How hard am I willing to work now so I can retire early? Honestly, folks, this is where most people get stuck. They dream of an early retirement, but they’re not willing to do the hard work or make the sacrifices to get there. Remember, nothing of value comes without a price. Your sweat equity, time and sacrifice are the price you pay to retire early.

For example, if your typical vacation costs your family $5,000, you may want to cut that in half and invest the remaining $2,500. Or what if you could cut your grocery budget by $100 a month? That’s an extra $1,200 a year toward investing.

Here are other areas you may want to look for savings:

- Clothing

- Entertainment

- Cable/satellite

- Eating out

- Gym membership (if you’re not using it)

- Subscription services (magazines, streaming video, audio books, etc.)

Can you imagine how much money you could put away for retirement every month if you cut just $15 from each of these budget categories? That’s $90 a month— $1,080 a year! What if you doubled that amount and cut $30 from each category?

You determine whether you get to retire early. It’s all in your hands.

Step 7: Play it smart when you retire early.

When you think you’re ready to say goodbye to your job, there are some practical things you need to think through—and possibly take action on—so you can take full advantage of your wealth potential. Before you retire, think about the following:

- Revisit your retirement dream. Are you still on the same page with your spouse? What are your expectations about travel? Hobbies? Giving? How do you picture your daily routine?

- Consider your retirement location. Before you retire, think about where you want to live. Will you have to move? Do you want to downsize? Which states have the highest cost of living? Which states offer the best tax breaks? Do you want to live close to family? You need to decide before you retire. An unplanned move after retirement can take a bite out of your retirement savings.

- Decide whether you’ll work. Some people still want or need a little extra income from work. What about you? Do you want to retire completely? Do you want to work part time or start your own business? Do you think you’ll miss the social interaction you get at work? Think through these questions before burning your business connections. It’s your future—and you get to decide how you want it to look!

- Keep a close eye on Social Security and health care. These are two wildcards that could change your retirement plans dramatically. You can’t count on Social Security to be a major source of income in retirement. It’s just gravy on the biscuit. You’ll need to plan your retirement budget as if Social Security isn’t an option.

Another major component to think about when you retire early is health insurance. If you leave your job before you qualify for Medicare, then you may need to buy private insurance. That’s a huge factor for your retirement budget.

- Determine how to manage income streams. An income stream is just a place you draw money from. Any savings outside of your emergency fund is an income stream. So are IRAs, 401(k)s, real estate and cash in your pocket. However, you need to know when you can take money out of your retirement accounts. You’ll get hit with a big tax penalty from Uncle Sam if you withdraw money too soon. You can also be penalized if you don’t take out money early enough. Your financial advisor can help you make a plan so you don’t miss those important dates!

Step 8: Meet regularly with a financial advisor.

Yes, you need to keep an eye on your money. You need to ask questions about concepts and terminology that don’t make sense. Stay involved in your financial portfolio—but don’t make decisions before you’ve talked them through with a professional who knows their stuff and has the patience to explain it.

It’s a lot to think about and remember. That’s why it’s so important to work with a financial advisor when you’re trying to figure out how to retire early. Our SmartVestor program makes it easy to get connected with an investment pro near you. These folks are MVPs of the investing world. And once they understand your financial goals, they can help you come up with a plan to get there.

Find your SmartVestor Pro today!

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

Ramsey Solutions is a paid, non-client promoter of participating pros.

Frequently Asked Questions

-

When do most people retire?

-

Here’s the deal: The average retirement age is 61, but most people can’t collect their full Social Security benefits until age 67 (if you were born after 1960).1,2

That means a lot of people can’t retire until 67 because they need their Social Security to make ends meet each month!

In fact, 1 out of 5 retirees said they expect to “unretire” and go back to work this year—many of them to fight the rising costs of living caused by inflation.3 So determining a true average retirement age is really tricky.

-

What is the easiest way to retire early?

-

If you want to retire (early or otherwise), there are no shortcuts—you have to save and invest. There are no ifs, ands or buts about it. Remember the folks in the F.I.R.E. movement we talked about? Their goal is to retire in their 30s or 40s, and there’s no such thing as a “retire quick” scheme. So folks in the F.I.R.E movement have to get radical about throwing huge chunks of their income toward their retirement.

If your goal is to retire early, we’ve got a plan that’s worked for thousands. It’s called the Baby Steps. If you’re out of debt (everything except for the house) and have a fully funded emergency fund in place (with 3–6 months of expenses saved), congratulations! That means you’re on Baby Step 4 and you’re ready to start investing for retirement.

Okay folks, start by investing 15% of your income into tax-advantaged retirement savings accounts, like 401(k)s and Roth IRAs. Be sure to invest your retirement money in mutual funds with a great track record.

The key is to get into a regular habit of saving and investing every single month. When you do that, time and compound growth work for you instead of against you.

After you knock out some of your other money goals, like paying off your mortgage early (which you can do if you’re investing 15% instead of 50% of your income), you can start investing more. This is where investing 50% of your income for retirement could actually be possible.

First, go back to your 401(k) and IRA and max out your contributions. Just keep in mind that in most cases, you won’t be able to withdraw money from your 401(k) or IRA without facing an early withdrawal penalty until you hit age 59 1/2. For example, with a traditional 401(k), you’ll not only have to pay income taxes on the money you take out, but Uncle Sam will also take another 10% on top of that. Yuck!

But there’s a solution to that problem that most people who want to retire early forget about: a bridge account. A bridge account will help you “bridge” the gap between when you want to retire and when you can take the money out of your retirement accounts.

As you plan your retirement dream, set a retirement age target and figure out how much money you’ll need to live on each year. Then multiply that number by how many years you expect to use your bridge account. That’s how much you should have in your bridge account so you can live comfortably until you’re able to access your retirement accounts without penalty.

For example, let’s say you want to retire early at age 55. That means you need to have enough money in your bridge account to last about 4 1/2 years. So if you expect to live off of $50,000 each year in retirement, your goal should be to have at least $225,000 in your bridge account by the time you turn 55 years old. Sweet!

-

How much money do I need to retire early?

-

If your goal is to retire early, then how much money will you need? It depends.

We tell folks all the time that retirement isn’t an age—it’s a financial number. So instead of aiming to retire at a particular age (even if you want to retire early), focus on how much you’ll need in retirement savings to meet your monthly expenses and pursue your retirement goals.

See, we can’t give you a number to reach by a specific age because we don’t know what your dreams are for retirement. Want to travel? Work part-time or volunteer at a ministry? Move to the beach? Everyone has their own plans for retirement. That’s why one dollar amount won’t fit every person.

You can figure out your financial number by using our Retire Inspired Quotient (R:IQ). It’s a free retirement assessment tool that helps you understand how much money you’ll need to retire on your terms. Plus, it also gives you an idea of how much you need to save each month to help you get there early!

-

How much should I save to retire early?

-

Like we discussed above, how much you should save for early retirement depends on a few things: what your retirement goals are, whether you plan to work part-time or start a small business, and at what age you plan to retire, for starters. That’s why it’s so important to sit down and create a mock retirement budget. It will give you a picture of how much your monthly expenses will be and how much income you’ll need.

We tell folks that once you reach Baby Step 4 with no consumer debt and a fully funded emergency fund, start saving and investing 15% of your gross household income for retirement.

Why 15%? First of all, investing 15% of your income consistently month after month, year after year, will put you on the path to becoming a Baby Steps Millionaire thanks to time and compound growth doing its thing.

And second, investing 15% still leaves some wiggle room in your budget to reach other important financial goals—like saving for your kids’ college funds and paying off your house early. Once you have no mortgage payments, you can really start ramping up your retirement savings and investing—then you’ll be well on your way to the early retirement of your dreams!

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.