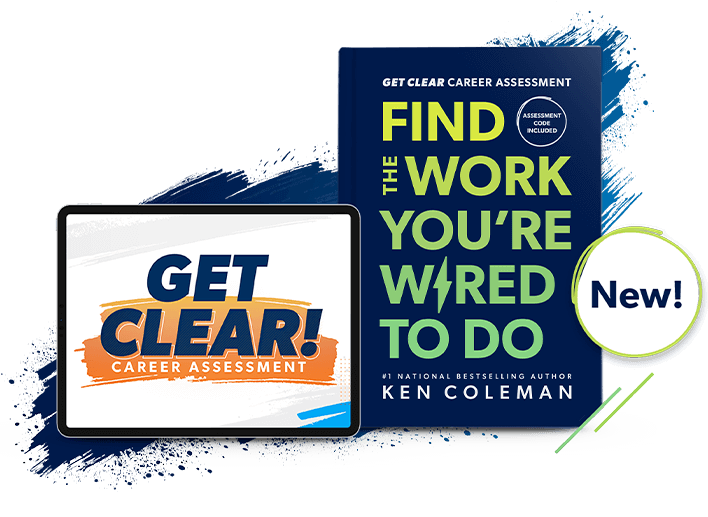

We’ve paired Ken Coleman’s bestselling Get Clear Career Assessment with his new book, Find the Work You’re Wired to Do, as the ultimate guide for finding a fulfilling and successful career.

Level Up Your Career

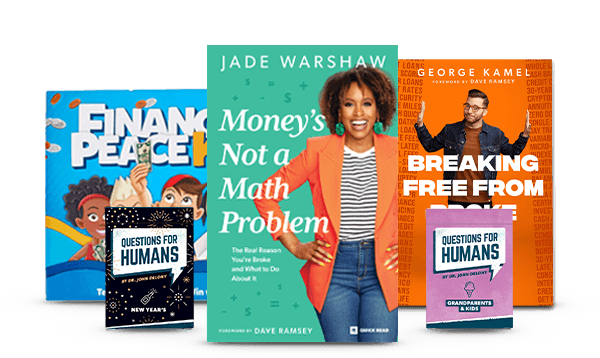

New Arrivals

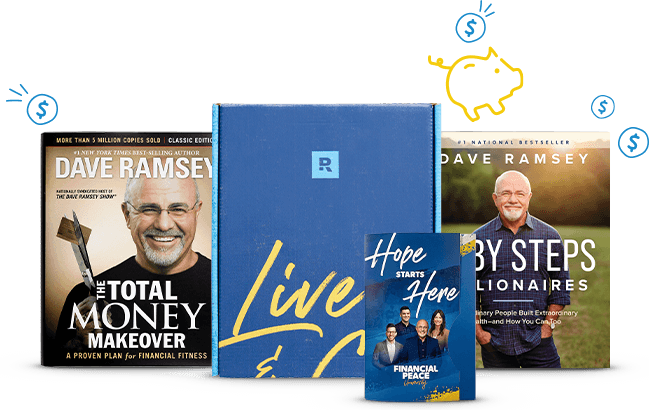

Most Popular

As Featured on The Ramsey Show