Natural Disasters: Are You Covered?

10 Min Read | Nov 21, 2023

Common sense tells us that homeowner’s insurance should cover our homes. But does it cover everything that could affect our homes, including “acts of God?” What about the 15 natural disasters the U.S. faced just last year that each caused more than a billion in damages—were those homes that were included in the $45 billion in losses protected by their homeowner’s insurance?(1)

It’s crucial to understand what exactly your homeowner’s insurance covers before an “act of God” occurs. You also need to know the catastrophe insurance options available to cover what your homeowner’s policy doesn’t. The last thing you want to find out after an event is that you don’t have the coverage you need.

Natural Disasters: What is an "Act of God”?

When it comes to insurance, an “act of God” generally refers to an event, like a natural disaster, that occurs “through natural causes and could not be avoided through the use of caution and preventative measures.”(2) A catastrophe like an earthquake or a tropical storm—regardless of how you might try to prepare for it—is simply out of your control.

Still, the question remains: What does your insurance cover? And what, if any, exclusions apply? Because policies vary depending on your location, your insurance carrier, and your risk levels, it’s wise to never assume you’re covered. Ask an insurance agent to help you understand what your policy entails and which exclusions may apply to you.

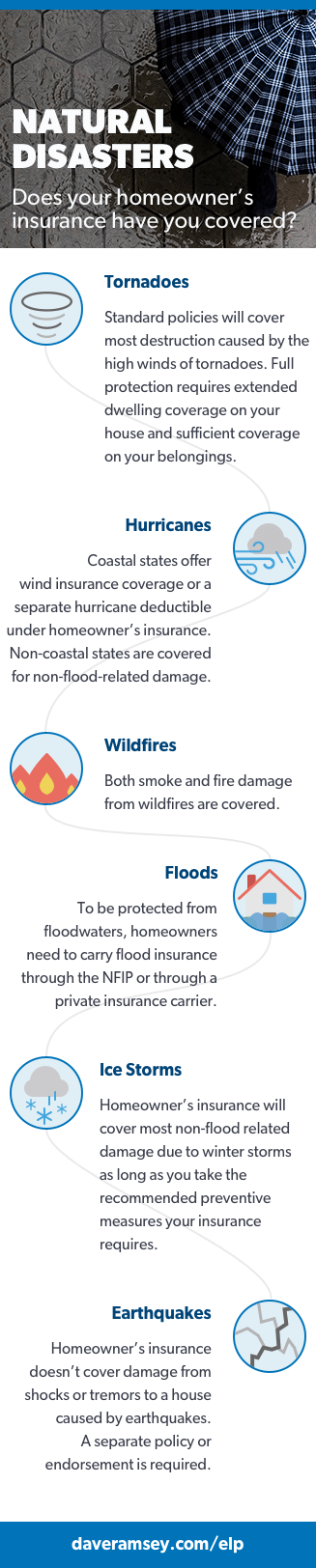

Below are some of the most common natural disasters and what you need to know about protecting your home with each of them.

Tornadoes

Every year about 1,200 tornadoes touch down in the United States bringing up to 300 mph winds with them.(3) Deemed the “most sudden, unpredictable and violent” storms on earth, tornadoes account for approximately 40% of catastrophe claims.(4, 5) While Florida sees its fair share of twisters, the many tornadoes occur in “Tornado Alley” which stretches all the way from west Texas to Iowa.(6) But, in the last two decades, “Dixie Alley” (a handful of southeastern states) has seen devastation far worse than “Tornado Alley” due to its weather conditions and higher mobile home population.(7)

Thankfully, standard homeowner’s insurance policies will cover most destruction caused by the high winds of tornadoes. Keep in mind that, in order to be fully protected insurance-wise, you need extended dwelling coverage on your house and sufficient coverage on your belongings. Otherwise, your insurance company will pay you for your home’s current market value, rather than what it would cost to rebuild.

Typically Covered by Home Insurance:

- Food spoiling in the freezer thanks to a power outage caused by a tornado

- Temporary relocation expenses (food and lodging)

- Wind damage (except in coastal states)

- Damage to your home due to a tree falling on it (assuming you didn’t already know you were at risk)

- Removal of a tree that causes damage to your home (regardless of who it belongs to)

Typically Covered by Car Insurance:

- Damage to your car resulting from the tornado

Hurricanes

Thanks to the Atlantic hurricane season (June through November) that affects nearly every coastal state, 19 states offer wind insurance coverage or a separate hurricane deductible under homeowner’s insurance.(8)

Rather than typical “dollar” deductibles, these deductibles are based on a percentage of the insured property to minimize possible losses. For example, if your home is worth $250,000 and you have a 10% hurricane deductible, you would need to pay $25,000 out of pocket before your insurance company would cover any repairs for hurricane damage. Outside of these states, homeowner’s insurance typically covers non-flood-related damage due to hurricanes.

Protect your home and your budget with the right coverage!

To be protected from floodwaters, homeowners need to carry flood insurance through the NFIP or through a private insurance carrier in addition to their homeowner’s policies.

Typically Covered by Home Insurance:

- Wind damage (except in coastal states)

- Temporary relocation expenses (food and lodging)

- Flooding caused by water coming through a hole in the roof

- A lightning storm destroys your favorite oak tree (up to $500)

- Food spoiling in the freezer thanks to a power outage caused by a hurricane

Typically Covered by Car Insurance:

- Hail damage to the hood of your SUV

Typically Covered by Wind Insurance:

- Home damage caused by wind-driven rain (in coastal states)

Typically Covered by Flood (or Hurricane) Insurance:

- Water damage to your home caused by flooding

- Water-damaged appliances thanks to a flood

- Furniture destroyed by floodwaters

Do You Have the Right Insurance?

Find out what insurance coverage you should add, tweak or drop based on your individual needs.

Wildfires

The first three quarters of 2017 alone saw nearly 50,000 wildfires rage across 8.4 million acres in the United States.(9) Whether it’s a campfire left unattended, burning debris that gets out of control, negligence or arson, approximately 90% of wildfires are caused by humans.(10)

The good news for homeowners is that you don’t need additional coverage, like a catastrophe insurance policy, to protect your home from wildfires—both smoke and fire damage are covered by your homeowner’s insurance.

Your insurance premium will largely depend on both the risk level of the area you live in and how close your home is to firefighting resources. If your community has taken steps to limit wildfire destruction, ask your local insurance agent if you’re eligible for a discount.

Typically Covered by Home Insurance:

- Damage from smoke or flames

- Loss due to looting or theft in the wake of a fire

- Fire caused by a broken gas line

- Temporary relocation expenses (food and lodging)

Typically Covered by Car Insurance:

- Fire damage to your car

Related: Saving money shouldn’t mean sacrificing coverage. People who have worked with an insurance Endorsed Local Provider saved over $700 and got 50% more coverage. Find out how much you could save.

Floods

Whether it’s rising water from a heavy rainfall, a hurricane, or a dam break, flooding is one of the most misunderstood natural disasters when it comes to both risk and insurance coverage.

It’s easy to think that because you live in a low-risk zone that you’re in a “no risk” flood zone. But you don’t have to live in a floodplain or be in a high-risk area to experience damage from floodwaters. In the last three years alone, Houston, Texas, has seen three “500-year floods” with waters affecting areas so low-risk that they were expected to flood just once every five centuries.(11)

Contrary to popular belief, damage from floodwaters is generally not covered under your homeowner’s insurance. Though approximately 90% of all natural disasters involve flooding, only about 12% of homeowners have coverage for it.(12,13)

To ensure your home and belongings are covered for damage caused by flood waters, you need to purchase flood insurance through the National Flood Insurance Program (NFIP) or through a private insurer. NFIP premiums for low-risk zones start out at $112 annually, but can range up to $1,200 in higher-risk areas.(14,15) Private flood insurance coverage offers higher limits of coverage, but it will likely be more expensive. Since NFIP coverage maxes out at $250,000 for your home and $100,000 for your belongings, some homeowners choose to add coverage through a private insurer or carry the entire amount through a private insurer.

Typically Covered by Home Insurance:

- Temporary relocation expenses (food and lodging)

Typically Covered by Flood Insurance:

- Water damage to your home caused by flooding

- Water-damaged appliances thanks to a flood (non-coastal states)

- Furniture destroyed by floodwaters (non-coastal states)

Typically Covered by Car Insurance:

- Flood damage to your car

Not Typically Covered by Insurance:

- Finished basements ruined by floodwater

- Landscaping washed away by floodwater

- Sewage backup into the house (ask about purchasing a separate policy)

Free Flood Preparedness Checklist

If you're ready to be prepared in case of a flood, here's a free checklist to help you stay on track.

Ice Storms

Each year, winter storms result in about $1.5 billion in claims, and in 2016 alone, winter storms accounted for nearly 7% of all catastrophe losses—causing everything from flooding and power outages, to trees and roofs collapsing under the weight of ice and snow.(16)

If you have homeowner’s insurance, you’ll likely be covered for most non-flood related damage due to winter storms as long as you take the recommended preventive measures your insurance requires, like keeping your heat on during a freeze or making sure your pipes are in good working condition. If your area is prone to heavy snowfalls and quick temperature changes that cause flooding, you may want to consider adding flood insurance through the NFIP or a private insurer. And don’t forget to carry comprehensive coverage on your car as well, as it’ll cover any needed repairs if black ice decides to take you and your car for a ride.

Winter storms may bring their share of damage, but you don’t have to face the winter season unprepared. With the right insurance in place, you can be protected!

Typically Covered by Home Insurance:

- Temporary relocation expenses (food and lodging)

- A neighbor slipping and falling after you just cleared the snow off your front porch

- Wind-driven rain or snow (except in coastal states)

- Roof damage due to hail

- Pipes bursting during a freeze (despite you taking preventative measures)

- Food spoiling in the freezer thanks to a power outage caused by the storm

Typically Covered by Wind Insurance:

- Hail damage to your home (in coastal states)

Typically Covered by Car Insurance:

- Fender bender with a tree due to black ice

Earthquakes

Of the more than three million earthquakes that occur worldwide every year, more than 900 of them measure a five or higher on the Richter scale. Historically, California experiences the highest number of quakes within the U.S. while Alaska tends to have the most destructive—up to a 9.2 on the Richter scale.(17)

Because homeowner’s insurance doesn’t cover damage from shocks or tremors to a house caused by earthquakes, private insurers or the nonprofit California Earthquake Authority (CEA) offer earthquake insurance. This is done through a separate policy or endorsement with a deductible that ranges from 5–15% of your policy limit.(18)

Keep in mind that when earthquakes occur more than 72 hours apart, they are typically considered separate events which would mean multiple claims and deductibles. Because deductibles usually run 2–20% of your home’s replacement value, this can add up to a large of out-of-pocket expense.(19)

Not all earthquake policies cover the cost to stabilize the land beneath the home, replace the structure of your home, or repair brick or stone, so be sure to ask your insurance agent exactly what features your policy offers, and how they define an “earthquake.”

Typically Covered by Home Insurance:

- Temporary relocation expenses (food and lodging)

- Shake damage to your home or foundation due to an earthquake

- The garage needs to be rebuilt due to an earthquake

Typically Covered by Car Insurance:

- Damage to your car resulting from the earthquake

Natural Disasters: Are You Covered?

Due to the billions of dollars in claims natural disasters have cost insurance companies—nearly $50 billion in 2016 alone—many have made changes to their coverage that make it important to have a healthy emergency fund in place so you’re prepared to handle some of the costs yourself.(20)

Don’t wait until it’s too late to get educated about your coverage. Though adequate coverage may come at a significant cost, the consequences for not having it can quickly add up. Ask your insurance agent to explain exactly what your insurance covers so you know what to expect if you need to file a claim. And don’t be afraid to shop around for the best rate! You want the most affordable policy that will provide the right amount of coverage for you and your family.

In tough times, the right insurance coverage can make all the difference when you and your family are trying to rebuild everyday life.

Contact one of our ELPs today to ensure that, when the winds of change come, you are standing on solid financial ground.