Remember Jack and those magic beans of his? Well, cash value life insurance promises magic beans—like, you know, cash—but it turns out those beans don’t grow into much at all. (Definitely not on that giant, skyscraper-size beanstalk level.) That’s because life insurance companies aren’t great at investing and should stick to what they do best: replacing your income when you die.

So, what is cash value life insurance? And what’s the cash value of a life insurance policy? Most importantly, is it worth the effort? We’ll help you cut through the confusion and find the answers you’re looking for.

What Is Cash Value Life Insurance?

Cash value life insurance is a type of life insurance policy that’s in place for your whole life and comes with a sort of savings account built into it.

So, you’re paying for two things here—the life insurance part (the bit that covers your family if you die) and the cash value part (the savings account that supposedly grows your money over time). How much it grows really depends on the type of cash value policy you buy, and what its returns are.

Types of Cash Value Life Insurance

Each of these policies works a little differently—and there’s a lot of fine print to wade through. Here’s a breakdown of each type of cash value life insurance.

Whole Life Insurance

Whole life insurance is the least flexible of the three choices we’re going to cover. Once you decide on your premium, that amount gets permanently specified in your policy. You’re stuck paying that premium amount every year (or month) for, well, your whole life. A slice of that premium will go into the cash value part of your policy, and that can’t change either. You can expect your rate of return to hover around 2%—so it’ll basically just keep up with inflation. The longer your policy lasts, the more cash value you’ll build up.

Universal Life Insurance

Universal life insurance is different (and more complicated) when compared to whole life because it comes with “flexible” premiums and payouts. This means you have some control over how much you pay in premiums. If you’re feeling flush, you could "overpay" your monthly premium and have the difference go into the cash value side of your policy. And if you’ve built up enough of that cash value over time, this could be used to reduce your premiums (more on this later).

When it comes to how your money will build up over time, it all depends on the type of universal life insurance you have (remember when we said it was complicated?). These types are: variable universal life, guaranteed universal life and indexed universal life.

Variable Life Insurance

Variable life insurance serves up an extra helping of complication because unlike regular universal life and whole life—both of which can have a guaranteed rate of return—variable life allows you to decide how your cash value is invested. This could be in stocks or bonds, for example. So you’d be making the call, and it’s a risky one if you’re not always keeping an eye on your investments. (If you really want to get into the weeds with complicated rip-offs, you can also learn about variable universal life insurance here.) Oh, and variable life insurance comes with crazy-high fees, so don’t expect to see much cash value in the first three years!

How Does Cash Value Life Insurance Work?

That phrase “cash value” sounds cool, doesn’t it? Maybe you’re thinking you’ll have your own personal ATM that spits out cash whenever you need it. Sadly, it doesn’t live up to that promise.

Compare Term Life Insurance Quotes

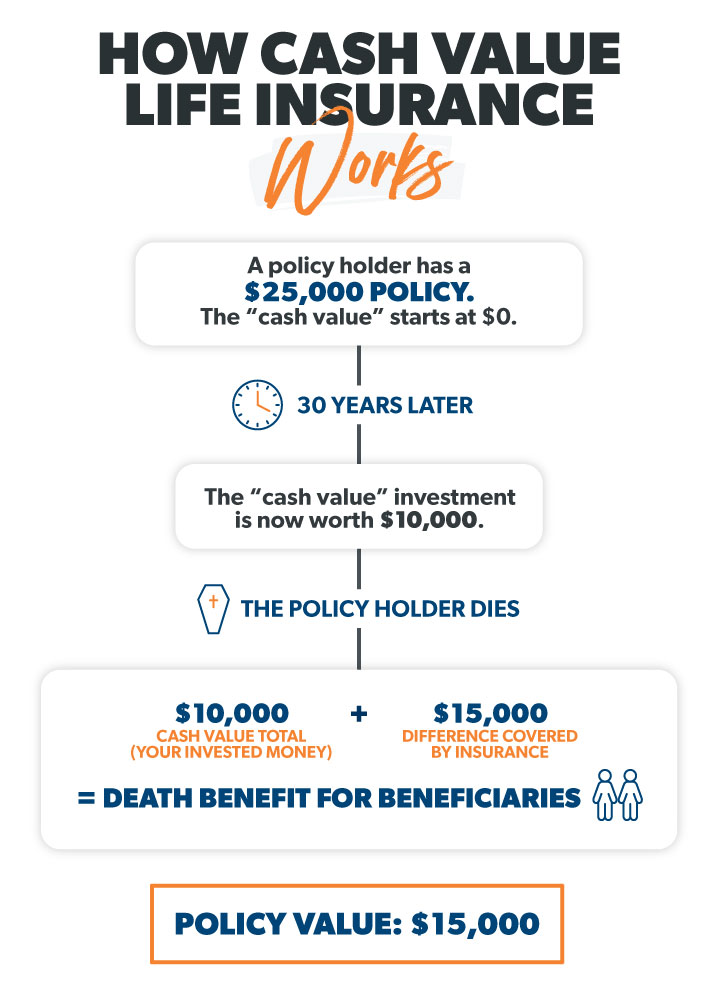

Cash value works like this: Say you’re paying $100 a month for your cash value life insurance policy. A portion of that $100 covers the cost of actually insuring your life and the rest is put into investments by the insurance company.

The breakdown of how much is invested versus how much goes toward your policy varies over the years. In the earlier years, a larger percentage of your premiums is put toward the cash value, while in the later years, more of your premiums are going toward your policy since the cost of insurance will increase as you age.

These investments are meant to build and make you money over time. As we said earlier, the rates of return on your cash value investment depend on what type of cash value life insurance you’re buying.

Insurance companies will point to the cash value as a positive thing. You pay your premium, part of it gets invested, and eventually you get a pile of cash . . . just as long as you’re still alive.

Wait, what?

Yep. Most of the time, if you don’t use the cash value while you’re alive, it goes back to the insurance company when you die.

Here’s the thing: If you try to get your hands on some cash from your cash value life insurance after a year, guess how much you’ll have? A big fat zero. After three years? Still zero.

During those first few years, you’ll see no cash value because of all the fees, expenses, commissions and costs you’re paying to the insurance company just to have a policy in the first place!

How Do I Access the Cash in Cash Value Life Insurance?

Jack didn’t have to wait long for those magic beans to turn into a huge beanstalk. But what is the cash value of a life insurance policy—and are you willing to wait 10–15 years for some decent cash value? Because that’s how long it’ll take.

Let’s say you can wait 10–15 years to build up your cash value. How can you take it out? Well, here are your choices, depending on whether you’ve got whole life or universal/variable life insurance . . .

1. You can take out a loan against the cash value.

- With whole life: Taking out a loan against the cash value is the worst thing you can do. Why? First up, you’re going into debt, which is never a good idea. Second, you’ll have to pay interest on the loan, and if you don’t pay all of it back, your death benefit will decrease. Think about how crazy this is—you’re paying interest on a loan made up of your own money.

- With universal or variable: The same applies as with whole life insurance. Your death benefit will reduce if you take out a loan against your universal/variable cash value. And you’ll pay interest on the loan you’ve just taken out too.

2. You can make a partial withdrawal.

This is the closest you’ll get to actually taking out cash. But if you withdraw money and don’t put it back into your policy, guess what happens? Your death benefit (you know, the money that’s paid out when you die) will decrease.

- With whole life: Although you may be able to cash out a portion of the dividend paid by the insurance company, you cannot use the cash value you’ve accumulated like an ATM without surrendering the policy. That’s crazy, considering it’s your invested money, but it's so hard to get your hands on it!

- With universal or variable: A partial withdrawal is like getting a chunk of the death benefit early. So, the amount you withdraw is subtracted from the death benefit payout at the end. You won’t get taxed on your withdrawal if it’s for an amount that adds up to less than what you’ve paid in premiums.

3. You can surrender the policy.

- With whole life: This means you tell your insurance company you want to give up the policy and get the entire cash value you’ve built up in one lump sum. Sounds easy enough, right? But you’ll have to pay a fee to the insurance company, and you’ll be taxed on the amount you receive if it’s more than what you’ve paid in premiums over the years!

- With universal or variable: Surrendering your policy has the same results as with whole life. Giving up the policy and cashing in your cash value comes with fees. Oh, and don’t forget—because you’ve surrendered the policy, you’ve also ended your life insurance coverage.

4. You can sell your policy for a life insurance settlement.

- With whole life: Instead of surrendering your policy, you could sell it for a cash settlement. Cash sounds good, right? Especially if your premium is high or your kids have left the nest. But there’s a catch! (There’s always a catch.) The broker who sets you up with the company buying your policy will get a cut from your settlement amount. And when it comes to the settlement, it’ll be less than your death benefit amount. The company buying your policy (usually some sort of investment company) will try to swing this by saying that while you’re getting less money than your death benefit, you’re receiving more than whatever cash value you have. That doesn’t mean a lot since it’s your money in the first place! Plus, if your settlement is more than the total you’ve paid over the years in premiums, you’ll pay capital gains and income tax on this “profit.”

- With universal or variable: Selling your policy comes with similar issues to whole life. You’ll pay taxes on the amount you’ve made in cash value if it totals more than what you’ve paid in premiums over the years.

5. You can pay your life insurance premium with the cash value.

- Whether you have whole life or universal/variable:

Some folks use their cash value to pay for the monthly or annual premium itself. That’s if they’ve built up a big pile of cash, of course! But this makes no sense, because the whole point of cash value life insurance is to use the cash value to spend on the fun stuff—not to use those savings on the actual life insurance bill. This is not smart financial planning.

Notice how all of these ways of accessing the cash value come with a catch? You’ll either slash your death benefit, face a heavy tax, or pay a fee. Getting a hold of the cash value without any consequences to you isn’t in the insurance company’s interests. It’s how they make their money, and yet another reason to stay away from cash value life insurance.

Get Term Life Insurance Rates from Zander Today!

RamseyTrusted partner Zander Insurance will get you rates from top life insurance companies and pair you with the one that fits you best.

Is Cash Value Life Insurance a Good Way to Boost My Retirement Income?

This one’s easy: No! One of the worst things you can do is buy cash value life insurance with the hopes of it helping you in retirement. The returns will barely keep up with inflation, and you’ll get hit with tons of fees and commissions.

You’d be much better off buying a term life policy and investing 15% of your household income into good growth stock mutual funds through a Roth IRA and/or 401(k).

What Happens to the Cash Value When You Die?

By now you’ve probably gotten the hint—cash value life insurance is a total waste of money. But we haven’t even hit the worst part! Like we mentioned before when you die, the only payment your family will get is the death benefit amount. Any cash value you’ve built up will go back to the insurance company.

Just let that sink in.

You faithfully invested your whole life only to leave all that money to the insurance company. Doesn’t sound right, does it? But that’s how insurance companies make their money, and that’s why they’re so quick to sell you cash value life insurance.

The Difference Between Cash Value and Term Life Insurance

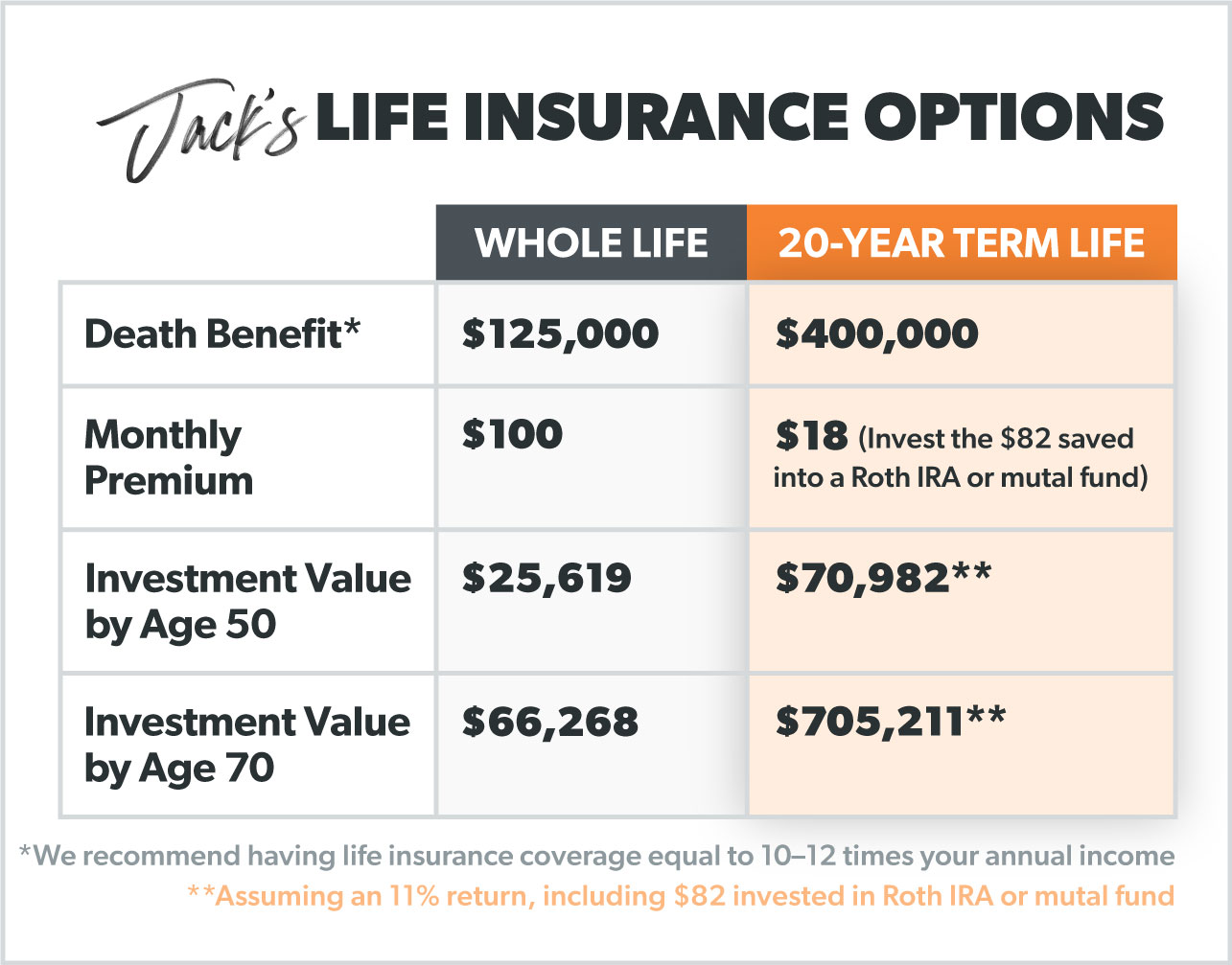

Let’s talk about a different Jack. He’s 30 years old, doesn’t smoke, is pretty healthy, and wants life insurance. But he’s really confused with all the options out there. (Aren’t we all, Jack?)

He heard that a term life insurance policy is different because it only lasts for a certain amount of time (we recommend 15–20 years). He knows a term life insurance policy is just life insurance and no cash value, so that makes it cheaper. This Jack might not have magic beans, but he wants to make the most of what he does have. So what are his options?

When it comes to Jack’s death benefit, term life offers almost four times as much coverage. But he’s only paying $18 a month for it! If he follows Dave’s advice when it comes to investing and paying off his debts, he would be self-insured by the time he reaches retirement. The biggest difference between a term life insurance policy and a cash value policy is the price he would pay every month. Even though he’s putting some of the $100 of his cash value premium into investments, it’s not going to make him as much in the long run compared to investing outside of his life insurance policy.

Monthly Estimate

0 - 0

What Life Insurance Does Dave Ramsey Recommend?

Dave always says not to buy life insurance as an investment! That’s not what it’s for—and it’s a lousy way to invest.

In recent years, more people have been buying cash value policies, so it’s even more important for us to say this loud and clear: With cash value life insurance, you’re throwing away more of your cash while you’re still alive when you could be saving and investing it somewhere else for much more return.

If you’re in debt and think cash value life insurance will help you down the line, it won’t. You (and your family) will be better off getting a term life policy and putting 15% of your household income into a Roth IRA or 401(k) that offers good mutual funds instead. It’s the smart way to make your cash work for you!

Next Steps

- Learn more about how cash value life insurance stacks up against a better option, term life insurance.

- Learn more about what life insurance should really do for you.

- Calculate how much term life insurance you need.

- Get in touch with a RamseyTrusted insurance expert from Zander Insurance and get a free quote today.

Interested in learning more about life insurance?

Sign up to receive helpful guidance and tools.