Life Has No Remote. Get Up and Change the Channel.

5 Min Read | Sep 23, 2021

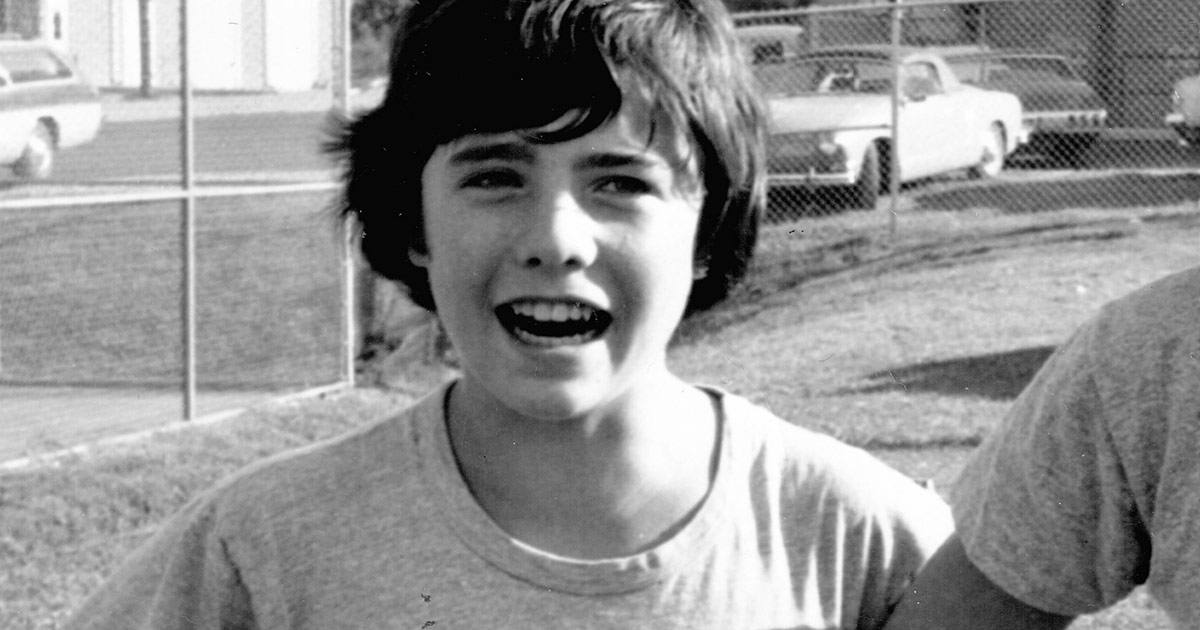

When I was a little kid in the 1960s, all the TVs in our neighborhood had a remote channel changer. I remember the three channels on the TV—ABC, NBC and CBS ruled the world. Walter Cronkite and David Brinkley were the deliverers of all truth on the nightly news, be it good or bad.

On my birthday around 5 years old or so, we bought our first color TV. For my birthday, we had a Super-Saturday-Cartoon-in-Color party so all the neighborhood kids could come and see cartoons in color. For a short moment I was popular. The TV my parents so proudly bought was the size of a small pickup truck. In those days the TV was a piece of furniture—a large piece of furniture. I think years later it was thrown out after a lot of discussion with a local cabinet maker about turning it into a liquor cabinet. Yea, we used to have cabinets for our liquor in the ’60s too.

This TV was so cool we actually ran a wire out the window to a big-time antenna on the roof to increase the quality of the signal. Gone were the old rabbit ears and the instructions to hold them just right by my dad. But the most groundbreaking, life-changing technology this TV had was a Remote Channel Changer. It was a small handheld device that notified the TV with a “click” to change the channel. The changer was a “clicker” . . . and that is what we call changers in my home to this day. “Give me the clicker”—although channel changers haven’t “clicked” in 50 years.

This marvel of technology gave hope to all the kids on my street that they too could be set free from the slavery of being the manual TV channel changer. You see, when I said all the TVs in my neighborhood had remote channel changers, I was telling the truth. The channel changers just looked like little kids. The dad would position himself after hard day’s work and a great dinner in the recliner. He would grab the 5x7 magazine called the TV Guide, the bible for TV watchers that detailed the times and content of the important programing on the three channels. Then as the evening progressed—if the program was slow or even if it wasn’t—the dad would proclaim to the kid on the floor, “change the channel.” We small children were the remote changers for the dads in the recliners. Then came the “clicker,” the emancipation of our slavery.

It is possible the remote began the downfall of our civilization. I have wasted hours and maybe years of my life surfing channels. For no apparent reason, I stumble into a movie I have seen six times and watch it again. Sucked into digital distraction addiction like a crack cocaine addict. With an intellectual hangover, I feel like a complete failure. Sometimes—too often—because of the remote, I am no longer intentional about what I watch. You see back in the pre-remote age, we actually watched things on purpose.

I have noticed my life is like that. I actually have to do things on purpose if I want to win. What I do on purpose, what I am intentional about, what I pay attention to, I win at. Life doesn’t have a remote. You have to get up and change the channel. When I take the easy path and don’t make clear purposeful decisions, I settle for mediocrity. What I pay attention to I win at. When I pay attention to my wife, my marriage is better. But you can ask her. In 37 years of marriage, I haven’t always done that. You can bet your life that when we were dating, she got my full, undivided attention, and guess what? We got married. When I run a half marathon, I have to focus on training. If I don’t, race day is embarrassing. People who get out of debt don’t do it by accident. You can wander into debt, but you can’t wander out. People don’t win by accident. No one wins the World Series and says, “Wow! How did that happen?”

The bad news is my success is up to me. The great news is my success is up to me. Yes, there are systems and prejudices that are stacked against me and you. We can’t control those, but we can control what we pay attention to. So what do you want to win at? Parenting, marriage, physical condition, weight, college degree, career, wealth, generosity, spiritual growth—what is it you want to win at? You can do this. I know it will be hard. But it will be worth it. You can do this. The people who win are not different than you and me, but they did pay attention. Life has no remote. Get up and change the channel.