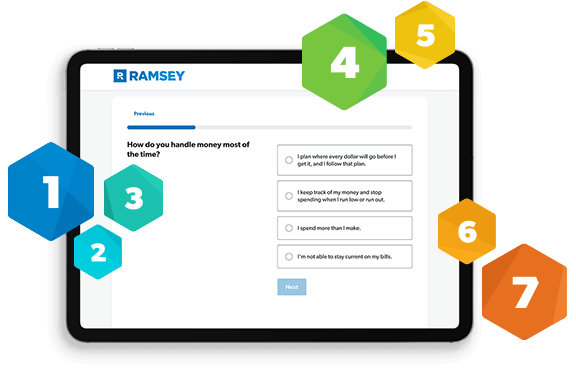

You can take control of your money! Dave Ramsey's 7 Baby Steps will show you how to save for emergencies, pay off all your debt for good, and build wealth. It’s not a fairy tale. It works every single time!

Step 1: Save $1,000 for your starter emergency fund.

Step 2: Pay off all debt (except the house) using the debt snowball.

Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

Step 4: Invest 15% of your household income in retirement.

Step 5: Save for your children’s college fund.

Step 6: Pay off your home early.

Step 7: Build wealth and give.

Why the Baby Steps Work

Forget everything you know about money-management plans. With Dave’s 7 Baby Steps, you don't need a degree in finance to take control of your money. Anyone can do it! With each step, you’ll change how you handle money—little by little.

Education

Learn how to better manage your money.

Encouragement

Build momentum with small wins along the way.

Empowerment

Make financial decisions with confidence in every aspect of your life.

Work the Baby Steps

Follow the proven plan that’s helped millions of people ditch debt and build wealth!

Financial Peace University

Take the course that's helped millions of people beat debt, build wealth, and live and give like no one else.

The Total Money Makeover

Get Dave’s #1 bestselling book and read inspiring stories of people who have learned how to manage their money the right way.

Baby Steps Millionaires

You can baby step your way to becoming a millionaire. Learn the quickest right way in Dave's newest book.

FREE Customized Plan

We’ll create a custom plan just for you to help you take control of your money. It only takes three minutes—and it’s FREE!

Baby Step 1: Save $1,000 for Your Starter Emergency Fund

In this first step, your goal is to save $1,000 as fast as you can. Your emergency fund will cover those unexpected life events you can't plan for. And there are plenty of them. You don’t want to dig a deeper hole while you’re trying to work your way out of debt!

Baby Step 2: Pay Off All Debt (Except the House) Using the Debt Snowball

Next, it’s time to pay off the cars, the credit cards and the student loans. Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Attack that one with a vengeance. Once it's gone, take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That's what's called the debt snowball method, and you’ll use it to knock out your debts one by one. Find out your debt-free date with the Debt Snowball Calculator.

Baby Step 3: Save 3–6 Months of Expenses in a Fully Funded Emergency Fund

You’ve paid off your debt! Don’t slow down now. Take that money you were throwing at your debt and build a fully funded emergency fund that covers 3–6 months of your expenses. This will protect you against life’s bigger surprises, like the loss of a job or your car breaking down, without slipping back into debt.

Baby Step 4: Invest 15% of Your Household Income in Retirement

Now you can shift your focus off debts and what-ifs and start looking up the road. This is where you begin regularly investing 15% of your gross income for retirement. Because if you're still working at 67, it should be because you want to, not because you have to. An investing pro can help you build a solid strategy.

Baby Step 5: Save for Your Children’s College Fund

By this step, you've paid off all debts (except the house) and started saving for retirement. Next, it's time to save for your children’s college expenses (that is, if they pass Algebra II and Chemistry). We recommend 529 college savings plans or ESAs (Education Savings Accounts).

Baby Step 6: Pay Off Your Home Early

Now, bring it all home. Baby Step 6 is the big dog! Your mortgage is the only thing between you and complete freedom from debt. Can you imagine your life with no house payment? Learn how extra money put towards your mortgage can save you tens (or even hundreds) of thousands of dollars in interest with our Mortgage Payoff Calculator.

Baby Step 7: Build Wealth and Give

You know what people with no debt can do? Anything they want! The last step is the most fun. You can live and give like no one else. Find out your current net worth, then keep building wealth and become outrageously generous, all while leaving an inheritance for your kids and their kids. Now that's what we call leaving a legacy!

Baby Step 1: Save $1,000 for Your Starter Emergency Fund

In this first step, your goal is to save $1,000 as fast as you can. Your emergency fund will cover those unexpected life events you can't plan for. And there are plenty of them. You don’t want to dig a deeper hole while you’re trying to work your way out of debt!

Free Resources for Baby Step 1

Baby Step 2: Pay Off All Debt (Except the House) Using the Debt Snowball

Next, it’s time to pay off the cars, the credit cards and the student loans. Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Attack that one with a vengeance. Once it's gone, take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That's what's called the debt snowball method, and you’ll use it to knock out your debts one by one. Find out your debt-free date with the Debt Snowball Calculator.

Baby Step 3: Save 3–6 Months of Expenses in a Fully Funded Emergency Fund

You’ve paid off your debt! Don’t slow down now. Take that money you were throwing at your debt and build a fully funded emergency fund that covers 3–6 months of your expenses. This will protect you against life’s bigger surprises, like the loss of a job or your car breaking down, without slipping back into debt.

Baby Step 4: Invest 15% of Your Household Income in Retirement

Now you can shift your focus off debts and what-ifs and start looking up the road. This is where you begin regularly investing 15% of your gross income for retirement. Because if you're still working at 67, it should be because you want to, not because you have to. An investing pro can help you build a solid strategy.

Baby Step 5: Save for Your Children’s College Fund

By this step, you've paid off all debts (except the house) and started saving for retirement. Next, it's time to save for your children’s college expenses (that is, if they pass Algebra II and Chemistry). We recommend 529 college savings plans or ESAs (Education Savings Accounts).

Baby Step 6: Pay Off Your Home Early

Now, bring it all home. Baby Step 6 is the big dog! Your mortgage is the only thing between you and complete freedom from debt. Can you imagine your life with no house payment? Learn how extra money put towards your mortgage can save you tens (or even hundreds) of thousands of dollars in interest with our Mortgage Payoff Calculator.

Baby Step 7: Build Wealth and Give

You know what people with no debt can do? Anything they want! The last step is the most fun. You can live and give like no one else. Find out your current net worth, then keep building wealth and become outrageously generous, all while leaving an inheritance for your kids and their kids. Now that's what we call leaving a legacy!

Baby Step 1: Save $1,000 for Your Starter Emergency Fund

In this first step, your goal is to save $1,000 as fast as you can. Your emergency fund will cover those unexpected life events you can't plan for. And there are plenty of them. You don’t want to dig a deeper hole while you’re trying to work your way out of debt!

Free Resources for Baby Step 1

Baby Step 2: Pay Off All Debt (Except the House) Using the Debt Snowball

Next, it’s time to pay off the cars, the credit cards and the student loans. Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Attack that one with a vengeance. Once it's gone, take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That's what's called the debt snowball method, and you’ll use it to knock out your debts one by one. Find out your debt-free date with the Debt Snowball Calculator.

Baby Step 3: Save 3–6 Months of Expenses in a Fully Funded Emergency Fund

You’ve paid off your debt! Don’t slow down now. Take that money you were throwing at your debt and build a fully funded emergency fund that covers 3–6 months of your expenses. This will protect you against life’s bigger surprises, like the loss of a job or your car breaking down, without slipping back into debt.

Baby Step 4: Invest 15% of Your Household Income in Retirement

Now you can shift your focus off debts and what-ifs and start looking up the road. This is where you begin regularly investing 15% of your gross income for retirement. Because if you're still working at 67, it should be because you want to, not because you have to. An investing pro can help you build a solid strategy.

Baby Step 5: Save for Your Children’s College Fund

By this step, you've paid off all debts (except the house) and started saving for retirement. Next, it's time to save for your children’s college expenses (that is, if they pass Algebra II and Chemistry). We recommend 529 college savings plans or ESAs (Education Savings Accounts).

Baby Step 6: Pay Off Your Home Early

Now, bring it all home. Baby Step 6 is the big dog! Your mortgage is the only thing between you and complete freedom from debt. Can you imagine your life with no house payment? Learn how extra money put towards your mortgage can save you tens (or even hundreds) of thousands of dollars in interest with our Mortgage Payoff Calculator.

Baby Step 7: Build Wealth and Give

You know what people with no debt can do? Anything they want! The last step is the most fun. You can live and give like no one else. Find out your current net worth, then keep building wealth and become outrageously generous, all while leaving an inheritance for your kids and their kids. Now that's what we call leaving a legacy!

Who Is Dave Ramsey?

More than 25 years ago, Dave Ramsey fought his way out of bankruptcy and millions of dollars of debt. He took what he learned and started teaching people God's and Grandma's ways of handling money. Since then, Financial Peace University has helped nearly 10 million people take control of their money for good. Today, The Ramsey Show, formerly known as The Dave Ramsey Show, reaches more than 18 million listeners every week on the Ramsey Network radio show and podcast.

Get a FREE Customized Plan for Your Money!

Answer a few questions and we’ll create a custom plan just for you to help you take control of your money. It only takes three minutes!