Home Maintenance: Your Handy Checklist

13 Min Read | Sep 11, 2023

Owning a home is a big deal, and it’s the biggest investment most people will make in their lifetime. So let’s hear it for being house-proud!

But being house-proud also means keeping your home in good condition inside and out. It’s about tackling those maintenance jobs that (let’s face it) some of us forget about or put off until it’s too late. Those delays in maintenance can cost you lots down the road and lead to your house owning you instead of the other way around.

Part of homeownership is being proactive about taking care of your castle and having a home maintenance plan. So get out your toolkit because we’re about to take you through the essentials of home maintenance.

Home Maintenance: What Should I Do and When?

Let’s start our home maintenance checklist with some tasks you can do yourself to keep your home running like a well-oiled machine inside and out. They’ll help you get the most out of your appliances and fixtures and help your biggest asset—your home—hold on to its value.

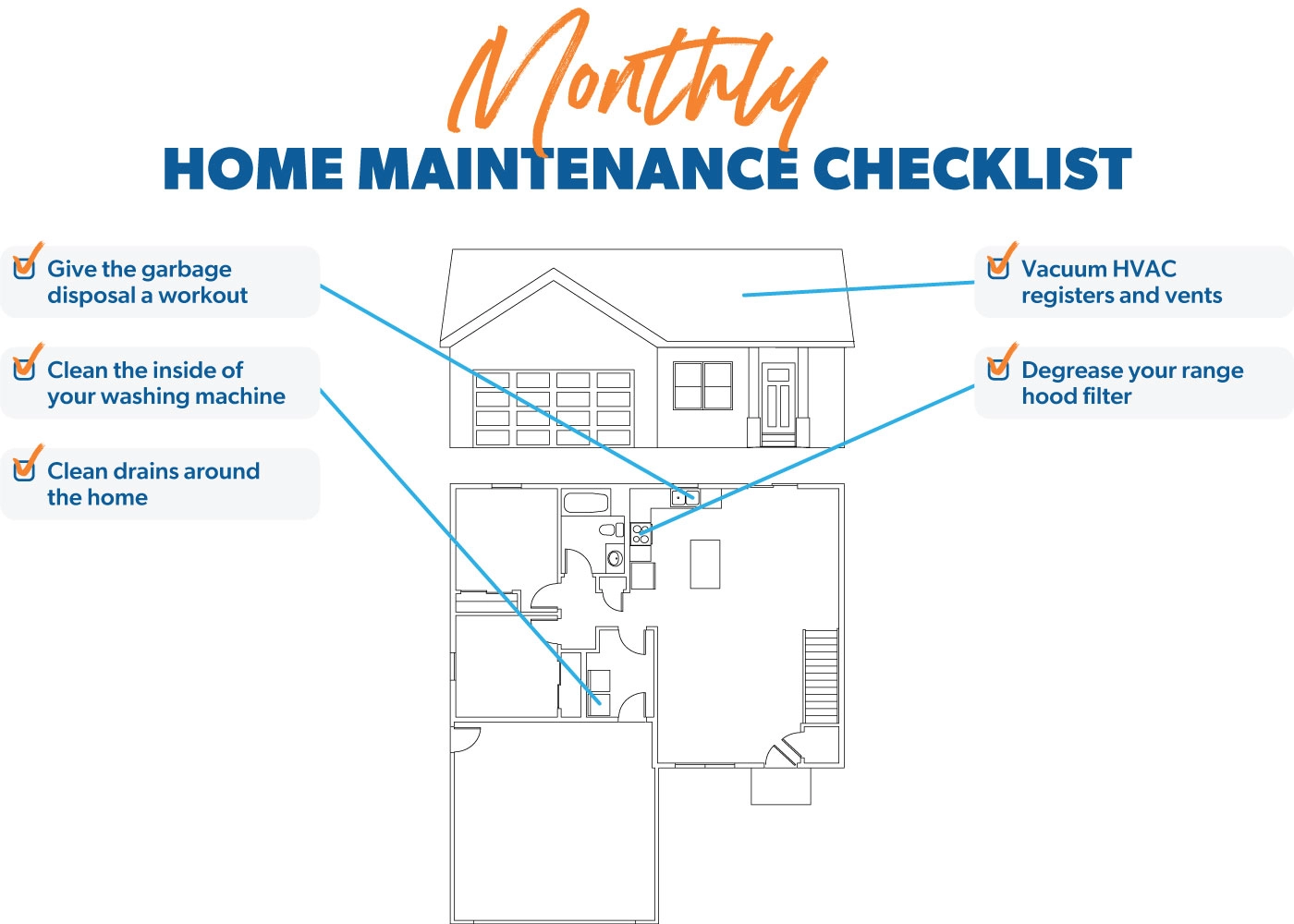

Monthly

Every 30 days, check these jobs off the list to keep some of your most important household tools in tip-top shape.

Clean the inside of your washing machine. Use store-bought sachets or throw a cup of white vinegar into an empty machine during a hot wash cycle to rinse away limescale and soap scum. Leave front-loading machine doors open after a wash to prevent mold from forming around the rubber seal.

Give the garbage disposal a workout. Run some ice cubes through the disposal to sharpen the blades. Vinegar and baking soda make a sizzling combo for breaking down food and grease buildup and freshening the insides.

Clean drains around the home. Hair. Soap. Limescale. Ugh! Rid your sinks, showers and bathtub drains of these things by using the vinegar and baking soda trick or grab a store-bought solution if you have a slow-flowing or smelly drain.

Degrease your range hood filter. If you love to cook (and even if you don’t), the extractor hood filter soaks up all the grease and aromas, so give it a clean every month to keep it running well.

Vacuum HVAC registers and vents. Your HVAC (heating, ventilation and air conditioning) system can become overworked and inefficient if you don’t keep the vents and registers clear of all dust and lint. You don’t want a shower of that stuff raining down on you anyway.

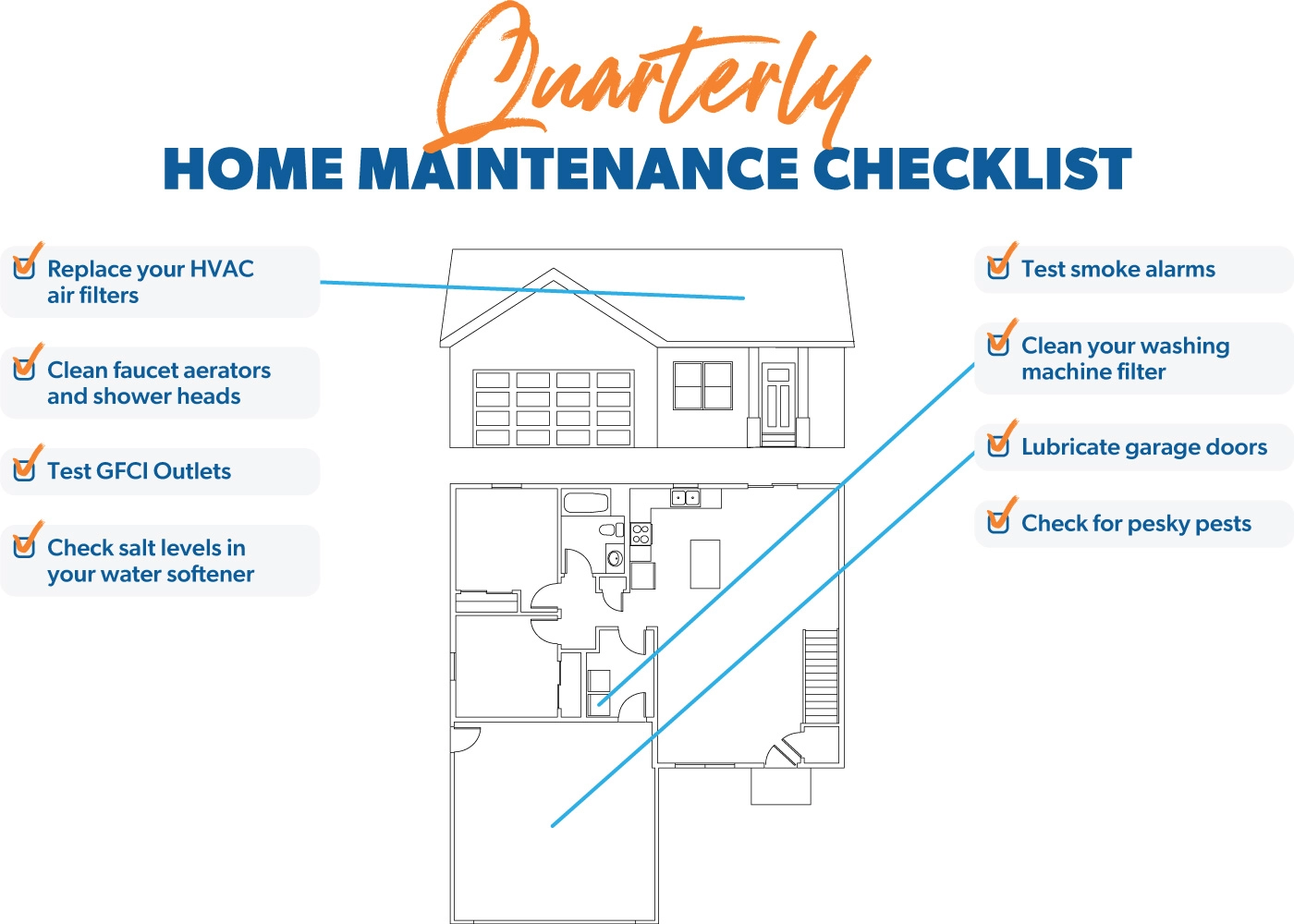

Quarterly

These items require your attention about every three months or so.

Replace your HVAC air filters. The amount you use your HVAC unit really affects how often you need to replace your air filters. Some folks replace their filters every couple of months and some do it monthly. This also depends on the thickness of the filter (1-inch filters need to be changed out more often than 4-inch ones). But at minimum, you should replace your filters quarterly.

Clean faucet aerators and shower heads. Dirty aerators (those things that look like a little net where the water comes out of your faucet) could mean limescale and dirt are blocking the water stream, and that can affect water pressure. The same goes for showerheads! A quick scrub will keep them flowing freely.

Clean your washing machine filter. This filter in your machine picks up larger bits of debris and lint from your clothes. Unscrew the filter and clean it every few months to keep your machine running well.

Find expert agents to help you buy your home.

Test smoke alarms. Alarms come with a test button to make this a quick and easy job. If your smoke alarms aren’t hooked up to your home’s power system, you should also replace the batteries every year—even if the low-battery beep hasn’t kicked in yet.

Lubricate garage doors. Garage doors have moving parts that need dusting and proper lubrication every few months. It’s also smart to coat the door springs (if you have them) with lubricant to lengthen their life. Visit your hardware store to grab some heavy-duty garage door lubricant to do the job.

Test GFCI outlets. Usually, in your bathroom and kitchen, you’ll see outlets with buttons that say test and reset on them. These are ground fault circuit interrupter (GFCI) outlets, and they monitor the electricity flowing through them to prevent shocks. Press test and then reset every few months to make sure the trip function is working correctly.

Check salt levels in your water softener. If you have a water softener unit (it removes minerals that cause hard water) connected to your water system, check the salt levels inside every few months.

Check for pesky pests. Ants? Termites? Spiders? Wasps? It’s worth keeping your eyes peeled for signs of pests inside and outside your home every few months. You can take care of some problems with over-the-counter products, while some might require professional attention.

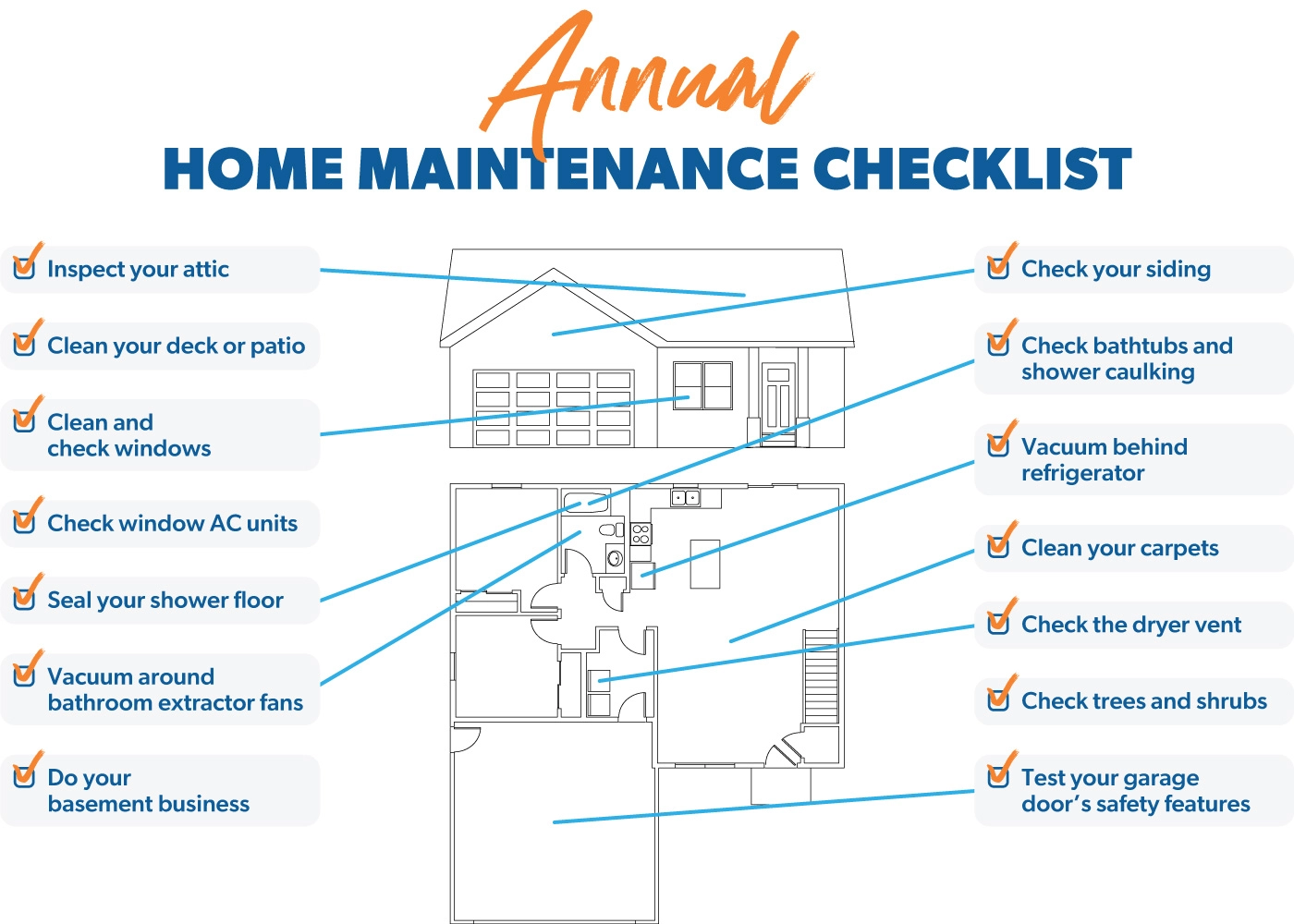

Annually

These are the jobs you should take care of every year. They usually require a little more time and effort . . . which is why you only have to do them once a year. Keep these tasks on your annual maintenance checklist and mark them off as you go.

Clean your deck or patio. Wooden decks tend to rot if they’re not properly maintained. If you’ve got a wooden deck stained with a thinner, transparent varnish, restain it every year or so. And remember those wood fences, too!

Check your exterior. If your home has wooden siding, inspect it annually for any signs of damage, rot or peeling paint. Also, check for cracks around the foundation of your home. It’s better to find them now before they turn into bigger issues.

Check the trees and shrubs. Monitor trees and shrubs that might be a bit too close to your house or need a trim. Get in touch with a tree doctor to check on the health of your trees if you need to.

Check the clothes dryer vent. The vent for your clothes dryer should be free of dirt and lint. While you’re running a load of laundry through the dryer, go outside to make sure the vent is doing its job. It should be releasing lots of fresh-smelling air. A clogged dryer vent can make your dryer less efficient and can start a fire!

Test your garage door’s safety features. Your garage door should have stop and auto reverse motion detection to sense if an object is in its path. Get a two-by-four piece of wood and place it underneath the open door, then close the door using the button on the wall. The door should stop closing once it detects the wood and go back up.

Inspect your attic. If you have an attic, get up there at least once a year to clean, check for pests, and rule out leaks after heavy rain.

Clean your carpets. Get your carpets cleaned professionally every year or so to keep them looking great and to remove allergens and odors. Or if you feel up to it, rent one of those rug cleaning machines at the grocery or home improvement store and do it yourself.

Check bathtubs and shower caulking. Retouch caulking around your bathtub and shower if there are places that need it.

Seal your shower floor. If your shower floor is tiled, clean the grout every year. There are lots of grout cleaners out there. Apply a sealant to protect the shower floor from all the water.

Vacuum around bathroom extractor fans. Clear away any dust and cobwebs from around extractor fans. Those are the ones that suck the moisture out of your bathroom, which can prevent mold and mildew (especially if your bathroom doesn’t have a window).

Vacuum behind the refrigerator. Do you know those coils on the back of your fridge? You should gently brush and vacuum them once a year to stop the fridge from needlessly working overtime.

Clean and check windows inside and out. Clear away dead bugs from between your bug screen and windowpane. Check window screens for holes and replace them if needed. Check the condition of weather stripping around your windows and doors, too. Any big gaps could mean losing heat in winter and cool air in summer.

Check window air conditioning units. If you have in-window units, clean them every year. There are lots of places where dust and dirt can get in and shorten the life of your unit.

Do your basement business. Basements can be a bit “out of sight, out of mind,” but try not to neglect them! Give basements a thorough cleaning every year and check for mold and cracks in the walls. Clean the window wells outside any basement windows too. You might have a sump pump (it removes accumulated water from the area), so inspect it every year.

Seasonally

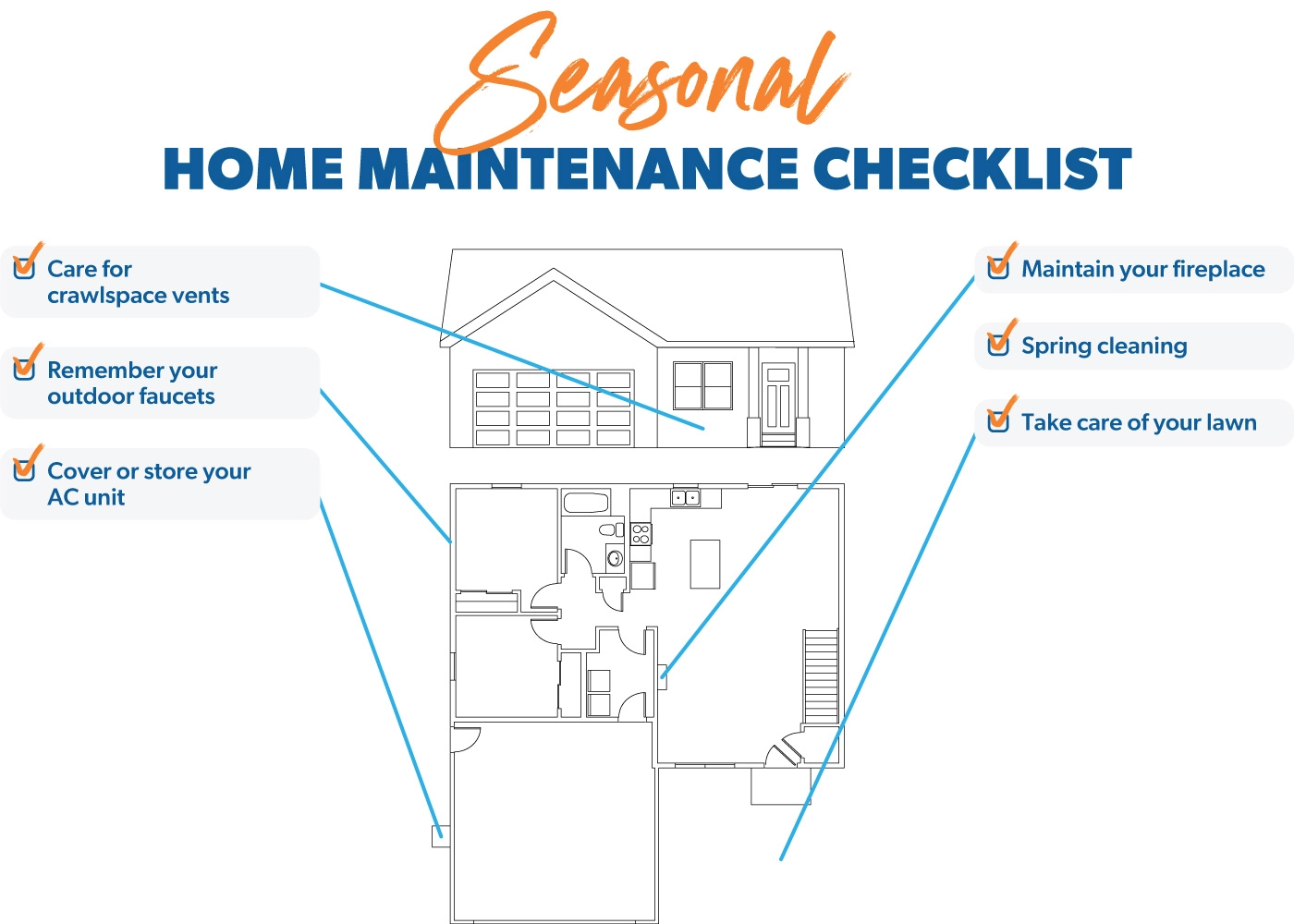

The changing of the seasons goes hand in hand with changes in the weather (well, unless you’re in California, Florida or Hawaii). Extreme heat or cold can impact many of the systems and appliances in your home. Here’s a checklist of crucial tasks you need to tackle before the seasons change.

Care for crawlspace vents. Close your crawlspace vents at the start of winter to protect pipes underneath your home from cold and dry conditions. Then open them in the spring to stop moisture buildup in your crawlspace.

Remember your outdoor faucets. If you live in a cold region, cover your outdoor faucets with an insulating cover in the winter to avoid frozen and bursting pipes.

Maintain your fireplace. Whether your fireplace works with real wood or is gas powered, get your chimney swept and have your flue inspected every year.

Cover or store your AC unit. Think about covering your outdoor AC unit in the winter. If you have a removable window AC unit, be sure to bring it in the house and store it before it gets too cold.

Take care of your lawn. Your lawn is one of the most prominent features of your house and can bring a lot of curb appeal, so you need to keep it healthy. Depending on where you live, that might mean fertilizing and overseeding your lawn in the spring or the fall so the new seeds can germinate.

Do some spring cleaning. We get it . . . life is busy. But having a clean house is a great way to prevent lots of long-term problems. While you should clean regularly, you should also take the time to deep clean your home every spring. That means getting into every little spot, dusting every corner, wiping the bookcases for dust, those kinds of things.

What Home Maintenance Items Should I Budget For?

While most of the jobs we’ve talked about are low cost, some big-ticket items like your hot water heater, heating and cooling systems, and the roof over your head cost more to maintain.

That’s why it’s a good idea to budget every year for the cost of an expert to come check out your HVAC unit, water heater and roof. Let’s take a closer look at each of these services and how much they cost.

HVAC

The HVAC unit is that boxy, noisy thing that sits outside your home, doing its job day in and day out. It gives you cool air in the summer and heat in the winter. The major parts inside an HVAC unit typically last between 10 and 25 years, so you need to have it serviced twice annually (AC in the spring and heater in the fall) to make sure things are running smoothly.

How much does it cost to have it tuned up? That’ll run you about $75–200.1 But if you need to replace your HVAC unit, that’ll cost you thousands of dollars! So it’s well worth paying for the annual checkup, especially if you spot a problem before it’s too late.

Hot Water Storage Tank

Just like the HVAC system, you should have a professional look at your hot water heater every year. A tank lasts eight to 20 years, and a new one can cost from $300–3,000 depending on the type you need.2 The cost of installing a new tank is anywhere from $500–3,000.3

During the annual service, the professional will flush and drain the tank (to remove sediment built up inside) and check the pressure relief valve. The cost of a service should be in the range of $100–500.4

Roof Inspection and Gutter Cleaning

Have an expert inspect your roof every year, especially if it’s on the older side. And if your home is framed by large trees, keep your gutters free of gunk and leaves by cleaning them once a year. If you’re fine with heights and have a sturdy ladder, you could do this yourself. Or, for around $115–450 (depending on how big and tall your house is), you could opt to have a pro take on the task.5

With the right agent, taking on the housing market can be easy.

Buy or sell your home with an agent the Ramsey team trusts.

How Can I Save Money on Home Maintenance?

Whew! That whole list seems like a lot of money to spend. But keeping your home in good shape doesn’t have to break the bank. Here are some basic ways you can save money on maintenance jobs:

1. Stay ahead of the game.

Get those important things (like your HVAC, roof and water heater) checked every year. If they do need repairs, you’re better off knowing sooner than later.

2. Remember that energy efficiency equals saving money!

If your home is older, check its energy efficiency. With proper insulation and effective weather stripping on windows and doors, you could save money on gas and electric bills. Plus, making your home energy efficient can help increase its value!

3. Build an emergency fund.

Aim to save 3–6 months of your monthly expenses in a separate account to pay for emergencies like car repairs or—you guessed it—a replacement water heater or HVAC unit. Give your emergency fund a boost by putting aside extra money each month to cover the cost of something you know is old and on its way out. Plan ahead and you’ll be set!

Help With Home Maintenance

There are lots of ways to find someone to do a job you might not have the time or expertise to do. These days, you can find pros in your area using online resources. And don’t forget to ask your friends, neighbors and coworkers for recommendations too.

If you want to know about the condition of your home, why not have a certified home inspector give it a checkup? For a few hundred dollars, an inspector will assess your whole property from roof to basement. You can use their report to create a budget for future repairs—especially if you’re planning to sell your home.

If you’re fixing up a home to make it ready to sell, get a professional real estate agent to guide you. They can walk you through an inspector’s report and advise you about specific maintenance projects that’ll add value to your home before you put it on the market. And the agents who carry the RamseyTrusted name are the only ones we trust to take care of you the Ramsey way by putting your needs first.