Is Your 401(k) Enough for Retirement?

8 Min Read | Dec 22, 2023

We talk to people every day who want to build wealth for the future. And one of the best pieces of advice we can give is this: Your workplace 401(k) is the foundation of a solid retirement plan.

Is that the most exciting investing tip out there? Not really. But do you know what is exciting? Becoming a millionaire! According to The National Study of Millionaires, 8 out of 10 millionaires said their 401(k) was their main wealth-building tool. And there are several reasons for that!

Let’s look at why a traditional 401(k) is a great place to start your retirement savings:

- If your employer matches your contributions (and most do), you get an instant 100% return on part of the money you invest in your 401(k). That’s free money. Take it!

- Tax-deferred growth means your money grows faster.

- Pretax contributions lower your taxable income, which makes it easier to invest more.

- You can invest up to $23,000 in 2024 (and if your spouse has a 401(k), they can also invest that amount). If you’re 50 or older, the contribution limit increases to $30,500 per year to help you catch up.1

But hold up: 401(k)s do have some shortcomings. First, you’ve got a limited number of mutual funds to choose from, which can keep you from investing in high-performing funds.

Second, your 401(k)’s tax-deferred growth is a double-edged sword. While it works to your advantage while you’re saving today, it means you’ll owe taxes on the money you withdraw from your 401(k) in retirement tomorrow—unless your employer offers a Roth 401(k), which we’ll get to in a minute.

That’s why you usually need more than just a traditional 401(k) if you want a secure retirement. So, where else can you put your hard-earned investing dollars to work? We’re glad you asked! It’s time to meet the Roth IRA.

The Advantages of a Roth IRA

Almost three-quarters (74%) of the millionaires we talked to also said they invested outside of their workplace retirement plan.2 It’s not either/or—it’s both! And when it comes to investing beyond your 401(k), the best tool you can use is a Roth IRA.

The Roth IRA is the butter to the 401(k)’s popcorn—they just go better together! Here’s why a Roth IRA is the perfect choice to go along with your 401(k):

- Tax-free growth and withdrawals: When you retire, you’ll be able to use the money in your Roth IRA tax-free. Did you hear that? Tax-free! A tax-free option will come in handy since most people expect tax rates to be higher in the future.

- Flexibility: You can work with an investment pro to choose from thousands of mutual funds to invest in through your Roth IRA. That means you can choose high-performing funds and diversify with different fund types.

These may seem like minor details, but they can make a big difference in the size of your nest egg over time.

How Tax-Free Withdrawals Help Your Retirement Savings

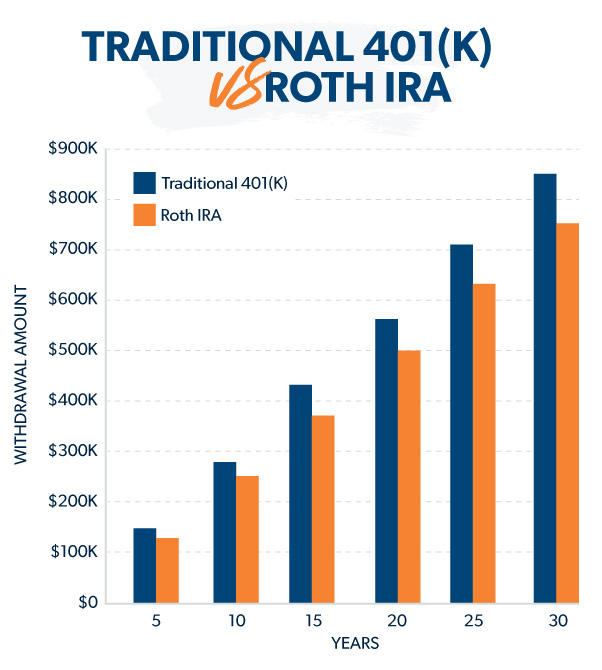

When you retire, the money you’ve saved in your Roth IRA will stretch further than your 401(k) savings for one big reason—taxes!

How badly can taxes reduce the lifespan of your retirement account? Let’s say you have a 401(k) and a Roth IRA, and you want to withdraw $25,000 from each account so that you can have a $50,000 annual income in retirement.

On the Roth IRA side, you could take out $25,000 from your account every year and not owe any taxes on it. No problem there! And since most Roth IRA withdrawals in retirement do not count as taxable income, it puts a little less stress on you once tax season rolls around.

How much will you need for retirement? Find out with this free tool!

But your 401(k) savings are a different story. Those withdrawals will count as taxable income. And if your retirement income puts you in the 12% tax bracket, that means you’d actually have to withdraw around $28,200 from your 401(k) every year to cover your taxes and still get the income you need.

While an extra $3,000 might not seem like much, those numbers start to add up over time! In this scenario, you would end up withdrawing almost $100,000 more out of your 401(k) than your Roth IRA to maintain that income over the course of a 30-year retirement. That’s a lot of dough.

The point here is that the taxes you’ll owe on your traditional 401(k) savings in retirement put even more pressure on your investments to perform better and bring in higher returns. Meanwhile, retirement savings inside of Roth accounts take taxes out of the equation entirely.

It’s a pretty clear choice: Take advantage of Roth IRAs—and Roth 401(k)s—whenever and wherever you can!

How the Flexibility of a Roth IRA Works in Your Favor

While your 401(k) plan might not have a lot of mutual funds to pick from, you can choose any of the thousands of existing mutual funds for your Roth IRA. How do you know which funds are right for your portfolio? Work with an investment pro you trust to help you weigh the pros and cons of different fund options.

With thousands of funds to choose from, you can select good growth stock mutual funds to build what the investing experts call a “well-diversified portfolio” to grow your retirement nest egg.

That might sound like boring investment lingo, but aside from increasing the amount you invest for retirement, spreading out your investments by selecting a balanced mix of mutual funds is probably the best thing you can do with your retirement savings.

A Roth IRA gives you the freedom to choose a balanced mix of mutual funds for retirement. You should split your portfolio evenly between these four types of mutual funds: growth, aggressive growth, growth and income, and international.

How Do Your 401(k) and Roth IRA Work Together?

When you invest in your workplace 401(k) and a Roth IRA, you combine the power of the match in your workplace 401(k) with the tax-free withdrawals and flexible fund options of a Roth IRA. It’s a winning combo!

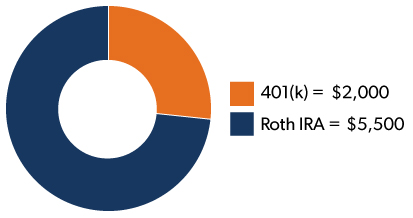

Investing in two retirement accounts isn’t complicated. You just have to do some quick math. Once you’re debt-free and have an emergency fund with 3–6 months’ of expenses, you should invest 15% of your gross income for retirement. That means if you make $50,000 per year, you should invest $7,500 into retirement savings.

How do you divide that between your 401(k) and Roth IRA? If your employer matches contributions up to 4% of your pay, for example, then you’d contribute $2,000 a year to your 401(k). The remaining $5,500 would go into your Roth IRA. Boom. You’re done!

Some What-Ifs:

- What if my employer doesn’t match contributions? If that’s the case, max out your Roth IRA first. If you still have money to invest, you can invest in your company plan and at least take advantage of your 401(k)’s tax benefits.

- What if my employer doesn’t offer a retirement plan at all? Go max out your Roth IRA first. And then, if you still haven’t hit 15%, you can open up a taxable brokerage account to invest in growth stock mutual funds.

- What if I max out my Roth IRA and still haven’t met my 15% goal? The contribution limit for Roth IRAs in 2024 is $7,000 per person, and it increases to $8,000 if you’re 50 or older.3 So it’s possible that you might not reach 15% of your income after maxing out your Roth IRA. Don’t worry! If that happens, go back to your 401(k) and invest the rest there to take advantage of your 401(k)’s tax-deferred growth.

- What if my employer offers a Roth 401(k) option? Great! A Roth 401(k) works almost exactly like a Roth IRA. It’s funded with after-tax dollars, so your contributions grow tax-free. That means when you withdraw money in retirement, you won’t have to pay taxes on your contributions or its growth—but you will have to pay taxes on the match your employer provided. If you have good mutual funds to choose from, you can simply invest your entire 15% in your Roth 401(k).

Get Team 401(k) and Team Roth IRA on the Same Side

When it comes to your 401(k) and a Roth IRA, there’s no need to pick sides! The investments you choose for both accounts should complement each other. They should work together to help you make the most of the stock market’s growth while limiting your risk.

Don’t know where to start? The SmartVestor program can connect you with experienced investment professionals who can help you find out if you’re on track to meet your retirement goals and what you can do to make your outlook even brighter.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.