How the Fair Debt Collection Practices Act Protects You

17 Min Read | Aug 17, 2022

The phone rings. As soon as you see the number, you start to sweat. Oh no, it’s them again . . . the debt collector. Ugh!

If you’re afraid to answer the phone because a debt collector’s hounding you, you’re not alone. More than 1 in 4 people who use credit have at least one debt in collections. But thanks to the Fair Debt Collection Practices Act, you have more power than you think. Knowing exactly what debt collectors can and can’t do will help you take charge of your situation. Here’s how to get those collectors and your debt out of your life for good!

What Is the Fair Debt Collection Practices Act (FDCPA)?

The Fair Debt Collection Practices Act (FDCPA) puts strict rules on how debt collectors can talk and behave when they’re trying to collect money from you.

Now, here’s the thing: The FDCPA doesn’t stop debt collectors from asking for the debt you owe them (that’s totally legal). But it does keep them from doing some real shady stuff to get your money—like lying, threatening or manipulating.

Think of it like a wrestling match—if a debt collector is in one corner and you’re in the other, then the FDCPA is basically the referee. A debt collector may talk a lot of smack, but there’s only so much they can actually do without breaking the law. You just have to know the rules and call them out when they cross the line.

But to really understand how the FDCPA works, you first need to know what kinds of debt can go into collections and who has the right to collect it.

How the Fair Debt Collection Practices Act Works

If you’ve been fielding calls from collector after collector hounding you at all hours of the night, the Fair Debt Collection Practices Act will be music to your ears. It gives you the power to end late-night phone calls, embarrassing calls to your office, and potty mouth trash talk. While the FDCPA can’t promise these things won’t happen to you again, it does give you the upper hand in the situation because you can report debt collectors who abuse the rules.

Who Is Covered by the FDCPA?

Here’s the thing though: The FDCPA only protects you from third-party debt collectors, not creditors (we’ll talk about the difference in a minute). The exception would be if a creditor uses a different business name to try and collect your debt—that would automatically make them a third-party collector, and they would have to follow the FDCPA guidelines. But creditors aren’t completely off the hook. They still have to stay away from unfair or deceptive practices under the Federal Trade Commission Act.

So, if you borrowed money from your cousin Vinny and he won’t stop bugging you to pay him back . . . the Fair Debt Collection Practices Act can’t help you—you’ll have to deal with that on your own. Let’s just say Thanksgiving will be awkward until you can pay him back.

What kinds of debt can go into collections?

It doesn’t matter what type of debt you’ve got—credit cards, student loans, mortgages, medical bills, car loans, utility bills. If you miss a payment, you run the risk of your debt going into collections. But what does that mean?

Get help with your money questions. Talk to a Financial Coach today!

Let’s say you get a hospital bill for a recent surgery. If you don’t pay on it within a certain amount of time (anywhere from 30 to 180 days after it’s due), it becomes delinquent debt. At that point, your creditor (the person or business you owe money to) figures they aren’t likely to get any money from you. They may hire a debt collector to pressure you into paying. Or they might go ahead and sell your debt to a collection agency for cheap because they’d rather get some money than nothing at all. In either case, you’ll have to deal with a debt collector. And if that collector treats you unfairly, they’ll have to answer to the FDCPA.

What is a debt collector?

A debt collector is a person or business that (surprise, surprise) collects debts for a living. Calling people up and demanding money is literally in their job description. A collection agency (or third-party agency) buys your debt from your creditor hoping they can strong-arm you into coughing up cash, even if it’s not the full amount you owe. And unless you know how to put debt collectors in their place, they typically stop at nothing to get your money.

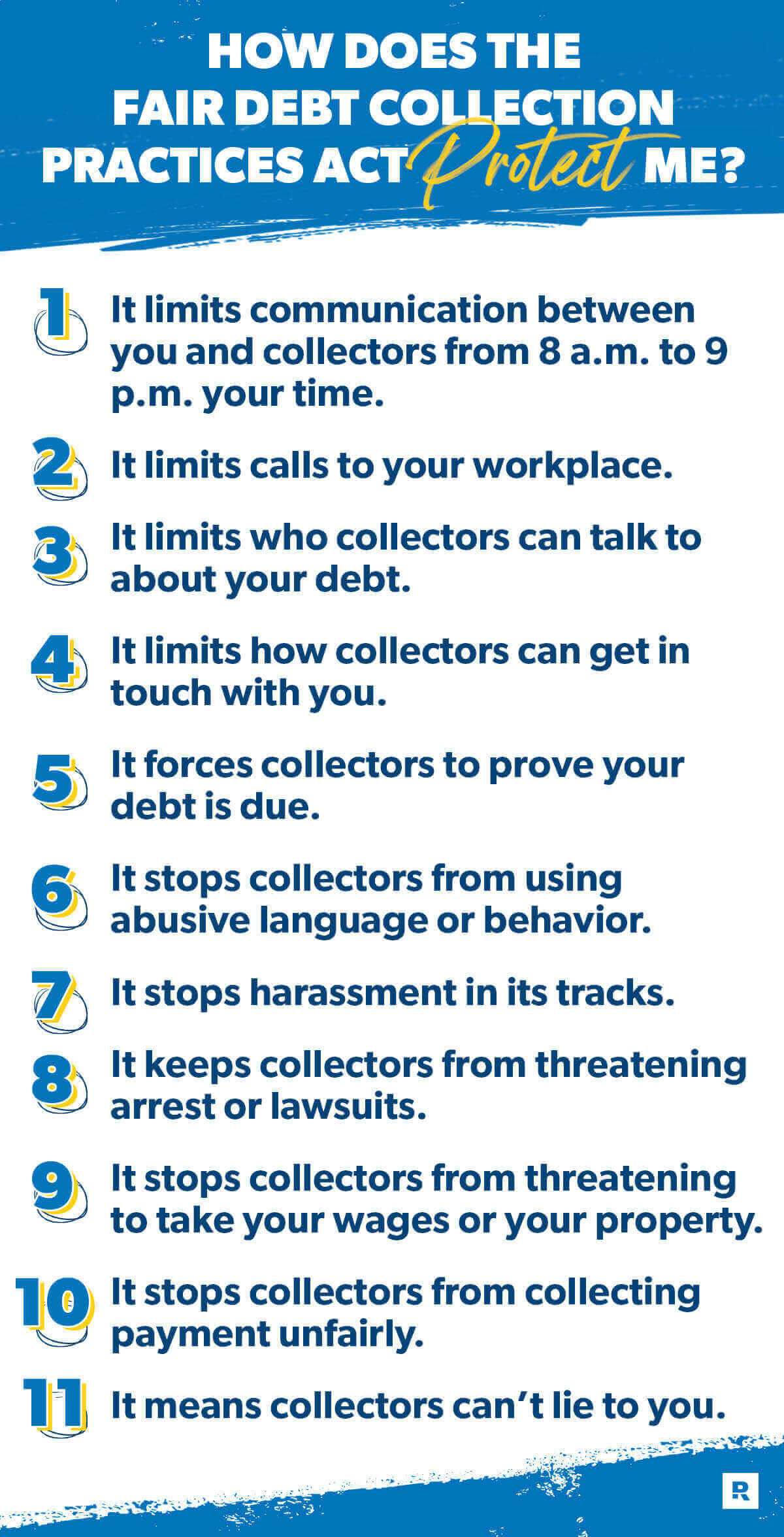

How Does the Fair Debt Collection Practices Act Protect Me?

Collectors have one mission and one mission only—to get your money. And they’re not above stooping to some pretty low levels to make you pay. But there are ways to defend yourself against these bullies when you know exactly how the FDCPA protects you.

1. It limits communication between you and collectors from 8 a.m. to 9 p.m. your time.

Debt collectors aren’t allowed to contact you at inconvenient times. Under the FDCPA, they can only do so between 8 a.m. and 9 p.m. your time.1 This rule also covers in-person visits. If you ever do find a debt collector on your doorstep, they have to stick to that time frame, and they can only ask you to pay what you owe. You don’t have to give them any money (or even talk to them). In fact, don’t make any negotiations in person—it’s best to do business in writing.

Remember, if a collector shows up in person and you feel like they’re harassing you, you’re more than welcome to slam the door in their face or call the police. And if you’re tired of the constant calls, you can ask for a cease and desist, which means the debt collector can no longer try to get in touch with you. Send a letter by certified mail and get a return receipt so you have proof the collector got the message. At that point, a debt collector can only reach out to confirm they’ll stop contacting you or to say they’re suing you.

2. It limits calls to your workplace.

Debt collectors can’t contact your workplace if you’re not allowed to receive calls while on the job. And even if they do call, they’re not allowed to say what agency they’re with or that they’re collecting a debt unless specifically asked. Keep in mind, they’re only allowed to call your place of work one time (and only to verify your contact information).

3. It limits who collectors can talk to about your debt.

If you give a debt collector the cold shoulder, it’s only a matter of time until they start calling your friends, family members, neighbors or even that one guy from your high school math class. Their goal is to try to shame you into handing over money.

But here’s the deal: They can tell someone they’re looking for you and ask if they know how to get in touch with you. But debt collectors can’t talk about your debt with anyone other than you or your spouse. That means they can’t give anyone details about your debt, say you’re in debt, or even identify themselves as debt collectors. And they can’t call these people more than once (so don’t worry, your family and friends aren’t going to be harassed either).

4. It limits how collectors can get in touch with you.

Like we said before, debt collectors will try all kinds of ways to get in touch with you. Besides the obvious methods like calling and mailing letters, collectors can now email, text or send you direct messages on social media. Yikes. But they can’t tag you publicly on social media, put your name in the newspaper, or even send postcards (because then the mail carrier would know your debt details). And if you tell a debt collector to contact you through your attorney, they have to stop bothering you.

5. It forces collectors to prove your debt is due.

You probably already know there are a lot of debt collection scams out there. Even if you do have delinquent debt, that doesn’t mean every person who calls is a real debt collector. You need to be sure a collection claim is legit before you give anyone your money. Under the FDCPA, a collector has to send you a written validation letter within five days of first contacting you to provide proof you have debt due.2 This letter must include:

- The name of the creditor (the person you owe money to)

- The amount you owe

- Instructions on how you can repay the debt

- What to do if you think the debt isn’t yours

If you don’t dispute the debt (argue it’s not yours) within 30 days of receiving the validation letter, then the collection agency will assume you’re claiming the debt as yours. You can also ask for more information about the debt within those 30 days, and the collector has to give it to you.

But here’s the main takeaway: Don’t do any business with someone saying they’re a debt collector until you have a validation letter. Remember—you want everything in writing!

6. It stops collectors from using abusive language or behavior.

Sugar, spice and everything nice—that’s not what you should expect from a debt collector. There’s always a chance you’ll get a collector who has the personality of Mary Poppins, but more likely, you’ll be dealing with somebody who couldn’t care less about how your day is going. And some will even use threats and harsh language to scare you into doing what they want. But their bark is usually bigger than their bite. Oh, and if they’re cursing at you or using foul language, that’s a big no-no too!

7. It stops harassment in its tracks.

This may seem broad, but under the FDCPA, harassment includes calling multiple times in a row to try to annoy you, threatening harm or violence, and listing your debt for sale. Here’s the bottom line: If you feel like you’re being bullied, it’s probably harassment.

8. It keeps collectors from threatening arrest or lawsuits.

This one can be pretty scary. But here’s the truth: A debt collector can’t arrest you for delinquent debt. Period. And unless they have an actual court order, they can’t threaten to sue you either.

9. It stops collectors from threatening to take your wages or your property.

Collectors know exactly what buttons to push to make people straight-up panic. (They can be pretty convincing.) But they can’t take money out of your paycheck without permission from a judge (unless you owe child support, taxes or federal student loans). And they also can’t threaten to come take your car or other possessions (unless they’re collateral for a loan). So, breathe easy, friends!

10. It stops collectors from collecting payment unfairly.

Debt collectors aren’t allowed to add any interest, random fees or other charges to the amount you owe if it’s not part of your original lender contract. And if you send them a postdated check because you’re planning to pay later in the month, they’re not allowed to deposit it ahead of time. But that doesn’t mean they won’t try—so don’t send a check unless you’re ready for the money to be taken out of your account immediately. And while we’re on the subject: Never send more than one check at a time. That’s just asking for trouble.

11. It means collectors can’t lie to you.

Debt collectors can’t lie about who they are—they have to be up-front and identify themselves as debt collectors. They also can’t lie about what might happen to you if you don’t pay your debt, like saying you’ll lose your house if you owe them for medical bills.

And collectors have to be honest about your debt details, like how much you owe, who you owe money to, or if your debt has passed the statute of limitations. But just because collectors can’t lie doesn’t mean they have to answer your questions. So if you get the run-around from a collector, it’s safe to assume they’re avoiding the truth.

When and How Debt Collectors Can Contact You

So, now that you know what debt collectors can’t do, you also need to know what they can do. That’s right, if a debt collector is just contacting you about a debt, that doesn’t mean they’re in the wrong (especially if they’re contacting you between the hours of 8 a.m. and 9 p.m.). And like we said earlier, there are many ways a debt collector might try to communicate with you: phone calls, texts, emails, snail mail, fax and even direct messages on social media. Sounds a little crazy right? Don’t worry, the FDCPA exists for a reason—there are certain things debt collectors must do when they contact you.

Debt collectors are required to:

- Tell you exactly who they are

- Explain that any info you give them will be used to help them collect on your debt

- Share your right to dispute the debt in a debt validation letter (they must let you know this within five days of their first contact with you)

- Give you the name and contact information for your original creditor

- File a lawsuit in a location convenient to you (either where you live or originally signed the contract for your debt)

What if a Debt Collector Breaks the Law?

Even with the FDCPA, debt collectors break the rules all the time. And they mostly count on you not knowing your rights so they can get away with it. But if you’ve got a debt collector constantly harassing you or if you’re still getting calls even after you’ve sent a cease and desist letter, you can take action.

How to File a Complaint

First, you can file a complaint against a debt collector with the Consumer Financial Protection Bureau (CFPB). You can only submit one complaint per company, so you want to make sure to be as detailed as humanly possible. Here’s what you should include:

- The problem: Be as clear as possible, including dates, names of people you’ve communicated with, and what was communicated.

- Relevant documents: Attach any documents that support the problem like emails, detailed communication records or account records.

- Company info: Select the company you’re complaining about from the list or give the company’s contact info.

- Your contact info: Include your name, email, address and phone number.

Second, if you feel like a debt collector really stepped over the line and things are getting out of hand, talk with a lawyer to see if you should take legal action against the collection agency.

But remember, just because a debt collector broke the law or you get a collector to stop calling, it doesn’t mean your debt disappears. You’re still legally responsible for paying it back. And you should—ASAP!

Tips for Dealing With Debt Collectors

With the FDCPA guidelines in mind, here are some things to remember when you’re dealing with debt collectors:

1. Stay calm.

Debt collectors are trained to make you feel upset, mad or guilty. But even if a debt collector is yelling or throwing insults at you, there’s no need to stoop to their level. Take a deep breath and tell them you won’t be answering any questions until they talk to you like a human being. And of course, hanging up is totally allowed!

2. Validate the debt collector and debt.

Don’t do any business with someone until you’re 100% sure the collector and the debt they’re asking about is legit. Remember that validation letter we mentioned earlier? Yeah, you definitely want that.

3. Get everything in writing.

You can tell debt collectors are lying if their mouths are moving. They may try to sweet-talk you or act like they’re doing you a favor, but don’t take their word as truth. Never, ever give someone money until you’ve got a full agreement in writing. And be sure to save copies of everything in case they ever try to come after you again later.

4. Don’t give them access to your bank account.

This one is super important! Debt collectors may ask you to give them your checking account or debit card info to make it “easier” for you to pay your debt. But trust us, they will clean you out, no matter what they say. And it’s almost impossible to get that money back once it’s gone. So, be smart when sending payment to a debt collector.

How to Get Rid of Debt Collectors for Good

Yes, getting debt collectors off your back is nice, but you know what’s even better? Kicking debt out of your life once and for all! If you never want to worry about a collector harassing you for money ever again, then you need to focus on paying off your debt as soon as possible, and then stay out of debt.

But listen, if a collector is calling about a legit bill, and you have the money, you should pay it. Immediately. Ignoring a collector won’t solve your problem—it only delays it. In fact, sending a cease and desist might actually lead to a lawsuit because the collector has no other option to get you to pay.

So, before you cut off a debt collector completely, take charge of the conversation and find out the exact details of what they say you owe. That way, if you have the money, you can pay and get them out of your life. Here are some ways to make that happen:

Take care of necessities first.

Even when you’ve got collectors breathing down your neck, your priority is to take care of you and your family. So, before you do anything else, make sure your Four Walls are taken care of—that’s food, utilities, shelter and transportation. Paying off debt can wait until you can feed everyone, keep the lights on, and put gas in the tank. Don’t be afraid to tell a debt collector you’ve got nothing to give them until you get your household in order.

Get aggressive.

If there’s one thing debt collectors are, it’s persistent. Time for you to channel some of that same intensity into paying off your debt. Got a car you can’t afford? Sell it. What about a second job or a side gig? If you don’t have one, get one. Getting out of debt doesn’t happen by accident. It takes lifestyle changes and hard work. But you can do it! The more aggressive you get about attacking your debt, the sooner you’ll be out of the collection agencies’ clutches.

Stick to a plan.

If you’re tired of fending off debt collectors and struggling to make payments each month, you need a solid game plan to pay off your debt and get back on your feet. And it doesn’t hurt to have someone you trust in your corner to help keep you accountable to your finances. That’s why the community you gain in a Financial Peace University (FPU) class is so important. Not only that, with FPU you’ll learn exactly how to pay off all your debt and save for expenses so you never have to borrow money again! And with a community of people on mission to do the same thing . . . nothing will stand in the way of your debt freedom. It’s time to take yourself off the debt collectors’ call list for good—get started today.