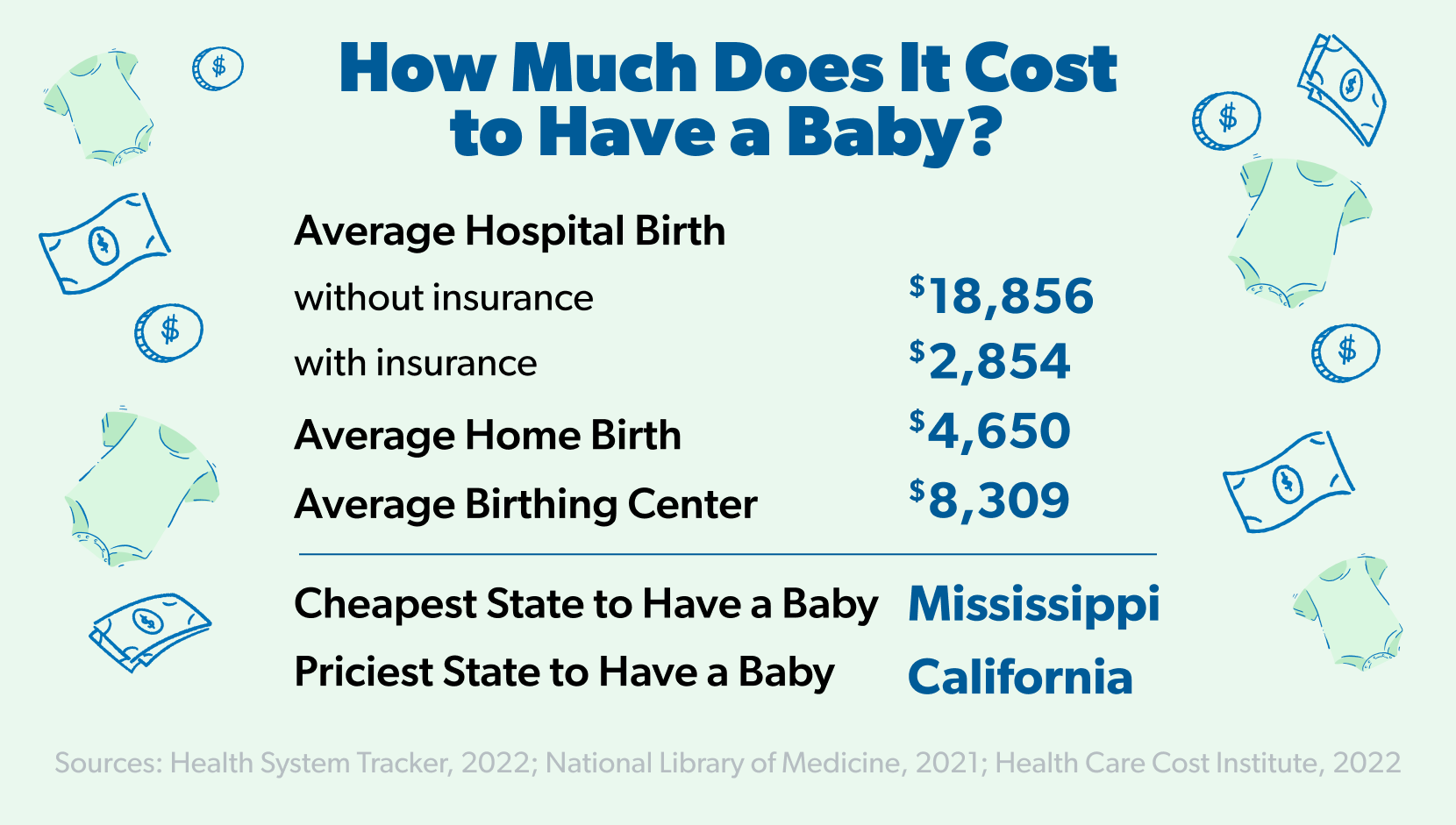

Are you looking to the future and thinking to yourself, How much does it cost to have a baby anyway? Well, the quick answer is an average of $18,865 (or $2,854 with insurance).1

Yeah, that sweet little bundle of joy can come with a big bundle of bills. But of course it’s worth it! So, what all does that big number include? Let’s break it down so you can start planning ahead.

How Much Does It Cost to Have a Baby

So, the average $18,865 cost we just mentioned covers pregnancy, hospital childbirth and postpartum care. Insurance typically covers $16,011 of that, leaving you with an out-of-pocket average of $2,854.2

But your exact cost depends on a whole list of things. So. Many. Things. Here are a few of those:

Type of Birth

The average cost of a traditional delivery is $14,768 ($2,655 out of pocket). But a C-section is more like $26,280 ($3,214 out of pocket).3

Where You Give Birth

The “where” here means a few things. First, if you go the hospital route, that’s where those average numbers we’ve already mentioned come in.

A home birth is generally much cheaper at $4,650 for the midwife costs and everything else involved with pre- and postnatal care.4

Of course these days you’ve got even more options. Birthing centers are rising in popularity and cost an average of $8,309.5

That’s not all the “where” can mean when we’re talking about giving birth. The cost is also affected by what state—and even what city—you’re in! The cheapest state to have a baby is Mississippi at $7,639, and the priciest is California at $19,230.6 Yeah. It’s more than double the cost to give birth in the birthplace of In-N-Out Burger than the birthplace of the Blues.

Type of Insurance

Not only does having insurance (or not) affect how much it costs to have a baby, the kind of insurance does too!

What’s your deductible (aka how much you’re responsible to pay before your health insurance provider starts sharing some of the medical treatment costs with you)? Do you have a more traditional plan or a health share plan? Each of these affects what you’ll pay overall.

Length of Hospital Stay

If your hospital stay is just a couple days, you’ll pay less than someone who needs to be in for longer. You know, kind of like a lengthy hotel stay costs more than a short one. (Except they don’t wake you up to check your blood pressure at a hotel. Usually.)

Birth or Health Complications

If you or your baby has complications throughout the process, that can increase your stay, amount of care and medications—and all of these can increase your cost, depending on your insurance deductible.

How Much Does It Cost to Have a Baby Without Insurance

We keep saying “out of pocket” costs. That phrase means what you pay of your own money—if you have insurance. If you don’t have insurance, you’re looking at that average $18,865.

So, if you don’t have any kind of health insurance right now, look into how you can get covered pronto. Some plans won’t cover your pregnancy if you’re already pregnant, so read the fine print, and look into health insurance alternatives (only the legit ones, please) to see how you can help keep that number down.

Cost of Pregnancy

Between your prenatal checkups, baby essentials and even a new wardrobe to dress that growing belly, things can add up quickly. Here are some pre-baby expenses to include in your budget before your little one gets here.

Checkups

The largest cost in prenatal care comes from doctor or midwife visits. Expect a few appointments in the first trimesters and more frequent visits later in your pregnancy. Review your coverage or speak with your provider to get details on the following:

- Copay amount for doctor visits

- Deductible required before coinsurance kicks in

- Percentage of coinsurance coverage

- Your out-of-pocket maximum for the year

- Any additional costs for doctor visits or care outside of your insurance network

Ultrasounds and Lab Work

Typically, insurance will cover a “visibility scan” in your first trimester to share your due date, check on the health, and give you that first peek at your sweet baby. You’ll probably get another sonogram around 20 weeks to check on the baby’s organ development (and reveal the gender, if you choose). Most required or standard tests, lab work and blood draws should be covered by your insurance provider too.

Every savings goal starts with a budget. Create yours today with EveryDollar.

Anything additional in these areas will probably be an added cost for you.

Prenatal Vitamins

Over-the-counter prenatal vitamins can cost $10–30 for a month-long supply, depending on your preferences. Not too bad, and completely worth the investment in your (and baby’s) health!

Dietary Needs

Sometimes pregnancy makes a mom take more interest in her diet. After all, she’s eating for two—not in quantity (that baby’s tiny), but in quality. The good news is that eating healthy on a budget is totally doable, pregnant or not. But it might mean upping your grocery budget, at least a bit.

Maternity Wardrobe

Growing a tiny human requires new clothes. At least, new to you. Remember, plenty of the things in your closet are stretchy enough to keep wearing. Also, borrow from others and check out consignment shops or thrift stores. You don’t have to pay a ton to still feel fashionable for the next nine months.

Baby Gear

Before baby gets here, you’re probably buying a car seat, diapers, wipes, a crib and crib sheets. But there are plenty of other baby gear items people stock up on like a stroller, a bassinet, more diapers, a baby monitor, a high chair, more diapers, a baby bathtub, itty-bitty clothing, a changing table, more diapers and a diaper bag for all those diapers and multiple changes of that itty-bitty clothing.

Postpartum Expenses

Once baby’s here, the expenses will continue. Put some of these (and that baby gear) on your baby register, and don’t be afraid of hand-me-downs from family and friends. For what you still need to buy, we’ve got some quick ways to save money on these baby expenses.

Formula

If you’re going the formula route, ask your pediatrician for samples you can try out, and always be on the lookout for manufacturer coupons.

Food

When baby’s ready to try some real food, try to make your own! Yes, it takes time—but often you have to spend a bit of time to save money.

Childcare

If you and your spouse both work, make sure childcare is in the budget. Finding an in-home day care or a stay-at-home parent to watch your child can be a major budget saver.

Books and Toys

Ask for these as baby shower gifts. Gather coupons and look in secondhand consignment shops. And don’t forget to use the library for sweet books to read to your little one for free.

Life Insurance and Wills

Yeah, no one wants to talk about these two. But you need life insurance and you need a will. Both of these will give you so much peace of mind as you make sure your beautiful family will be well taken care of when you’re gone. Okay. We’ll stop talking about it—but don’t forget to do this!

Clothing

Baby clothes can get pricey, so buy secondhand whenever you can. And remember: Baby doesn’t need to look like a runway model. Baby can’t even walk.

Also, babies grow out of things faster and stain things quicker than you’d think. We won’t get too detailed, but don’t buy a $40 onesie the bundle of joy could ruin in four minutes.

Higher Water and Electric Bills

You might notice your water and electric bills going up from all the extra laundry costs. Here’s an easy tip: Wait until you have a full load of Junior’s dirty clothes to wash before you run a load. Trust us, it won’t take long for that washer to fill up.

Diapers (Cloth or Disposable)

Cloth diapers were the norm when our grandparents were new parents. And they’re growing in popularity again. But not everyone’s about that dirty diaper laundry life, no matter how much money it saves.

If you prefer disposable diapers, we get it. Use these tips: Don’t be afraid of store-brand diapers. It’ll be trial and error as you find one you like—but some are just as good as the pricier ones. And consider buying diapers in bulk. You. Will. Use. Them.

Unpaid Time Off

Depending on your maternity and paternity leave policies, you might be taking paid time off or even some unpaid leave when baby arrives.

Could you live on one income during leave? Can you work from home for a time? Can you earn some extra cash to fill in the gaps? Start making plans now so you aren’t blindsided when the time comes.

How Much Should I Save Before Having a Baby?

Okay, that was a lot. But we’ll say it again: It’s worth it.

And no one is ever 100% ready to have a baby—though you can be more ready by making sure you get your budget ready.

Start saving so you can hand over cash for the bills, diapers, gear, itty-bitty clothing, new and different food costs, any income changes and more diapers. All the things.

The best way to get prepped is by budgeting for all these things. And the best way to budget is by using EveryDollar, which is free—so you can put more toward . . . all those diapers.