Diversification: What It Is and How to Apply It

7 Min Read | Mar 18, 2024

Diversification might sound like one of those intimidating financial words that requires a Ph.D. to understand. But if you pause and think about the first part of that word—diverse—all it means is we're talking about variety here. It’s similar to going to a buffet and choosing what you want to eat. You pick some veggies, meat, rolls and maybe a dessert. By the end of it, you’ve got a lot of delicious options to enjoy.

But let's admit, diversifying your investments is much more complicated than walking through a buffet line.

So what exactly does it mean to have a diversified portfolio? And why is it important?

Let’s take a look!

What Is Diversification?

Diversification is simply the strategy of spreading out your money into different types of investments, which reduces risk while still allowing your money to grow. It’s one of the most basic principles of investing.

You’ve probably heard that old saying, “Don’t put all your eggs in one basket.” In other words, don’t put your money all in one investment, because if it fails, you’ll lose everything. Diversification is an important part of long-term investing—think marathon, not sprint. Instead of chasing quick gains on single stocks, you’re taking a more balanced approach to building wealth.

Why Is Diversification Important?

The main reason to diversify is to reduce your risk. Keep in mind, though, that investing always involves some risk. But by having many types of investments (aka diversification), you can still put your money to work without destroying your financial future if one of your investments goes under.

Here’s a story to illustrate this point. Let’s say Cody and Meredith both make $100,000 a year in their business. Cody’s money comes from four different clients, but Meredith’s money comes from one client. What would happen to Meredith’s income if the client she works for goes belly up? Her only source of income is gone in an instant!

The same principle applies to your portfolio. If you’ve put your retirement savings into one stock, what happens if that company goes under? Boom! Your investments are gone. This is why we don’t recommend investing in single stocks—someone hiccups in Washington and the price plummets!

Diversification by Asset Class

When finance experts talk about diversification, they often recommend having various types of investments (called asset classes) in your portfolio. Here are the most common asset classes:

- Mutual funds

- Single stocks

- Bonds

- Exchange-traded funds (ETFs)

- Index funds

- Real estate

If you’re a homeowner, then you can already consider yourself somewhat diversified. Owning a home is a great way to build equity outside of a traditional investment portfolio, and there are tons of great ways to invest in real estate. When it comes to diversification, however, we take a different approach than most financial experts. Instead of focusing on asset classes and encouraging you to buy single stocks and bonds, though, we recommend people invest in mutual funds and diversify within those funds.

Here’s why mutual funds are better than other common asset classes:

- Unlike single stocks, mutual funds are already naturally diversified—it’s like buying the variety pack of your favorite candy so you get a mix of everything.

- Long-term government bonds have a history of yielding between 5–6%.1 Good mutual funds, on the other hand, will often double that rate of return.

- Investments like index funds and most ETFs try to mirror what’s happening in the market. But if you pick the right mutual funds, you can beat the market’s growth.

How To Diversify Your Investment Portfolio

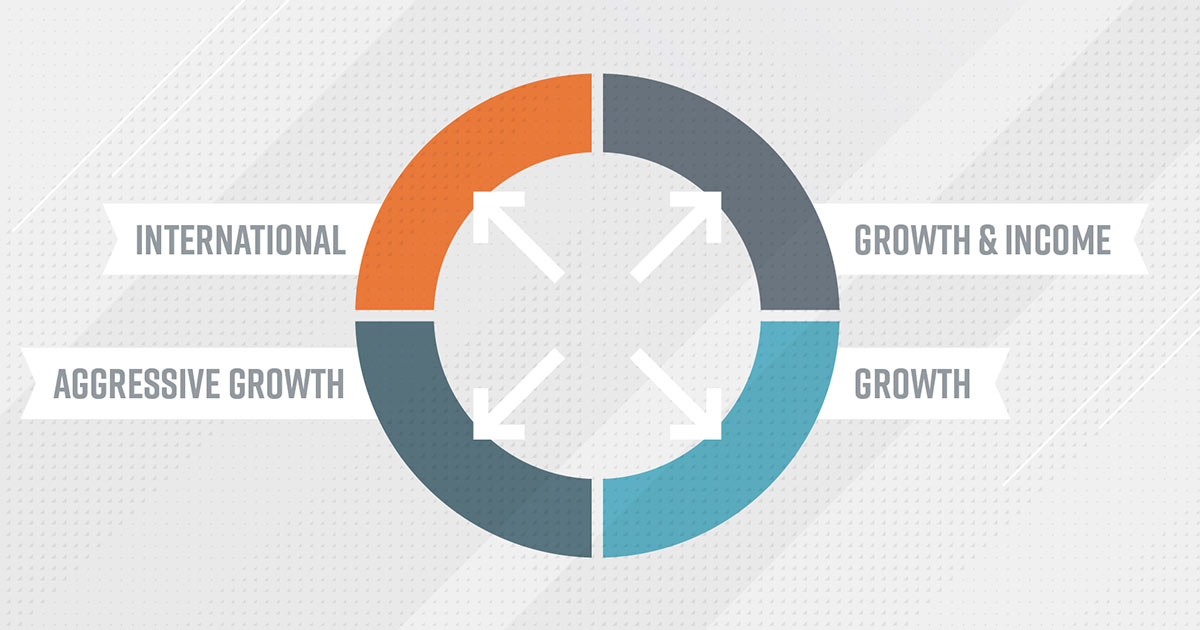

The best way to diversify your portfolio is to invest in four different types of mutual funds: growth and income, growth, aggressive growth and international. These categories also correspond to their cap size (or how big the companies within that fund are).

Market chaos, inflation, your future—work with a pro to navigate this stuff.

Here are three steps for diversifying your mutual fund portfolio:

1. Choose your account.

The best way to actually get started is to crack open your 401(k) or 403(b) at work and see what mutual fund options you have. Workplace retirement plans like these have many advantages—they give you a tax break, they can be automated through your payroll deduction, and your employer most likely offers a match. If you don’t have access to a retirement account, then your best option is a Roth IRA through an investment group or broker. The word Roth gets us excited, because it means that your money grows tax-free!

2. Diversify through cap sizes and international funds.

Now, once you open a 401(k) or Roth IRA, you’re not done yet. Your investment account is like the grocery bag, but you still need to pick your groceries—the actual funds where you’ll place your money. As you explore your account, you’ll see a list and description of your fund options. They all have different names (like Bank X Growth Fund or Group X International Fund).

Here are the four types of mutual funds you should spread your investments into:

- Growth and Income: These funds bundle stocks from large and established companies, such as Apple, Home Depot and Walmart. They’re also called large-cap funds because the companies are valued at $10 billion or more. The goal of investing in these funds is to earn you money without too much risk. These funds are the most predictable and are less prone to wild highs or lows.

- Growth: These funds are made up of stocks from growing companies—or mid-cap companies valued in between $2 billion and $10 billion. They often earn more money than growth and income funds but less than aggressive growth funds.

- Aggressive Growth: These funds have the highest risk but also the highest possible financial reward. They’re the wild child of funds, also referred to as “small cap” because they’re valued at less than $2 billion and are possibly still in the start-up phase. They’re made up of different stocks in companies that have high growth potential, but they’re also less established and could swing wildly in value.

- International: These funds are made up of stocks from companies around the world and outside your home country. When the market takes a turn here in the States, you might not see the same downturn in foreign countries—which is why you want to have stock in them!

To diversify your portfolio, you need to spread your money evenly across these four kinds of funds. That way, if one type of fund isn’t doing well, the other three can balance it out. You never know which stocks will go up and which will go down, so diversifying your investments gives you the best protection against losses.

3. Meet with your investment pro to rebalance as needed.

The market is a living and breathing thing, so your funds’ values will change over time as they respond to how companies’ values rise and fall. That’s why you need to keep an ongoing conversation going with your investment pro and meet regularly to rebalance your portfolio.

Rebalancing is simply about making small adjustments to how you’re allocating money so that you maintain that 25% diversification in each type of fund we just mentioned. We recommend meeting once a quarter with your investment pro.

The key for successful investing is to be consistent. Ride out the downturns in the market. Stay focused for the long haul. And whatever you do, don’t withdraw from your 401(k) or Roth IRA early!

Work With an Investment Professional

Okay, you've probably got lots of questions about how to get started diversifying your portfolio. That’s a good thing! As you figure this out, we want you to work with an investment professional like a SmartVestor Pro.

Don’t go it alone—your financial future is too important for guesswork! An investment professional can help you make sure your investments and assets are mixed to create a balanced plan for retirement.

Find a SmartVestor Pro near you!

And if you're looking to learn more, Dave's newest book, Baby Steps Millionaires, doesn’t just tell you what to do. It also tells you why to do it, how to do it, and when to do it. Grab a copy today to learn how to bust through the barriers preventing you from becoming a millionaire.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.