Albert Einstein once said compound interest is the “eighth wonder of the world.” And when one of the smartest people who ever lived puts something in the same category as the Great Pyramid of Giza, you better pay attention!

After all, this powerful investing concept could make you millions of dollars over your lifetime—if you use it right. But there’s also a dark side to compounding interest that could keep you stuck in a cycle of debt if you’re not careful.

But what exactly is compound interest? And how does it work? We’ve got a lot of ground to cover, so let’s jump right in.

What Is Compound Interest?

Compound interest is the interest you earn from the original amount (or principal) of an investment plus any interest you’ve already made through that investment. Basically, you’re earning interest on top of interest.

Benjamin Franklin explained it best when he said, “Money makes money. And the money that money makes, makes money.” Well said, Ben!

Compound interest is the secret sauce for building wealth, and it’s one of the most basic principles of investing. It’s your best friend as you continue to save and invest for the future, helping your money grow faster and faster over time.

How Does Compound Interest Work?

When you save and invest money, you expect to get a return on your money, meaning you should end up with more money than you originally put in. If you leave that money alone (the initial principal plus the interest), compound interest applies the interest rate to the total new amount of money earned, so it builds exponentially over time.

Here’s an example: Let’s say you invest $10,000, and—just to keep it simple—it earns 10% a year in interest. After one year, you’d have $11,000—the original money plus the $1,000 in interest you earned. The second year, you’d have slightly more—$12,100—because you’re earning interest on top of the interest you earned the year before. The investment compounds, or builds up, over time.

Now, $12,100 doesn’t seem like a big deal at first, but it becomes a huge deal later. If we leave that $10,000 alone for 40 years, and it compounds annually at 10%, it will grow to over $452,000. And remember, all you put in was $10,000!

The number of compounding periods will determine how quickly your investment grows. Interest can be compounded daily, weekly or yearly.

|

THE POWER OF COMPOUND INTEREST |

|

|

If you invest $10,000 with a 10% annual return and left it alone for 40 years . . . |

|

|

Years Invested |

Total Savings |

|

1 |

$10,000 |

|

10 |

$25,937 |

|

20 |

$67,257 |

|

30 |

$174,494 |

|

40 |

$452,592 |

|

Total Contributions: $10,000 |

Total Growth: $442,592 |

How Does Compound Interest Affect Debt?

If you’re still trying to pay off debt, compound interest becomes your worst enemy. Why? Because when you borrow money, it works against you and increases what you owe to your bank or lender.

If you have credit card debt, brace yourself. Your credit card charges interest on the balance on your card every single month—and the average interest rate (or annual percentage rate) on a credit card account is 16.65%.1 And guess what? If you don’t pay enough to cover the month’s new interest, it’ll be added to your credit card balance. Then, the next month’s interest is calculated based on that new, higher amount—which means you end up paying more and staying in debt longer.

And the same goes for other types of loans too—including student loans, car loans and personal loans. If you don’t pay your interest charges on time, they get added to your initial loan balance. Then your interest rate gets applied onto that new, larger amount. Meanwhile, your lender is smiling all the way to the bank.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

That’s why we don’t want you to mess around with credit cards or any kind of consumer debt—once you fall into their trap, it’s hard to get out.

Remember our old pal, Albert Einstein? He also said this about compound interest: “He who understands it, earns it. He who doesn't, pays it.” The choice is yours.

If you really want to build wealth, you have to get out of debt (paying interest) before you start investing (earning interest).

How Does Compound Interest Grow?

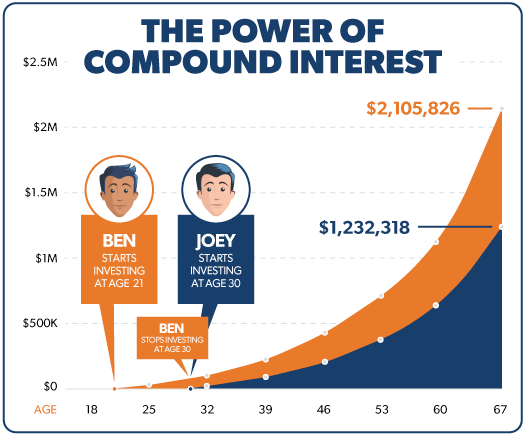

To help you see the power of compounding in action, here's the story of Ben and Joey—two guys who got serious about investing for retirement. They picked good growth stock mutual funds that average an annual return of about 11%—just under the long-term growth rate of the S&P 500.

(Note: Since mutual funds don’t earn a fixed rate of interest, we’re using the average annual return to calculate the compound growth of their investments.)

Ben

- Starts investing at age 21

- Invests $2,400 every year

- Stops contributing money at age 30

- Total amount contributed: $21,600

Joey

- Starts investing at age 30

- Invests $2,400 every year

- Contributes money until age 67 (a total of 37 years!)

- Total amount contributed: $88,800

At age 67, Ben’s investment has grown to over $2.1 million, and Joey’s has grown to more than $1.2 million! Nine years made a difference of close to $1 million.

What Is the Formula for Compound Interest?

All right, math nerds, it’s your time to shine. Here’s how you calculate compound interest:

A = P(1+r/n)nt

- P is the principal (starting amount)

- r is the interest rate

- n is the number of times the interest compounds each year

- t is the total number of years your money is invested

- A is your final amount

If you’re experiencing terrifying flashbacks to school days when you had to memorize math formulas for a test, don’t worry. We’ve got a compound interest calculator that will do the calculations for you.

How to Grow Your Investments With Compound Interest

The combination of compound interest (or growth) and time is the key to investing. But it won’t make you rich overnight. It’s all about having the right mindset. Stay focused for the long haul. Be disciplined. It will pay off in the end!

Remember: Interest you pay is a penalty. Interest you earn is a reward. Here are five key strategies to get your money working for you:

1. Get out of debt.

Compound interest is a powerful force. You want it to work for you, not against you. If you’re in debt, you might be making compounding interest payments on a credit card or a personal loan.

That’s why it feels like you’re drowning—because the amount you owe keeps increasing. Avoid debt like the plague. Check out the debt snowball for a proven plan to destroy your debt—for good.

2. Invest with mutual funds.

When you’re investing to save for retirement, you should put your money in mutual funds. Like we said earlier, mutual funds don’t earn a fixed interest rate, which means they don’t earn compound interest—but they do experience compound growth, which works pretty much the same way!

That’s because the value of a mutual fund can rise and fall. Some years you’ll see a lot of growth, some years you might see just a little bit of growth. . . and some years, you might get negative returns. That’s why it’s important to choose mutual funds with a long history of strong returns!

When estimating the overall growth of mutual fund investments, some people use the long-term growth rate of the S&P 500—a common measuring stick for how the stock market is performing—which historically has an average annual rate of return between 10–12%.2

3. Start as soon as possible.

The key to harnessing the power of compound interest is time. The number of compounding periods is what makes your interest explode. Remember Ben and Joey? The more compounding periods your money experiences, the larger it will grow. Start investing in growth stock mutual funds (either through your workplace retirement plan or a Roth IRA) as soon as you can.

4. Increase your contributions each year.

If you get a raise this year, earn some money through a side hustle, or come into some money through an inheritance, increase your contributions instead of increasing your standard of living.

As long as you’re out of debt and have a fully funded emergency fund, you should always invest at least 15% of your income for retirement. And there are ways to invest more than 15% as your earnings increase. It will be worth it when you watch your investments explode.

5. Exercise patience.

Have a long-term mindset. The power of compound interest only works if you leave your money alone for an extended amount of time. If you start to panic and pull out your investments the second the stock market dips, all you’re doing is robbing yourself of compound growth.

For the first few years, it might feel like nothing’s happening. But remember that exponential growth graph we talked about earlier? The longer you let it be, the higher it grows!

Work With an Investment Pro

It’s great to save money and build wealth, but what’s it all for? The whole point of understanding the power of compound interest is to be able to invest and reach your retirement dreams.

If you haven’t started planning for your financial future, reach out to an investment professional to help you get started. Our SmartVestor program will connect you with investment pros in your area who can take a look at where you are and help you create a plan you can get started on.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.