Umbrella Insurance: How It Works and What It Covers

12 Min Read | Feb 13, 2024

Mary Poppins floats down onto your front lawn to attend a Christmas party, rolls up her umbrella, and strolls in for some holiday cheer. But before she can even reach the banquet table, she slips on an unseen puddle of eggnog and badly bruises her tailbone, shouting supercalifragilisticexpialidocious! The next thing you know, Mary pulls a lawsuit out of her carpet bag and swears she’ll sue you for millions.

After years of hard work and sacrifice, your whole estate’s at risk—and all because you wanted a jolly holiday with Mary! While Mary’s umbrella might protect her from the rain (and traffic jams), what can possibly protect you from Miss Poppins’ frivolous lawsuit? The good news is you can have your own umbrella to protect you from life’s rainy days with umbrella insurance.

An umbrella policy provides coverage for lawsuits and large claims that aren’t covered by your homeowners or auto insurance policies.

We’ll answer all your questions about what umbrella insurance is, how it works, and what it covers. It’s pretty much your money’s best friend.

What Is Umbrella Insurance?

First, let’s talk about your auto and homeowners policies. You probably know they cover damage to your car and home, but they also provide personal liability coverage if someone gets injured on your property or if you injure someone (or their property) in a car accident. But that coverage has limits. In the case of a lawsuit, those policies will only cover up to, say, $100,000 in damages. And lawsuits could bust through those limits pretty quickly.

So, what can you do?

An umbrella insurance policy helps fill gaps in your homeowners, auto and even boat insurance policies. Umbrella insurance is a form of personal liability coverage that protects you (plus your family and other household members) from large claims or lawsuits that go above your other insurance policies.

Just like an umbrella protects you from getting wet, an umbrella policy protects your money by filling the financial gap that your primary liability insurance doesn’t cover.

Key Umbrella Insurance Terms to Know

Liability insurance: The kind of coverage that protects you from lawsuits. You need to have plenty of liability coverage because the world’s gone sue-happy. It’s included in policies like auto, homeowners and renters insurance. Umbrella is a type of liability insurance.

Damages: The legal term for what you must pay when you’re found liable for injuries or damage to someone else’s property. That’s a great time to have coverage like umbrella insurance. Helps pay for anything like lost wages, repairs or medical bills.

Assets: Your valuable property! Investments, cars and your house are a few obvious examples of assets. Your property is always at risk from lawsuits, especially with Mary Poppins types running around trying to stuff all your stuff into their bottomless bags. Protecting your assets is the whole point of getting an umbrella policy.

How Umbrella Insurance Works

Say you’re driving home after visiting family for Thanksgiving. Traffic’s bad, and you end up in a horrible 10-car pileup. Despite several injuries to others, you’re physically okay. But it gets worse when you find out the accident was your fault.

Now what? You’re liable for the vehicle damage and medical bills of all the other drivers in the accident. (Ouch!) Two of the drivers sue you for lost wages from missing work. (Oh boy.) And you’re suddenly looking at a $700,000 bill. (OMG!) Your car insurance liability limit only takes care of $100,000, and that means you have to foot the other $600,000!

You’ve worked hard to get to where you are. But don’t leave yourself vulnerable.

Let’s hope you had umbrella insurance. It would swoop in and take care of the $600,000, including legal expenses. Wow! Talk about a game changer for your savings and assets. That’s the power of an umbrella policy. It prevents you from wiping out your savings or going back into debt.

Homeowners insurance works the same way. So if you host a huge Christmas party and Mary Poppins slips on your eggnog and sues you (c’mon, Mary!), you’ll be covered for any legal fees or court judgments (if you lose the lawsuit) above and beyond your home insurance liability limits.

And one more piece of good news. In most cases, there’s no separate umbrella insurance deductible. Once you pay your primary policy deductible (auto or homeowners), you won’t have to pay it again. But there can be exceptions to this—some policies have a small umbrella deductible, known as self-insured retention, that’s normally in the range of $250–500.

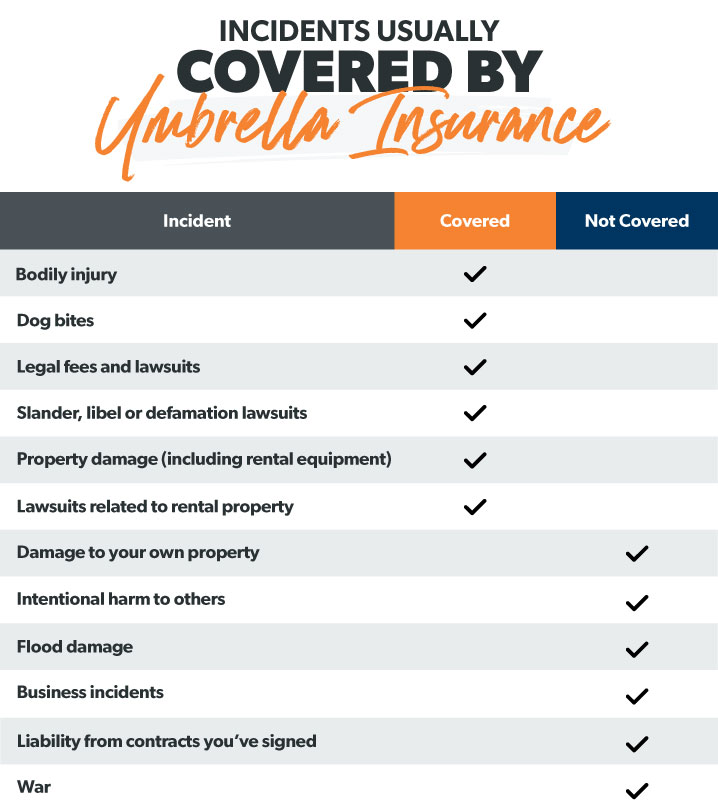

What Does Umbrella Insurance Cover?

So, what’s under the umbrella? What does umbrella insurance cover? If you have an umbrella insurance policy, you’re protected in these five main areas:

Bodily Injury

Everyone knows skydiving is risky. But not if you have a magical flying umbrella!

Just kidding—those don’t exist outside Disney movies, and we don’t recommend packing an umbrella with your parachute on your next jump. But you know what is seriously risky? Your kids hosting a neighborhood trampoline party. And if one of those kids breaks their arm (party’s over, kids!), umbrella insurance has got you covered. It will help with medical bills or lawsuits—if the parents get really upset.

Bodily injury protection also covers things like pet incidents (dog bites) and car accidents. So if your pooch decides it really doesn’t like your neighbor and goes into attack mode, you’ll be covered if your neighbor decides to sue you.

Legal Fees

Lawyers are expensive. So if someone sues you—whether it’s justified or not—you could be facing some pretty hefty legal fees. And the last thing you want is to pay out of pocket to defend yourself. Don’t let others take a piece of your hard-earned money—get an umbrella policy.

Injury to People’s Reputations

Slander. Libel. Defamation. If you damage someone’s reputation, even if it’s online, you could be sued for all you’re worth. Umbrella insurance will protect you if you’re at risk of any slander, libel or defamation lawsuits. This kind of coverage is especially important nowadays with everything that goes on in social media and online. For example, a business could file a lawsuit against you for writing a negative review online.1 (Be careful.)

Property Damages

An umbrella insurance policy covers you if you get into a bad car accident and the repair costs to people’s property are more than your car insurance’s liability limits. It even covers rental equipment, like if you crash a rented Jet Ski into the dock (oops). Or if your kid accidentally damages school property, you’re covered.

Rental Property

If you own rental property, umbrella insurance can give you extra coverage from liability you have as a landlord. So if someone breaks their ankle on the steps of your rental property and sues, you’ll be protected.

What Isn’t Covered by Umbrella Insurance?

Umbrella insurance doesn’t cover everything. Here are some of the incidents that fall outside that umbrella:

Personal Property

When it comes to you accidentally damaging your own stuff, umbrella insurance won’t help with that. This is because it’s a liability policy, meaning it only kicks in if you’re at fault for harming other people’s property. So, if you thought driving your motorbike into the pool was a good idea (you were trying to ramp over it, right?), and now the oil and gasoline and brake fluid have damaged your pool, don’t expect an umbrella policy to cover the repair costs.

Intentional Harm

If you hurt someone on purpose or damage their property intentionally, what is wrong with you? And oh by the way, umbrella insurance isn’t going to bail you out. You’ll be paying those medical bills or lawsuits out of your own pocket. Just another reason crime really doesn’t pay . . .

Water Damage

A lot of people assume flood damage is covered by property insurance. Nope. And umbrella insurance won’t help either. If you live in an area prone to flooding, you need separate flood insurance.

That said, if you accidently leave the bathtub faucet on, flood your apartment, and your neighbors take you to court for water damage in their apartment . . . you might need adulting lessons. But on the bright side, umbrella insurance covers lawsuits in that situation.

Business Incidents

If you own your own business, an umbrella policy won’t help with those kind of liability incidents. You need commercial insurance for that.

Contracted Worker Injuries

If you’re remodeling your home, make sure your contractor carries their own insurance. This is because your own umbrella insurance policy won’t cover you if a worker gets hurt on your property. Some people accidentally sign a contract that makes them liable for the workers. The moral of the story? Read the fine print. And while we’re talking about construction companies, umbrella insurance also won’t help if you’re sued for not keeping your end of the bargain in a contract.

War-Related Expenses

World War III? The zombie apocalypse? Umbrella insurance won’t touch war-related expenses (it’s not that big of an umbrella, folks). So don’t expect your umbrella insurance policy to pay for damages to your belongings or property.

Is Umbrella Insurance the Same as Excess Liability Insurance?

Sometimes umbrella insurance is mixed up with excess liability protection. But don’t be confused. These are two different policies.

Excess liability insurance is an extra layer of coverage added to, for instance, a homeowners insurance policy. It gives excess coverage in areas that are already protected in a standard home insurance plan. But it doesn’t cover the same things an umbrella insurance policy would. For instance, excess liability doesn’t help with slander or libel lawsuits.

Do You Need Umbrella Insurance?

Now, you might still be wondering how to know if you need umbrella insurance. Hiring a nanny who travels on a flying umbrella does not require umbrella insurance, because (reminder) flying umbrellas aren’t real. But if you have a net worth higher than $500,000, you definitely need an umbrella policy.

Or if you’re making good money, starting to build up some wealth in your retirement accounts, and have a paid-for home or a good chunk of equity, you also need it. Without it, you’re setting yourself up for financial risk.

Basically, the more assets you have, the more you have to lose. And a lot of folks are willing to sue over just about anything these days, so wealthy people often have a target on their backs.

If someone suffers a serious injury on your property or is in a car accident that was your fault, how much do you think you could be sued for?

$500,000?

$1 million?

$5 million?

More?

Oftentimes, yes.

But with a rock-solid umbrella insurance policy, you won’t be up in the middle of the night worrying about some gold-digging house guest cooking up an expensive lawsuit to wipe out your hard-earned wealth—or who you might have offended on the internet. You’ll have peace of mind knowing your money is protected.

Protect your wealth with umbrella insurance.

You’ve worked years to build your legacy. Keep it safe for the future with a RamseyTrusted pro in your corner.

Umbrella Insurance Pros and Cons

Still waffling on umbrella insurance? Maybe a quick-hit list of the pros and cons will help you decide.

Umbrella Insurance Pros

- Kicks in after you’ve blown through the liability limits on home and auto

- Super affordable coverage that could save you millions if the worst happened

- Protects you from slander and libel suits (which other liability policies won’t cover)

- Gives you peace knowing your assets are safe from lawsuits

Umbrella Insurance Cons

- Requires other liability coverages like auto and homeowners—but you should never be without those anyway

- If you’re bundling umbrella with other liability policies, your premium may rise a bit—but not much (and the bundling discount ought to cancel some of that out)

How Much Umbrella Insurance Do I Need?

Now let’s take a look at how much umbrella insurance you might need.

Umbrella insurance starts at $1 million worth of protection. You might think that’s enough, but now’s not the time to go bare-bones.

The rule of thumb is that your umbrella policy should cover your entire net worth. You might need more than the $1 million minimum coverage if more than two of the following apply to you:

- You own property

- You have recreational vehicles (Jet Skis, dirt bikes, etc.)

- You have an inexperienced driver in your household

- You coach kids' sports

- You regularly invite people over to your home

- You have "attractive nuisances" to a curious child (trampoline, pool, etc.)

- You drive a luxury car

- You serve on a board or nonprofit

- You regularly post reviews of products and businesses

- You participate in sports where you could injure others (hunting, skiing, etc.)

- You frequently travel outside the U.S. and worry about liability claims

- You are a landlord

- You have a public profile of success and wealth

After you’ve calculated your assets, ask yourself, How much risk do I have of being sued? Chances are, you’re more at risk than you think.

How Much Does Umbrella Insurance Cost?

For the amount of coverage you get, the price of umbrella insurance is dirt cheap. You can easily get $1 million of coverage for around $150 to $300 a year.2

Protect Your Money and Future

If you have wealth, you’re at risk of being sued—and seeing it all fly away like Mary Poppins into the stratosphere. It doesn’t matter how nice and friendly you are, there are suit-happy fraudsters everywhere. And it definitely doesn’t matter how much time and energy you’ve put into getting out of debt, building savings, and growing your investments. All it takes is one nasty lawsuit to take it all away.

If your net worth is above $500,000 and you don’t have umbrella insurance, what are you waiting for?

Sitting down with a RamseyTrusted insurance pro can take the mystery out of any kind of insurance—including umbrella coverage. They’ll be sure to help you understand what’s covered—and what isn’t—while getting you all the coverage you need to protect your assets.

Plus, working with an independent agent who isn’t tied to one insurance company might help you save money. That’s because they can shop around for rates from dozens of different companies and find the best deal for you. They might even be able to bundle umbrella insurance for a bigger discount.

Don’t put this off! Protect your assets today and experience the peace of mind that comes from knowing your wealth is off-limits to other people.

Connect with a RamseyTrusted pro today to get free umbrella insurance quotes.

Expert Advice Delivered Straight to Your Inbox

Our weekly email newsletter is full of practical advice you can easily apply to your daily routine so you can win with your money, relationships and career.