What Is Whole Life Insurance?

9 Min Read | Apr 16, 2024

Ready for some insider knowledge?

Whole life insurance sucks. Insurance companies market it as an awesome product that lasts your entire life—they call it permanent life insurance. Then they dress it up with things like fixed premiums and cash value accounts to lure you into buying a policy.

But just like those extended warranties you can buy for a light bulb, whole life insurance is a way better deal for the company selling it than it is for you. That’s why they dangle so many carrots they know will grab your attention.

Don’t fall for it! We’re here to tell you all the stuff life insurance companies don’t. By the end of this article, you’ll see why term life insurance is always the best option.

- How Does Whole Life Insurance Work?

- What Are the Types of Whole Life Insurance?

- How Can I Use My Whole Life Insurance Cash Value?

- How Much Is Whole Life Insurance?

- What’s the Difference Between Whole Life Insurance and Term Life Insurance?

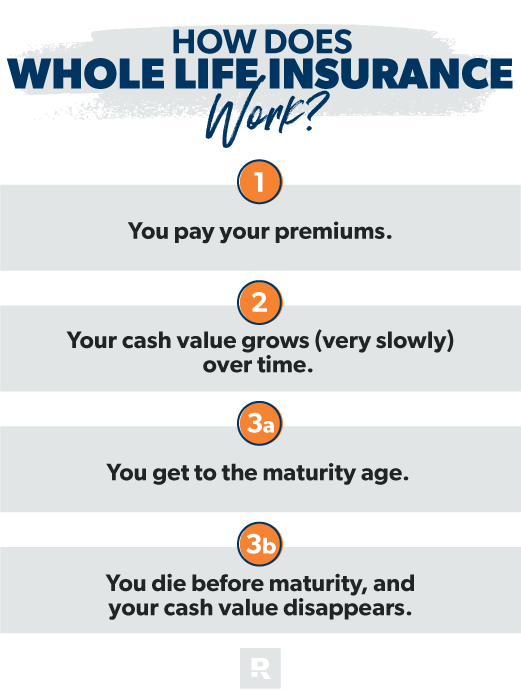

How Does Whole Life Insurance Work?

Whole life insurance policies package life insurance coverage with a savings or investment account that’s supposed to build cash value. They often come with a guaranteed return on your cash value, but these profits are pretty low on average. Lower returns are easier to guarantee, right? But that’s just the beginning of the bad news about whole life.

Let’s dig a little deeper into how this con—err, process—works.

1. You pay your premiums.

Every month, the insurance company uses part of your premium to cover your life insurance costs and puts the rest into a cash value account. The breakdown of how much is invested versus how much goes toward your policy changes over time. In the earlier years, a larger percentage of your premiums pays into the cash value, while in the later years, more goes toward your life insurance coverage since the cost of life insurance increases as you age.

2. Your cash value grows (very slowly) over time.

Your insurance company will give you an (unimpressive) interest rate on your cash value account. If these rates were slices of cake, they’d be the almost-stale ones you see in the get-it-before-it-expires stand. So, just like in a savings account, your cash value is supposed to grow. And after you’ve built some savings, you can choose to borrow against it or leave it as it is (both options come with downsides, which we’ll explain in a minute).

3a. You get to the maturity age.

Maturity age is when you can finally withdraw all the money you’ve saved in your cash value account. Some insurance companies define this age differently, but most agree on 120 years old.

Or (and this next scenario is most likely):

3b. You die before maturity, and your cash value disappears.

If you didn’t do anything with that cash value while you were alive—guess what? The insurance company keeps it! Your family gets the death benefit, and the insurance company nabs your cash value account. (This is one of the worst parts of cash value life insurance and why we will always tell you to steer clear of it.)

Interested in learning more about life insurance?

Sign up to receive helpful guidance and tools.

What Are the Types of Whole Life Insurance?

Whole life insurance comes in all shapes and sizes—and each type is as bad as the next. Here are some of the different types of whole life insurance:

- Universal life

- Indexed universal life

- Variable universal life

- Final expense

- Group life

- Family life

- Accidental death and dismemberment

Those are the main kinds, but there are even more specific types of whole life—like joint life insurance that covers two people. Or children’s whole life insurance, which is meant to lock in a policy early for your child and be an investment for their future.

Compare Term Life Insurance Quotes

But every type of whole life insurance has the same problems—they combine life insurance with some kind of savings or investment account that comes with low returns and high fees. The result—you don’t get the life insurance coverage you really need or build the savings you expected.

How Can I Use My Whole Life Insurance Cash Value?

Most people don’t wait until the policy is at maturity to take out their whole life insurance cash value. You can tap into it any time you want. But be warned: This isn’t like getting a paycheck or withdrawing money from an ATM.

While most whole life policies will let you borrow against them or cancel (aka surrender) the policy and claim whatever cash value you made, doing this isn’t as good of a deal as it seems.

Let’s look at the options:

Taking Out a Loan Against the Cash Value

If you’ve built up some cash value, you can take out a loan against your policy. Like any loan, you’ll have to pay interest as you pay it back, even though you’re borrowing against your own money. How crazy is that?

And it gets worse—if you don’t pay back the money you borrow, your insurance company will take that amount out of your death benefit. Plus, it’s not always dollar for dollar. That means your policy can be reduced by more than the actual cash amount you borrowed. Harsh!

Surrendering Your Policy

You can also tap into the cash value of a whole life policy through a cash surrender or cancellation.

Here’s how that works.

You tell the insurance company you want to cash out your whole life policy, and they send you a percentage of the policy’s cash value. How much money you get back depends on your particular policy, the insurance company fees, and the amount of time you’ve had the policy.

By now, you can see that no matter how you decide to tap into the cash value of a whole life policy, it’ll never work out in your favor. Your cash value will lose a lot of its worth because less and less of your premiums have been invested over the years, or you’ll have to settle for less than the full value of the policy you’ve been paying for. Either way, it’s not a good choice.

How Much Is Whole Life Insurance?

If you’re wondering how much whole life costs, the short answer is, it depends.

Whole life insurance rates depend on a bunch of factors. The top ones are age, occupation, health history and the amount of your policy. Altogether, these factors are how insurance companies figure out what the odds are of having to pay out a death benefit—aka your risk profile.

For example, let’s look at Ed: He’s in his early 50s, a heavy smoker and a stunt pilot. Ed applies for $100,000 of whole life insurance.

Now let’s look at Brynna. She’s a 30-year-old nonsmoker who works as an office assistant. Brynna applies for a $50,000 whole life insurance policy.

Who might have a lower premium—Ed or Brynna? If you guessed Brynna, you’re absolutely correct! She’s younger, healthier, has a relatively safe occupation, and is buying a policy for half as much as Ed. And all that adds up to less risk for the insurance company.

What’s the Difference Between Whole Life Insurance and Term Life Insurance?

Term life is different from whole life because it’s just life insurance. In other words, term life insurance doesn’t pretend to be an investment and life insurance at the same time. It also only lasts for set number of years—and that makes it much cheaper.

Let’s see why whole life isn’t a smart idea when you compare it to term life . . .

You’ll pay a higher premium with whole life insurance.

There isn’t a cash value element with term life. So, the premiums for whole life are a lot higher than term life premiums. And when we say higher premiums, we mean outrageously high. But why? For a cash value account with a low interest rate? No thanks!

You can invest smarter with term life insurance.

People buy whole life because they think they’re killing two birds with one stone. They get life insurance and an investment. When you really think about it though, using your insurance as an investment makes no sense—especially when there are better investment options out there. You can easily get more for your money by learning to invest properly. This is so important—be very wary of any type of insurance acting as an investment opportunity.

Insurance companies make more money on whole life insurance.

Who really benefits from whole life insurance? The truth is the insurance companies and agents who sell it are the ones profiting. They make a heck of a lot more money on whole life policies than they do with term policies, so which one do you think they push more?

Remember, you’ll pay a much higher premium for a whole life policy than for a term life policy. Insurance companies use that expensive whole life premium to invest your money for their profit. Don’t fall for it!

Monthly Cost by Age

| Term Life | Whole Life | Savings |

|---|---|---|

| $12.18 | $142.12 | $129.94 |

| Term Life | $12.18 |

| Whole Life | $142.12 |

| Savings | $129.94 |

Get the Right Type of Life Insurance

The cash value part of a whole life policy can sound like a good deal. We get it—everyone needs to think about building their retirement fund. But a whole life policy isn’t the way to do it. Instead, invest 15% of your household income in good growth stock mutual funds through tax-advantaged accounts, like a 401(k) or Roth IRA. You’ll build wealth faster and be in a much stronger position when it’s time to retire.

Whole life insurance—and the lousy way it builds up cash—just can’t compare to the results you get by investing your money independently. Don’t leave investing to the insurance company. Skip whole life insurance!

Next Steps

- Still not convinced whole life is a scam? Check out the differences between whole life insurance and the better option, term life.

- If you're not sure you even need life insurance at this point, make sure you're covered in all the right places by taking our quick Coverage Checkup.

- Learn more about how much term life insurance you should get.

- Calculate how much term life insurance you need with our calculator below.

- Get in touch with a RamseyTrusted insurance expert from Zander Insurance to get a free quote today!