Debt

Kick Debt to the Curb

How to Pay Off Debt

Debt might be normal, but normal is holding you back. If you're sick and tired of paying for your past every single month—it's time to learn how to pay off debt. For freaking good.

Read ArticleMost Popular Articles

Tools and Resources

Trending Debt Articles

How to Get Out of a Car Loan

How Does Credit Card Interest Work?

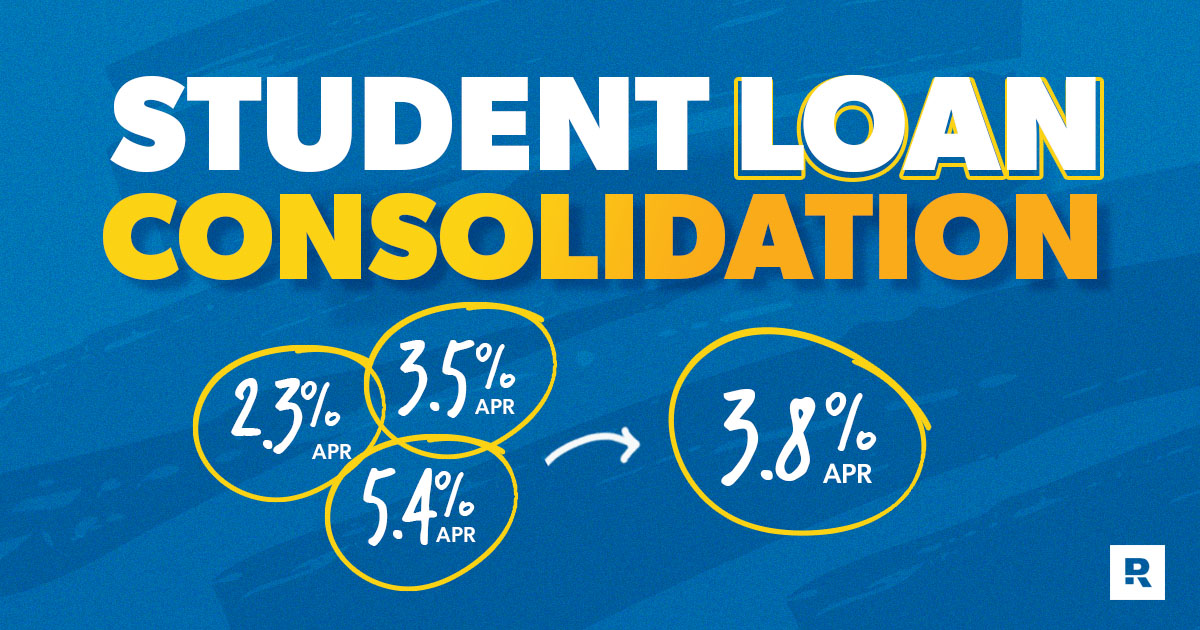

Should I Consolidate My Student Loans?

Should I Refinance My Student Loans?

Student Loan Relief: What You Need to Know

How to Pay Off Debt

More Debt Resources

The Book That’s Helped Millions

Leave paycheck-to-paycheck living behind with The Total Money Makeover.

Financial Peace University

Take the course that's helped millions beat debt, build wealth, and get ahead with money.

Free Easy-to-Use Budgeting Tool

Take control of your money by planning where it should go every month.